Thanks to its friendly regulations, Switzerland is a safe, dependable, and transparent environment for investing and innovation for cryptocurrencies. The country is regulated by FINMA and has a flourishing blockchain ecosystem.

This encourages traders to access various digital assets. The Best Crypto Exchanges in Switzerland incorporate low operating costs, robust security, and user-centered characteristics which allow traders, both novices and professionals, to exchange Bitcoin, Ethereum, and altcoins confidently and embrace the prospects of long-term growth.

Key Point

| Exchange | Unique Features |

|---|---|

| Kraken | Strong security, futures, staking |

| Bybit | High-leverage derivatives, copy trading |

| Binance | Massive altcoin range, launchpad, DeFi |

| Bitpanda | Easy interface, stocks & metals too |

| SwissBorg | Smart engine for best liquidity prices |

| Bitstamp | Oldest regulated exchange, reliability |

| Uphold | Multi-asset: crypto, stocks, metals |

| AvaTrade | CFD trading, regulated, forex focus |

| eToro | Social trading, copy portfolios |

1. Kraken

Kraken offers great low fees between 0%–0.26% which makes it one of the best trusted exchanges. Leverage of 5x is Kraken’s standard. Kraken also offers a variety of crypto futures and staking.

With fiat currencies like the USD, EUR, and CHF, Kraken offers Swiss users easy deposit and withdrawal options. Kraken also offers cold storage, 2-factor authentication, and adheres to regulatory requirements for security.

Kraken is in the Best Crypto Exchanges in Switzerland and placed best for users who appreciate trading tools transparency and trust. This makes Kraken suitable for professionals and beginners looking for a reliable long-term investment.

| Category | Details |

|---|---|

| Trading Fees | 0%–0.26% maker-taker |

| Max Leverage | Up to 5x |

| Available Assets | 200+ cryptos, futures, staking |

| Fiat Support | USD, EUR, CHF, GBP |

| Security Features | Cold storage, 2FA, regulatory compliance |

| Best For | Secure trading, futures, and staking |

2. Bybit

Bybit focuses on derivatives trading and has competitive pricing, with a 0.1% fee on spot trades and 0.01% maker and 0.06% taker fees on futures trades. With up to 100x leverage available, it’s a great option for high-risk trading.

Although it has limited fiat access through third-party integrations, Bybit has hundreds of crypto assets. The exchange also has cold storage, insurance funds, and risk management systems to protect users.

As part of the Best Crypto Exchanges in Switzerland, Bybit is highly recommended for margin and futures traders. Its innovative crypto derivatives trading features strong liquidity, rapid execution, high leverage, and advanced order types.

| Category | Details |

|---|---|

| Trading Fees | 0.1% spot, 0.01%/0.06% futures |

| Max Leverage | Up to 100x |

| Available Assets | 300+ cryptos, derivatives |

| Fiat Support | Limited via third-party |

| Security Features | Cold wallets, insurance funds, risk systems |

| Best For | High-leverage derivatives traders |

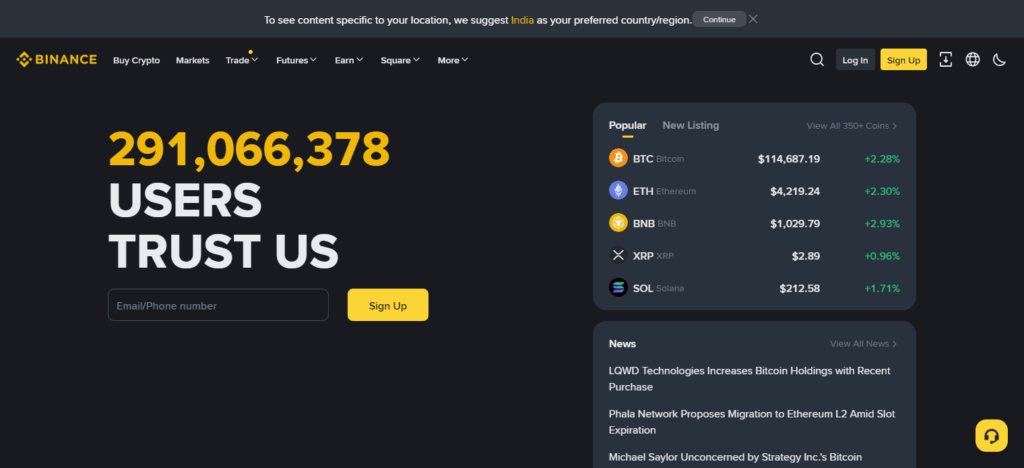

3. Binance

With a global presence, Binance handles more volume than any other exchange in the world. It has a fee structure around 0.1% with additional discounts for using Binance’s BNB tokens, making trading cheaper. Binance also has a 125x leverage for futures trading.

Customers can trade more than 350 cryptocurrencies, dozens of trading pairs, and trade fiat currencies of USD, EUR, GBP, and CHF. Binance has a reputation for robust security features and the SAFU insurance policy.

Among the Best Crypto Exchanges in Switzerland, Binance is perfect for high-volume retail and institutional traders in need of a wide range of innovative trading instruments, launchpads, and other products centered around DeFi.

| Category | Details |

|---|---|

| Trading Fees | 0.1% spot (BNB discounts) |

| Max Leverage | Up to 125x futures |

| Available Assets | 350+ cryptos, DeFi, NFTs |

| Fiat Support | USD, EUR, GBP, CHF |

| Security Features | SAFU fund, anti-phishing, cold storage |

| Best For | Wide asset variety and advanced tools |

4. Bitpanda

Bitpanda has a presence in Austria and has spread to other European countries. It has a simple and transparent trading model and charges around 1.49% for buy and sell orders. Bitpanda is more of a straightforward investing platform since it does not provide high leverage on any of the assets.

Customers can trade crypto, stocks, ETFs, and precious metals. Bitpanda also has fiat support of EUR, GBP, and CHF. This makes it easy for European investors. Bitpanda is also licensed and has secure wallets which makes it compliant to provide other security frameworks.

As one of the Best Crypto Exchanges in Switzerland, Bitpanda is perfect for beginner investors looking for a simple, all-in-one investment platform safely integrating cryptocurrencies with traditional assets. This is in a regulated trading environment.

| Category | Details |

|---|---|

| Trading Fees | ~1.49% buy/sell |

| Max Leverage | Not applicable |

| Available Assets | Crypto, stocks, ETFs, metals |

| Fiat Support | EUR, GBP, CHF |

| Security Features | AML compliance, secure wallets |

| Best For | Beginners and multi-asset investors |

5. SwissBorg

SwissBorg is a Swiss-based cryptocurrency exchange with trading fees ranging between 0%–1% based on membership level. It caters to major cryptocurrencies, DeFi, and has low leveraged fiat trading with EUR and CHF.

For encryption, custody, and regulatory compliant solutions, SwissBorg has been awarded for its security. SwissBorg offers sophisticated tools for price scouting and community-driven features of governance.

It is recognized as one of the Best Crypto Exchanges in Switzerland, offering superb customer service through a fully featured mobile application for portfolio management.

| Category | Details |

|---|---|

| Trading Fees | 0%–1% depending on tier |

| Max Leverage | Not applicable |

| Available Assets | Major cryptos, DeFi tokens |

| Fiat Support | EUR, CHF |

| Security Features | Custody solutions, encryption, regulation |

| Best For | Smart engine price optimization |

6. Bitstamp

Bitstamp is one of the oldest regulated trading platforms. It carries tiered trading fees which range from 0% to 0.4%. It does not focus on extreme leverage but on stability and trust. It offers support for more than 70 cryptocurrencies and fiat variants of USD, EUR, and GBP.

Because of strong security like cold storage, insurance, and regulatory compliance, it is trusted globally. Considered to be one of the Best Crypto Exchanges in Switzerland, Bitstamp is intended for conservative investors who need a long-standing reputation, and transparent fees, institutional-grade compliance friendly to retail and professional traders in Europe.

| Category | Details |

|---|---|

| Trading Fees | 0%–0.4% tiered |

| Max Leverage | Limited (low-risk focus) |

| Available Assets | 70+ cryptos |

| Fiat Support | USD, EUR, GBP |

| Security Features | Cold storage, regulatory compliance |

| Best For | Long-term, conservative traders |

7. Uphold

Uphold has a spread-based model which allows it to offer fees of 0.8% to 1.2%. This makes it very easy for users. Although not extreme, it does leverage support for crypto, stocks, and precious metals. US, Euro, and GBP fiat also allows for wider funding.

Security includes multi-asset custody, two- factor authentication, and full reserve transparency. Uphold is ranked one of the Best Crypto Exchanges in Switzerland.

For investors who want more than crypto, Uphold enables the construction of a balanced portfolio with simple and intuitive support for everyday traders and long-term wealth builders.

| Category | Details |

|---|---|

| Trading Fees | Spread 0.8%–1.2% |

| Max Leverage | Not applicable |

| Available Assets | Crypto, stocks, metals, forex |

| Fiat Support | USD, EUR, GBP |

| Security Features | 2FA, transparent reserves |

| Best For | Multi-asset investing simplicity |

8. AvaTrade

AvaTrade fits the regulatory environment as a CFD crypto broker. Commission and Spread offers varied alternatives for crypto trading. Also has a 20x leverage on crypto CFDs and dozens of major digital assets.

For AvaTrade, fiat has global currencies. Safety features include negative balance protection, regulatory oversight, and various other risk management tools.

From the risk management perspective, AvaTrade and the combination of forex, stocks, and crypto trading makes it a regulated environment place to be. For all these factors combined, AvaTrade makes crypto trading worth it.

| Category | Details |

|---|---|

| Trading Fees | Spread-based (no commissions) |

| Max Leverage | Up to 20x CFDs |

| Available Assets | Crypto, forex, stocks, CFDs |

| Fiat Support | Global major currencies |

| Security Features | Negative balance protection, regulation |

| Best For | CFD traders in regulated markets |

9. eToro

eToro provides an easy pricing model for trading as well as a flat 1% fee. There is 2x leverage on crypto CFDs as well, but eToro emphasizes on low risk retail trading. Assets include crypto, stocks, ETFs and commodities, and for fiat there are USD, EUR, and GBP.

Funds are protected with advanced encryption, regulatory licenses and segregated funds. For eToro, as the Best Crypto Exchanges in Switzerland, the mobile trading platform provides a wide range of investment products with intuitive features, making it easy for social and copy trading.

| Category | Details |

|---|---|

| Trading Fees | 1% flat |

| Max Leverage | Up to 2x crypto CFDs |

| Available Assets | Crypto, stocks, ETFs, commodities |

| Fiat Support | USD, EUR, GBP |

| Security Features | Segregated funds, encryption, regulation |

| Best For | Social and copy trading |

What to Consider When Choosing a Crypto Exchange in Switzerland

In Switzerland, a crypto exchange must weigh trust through regulations, costs, features, and safety. Take into account these demands:

Regulation & Compliance – FINMA regulations watch over Switzerland closely. Confirm that the exchange abides by Swiss and EU laws for additional protection of the investors.

Trading Fees – Maker-taker fees, spread costs, and hidden fees must be analyzed. Cost structures must be low for day traders, but new users may care more about easy-to-understand fee structures.

Fiat Support – See if the exchange allows CHF deposits or withdrawals through bank transfers, cards, or e-wallets.

Security Features – Assess safety through the presence of cold storage and 2-factor authentication, insurances, funds, and historical evidence.

Available Assets – Determine if the exchange only has Bitcoin and Ethereum or more varied altcoins, tokens, NFTs, and DeFi products.

Leverage & Products – Know if primitive spot trading is enough, or if more enhanced trading options such as derivatives, staking, or copy trading must be available.

User Experience & Support – Swiss users must have mobile apps and readily accessible, clear interfaces, round-the-clock support, and 24/7 operating systems.

Conclusion

The platform you decide to use will greatly influence your experience during your trading and investing journey. Best Crypto Exchanges in Switzerland are no exception: they take into consideration security and compliance with regulations and tailor user friendly features to Swiss investors.

Kraken is appreciated for its transparency, Binance for having a wide variety of assets, and SwissBorg is great for having a local focus. Regardless, every trading style is covered. Don’t forget to check the fees, support for fiat currencies, and assets available.

Well-regulated and trustworthy exchanges permit Swiss traders to build crypto market long-term strategies. Its safe to say that peace of mind is guaranteed.

FAQ

Are crypto exchanges legal in Switzerland?

Yes. Crypto exchanges are legal and regulated under FINMA (Swiss Financial Market Supervisory Authority). Switzerland is known for its strong blockchain and crypto-friendly laws.

Which is the best crypto exchange in Switzerland?

The Best Crypto Exchanges in Switzerland include Kraken, Binance, SwissBorg, and Bitstamp. Each offers different strengths like low fees, fiat support, or local Swiss services.

Can I buy crypto with CHF in Switzerland?

Yes. Many exchanges such as SwissBorg, Kraken, and Bitpanda support CHF deposits via bank transfer, credit card, or other payment methods.

What fees do Swiss crypto exchanges charge?

Fees vary by platform. Some exchanges charge 0.1%–0.4% trading fees (e.g., Binance, Bitstamp), while others use spreads like Uphold. Always compare before trading.

Which crypto exchange is safest in Switzerland?

Kraken, Bitstamp, and SwissBorg are considered among the safest due to strong security measures like cold storage, two-factor authentication, and insurance funds.