In this article, I will review the Best Crypto Exchanges available in the Holy See. As you might know, selecting the proper exchange is critical when it comes to the security and convenience while trading cryptocurrencies.

The Holy See has several reputable exchanges with varying crypto offerings and low fees, as well as high-security features. This guide aims at assisting you with the tailored solutions for your trading requirements in the region you are in.

Key Points & Best Crypto Exchanges In The Holy See List

| Exchange | Key Point |

|---|---|

| Coinbase | Beginner-friendly interface with strong U.S. regulatory compliance. |

| KuCoin | Offers a wide variety of altcoins and trading bots for advanced users. |

| Kraken | Known for security and margin trading with fiat support. |

| Binance | Largest global exchange with low fees and a wide selection of assets. |

| SpectroCoin | Combines exchange, wallet, and crypto card services. |

| LocalCoinSwap | Peer-to-peer platform with no KYC requirement and global reach. |

| Bybit | Popular for derivatives trading and high-leverage options. |

| WhiteBIT | European exchange with competitive trading tools and fast KYC. |

| PrimeXBT | Leverages crypto and traditional assets like forex and indices. |

| MEXC | Offers spot and futures trading with frequent listing of new tokens. |

10 Best Crypto Exchanges In The Holy See

1.Coinbase

Coinbase is arguably one of the finest cryptocurrency exchanges available to residents of Holy See. Established in the United States in 2012, Coinbase allows users to trade in more than 250 cryptocurrencies, including Bitcoin, Ethereum, and Solana.

Its relatively simple design is perfect for people just starting out. The platform is entirely licensed and operates in more than 100 countries. Coinbase has a spread fee as well as fluctuating fees relative to the user’s payment method and location.

It also offers safe custody, educational materials, and a trading app for traders who need to trade at their convenience. Holy See residents may find better options, but for those looking for simplicity and regulatory compliance, Coinbase is a decent choice, albeit with higher fees than its competitors.

Features Coinbase

- User-friendly design that facilitates effortless buying and selling of over 250 cryptocurrencies and unique coins.

- Operated within the boundaries and instructions of national authorities, legal jurisdictions, and other pertinent integrated frameworks worldwide.

- Scholarship programs reward learners and platform users, as well as offer educational resources.

- Custodial services backed by reputable insurers on the assets held and stored are provided.

2.KuCoin

In the Holy See, one of the most popular options for trading crypto is KuCoin due to its access to over 700 cryptocurrencies, including lesser-known altcoins. Established in 2017 and situated in Seychelles, KuCoin assists users from more than 200 countries.

It has low trading costs of only 0.1% per trade which can be lowered further using the company’s KCS token. The platform offers spot, margin and futures trading alongside trading bots and staking.

KuCoin has a lenient approach to KYC for basic functions which many international users can appreciate. The exchange is suitable for users residing in Holy See who have access to a variety of crypto investments and low trading fees.

Features KuCoin

- Availability of more than 700 cryptocurrencies among which are numerous altcoins.

- Extremely low charges while trading set at 0.1% alongside further preferences to KCS token holders.

- Futures trading, options for margins trading, and Automated trading bots.

- Minimal KYC verification for some fundamental level usage.

3.Kraken

Known for security and regulation, Kraken is an exchange that users in the Holy See can rely on. Founded in 2011, Kraken is US-based and supports more than 200 cryptocurrencies including Bitcoin Ethereum and Polkadot.

Kraken offers spot, margin, and futures trading with low fees of 0.16% for makers and 0.26% for takers. Kraken services users in over 190 countries and boasts USD, EUR, and JPY deposits alongside advanced customer support. Investment tools and strong customer support makes Kraken appealing to traders from Holy See.

Features Kraken

- Availability of more than 200 cryptocurrencies alongside companies offering fiat-linked currencies.

- Excellent protective features, strong security measures, safekeeping services, solid compliance with trading laws and rules of relevant authorities.

- Futures trading alongside margins for advanced trading techniques which come with strong competition in fees.

- Strong and widely available customer care.

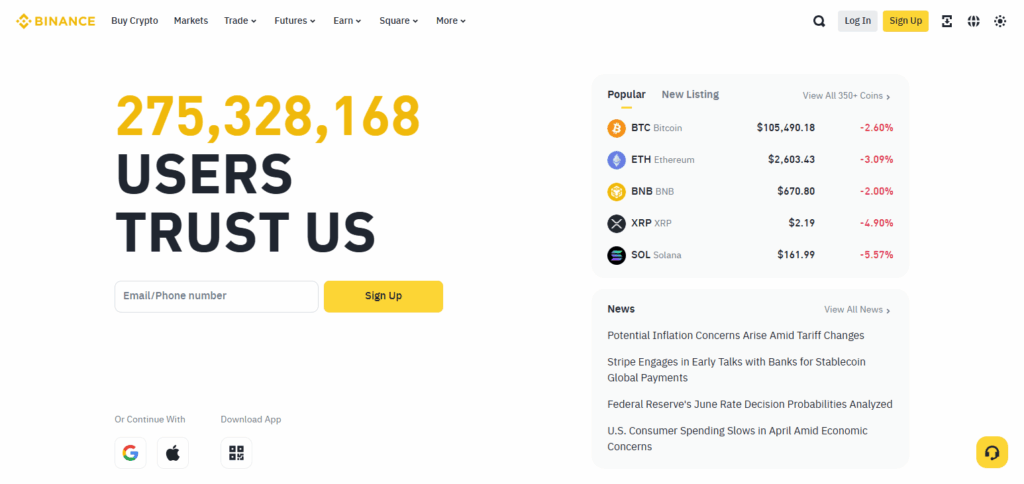

4.Binance

In the case of cryptocurrency exchange platforms, Binance may be the best in the Holy See as it provides access to more than 350 cryptocurrencies that include BTC, ETH and BNB. Binance started in 2017 and was initially based in China but now operates globally, serving over 180 countries.

The exchange boasts a low trading fee starting from 0.1% and can be lowered further when using the native BNB token. Binance also supports spot and futures trading, staking, saving, and an NFT marketplace, making it a one-stop shop for all trading needs.

Apart from the KYC requirements that mandate identity verification, the trading tools coupled with the multilingual interface make it a go-to platform for seasoned and beginner traders in the Holy See.

Features Binance

- Offers various trading methods and has a variety of more than 350 cryptocurrencies available.

- 0.1% trading charges are regarded also as low fees and further be reduced utilizing BNB; also changes forms of payments accepted to more flexible ones.

- Ranging from staking to savings accounts offering NFTs, there’s so many marked as part of the platform it’s hard to name them all in succinct.

- Multi-language customer support and traders at every level of experience with proficient instruments placed at hand.

5.SpectroCoin

English: Users in The Holy See can now enjoy the unique services of SpectroCoin – a one-stop shop for exchange, wallet and payment card services, available in the region since 2013.

Based in Lithuania, the platform combines over 50 cryptocurrencies like Bitcoin, Ethereum, and Dash with an ease of buying, selling, storing or spending crypto via a prepaid card.

SpectroCoin operates globally, serving clients from over 150 countries with tailored trading fees of 0.1%–0.15% commision.

Customers can also get IBAN accounts, crypto loans, and multicurrency fiat deposits. Thanks to its universal crypto services, SpectroCoin can be considered an effective solution for crypto users in The Holy See.

Features SpectroCoin

- Combining crypto cards services, wallet and exchange.

- Acceptance of deposits and withdrawals using a wide range of currencies of more than 50 along with cryptocurrency.

- Nearly everyone pays competitive fees which float around 0.1-0.15% per trade.

- Enhanced financial aid services feature IBAN accounts and crypto loans.

6.LocalCoinSwap

LocalCoinSwap is a Hong Kong based p2p exchange that accepts crypto trading for users from the Holy See as it does not require a know your customer verification.

It started its operations in 2018 and has grown to support more than 20 different cryptocurrencies which includes Bitcoin, Ethereum and Monero.

The platform allows users to directly buy and sell cryptocurrency from and to their local payment providers. It enjoys low trading fees which are in the region of 1% for every trade and are distributed to LCS token holders.

LocalCoinSwap has a wide reach and operates in nearly all countries which includes the Holy See, providing generous trading limits and strongly decentralized sites that never block domains. This makes it convenient for users concerned about privacy.

Features LocalCoinSwap

- Trade in excess of 20 cryptocurrencies using the peer-to-peer method.

- Absence of obligatory KYC for privacy-centric individuals.

- Locally based payment methods worldwide are accepted.

- Reduced fees are experienced alongside LCS token holders.

7.Bybit

Bybit is one of the best rated crypto exchanges accessible to users in the Holy See, particularly valued for its derivatives and high-leverage trading options.

Bybit was established in 2018 and is based in Dubai. It supports more than 400 cryptocurrencies, including BTC, ETH, and SOL. It also offers spot trading, futures trading, options trading, copy trading, and more.

It has competitive trading fees – starting from 0.1% for spot trading and 0.06% for derivatives trading. Furthermore, Bybit functions in over 160 countries.

Its intuitive interface, strong security features, and advanced trading tools make it stand out. Although some promotional campaigns make it a great option for Holy See traders, full access requires KYC.

Features Bybit

- In excess of 400 cryptocurrencies available including spot, futures, and options trading.

- Low fees starting at 0.1% for spot trading and 0.06% for derivatives.

- High leverage surpassing or equal to 100x for futures.

- User-friendly interface and copy trading options available.

8.WhiteBIT

Cryptocurrency users in the Holy See can now access one of the premier trading platforms in Europe – WhiteBIT. WhiteBIT was founded in Ukraine in 2018 and is currently headquarttered in Lithuania.

To their credit, WhiteBIT supports more than 325 different cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and WhiteBIT Coin (WBT), which is their very own cryptocurrency. The platform provides spot, margin, and futures trading at industry competitive rates with maker and taker fees starting at 0.1%.

WhiteBIT users located in over 190 countries are supported with full KYC and AML regulation compliance. Maintaining security is critical with 96% of assets kept in cold wallets, alongside a $30 million insurance fund.

Additional features offered include staking and crypto borrowing alongside a mobile app, giving residents of the Holy See seeking a secure versatile trading platform a comprehensive choice in WhiteBIT.

Features WhiteBIT

- Support for over 325 cryptocurrencies including WBT token.

- Starting trading fees set at 0.1% subject to increase for non-WBT holders.

- 96% cold storage coupled with a $30M insurance policy offer security.

- Access to mobile apps as well as staking and crypto borrowing is offered.

9.PrimeXBT

PrimeXBT is a multifaceted trading platform available to users in the Vatican City, offering a wide range of financial instruments. The Company was founded in 2018 and is based in Seychelles. The Company has market access in excess of 100 for trading including cryptocurrencies, forex , indices and commodities.

Also, the site provides trading in more than 40 cryptocurrencies, including Bitcoin (BTC), Ethereum and XRP, Litecoin (LTC), and EOS. Its trading fees are considered competitive with lower fees of 0.01% and 0.02% for makers and takers respectively in crypto futures and flat 0.05% in crypto CFDs.

There is substantial leverage with respect to crypto futures going up to 200x and 1,000x on forex pairs. The Company has a presence in more than 150 countries except the U.S, Canada, Japan among a few others.

The platform is easy to use with WebTrader and mobile app, copy trading and advanced charting features. Considering the strong security including 2FA and cold storage, the platform is suitable for users in the Vatican City looking for a well-rounded trading service.

Features PrimeXBT

- Access to over 100 markets including cryptocurrency, forex, indices, and commodities.

- Trading cryptocurrency futures as low as 0.01% maker and 0.02% taker.

- Enhanced leverage with 200x on crypto futures and 1000x on forex.

- Provided copy trading and advanced charting tools.

10.MEXC

Founded in 2018 and headquartered in Seychelles, MEXC is a top crypto exchange available in the Holy See. It supports more than 2800 cryptocurrencies and offer more than 3100 trading pairs, ensuring extensive coverage of the market.

A competitive fee structure is in place, with 0% maker and 0.05% taker fees on spot trades. MEXC services users in more than 170 countries and features high leverage up to 200x for futures trading. Security measures include cold storage and dual factor authentication 2FA, making it a reliabe platform for traders from Holy See.

Features MEXC

- More than 2,800 cryptocurrencies along with over 3,100 trading pairs.

- Competitive fees alternate between 0% for maker and 0.05% for taker when trading spots.

- Strong security includes cold storage, 2FA, and withdrawal whitelisting.

- A high-performance engine capable of handling 1.4 million transaactons in a second.

Conclusion

To sum it up, the Holy See provides a reputable list of crypto exchanges which have varying advantages. Security, selection of various crypto assets, low fees, and additional trading features are some of the considerations prioritized.

Exchanges such as Coinbase, Binance, KuCoin, and MEXC provide crypto traders with confidence. Finding an appropriate exchange is dictated by an individual trader’s requirements and desire for ease and security in trading crypto.

FAQ

What are the best crypto exchanges available in the Holy See?

Some of the top crypto exchanges accessible in the Holy See include Coinbase, Binance, KuCoin, Kraken, MEXC, WhiteBIT, and Bybit. These platforms offer strong security, diverse cryptocurrency options, and competitive fees.

Are crypto exchanges regulated in the Holy See?

The Holy See itself has limited direct crypto regulations. However, many exchanges operating globally comply with international regulations and provide services to Holy See residents while ensuring legal compliance.

What trading fees should I expect on these exchanges?

Trading fees vary by platform but generally range from 0.1% to 0.2% per trade. Some exchanges offer fee discounts when using their native tokens or for high-volume traders.