In this article, I will discuss the Best Crypto Exchanges with Liquidity Pools. These platforms facilitate users to participate in decentralized finance by allowing them to provide liquidity and earn rewards.

i will look at definitions, use cases, and what makes these exchanges unique. Exploring liquidity pools can help beginners and experts alike streamline their crypto revenue.

Key Point & Best Crypto Exchanges with Liquidity Pools List

| Exchange | Key Point |

|---|---|

| Binance | Largest global exchange by trading volume with low fees and many assets. |

| Kraken | Known for strong security and support for fiat trading. |

| KuCoin | Offers wide range of altcoins and features like trading bots. |

| OKX | Advanced trading tools and robust DeFi integrations. |

| Gate.io | Supports many new and niche tokens with extensive features. |

| Crypto.com | Offers crypto Visa cards and strong mobile app experience. |

| Coinbase | Best for beginners; highly regulated with easy fiat onramps. |

| Huobi | Major Asian exchange with broad crypto selection. |

| PancakeSwap | Leading DEX on BNB Chain with yield farming and staking. |

| SushiSwap | Multi-chain DEX with strong community governance and rewards. |

1.Binance

Binance retains its position as one of the best crypto exchanges with liquidity pools due to its vast market liquidity and accessible DeFi services. Interoperability between centralized exchange functionalities and decentralized liquidity farming, set apart Binance Liquid Swap.

Users are rewarded for providing liquidity due to reduced slippage on the platform and its overall stability. The large number of users guarantees constant trading volume which improves liquidity provision for novice and expert users alike.

Features

- Low Slippage & High Liquidity: Liquidithy is most optimally provided with little price differebce due to high trading volumes.

- Binance Liquid Swap: For effortless yield farming, further centrialized exchange is blended with DeFi liquidity pools.

- Hundred Asset Support: Enables participation in liquidity pools for hundreds of tokens and facilitates earning.

2.Kraken

Kraken is known as one of the best cryptocurrency exchanges with liquidity pools because of its strong security focus and institutional-level infrastructure. Its competitive edge lies in the provision of staking and liquidity within a boundingly regulated framework appealing to both retail and professional clientele.

Kraken reputation as an open exchange and trustworthy one undisputed increases user confidence when taking part in liquidity provisioning. This combination of security, rigid compliance, and liquidity possibilities makes Kraken a preferred buy for users looking for easy ways to earn on their crypto assets.

Features

- Security and Compliance: Trust from users is enhanced with every liquidity activity conducted making use of institutional-grade security.

- Liquidity and Staking Options: Provides liquidity pools or staking for earning assets.

- Regulated Environment: Gained trust from users so that users focused on not taking risk feel at ease.

3.KuCoin

KuCoin is one of the best crypto exchanges with liquidity pools. It enables access to lesser-known altcoins through its DeFi center, KuCoin Earn. What distinctly stands out about it is the platform’s user-centric policy that permits flexible staking and liquidity mining even for low-cap tokens.

The merge between liquidity provision and soft-staking KuCoin’s Pool-X platform offers makes it unique because participants maximize rewards. This powerful design allows ordinary people to participate in DeFi without any sophisticated skills, which makes KuCoin attractive to retail investors around the world.

Features

- Multiple Altcoin Availability: Access to emerging and low cap tokens in liquidity pools increases.

- Flexable stakinig with liqiudity mining on Pool-X Platform: Increased rewards is achieved via

- User-friendly Interface: Accessible for all DeFi users guiding DeFi novices and proficient in participating.

4.OKX

OKX, we provide some of the most advanced liquidity pools along with a crypto exchange. We have a sophisticated DeFi ecosystem available through our Web3 wallet and OKX Earn, and our strengths lie in centralized performance along with decentralized accessibility. Users can join multi-chain liquidity pools from a single interface.

OKX further provides cross-chain farming, allowing users access to a multitude of yield opportunities. The seamless integration of DeFi tools with professional trading makes OKX the sole crypto exchange that caters to users looking for efficiency, versatility in offering liquidity, and resource consolidation.

Features

- Cross-chain liquidity pools: Support for varied yield opportunities for cross-chain farming.

- Integrated Web3 Wallet: Provides effortless engagement with DeFi protocols from outside the exchange ecosystem.

- Optimized Trading with DeFi Tools: Features professional trading with decentralized liqudity tools.

5.Gate.io

Gate.io is among the most proficient crypto exchanges with liquidity pools. These pools offer a wide range of tokens and novel DeFi services with it’s HODL & Earn and liquidity mining options.

One of it’s unique advantages is the early offering of ineofurther emerging assets, enabling users to provide liquidity to new projects prior to them becoming popular.

This increases the odds for liquidity providers to participate in rewarding earnig trends while mitigeting risk in offered funds, thus making Gate.io the go to exchange for high end adventurous investors.

Features

- Get New Tokens First: Access to liquidity pools for new projects comes with high reward potential.

- HODL Earning Program: Staking and flexible liquidity mining is offered.

- Broader Range of Token Listings: Provides numerous assets for liquidity allocation and investment diversification.

6.Crypto.com

Crypto.com is one of the best in terms of liquidity pools thanks to its user-friendly app, extensive rewards program, and DeFi services, all available in one place. Unique to Crypto.com is the ease of combining liquidity pools with the popular Crypto Earn platform enabling users to stake and earn yields across various assets with little effort.

Also, the increased focus on consumer adoption and everyday use of Crypto.com services enables effortless and rewarding liquidity provision for both novice and seasoned crypto enthusiasts.

Features

- Integration Into App: Fan-favorite mobile platforms allow for easy participation in liquidity pools.

- Crypto Earn Program: Combines liquidity staking with very appealing interest rates.

- DeFi Adoption by Consumers: Focused on making DeFi friendly to the average citizen.

7.Coinbase

Coinbase is considered one of the best crypto exchanges with liquidity pools because of its reputation and adherence to regulations. Its distinct competitive advantage is offering liquidity pool participation via the integration of Coinbase Wallet with well-known decentralized protocols which allows users to provide liquidity in a safe manner.

Coinbase’s simple interface and reliability gives users confidence while using DeFi, closing the gap between traditional crypto trading and decentralized liquidity pools, especially for novice users who want a trustworthy platform.

Features

- Cautious But Efficient: Highly compliant with regulations, maintains secure access to liquidity pools.

- Coinbase Wallet: Available with wallet integration. Enables liquidity provision on-chain through Coinbase wallet and on-chain and decentralized protocols.

- Easier Interfacing for Veterans: DeFi liquidity farming is easier to access via simple interfaces for new users.

8.Huobi

Huobi is regarded as one of the best crypto exchanges with liquidity pools due to its international coverage and great flexible support for different types of digital currencies. Its main highlight is Huobi Prime and Huobi Pool, which contains unique liquidity mining and staking opportunities with unmatched bonuses.

Good’s Huobi’s sophisticated risk management measures coupled with the intuitive connections to DeFi make the environment safe for the liquidity providers. These factors of creativity, immense choice of assets and security make Huobi a user’s choice whether new to the ecosystem or profound.

Features

- Premium Rewards And Pool Programs: Special Huobi offer exclusive liquidity mining with more appealing reward schemes.

- Increased Risk Management: Offers enhanced security policies that protect liquidity providers.

- Great Range of Huobi Assets: Large amount of digital assets supported offer many different possibilities for liquidity.

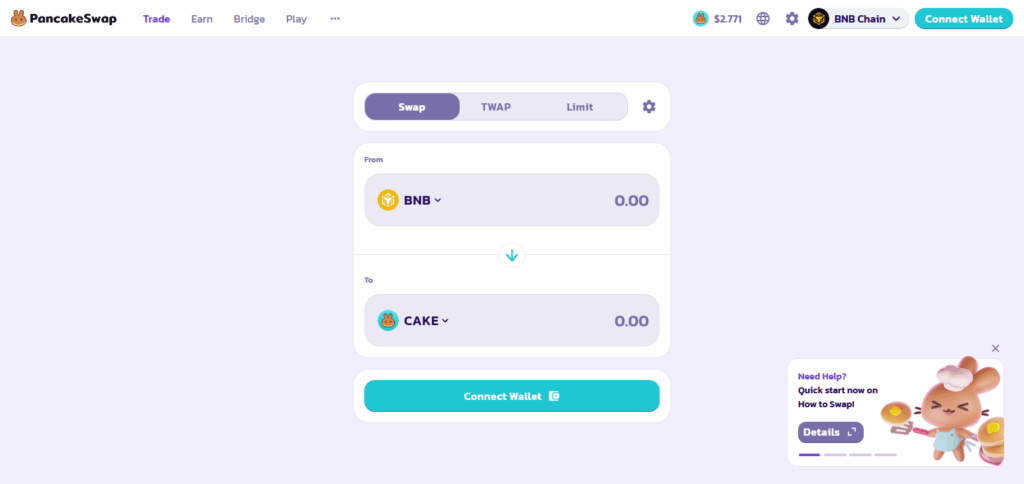

9.PancakeSwap

PancakeSwap’s liquidity pools make it one of the most popular cryptocurrency exchanges because of its position as a decentralized exchange on the Binance Smart Chain. It offers low transaction fees and a thriving ecosystem that incentivizes liquidity provision and CAKE token earnings via yield farming and staking.

Users keen on low-fee DeFi services beyond the Ethereum network will appreciate the flexibility offered by PancakeSwap’s innovative features like lotteries and NFT collectibles, which make supplying liquidity entertaining as well as profitable.

Features

- Low BNB Fees: Costs associated with transactions encourages higher levels of liquidity provision.

- Rewards Paid In Cake Token: Participation over a longer term is incentivized through staking and yield farming rewards..

- Additional Features: Offers lotteries and NFTs to increase interaction and reward users.

10.SushiSwap

SushiSwap is regarded as one of the best crypto exchanges with liquidity pools because of its multi-chain decentralized platform and community-driven governance. It enables providing liquidity over multiple blockchains, which yields more farming opportunities outside of Ethereum.

SushiSwap’s innovative reward system with SUSHI tokens also promotes active engagement and long-term investment. Users can leverage higher yield prospects without permission and maximally secure the system, providing strong influence over governing changes on the platform. That, coupled with the absence of centralized control, allows consumers to determine how the platform evolves.

Features

- Multi-Chain Support: Utilize liquidity pools on various chains apart from Ethereum.

- Community Governance: Stakeholders participate in the voting process for system changes and subsidization policies using SUSHI tokens.

- Innovative Reward System: Participation and continued support through liquidity boosting are extensively motivated.

Conclusion

To sum up, the leading cryptocurrency exchanges with liquidity pools offer integrations of security, multiple assets, intuitive designs, and interfaces that help users maximize profits in the world of decentralized finance. From the expansive universe offered by Binance, the Kraken comprad corporate-grade security features, and low fee access to PancakeSwap on the Smart Binance Chain add multiple advantages that cater to distinct user preferences. Selecting the ideal exchange is a matter of balancing asset selection, reward allocation, user friendliness, and in this case, liquidity pools become an effortless mechanism for increasing cryptocurrency holdings across different platforms.