In this article, I am going to share some great options of Forex algo trading software in 2025. With automation and strategy development reaching new heights, how one selects a platform can now make or break trading efficiency.

I will provide a list of some of the best options to improve your algorithmic trading, including robust applications such as Metatrader 5 and NinjaTrader, as well as their cloud-based counterparts like QuantConnect.

Key Points & Best Forex Algo Trading Software for 2025 List

| Software | Key Point |

|---|---|

| MetaTrader 5 (MT5) | Advanced algorithmic trading with built-in strategy tester and MQL5 support. |

| TradeStation | Offers robust backtesting and easy automation tools for expert traders. |

| NinjaTrader | Known for powerful strategy building and market analytics tools. |

| QuantConnect | Cloud-based platform supporting multiple assets and coding in C#. |

| Etoro | Institutional-grade platform with quantitative strategy automation. |

| Zorro Trader | Lightweight software ideal for research and algorithmic trading in C/C++. |

| ProRealTime | Features intuitive interface and powerful backtesting for visual strategy. |

| TradingView | Web-based charting with Pine Script for simple algo strategy development. |

| Quantower | Modular platform with algo trading, smart order routing, and integrations. |

| MultiCharts | Professional-grade trading with extensive backtesting and scripting in PowerLanguage. |

10 Best Forex Algo Trading Software for 2025

1.MetaTrader 5 (MT5)

MetaTrader 5 (MT5) remains among the top-ranked software platforms for forex algorithmic trading due to its sophisticated features for automation.

The platform allows for the creation, testing, and optimization of expert advisors (EAs) due to its support of the MQL5 programming language.

MT5 provides real-time cross-market data with multi-asset support alongside multi-threaded strategy testing. The comprehensive economic calendar and charting capabilities improve the trading decisions of novices and seasoned traders alike.

Its large 2025 marketplace for trading indications and robots places it at the forefront of algorithmic forex trading. Traders can access MT5 on mobile, desktop, or the web, ensuring unhindered trading opportunities at any time.

Features MetaTrader 5 (MT5)

- Provides automated trading with Expert Advisors (EAs).

- Supports advanced strategy tester for backtesting.

- Multi-asset platform for forex, stocks, and commodities.

2.TradeStation

TradeStation is a leading Forex algo trading platform recognized for its advanced strategy creation and extensive backtesting features. It offers the proprietary “EasyLanguage” programming language which helps in developing and automating trading strategies easily.

TradeStation offers real-time analysis, customizable charts, and complete automation for order execution. It is best for traders who need advanced professional-grade tools but prefer a simple interface.

TradeStation also stores historical market data, which allows testers to meticulously refine their strategies. As of 2025, TradeStation remains one of the best algorithmic forex trading platforms due to its high precision and performance combined with advanced trading analytics and smooth automation. Use on mobile and desktop.

Features TradeStation

- Provides custom strategy development with EasyLanguage.

- Offers detailed data and analytics for strategy testing.

- Includes real-time analytics of the market.

3.NinjaTrader

NinjaTrader is one of the best forex Algo trading platforms. It features complete automated strategy development, advanced charting, and powerful backtesting tools. Users can develop custom algorithms in C#, and plug in with other data vendors and brokers with ease.

All traders, novices and veterans alike, are catered to by NinjaTrader’s strategy builder which enables users to test and design various trading systems without needing any coding skills. Its performance is unparalleled when it comes to trade simulation, execution, and real time analysis of the market.

In addition to performance reporting, algorithmic trading basics can be manipulated through NinjaTrader’s user-friendly interface making it easier to achieve customized results.

Therefore, it is one of the best choices if you’re looking for trading algorithms in the year 2025. NinjaTrader can be used on desktops and has an active community constantly offering assistance.

Features NinjaTrader

- Includes an automated strategy builder for algorithmic trading.

- Features industry-grade backtest and optimization tools.

- Supports a variety of data feeds, brokers, and exchanges.

4.QuantConnect

QuantConnect is regarded as one of the best forex algo trading software. They allow for forex trading by cloud-based algorithmic trading utilizing the powerful LEAN engine.

It integrates several programming languages like C#, Python, F#, and allows trading in a variety of instruments such as Forex, equities, and even crypto.

As a forex trader, you can access enormous historical data and advanced tools on market strategies with QuantConnect.

There is also the capability of real-time strategy deployment. With unmatched infrastructure, it is perfect for both individual traders and larger institutional players. Their proprietary systems seamlessly integrate with leading brokerages.

The open-source platform facilitates further development and ensures customizable transparency.

Up until 2025, all data-driven automated Forex traders have been relying on QuantConnect for their optimal trading solution.

Features QuantConnect

- Offers performance-enhanced algorithmic trading in the cloud.

- Strategy development can be done using C#, Python, and F#.

- Extensive market data and backtesting capabilities provided.

5.Etoro

eToro is well-known for offering social trading services, but it also provides forex algo trading options. eToro enables automation with trading strategies by CopyTrading and by using Smart Portfolios.

This allows traders to execute automatic trading based on pre-configured parameters and copy successful strategies without requiring complex technical understanding. Users can also get access from numerous forex brokers and receive up-to-the-minute market information.

Like other social trading platforms, eToro lacks some features of highly-customizable algo trading platforms; but flexibility that eToro provides attracts many users, including novices and experienced traders who prefer using automation for their trading strategies. In 2025, traders will still appreciate the ease and accessibility eToro offers.

Features Etoro

- Covers high-frequency trading with rapid execution speeds.

- Includes strategy development with integrated machine learning.

- Intended for institutional-grade algorithm trading.

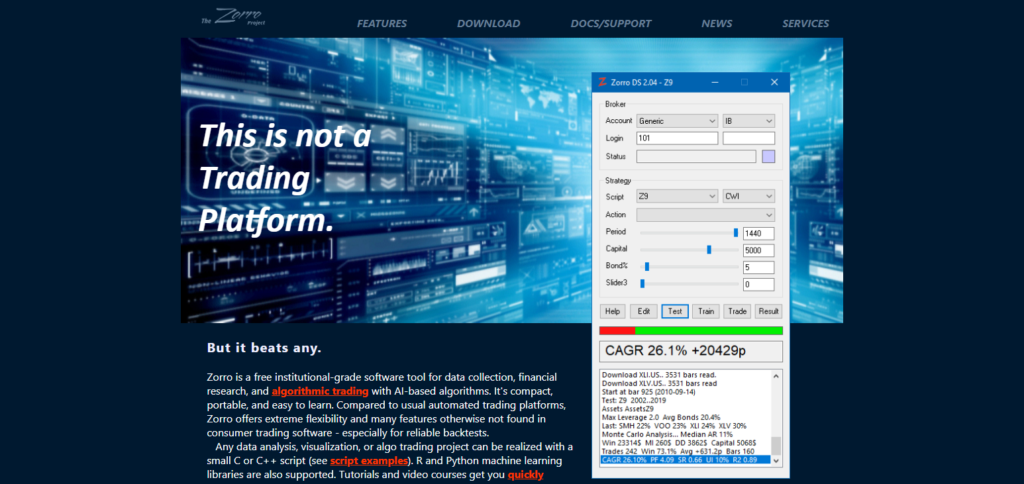

6.Zorro Trader

Zorro Trader is an advanced algo Forex trading software that is favored by quant traders due to its lightweight nature. It Supports C and C++ which allows for development of complex trading algorithms efficiently.

Zorro has good backtesting capabilities as well as live trading features and allows for connection with multiple brokers, data feeds, and other tools.

Even though Zorro is small in size, it contains features for strategy and risk management optimization, machine learning, and many more. Due to scripting flexibility,

Zorro can be used to design, build and test any Forex trading strategy regardless of complexity. As of 2025, Zorro Trader is still rated as one of the best solutions for performing algorithmic Forex trading for free or low cost, besides primary competitors.

Features Zorro Trader

- Provides tools and a platform for light-weight algorithmic trading.

- Users can create custom algorithms in C and C++.

- Advanced risk management and optimization tools integrated.

7.ProRealTime

ProRealTime is known for its exceptional forex algo trading software as it offers an easy to use interface. The software enables the integration of ProBuilder language which provides the ability to simplify coding into user friendly trading strategy tests.

ProRealTime also has features such as backtested simulations, automatic market data updates, and more than 100 market analysis indicators. Its integration brokers allows for automatic trading and smooth order execution.

The software’s design enables use from any electronic device, as it can be continuously accessed through the cloud. As of 2025, ProRealTime offers unparalleled command and reliability which makes them an industry leader on trust and ease of use.

Features ProRealTime

- Strategy development and automation done over the cloud.

- Allows users to write code through its intuitive ProBuilder language.

- Advanced charting and real-time data included.

8.TradingView

As one of the most popular forex algo trading software platforms, tradingView is well-known for having a friendly user interface and powerful charting tools.

Its Pine Script feature allows users to create and automate custom trading strategies to their liking via a simple coding language.

Trading View doesn’t offer its own trading services, although it connects with various brokers to its users enables for real-time data.

The trading platform is cloud-based and has a sizable social community where users competing ideas as well as share strategies.

In 2025 tradingView is still recommended to traders who need a browser-based platform to develop test and build algorithms visually and easily.

Features TradingView

- Offers web-based services for algorithm creation via Pine Script.

- Accessed through the cloud and provides real time data.

- Fosters strong social community for strategy collaboration.

9.Quantower

Quantower is an innovative algorithmic trading software for foreign exchange which caters to the needs of both retail and professional traders. It includes sophisticated charting and order execution capabilities along with algorithmic trading tools for a variety of assets including forex.

The unique modular interface of Quantower permits traders to tailor the software to their specific requirements. Traders are able to implement complex, automated strategies as Quantower allows the use of various programming languages such as C# and Javascript.

The platform connects seamlessly with a wide array of brokers and data providers, ensuring smooth execution. In 2025, Quantower provides unparalleled value for algorithmic traders, offering real-time data analysis, risk management, and extensive strategy testing features.

Features Quantower

- Execute multi-asset trading through a fully configurable modular interface.

- Automated trading algorithm can be programmed in C# and JavaScript.

- Includes integration with a range of brokers and data service providers.

10.MultiCharts

MultiCharts is one of the best forex algo trading software applications because of its sophisticated backtesting and strategy development capabilities. EasyLanguage and PowerLanguage are some of the programming languages that MultiCharts supports.

It has an unparalleled market reach with its integration with a multitude of data vendors and brokerage firms which guarantees real time low latency trading. It has powerful historical market data optimized backtesting engines for MultiCharts users.

Thanks to its advanced features and customizability, flexible interface, and thorough analytical tools, in 2025, it is still, one of the most popular choices among algorithmic traders and algorithmic forex trading beginners and professionals alike.

Features MultiCharts

- Allows creation of custom strategies with PowerLanguage and EasyLanguage.

- Provides backtesting with complex multi-layered conditional statements.

- Access to data from other companies and the execution of trades through those companies is provided.

Conclusion

To summarize, the top forex algo trading platforms for 2025 boasts of powerfully automated trading, sophisticated backtesting alongside flawless broker integrations.

MetaTrader 5, TradeStation, and NinjaTrader offer comprehensive strategy development resources, QuantConnect and AlgoTrader offer advanced functionality for professional traders. Each individual’s requirements dictate their level of preference.