The selection of a broker is crucial since Best Forex Brokers for High-Frequency Forex Trading necessitates extraordinary speed, accuracy, and dependability.

The top forex brokers for high-frequency trading include tight raw spreads, substantial institutional liquidity, ultra-low latency execution, and complete support for algorithmic and automated methods.

The best brokers that offer the technology, price transparency, and regulatory strength needed to successfully compete in the rapidly evolving forex markets are examined in this guide.

What Is High-Frequency Forex Trading (HFT)?

The goal of High-Frequency Forex Trading (HFT), a sophisticated type of algorithmic trading, is to profit from minute changes in currency market prices by executing thousands of deals in milliseconds using powerful computers and intricate algorithms.

To reduce slippage and increase efficiency, it depends on substantial liquidity, direct market access, and ultra-low latency connections. Arbitrage, scalping, and market-making are common HFT tactics, with positions held for incredibly brief periods of time.

HFT creates a high turnover rate by taking advantage of micro-market inefficiencies, necessitating brokers who facilitate quick execution.

Key Point

| Broker | Key Points for High-Frequency Trading |

|---|---|

| IC Markets | Ultra-low latency execution, ECN account, raw spreads from 0.0 pips, MT4/MT5/cTrader + FIX API, suitable for scalping & automated strategies |

| Pepperstone | Fast execution with minimal slippage, tight spreads, cTrader/MT4/MT5 support, free VPS for algorithmic trading, multiple liquidity sources |

| Interactive Brokers (IB) | Sub-10ms execution via API/FIX, deep multi-asset liquidity, institutional-grade reliability, global regulation, direct market access |

| Dukascopy | FIX API & JForex platform, co-located servers for ultra-low latency, tight spreads, transparency in order book depth, ideal for automated systems |

| Global Prime | ECN broker with fast execution (<30ms), raw spreads from 0.0 pips, VPS & FIX API support, NDD model, low slippage |

| FP Markets | ECN aggregation, low execution cost, MT4/MT5 support, fast trade processing, VPS for algorithmic trading, minimal slippage |

| BlackBull Markets | Sub-100ms execution, advanced liquidity pools, MT4/MT5 support, VPS hosting, suitable for professional HFT traders |

| Exness | Tight spreads, broad liquidity, no restrictions on scalping/EAs/HFT bots, 24/7 execution, fast order processing |

| OctaFX | Competitive execution speed, tight spreads, MT4/MT5 support, scalable trade execution, suitable for automated strategies |

| Admiral Markets | ECN account with spreads from 0.0 pips, low-latency routing, MT4/MT5 support, robust data access, suitable for frequent trading and bots |

1. IC Markets

IC Markets is also among the longest established and most reliable Forex brokers, offering excellent reputation for ECN pricing, and trading execution. Established in 2007 and headquartered in Sydney, IC Markets is regulated by top tier authorities like ASIC, and CySEC, offering high levels of client fund protection.

IC Markets offers the trading platforms: MT4, MT5, CTrader, and Trading View. offers multiple account types, including the Standard, Raw Spread, and Islamic accounts. IC Markets also offers a minimum account deposit of around $200, with trading spreads of 0.0 pips, providing ideal conditions for scalpers and high-frequency traders.

IC Markets

- Deep liquidity leading to ultra-low latency ECN execution.

- Raw spread accounts start at ~0.0 pips and entail low commission costs.

- Supports trading on MT4, MT5, and cTrader.

- Algorithmic/HFT systems supported with FIX API and VPS.

- Negative balance protection, segregated client funds, applicable global regulations (ASIC, CySEC, FSA).

- Numerous available tradeable instruments (FX, indices, commodities, cryptos).

IC Markets Pros & Cons

Pros

- Extremely low spreads (from raw around 0.0 pips) and excellent liquidity.

- Quick execution and low latency ideal for scalping/HFT.

- Multiple platforms (MT4,MT5, cTrader).

- VPS and FIX API support for automated strategies.

- Robust regulation (ASIC, CySEC).

Cons

- Raw account commissions can tally up for active traders.

- During peak times, support and onboarding may take longer.

- For novice traders, advanced features can be somewhat daunting.

2. Pepperstone

Since her inception in 2010, in Melbourne Australia, Pepperstone has continued to scale to become a World leading Forex and CFD broker. Highly valued by the World trading community, for providing a seamless experience of trading high-frequency strategies.

Pepperstone supports MetaTrader 4, MetaTrader 5, cTrader, TradingView, and its proprietary platform, offering spreads starting at 0.0 pips on Razor accounts. There are different trading accounts (Standard, Razor, Active Trader) with low or no minimum deposit requirements.

Pepperstone

- Via multiple LPs, trade execution and slippage is fast and low.

- Razor accounts enable spread availability at ~0.0 pips.

- cTrader, MT4, MT5, and Trading View is supported.

- Algo traders have advanced order types and free access to VPS.

- Global regulation coverage (ASIC, FCA, CySEC, DFSA) is present.

- Available augmentative educational systems and support.

Pepperstone Pros & Cons

Pros

- Competitive spreads + execution speeds.

- Excellent platform range including MT4, MT5, cTrader, and TradingView.

- Free VPS access.

- Global regulation (ASIC, FCA, CySEC).

Cons

- For smaller accounts, commissions on razor accounts can be high.

- Limited exotic pair offerings relative to some competitors.

- Lots of institutional API access can be complex to set up.

3. Interactive Brokers (IB)

With 1978 founding year, Interactive Brokers (IBKR) is one of the first companies to start offering online brokerage services and is one of the biggest as well. They provide customers with direct access to the online brokerage services covering all the major markets including forex, stocks, options, and futures and more all under a single account.

As a public company, IBKR is regulated by the U.S. Securities and Exchange Commission (SEC), and CFTC, among others, and is present in over 30 countries with deep liquidity. They offer institutional-grade execution.

IB supports advanced trading via its Trader Workstation (TWS) and API integrations. It is best suited for high-frequency trading and other algorithmic trading as well. Depending on jurisdiction and account type, minimum deposits differ and structures on fees and spreads are customizable.

Interactive Brokers (IB)

- Extremely low latencies, institutional-grade execution is present.

- Single account, direct market access (DMA) and multi-asset trading.

- Automated strategies supported with powerful API & FIX connections.

- Advanced analytics with deep access on the TWS platform.

- Top level entities regulation (SEC, CFTC, FCA, ASIC, etc.).

- Numerous interbank and ECN venues with a global reach.

Interactive Brokers (IB) Pros & Cons

Pros

- Extremely low latency Institutional-grade execution.

- Advanced APIs and Direct market access.

- Trading multiple assets is allowed under a single account.

- Very deep liquidity pools.

Cons

- Complex fee structures for new traders.

- Selection of Trading platforms (TWS) is quite extensive and will prove difficult and a steep learning curve.

- Minimum balance and inactivity fees may apply.

4. Dukascopy

Dukascopy Bank SA is a licensed Swiss bank, which also offers forex brokerage services regulated by FINMA (Switzerland) and JFSA (Japan) and other authorities, offering unique robust fund protection and pricing transparency.

The deepest liquidity, ECN execution, and competitive spreads from approximately 0.1 pips on major pairs. Dukascopy offers MetaTrader 4 / 5, and proprietary JForex trading platforms, with professional features and multiple account types tailored for scalping, algorithmic trading, and high-frequency trading.

Minimum deposit requirements can be approximately $100 for basic accounts with integrated advanced tools and leverage.

Dukascopy

- Offers Swiss Banking regulatory supervision and ECN pricing.

- JForex platform customized for automation via Java API.

- Co‑located servers and premium liquidity options.

- Order book transparency and efficient pricing.

- Regulated by FINMA with rigorous fund protection.

- Caters to retail and professional algorithmic traders.

Dukascopy Pros & Cons

Pros

- Swiss Bank Regulation (FINMA) and price transparency.

- JForex advanced platform dedicated to automation.

- Great liquidity and co-located execution alternatives.

Cons

- Minimum deposits required may be larger than those required by alternative brokers.

- The platform, while advanced, is not very user-friendly.

- During periods of insufficient liquidity, spreads may be wider.

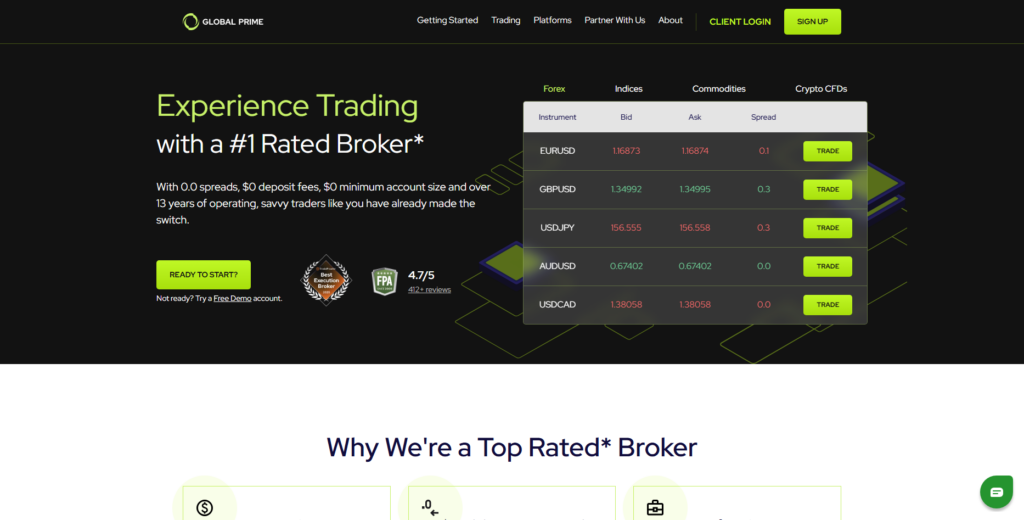

5. Global Prime

Established in 2010, Global Prime has been known for high-frequency forex strategies and low-spread ECN trading. This is regulated by ASIC (Australia) and the Vanuatu Financial Services Commission (VFSC), with client funds held in segregated accounts in credible banks.

The brokerage provides ultra-tight varies spreads starting from 0.0 pips, and no minimum deposit is enforced for standard retail traders, but a $200 balance is typically suggested for effective trading.

They offers MetaTrader 4 and TradingView, with account options varying from standard ECN to raw spread accounts with competitive commissions for the major and minor currency pairs.

Global Prime

- Good liquidity depth for major and exotic pairs.

- ECN pricing with extremely low spreads starting from ~0.0 pips.

- No dealing desk (NDD) execution and low latency routing.

- MT4 + TradingView integration with VPS.

- Oversight by ASIC and VFSC.

- Enhanced commission structure suited for high volume traders.

Global Prime Pros & Cons

Pros

- ECN pricing is available, offering spreads which go down to zero.

- There is little latency and no requotes at all.

- There is an integration to MT4 + TradingView.

- There are no downward restrictions on the latency of trading and high-frequency trading.

Cons

- The number of global regulators is less than the top-tier regulators.

- Limited educational resources available.

- Tools used for account analysis are not as developed.

6. FP Markets

FP Markets, operating since 2005 from Australia, is a broker with a high level of regulation from ASIC and CySEC, providing excellent trading conditions for active forex and CFD trading.

Considering the low execution speeds and low spreads (from zero to 1 on Raw accounts), scalping and HFT strategies, FP Markets supports the MetaTrader 4, MetaTrader 5, and cTrader platforms.

It has a range of accounts from standard to Raw ECN accounts which require a minimum deposit of 100 AUD and offer a maximum leverage of 1:500 based on regulation. FP Markets pricing and customer service reputation is solid.

FP Markets

- Raw spread accounts with deep ECN liquidity tier.

- Fast execution with minimal requotes channel.

- Supported platforms are MT4, MT5, cTrader.

- Availability of VPS for automated strategies.

- Regulated by ASIC & CySEC with robust compliance.

- Pricing and execution focused on active traders.

FP Markets Pros & Cons

Pros

- Finite spread accounts and prompt execution speed.

- Supports MT4, MT5, cTrader.

- Sufficient liquidity and available VPS.

Cons

- Customer service may lack reliability.

- Compared to some industry rivals, proprietary tools for high-frequency trading are limited.

- In volatile markets, the spreads which do not include profit can be larger.

7. BlackBull Markets

As of 2014, the broker is based in New Zealand and has licenses from the New Zealand FMA as well as the FSA from the Seychelles.

BlackBull Markets provides ECN-style execution and has accounts that allow spreads in the range of 0.0 on MetaTrader 4, 5, and TradingView on the Prime accounts.

They provide standard, prime, and institutional accounts, with a deposit of $200 for the retail accounts. They are geared to the more serious per forex: scalpers and algorithmic trading systems as a result of their liquidity and execution with the 0.0 spreads.

BlackBull Markets

- ECN-style liquidity with slim raw spread.

- Rapid trade execution and vast order book access.

- MT4/MT5 + TradingView with VPS availability.

- FMA (NZ) and FSA (Seychelles) regulate them.

- Scalable Commission Plans and Low Minimum Deposits.

BlackBull Markets Pros & Cons

Pros

- Fast execution and spreads like an ECN.

- Good platform support.

- Multiple tier accounts like institutional.

Cons

- Comparison to FCA/ASIC, overall regulation is weaker.

- Some HFT systems missing advanced API features.

- Less global presence and support.

8. Exness

Exness, which has been operational since 2008, is well-known as a broker with low trading costs and high leverage, which attracts both new and high-frequency traders.

With broad international regulations, Exness is overseen by the FCA (UK), CySEC (EU), FSCA (South Africa), and more. Exness is compatible with MetaTrader 4 and MetaTrader 5 and offers Standard, Raw Spread, Zero, and Pro accounts with a minimum deposit of $1.

Raw accounts offer spreads of 0.0 pips. Exness is also flexible with their leverage, which goes up to 1:2000 or higher depending on the jurisdiction, making them appropriate for high frequency trading.

Exness

- Extremely Low (Near Zero) Spreads on Raw Accounts.

- Depending on the region, different Leverage levels apply.

- Various Account Types, MT4 & MT5.

- On numerous accounts, deposits are very minimal.

- Regulated By: FCA, CySEC, FSCA and more.

- Unlimited scalping and no restrictions on algo trading.

Exness Pros & Cons

- Profoundly low cost of entry (very low initial deposits).

- Multiple account types with different levels of leverage.

- Low latency with tight spreads.

Cons

- The terms of leverage are country dependent.

- Support at times may be unhelpful.

- Low trade value, hindering access to tools that a professional trader would use.

9. OctaFX

Starting in 2011, OctaFX has a minimum deposit of $5, and has different accounts including Micro, Pro, and ECN. He supports MetaTrader 4, MetaTrader 5, and OctaTrader. He has good spreads for forex. This is a great option for international clients since he is regulated in most markets.

They also has varied payment options and good speeds. He is also popular for his low prices. Before trading, clients should check their local regulations and if the leverage is satisfactory for heavy high-frequency trading

OctaFX

- Spreads are competitive on MT4 & MT5.

- Easy access with a low minimum deposit requirement.

- For more active traders, there are Professional and ECN-style accounts.

- FSCA, FCA (UK).

- Beginner-friendly, especially when moving to High-Frequency Trading and scalping.

OctaFX Pros & Cons

Pros

- Minimum initial deposit is low and quick account initiation.

- Access to tight spread which is beneficial to frequent traders.

- Compatible with MT4/MT5 and provides VPS.

Cons

- Less HFT friendly than ECN-only brokers.

- Lack of regulations in important regions.

- Less advanced order functions.

10. Admiral Markets (Admirals)

Beginning in 2003, Admiral Markets (often called Admirals now) is one of the most regulated brokers, and is regulated by the UK FCA, CySEC (EU), and ASIC (Australia).

The broker offers MetaTrader 4 and MetaTrader 5 on desktop, web, and mobile, with spreads varying from 0.0–0.5 pips based on account type and location.

Minimum deposit is around $200, and they offer multiple accounts including Standard, Zero, and Pro, which are catered towards scalpers and high-frequency traders.

Besides having good liquidity for global trading, Admirals has a variety of educational materials and analytical tools.

Admiral Markets (Admirals)

- Very Tight Spreads, especially on Zero and ECN Accounts.

- MT4 & MT5 with advanced analytics and plugins.

- Regulated globally (FCA, ASIC, CySEC, EFSA).

- Educational trading resources and tools.

- Includes stock, FX, and ETFs among other multi-assets.

- Support for automated trading and VPS.

Admiral Markets (Admirals) Pros & Cons

Pros

- Good regulatory coverage (FCA, ASIC, CySEC).

- Zero/ECN accounts come with low spread.

- High quality educational and analytical tools.

- Compatible with MT4 and MT5.

Cons

- Compared to some brokers with lower cost, a high initial deposit value is required.

- Certain account types come with high commission.

- Speed of trade completion varies by instrument.

Key Criteria for Choosing the Best HFT Forex Broker

Low Latency Execution Look for brokerage firms that guarantee and consistently provide low latency order execution. Also, seek firms with advanced server and co-location arrangements.

Tight Raw Spreads Close to zero transactional costs are critical for increasing profitability in HFT strategies for split second pip trades that can occur thousands of times rapidly.

ECN or DMA Trading Model The pricing structure of an ECN or DMA broker is more transparent. Also, the broker will not be dealing desk authoritative with the market.

Deep Liquidity Providers A broker with multiple tier-one liquidity providers can offer sufficient depth, stable spreads, and reliable order execution in high/volatile market conditions.

Flexible Trading API, Automation Support The best API (Application Programming Interface) for FIX (Financial Information Exchange) will be low latency, highly customizable, and will integrate seamlessly with automation and algorithmic strategies.

VPS and Server Location Lower execution delays and increased fill speeds are achieved for high-frequency trading systems and in high-frequency trading in general.

Unrestricted Trading Brokers should permit scalping, arbitrage, and high-frequency trading bots with no execution delays, trade limitations, or concealed impedance on quick order placements.

Consistent Infrastructure & Uptime Consistent trading infrastructure with high uptime avoids system outages, execution delays, or disconnects that can result in losing trades during automated trading.

Attractive Commission Rates For high-frequency traders, low and clear commissions are critical since the high number of trades increases costs, affecting the profitability of the strategy in the long run.

Regulation & Safety of Funds Regulation by the trusted authorities provides safety of funds, assurance of fair execution and segregated accounts, and sustained operational continuity for professional HFT traders.

Conclusion

To engage in high-frequency trading, selecting trading platforms with the most optimal combination of speed, pricing, liquidity, and safety in regulation is crucial. After compiling the necessary information, it seems that IC Markets, Pepperstone, Interactive Brokers, Dukascopy, Global Prime, FP Markets, BlackBull Markets, Exness, OctaFX, and Admiral Markets are the best suitable options because of the good support for automation and algorithmic trading, as well as low latency in execution, tight spreads, and good ECN and DMA.

For these types of traders, execution speed, liquidity, deep market volume, FIX/API, and good quality VPS are more valuable than promotions.

Overall, the best high-frequency trading forex broker will best suit your trading positions, the amount of capital you have, your trading technique, and the ancillary equipment you use. It will also have a good level of regulation and transparent pricing that support high trading volumes over an extended period of time.

FAQ

What is high-frequency forex trading (HFT)?

High-frequency forex trading is an advanced trading approach that uses automated algorithms to execute a large number of trades at very high speeds, often within milliseconds, to capture small price movements.

Which forex brokers are best for high-frequency trading?

Based on execution speed, spreads, and infrastructure, top HFT-friendly brokers include IC Markets, Pepperstone, Interactive Brokers, Dukascopy, Global Prime, FP Markets, BlackBull Markets, Exness, OctaFX, and Admiral Markets.

Why is low latency important for HFT trading?

Low latency ensures faster order execution and reduced slippage, which is critical for HFT strategies where profits depend on speed and precise trade entries and exits.

Do HFT forex brokers allow scalping and trading bots?

Yes, most HFT-friendly brokers allow scalping, expert advisors (EAs), and trading bots without restrictions, provided traders comply with fair usage and risk policies.

What trading platforms are best for high-frequency forex trading?

Platforms like MetaTrader 4, MetaTrader 5, cTrader, JForex, and API-based systems are commonly used, as they support automation, fast execution, and advanced order management.