The Top Forex Brokers with Committed Account Managers will be covered in this post. For traders, having a professional account manager who offers individualized advice, strategy assistance, and knowledgeable market insights can make a big difference.

Brokers that provide customized services to improve trading success and efficiency include Capitalix, Hike, Suxxess FX, FirstECN, IG, Saxo Bank, Pepperstone, IC Markets, AvaTrade, and OANDA.

Key Point & Best Forex Brokers with Dedicated Account Managers list

| Broker | Key Points / Features |

|---|---|

| Capitalix | Offers low spreads, beginner-friendly platform, leverage up to 1:500, MT4/MT5 access. |

| Hike | Focus on fast execution, competitive spreads, demo accounts, and beginner support. |

| Suxxess FX | Provides ECN accounts, multi-asset trading, flexible leverage, and responsive support. |

| FirstECN | ECN execution, low commissions, direct market access, institutional-grade liquidity. |

| IG | Regulated broker, wide range of instruments, advanced trading tools, strong research. |

| Saxo Bank | Premium broker, multiple asset classes, sophisticated platform, strong regulatory compliance. |

| Pepperstone | ECN/STP execution, low spreads, MetaTrader & cTrader support, fast execution. |

| IC Markets | True ECN broker, ultra-low spreads, advanced trading platforms, strong liquidity access. |

| AvaTrade | Beginner-friendly, multiple platforms including MT4/MT5, range of assets, strong regulation. |

| OANDA | Regulated globally, competitive spreads, strong research & charting tools, API trading available. |

1. Capitalix

Capitalix is an outstanding forex broker with an extensive selection of trading instruments: forex, commodities, and indices. Among the many things that set Capitalix apart is the dedicated account managers that all clients get.

Capitalix’s account managers help clients devise individualized trading strategies, and on the risk management, and optimization of the account.

Account managers, on the trading journey, help the clients unlock and use advanced trading tools and features on the MT4 and MT5 trading platforms. Capitalix has great spreads, and fast execution, and is also secure. Capitalix is one of the best forex brokers with dedicated account managers.

Capitalix Features, Pros & Cons

Features

- Personalized support with dedicated account managers

- Access to MT4/MT5

- Fast execution and competitive spreads

- Variety of trading instruments (FX, indices, commodities)

- Provision of educational resources

Pros

- Tailored support and trading strategies

- Suitable for active traders with tight spreads

- Rapid account creation and quick execution

- High-quality assistance from dedicated account managers

- Beginner educational resources are available

Cons

- VIP services may come with higher minimums

- Smaller brokerage firms provide better research assistance

- Global regulations are few for trading services

- Not beneficial for blunt scalping traders

- Less value for more expensive services

2. Hike

Hike is recognized for its client-centric trading experience, prioritizing personalization, and service. Each account is assigned a specific account manager who provides assistance with market insights, trading techniques, and tool utilization.

They also help enhance trading configurations on the trading tools. Hike caters to beginner and experienced traders with its adjustable account options, narrow spreads, and quick withdrawals. In client support and professional assistance, Hike is recognized among the leading forex brokers with dedicated account managers.

Hike Features, Pros & Cons

Features

- 24/5 accessibility with dedicated account managers

- User friendly trading terminals

- Availability of multiple asset classes

- Training and educational webinars

- Tools for Risk management

Pros

- Excellent support especially for novice traders

- Managers provide assistance in strategizing

- Beginner-friendly trading platform

- Quality educational materials

- Rapid response for customer inquiries

Cons

- Spreads tend to be higher in comparison to other ECN brokers

- Advanced trading functionalities are limited in volume.

- Does not cater well to high-frequency traders.

- Fewer account types than bigger, more established brokers.

- Could use stronger research tools.

3. Suxxess FX

Suxxess FX provides institutional and active clientele with a distinctive trading experience. Providing dedicated account managers is one of its major benefits. These managers support traders in their portfolio, strategy, and any technical analyses creation.

Along this trading journey, these managers help clients leverage advanced trading tools like MT5 and ECM accounts with enhanced speed. Suxxess FX has low spreads, strong liquidity, and a wide range of trading options. Suxxess FX is recognized among brokers for trading performance and efficiency, providing dedicated account managers for personalized assistance.—

Suxxess FX Features, Pros & Cons

Features

- Account managers with dedicated VIP status.

- Pools of liquidity.

- Pricing, plus execution, through ECN.

- Trading platforms that are advanced.

- Tools for risk monitoring.

Pros

- Support that is personalized, plus a strategy that is tailored, is premium.

- Execution that is low latency for accounts that are ECN.

- Exemplary liquidity regarding elevated volumes.

- Tools for analysis that are advanced.

- Transparency of pricing that is strong.

Cons

- More elevated minimums for the VIP tiers.

- May have less platform options than bigger brokers.

- Not the optimal choice for traders that are more casual.

- More elevated costs of support at the premium levels.

- Not a well-known brand compared to brokers with legacy status.

4. FirstECN

FirstECN stands out as an ECN forex broker that aims to provide top-notch trading services for the clientele. Clients are given dedicated account managers who prepare them for the challenges of the market and offer insights surrounding market trends, liquidity, and risk crises. These managers assists clients during trade executions on MT4, MT5, and cTrader.

First ECN is recognized for partnerships with numerous liquidity suppliers, resulting in low spreads, rapid order layers, and extensive market reach. As a result of these bottom line factors, traders value the firm and often consider them to be the top forex brokers with account managers.

FirstECN Features, Pros & Cons

Features

- Execution model for orders through ECN that is true.

- Managers for accounts that are dedicated.

- Providers of liquidity that are multiple.

- Tools for advanced charting.

- cTrader, MT4, and MT5.

Pros

- ECN execution with raw spreads.

- Managers of accounts who provide professional support.

- Market liquidity that is deep.

- Choices of platforms that are excellent.

- Competitive for strategies that are algorithmic.

Cons

- ECN accounts have commissions.

- It is possible that more elevated minimums are required.

- Less content for education.

- May be challenging for novices.

- Tools that are premium, and are additional, have costs.

5. IG

IG is a broker which most traders know one way or another. It is also one of the few broker offerings IG has, which include forex, indices, and crypto. Once a Customer Gains a given trading volume, IG will assign them account managers who focus on bringing customers trading instructions and assisting them in the usage of the trading platforms.

These account managers also assist in the tweaking of trade margins and the positioning of trade layers on the web trading platform and MT4 as customers encounter trade barriers.

These account managers also assist in the tweaking of trade margins and the positioning of trade layers on the web trading platform and MT4 as customers encounter trade barriers. As a result of these bottom line factors, traders value the firm and often consider them to be the top forex brokers with account managers.

IG Features, Pros & Cons

Features– Global broker with solid regulations

- Customized VIP manager services

- Various markets to explore

- MT4 and Proprietary platforms

- News and research are available.

Pros

- Market and research at its best.

- Good reputation

- VIP manager at your disposal.

- Trade markets at your disposal.

- Proprietary platforms that are award-winning.

Cons

- VIP manager services at a premium.

- Not for beginners.

- More expensive than other brokers.

- Different regions allow for different cryptos.

- Spread during events can be wacky.

6. Saxo Bank

Among the many investment and foreign exchange (forex) brokers available today, Saxo Bank stands out thanks to its institutional-level service offerings. Clients working with the broker receive a personalized and dedicated account manager, who provides and walks them through the trading advice, portfolio management, and market research processes.

Mid manager walks clients through the strategies and optimal trade execution processes on the risk management SaxoTraderGO and SaxoTraderPRO platforms. Along with this, Saxo Bank provides clients with multiple asset trading and offers deep liquidity and advanced analytical trading tools.

Professional traders seeking high touch service support will appreciate Saxo Bank’s customer service support offering. Forex brokers are ideal for clients who want the Saxo Bank seamless trading experience with account managers offering migration support and trading strategies.

Saxo Bank Features, Pros & Cons

Features

- Services for large institutions

- Managers that are dedicated

- Platforms for SaxoTraderGO/PRO

- Trading on multiple assets

- Thorough research and understanding

Pros

- Analysis of research that is also top-tier.

- Support that is premium.

- Capacities for many assets

- Tools for professional trading

- Markets with a lot of liquidity

Cons

- For VIP tiers, the deposits are steep.

- More extensive costs

- Not the best for smaller traders.

- A lot of fees that are complicated.

- For some, it may be too much.

7. Pepperstone

Pepperstone is one of the largest forex brokers that has ultra-low spread offers with multiple platform choices and ECN execution. Clients work with dedicated account managers who guide them on account trading strategies, risk management, and platform usage.

In the middle of these, managers execute account setups and utilize smart trading tools with MT4, MT5, and cTrader. Because of Pepperstone’s high liquidity, fast execution, and 24/5 customer service, it is favorable to both professional and retail traders. Because of their focus on personalized customer service, Pepperstone is seen as one of the best forex brokers that offers account managers to traders. This is done to assist them with their trading potential.

Pepperstone Features, Pros & Cons

Features

- Execution and pricing of ECNs.

- Support for dedicated accounts

- MT4/MT5 and cTrader

- Execution that is quick and has tight spreads

- Tools for risk and portfolios

Pros

- Spreads that are ultra-competitive.

- Speed of execution that is excellent.

- Excellent backing, managers included.

- Perfect for strategies like scalping.

- Wide variety of platform options.

Cons

- A dedicated manager may be restricted to VIP.

- Standard accounts come with markups.

- Research that is proprietary is limited.

- There are fewer courses on education.

- Not offered in every country.

8. IC Markets

IC Markets is one of the best ECN forex brokers and is well-known globally for their competitive and low spreads, fast execution, and great liquidity. Each client is entitled to a dedicated account manager who, through trading and risk management, provides guidance, strategies, and support. Mid-paragraph, these managers help traders with their MT4, MT5, and cTrader tools for precision trading.

IC Markets provides a variety of account options along with advanced trading tools that are designed for algorithmic and performant scalping. Because of the personalized and professional support that IC Markets provides, they are deemed as one of the best forex brokers for traders who want to have the best trading experience through a dedicated account manager.

IC Markets Features, Pros & Cons

Features

- The True ECN Model

- Help with accounts is dedicated

- MT4/MT5/cTrader supported

- Spreads that are raw and liquidity that is deep

- APIs and Auto trading

Pros

- Extremely low expense for trading

- Perfect for algorithmic and expert advisors

- Support from a professional manager is available

- There is a wide variety of forex pairs

- There is high quality of execution

Cons

- VIP accounts may be prioritized by support

- The tools for research are very basic

- There is very little content for education

- Without guidance, it is not suitable for novices

- The times for processing withdrawals are not the same

9. AvaTrade

In the field of Forex and CFD trading, AvaTrade is an all- inclusive, regulated broker. They provide all clients, both novice and experienced, with individualized account representatives. These representatives help clients with market surveys and strategies and analyze behaviour on the platforms. In the middle of the process, account representatives analyze and guide traders on the MT4, MT5, and AvaTradeGO platforms.

AvaTrade provides a variety of trading platforms, has valuable educational tools, and provides a plethora of trading instruments. It is an excellent broker for those requiring a high degree of instruction and individualized assistance. Given its global reach and client-centered model, AvaTrade is among the world’s leading forex brokers, offers personalized account management, and assists clients in improving their trading strategies and accomplishing their financial targets.

AvaTrade Features, Pros & Cons

Features

- A lot of global regulation

- A dedicated manager is available for premium clients

- AvaTradeGO, MT4 and MT5

- CFDs on various assets

- A suite for the management of risks

Pros

- Strong presence for regulation

- Strong, positive reviews for educational content

- For serious traders, support is personalized

- There is more than one platform

- Strong presence for regulation

Cons

- ECN brokers has wider Spreads

- More capital may be needed for Manager Access

- There is little available trading on crypto in some areas

- Research tools are average

- Accounts that are inactive get charged.

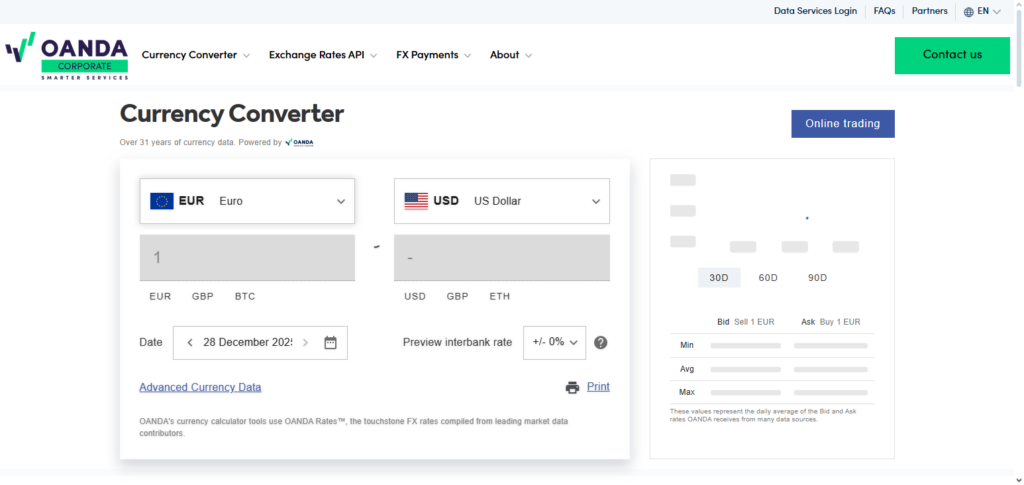

10. OANDA

With over 25 years in the forex trading business, OANDA is universally recognized for its transparency, competitive spreads, and trading platforms. OANDA provides account managers for all high-volume and professional clients.

These managers offer real-time, tailored trading consultancy, provide feedback on risk management, and assist with tech support. In the middle of the process, OANDA’s account managers partner with traders to optimize their platforms.

OANDA has a variety of account choices, solid liquidity, and valuable analytical tools. OANDA is a recognized leader in trading brokerage for enterprise clients and high-volume traders, backed by its strong regulatory framework and dedication to customer service.

OANDA Features, Pros & Cons

Features

- Global broker

- Customized support for some clients

- Proprietary and MT4 platforms

- Clear and Consistent Pricing

- Trading in CFDs and Forex

Pros

- Good Pricing and Regulation

- Good Pricing Transparency

- Strong Liquidity and Reliable Execution

- Personalized Account Support for some clients

- Good Tools and Analytics

Cons

- Access to Dedicated Account Managers is Restricted to a few clients

- Small Accounts can be more expensive

- Fewer Choices Outside of Forex

- Variable Research by Location

- Not for ultra-high frequency trading

Conclusion

Selecting a forex broker with a dedicated account manager can greatly improve a trader’s experience by offering both novice and expert traders individualized advice, strategic insights, and practical assistance.

These services are exclusive to brokers like Capitalix, Hike, Suxxess FX, FirstECN, IG, Saxo Bank, Pepperstone, IC Markets, AvaTrade, and OANDA, who guarantee that customers receive customized guidance on trading tactics, risk management, and platform optimization.

These managers assist in optimizing market opportunities and execution efficiency halfway through trade. All things considered, working with brokers that offer committed account managers guarantees a more knowledgeable, assured, and prosperous trading experience.

FAQ

What is a dedicated account manager in forex trading?

A dedicated account manager is a professional assigned to a trader by the broker to provide personalized guidance, strategy support, and assistance with trading platforms. They help optimize trades, manage risk, and offer market insights tailored to the trader’s experience and goals. Brokers like Capitalix, Saxo Bank, and IG are known for providing this service.

Why should I choose a broker with a dedicated account manager?

A dedicated account manager offers tailored advice, faster problem resolution, and hands-on support with strategies, execution, and tools. This can improve trading efficiency, especially for beginners or high-volume traders, ensuring better decision-making and reduced risk.

Which brokers offer the best dedicated account manager services?

Some of the top brokers include Capitalix, Hike, Suxxess FX, FirstECN, IG, Saxo Bank, Pepperstone, IC Markets, AvaTrade, and OANDA. These brokers provide personalized support, market insights, multiple platforms, and strategies suited to individual trader needs.

Are dedicated account managers only for professional traders?

No. While high-volume or institutional traders often benefit the most, many brokers assign account managers to retail traders as well. Their support can help beginners navigate platforms, learn strategies, and optimize trading performance.