For traders looking for accuracy and efficiency in the current fast-paced Forex market, having access to deep and dependable liquidity can be crucial.

By connecting customers to several elite Best Forex Brokers with Multi-Prime Liquidity Access guarantee tighter spreads, quicker execution, and less slippage.

In extremely volatile currency markets, selecting the best broker with multi-prime access enables institutional and ordinary traders to optimize opportunities while lowering trading risks.

What is Multi-Prime Liquidity in Forex?

A system where a broker aggregates prices and order flow from several liquidity sources, such as Tier-1 banks, non-bank market makers, and ECNs, is known as multi-prime liquidity in forex.

Multi-prime brokers establish a deeper, more competitive market by pooling liquidity from multiple providers rather than depending on a single source for quotes and execution.

This strategy minimizes slippage, lowers spreads, and guarantees more reliable execution—especially during times of extreme volatility.

Institutional brokers, professional traders, and sophisticated retail traders who need transparent pricing, low-latency execution, and access to a wide selection of instruments across FX, commodities, indices, and CFDs frequently employ multi-prime liquidity.

Key Point

| Provider | Key Point |

|---|---|

| B2Broker | A leading Prime-of-Prime liquidity provider offering aggregated Tier-1 bank and non-bank liquidity with FIX API, MT4/MT5 bridges, and multi-asset coverage for brokers. |

| LMAX Global | Operates an exchange-style execution model with transparent order books and institutional-grade multi-source liquidity, ideal for low-latency and high-volume trading. |

| Finalto | Provides customized multi-prime liquidity pools, advanced risk management tools, and access to FX, indices, commodities, and crypto markets. |

| IS Prime | FCA-regulated Prime-of-Prime provider delivering configurable liquidity aggregation from Tier-1 banks with strong execution and institutional connectivity. |

| Advanced Markets | Specializes in direct market access (DMA) with deep multi-bank liquidity, FIX connectivity, and no dealing-desk execution for professional clients. |

| X Open Hub | Offers multi-asset liquidity from multiple providers with advanced aggregation technology, serving brokers with scalable institutional infrastructure. |

| Equiti Capital | A regulated liquidity and prime services provider delivering tailored multi-prime access, strong compliance standards, and institutional execution quality. |

| FXCM Pro | Institutional division of FXCM offering wholesale FX liquidity, multiple LP connections, and deep market depth for professional traders and brokers. |

| Match-Prime | CySEC-regulated Prime-of-Prime liquidity provider delivering bespoke liquidity solutions and aggregated institutional market access. |

| Global Prime | Retail-friendly ECN broker providing access to multiple liquidity providers, transparent execution, and competitive spreads without dealing-desk intervention. |

1. B2Broker – Best Forex Brokers with Multi-Prime Liquidity Access

B2Broker has been providing multi-prime liquidity to institutional clients, brokers, and other companies since 2014. They are one of the most prime global technology companies and liquidity providers, offering liquidity for FX, metals, CFDs, indices, and cryptocurrencies.

They have a global reach with compliant robust customer protection and support due to the various regulated licenses (i.e., CySEC, FCA, FSC Mauritius, and VFSA Vanuatu.) B2Brokers multi-prime aggregation has sourced and accounted liquidity for the Tier 1 banks and non-banks.

They are able to offer customers low and even raw spread prices for over 100 currency pairs and CFD instruments.

Connection with clients is typically achieved by FIX API, PrimeXM XCORE, or bridge solutions to major platforms like MetaTrader 4 and 5. They have dedicated support for onboarding and interface, including a support team for 24/5 assistance.

B2Broker – Key Features

- Multi-Prime Liquidity Aggregation: Full depth of liquidity with both Tier-1 banks and non-bank liquidity providers.

- Multi-Asset Coverage: Flexibility with FX, CFDs, Indices, metals, and crypto.

- Connectivity Options: Options with FIX API, PrimeXM XCORE, MT4/MT5 bridges.

- Technology Stack: White Labels, bridging, and risk management.

- Regulatory Footprint: Units of varying regulations, i.e. FCA, CySEC.

- Scalability: Institutional level infrastructures for brokers and funds.

Pros & Cons of B2Broker

Pros:

• Consistent Deep Multi-Prime Liquidity From Tier-1 Banks & Tier-1 Non-Banking.

• Serts, Crypto, Metals, Indices, FX & CFDs Cover.

• Several Integration Options (FIX, MT4/5 Bridges).

• Scaleable For Both Brokers & Institutional Clients.

• Has White Label & Turnkey Offerings.

Cons:

• No Direct Retail Broker, Mainly A Liquidity /Tech Provider.

• Possible Minimum Size / Volume Requirements.

• Advanced Technology Solutions Takes Additional Set Up & Requires Expertise.

2. LMAX Global – Best Forex Brokers with Multi-Prime Liquidity Access

LMAX Global has developed an exchange style institutional FX and multi-asset liquidity venues, which is regulated by the FCA (UK) and CYSEC (EU) among other authorities, and provides transparency as patrons can expect executions with no ’last look’ rejections.

Tiers CLOB model integrates cross asset class liquidity from London, New York, Tokyo and Singapore across deep liquidity interbank, brokers, and professional traders via FIX API, Java/.NET APIs or MT4/MT5 bridges, including CFDs on FX, metals, commodities, indices, and cryptos.

Leverage policies are in accordance with the client’s regulatory classification. LMAX, in the interest of keeping the trading conditions, real-time data feeds, and high-touch support competitive while honoring the strict price/time execution to institutional clients, offers liquidity on all asset classes, including cryptos.

LMAX Global – Key Features

- Exchange Style Execution: Transacted with CLOB for clear and consolidated pricing.

- No Last Look Rejections: Transparency in pricing and reliability in execution.

- Global Liquidity Pools: London, New York, Tokyo, and Singapore liquidity.

- Multi-Asset Instruments: FX, CFDs, Indices, and Metals and Commodities.

- APIs and Integration: FIX, WebSocket, MT4/5 bridges through partners.

- Institutional Focus: Focus for professional traders and brokers.

Pros & Cons of LMAX Global

Pros:

• Transparent Order Books & Exchange Style Execution.

• No \”Last Look” with Consistent & Fair Pricing.

• Liquidity & Robust In Global Several Venue.

• Strong For Brokers & Institutional Trading.

Cons:

• Direct Retail Traders Not In Focus.

• Developer Support Required In Complex API Integration.

• Standard Retail Leverage Is Less Relevant.

3. Finalto – Forex Broker with Multi-Prime Liquidity Access

Finalto is a global provider of liquidity and prime brokerage services, specializing in multi-asset execution and tailored FX liquidity products for brokers and financial institutions.

Finalto operates globally via multiple licensed entities and provides cross-margined access to thousands of instruments including FX, FX derivatives, indices, commodities, and crypto in a single account.

His multi-prime model offers clients connectivity to multiple Tier-1 banks and market makers with bespoke spreads and active risk-control options. As such, brokers usually integrate with him via FIX API or front-end platforms such as MT4/5 via technology partners.

Additionally, Finalto provides dedicated account management, sophisticated analytics, and flexible commercial structures to accommodate institutional clients’ liquidity demands.

Finalto – Key features

- Prime Brokerage Liquidity: Multi-prime access to banks and liquidity providers.

- Broad Instrument Coverage: FX, Indices, Commodities, and Crypto.

- Risk & Pricing Tools: Customizable risk engines and pricing.

- Scalable Solutions: Available for brokers, hedge funds, and institutions.

- FIX/API Connectivity: Direct access & third-party bridge support.

- Responsible Compliance: Structured regulatory environment.

Finalto — Pros & Cons

Pros:

• Customizable multi-prime liquidity solutions.

• Covers FX, indices, commodities, and crypto.

• Strong pricing tools and risk management.

• Institutional quality.

Cons:

• Primarily target brokers & funds, not retail clients.

• Onboarding can be complicated.

• Small traders may find the pricing/tools excessive.

4. IS Prime – Forex Broker with Multi-Prime Liquidity Access

IS Prime is a Prime of Prime liquidity provider from London, UK, regulated by the Financial Conduct Authority (FCA), who has positioned himself in the market as an aggregator of cross-pricing from banks, non-bank market makers, and ECNs for professional and institutional clients.

They offer would-be brokers and liquidity networks low-latency FX and index swaps liquidity. With FIT and bridge integrations into trading platforms like MetaTrader through bridge providers, IS Prime fosters multi-prime execution and competitive pricing.

Clients access top-tier risk management, deep aggregated liquidity, and professional grade onboarding support along with technical connectivity.

IS Prime – KEY FEATURES

- FCA-Regulated Provider: Strong governance under UK FCA.

- Deep Liquidity Aggregation: Tier-1 bank & non-bank LPs.

- Professional Infrastructure: Low-latency feeds & execution.

- Integration Options: FIX API + bridge technology.

- Competitive Spreads: Tight FX pricing via PoP model.

- Institutional Orientation: Tailored for brokers & institutions.

IS Prime Pros & Cons

Pros:

• Provides prime of prime liquidity with FCA regulation.

• Execution is professional with tier 1 aggregated pricing.

• Professional low latency connectivity through FIX/API.

Cons:

• Only for professional/institutional clients.

• No retail access.

• Must have technical integration with bridges or platforms.

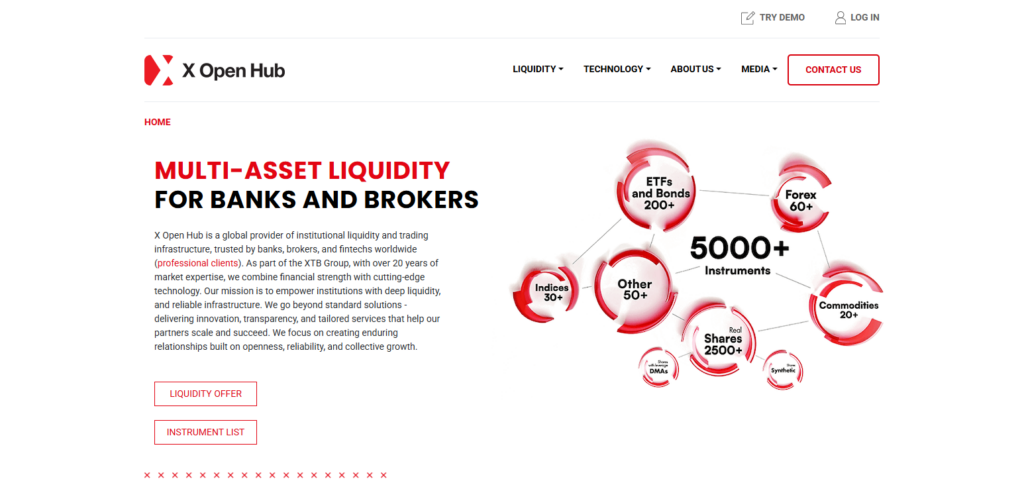

5. X Open Hub Worst Forex Brokers with Multi-Prime Liquidity Access Advanced Markets

X Open Hub brokers institutional FX and multi-asset CFD liquidity, and offers X Open Hub liquidity solutions to financial institutions. X Open Hub provides ultra-low latency execution and high quality data through FIX 4.3/4.4, xAPI, and MT4/MT5 gateways.

With a liquidity pool covering 5000+ instruments including 60+ currency pairs, shares, indices, commodities, and crypto, X Open Hub’s deep multi-prime liquidity provides brokers access to a multi-layer liquidity grid for better pricing and execution.

Although some regulations differ based on a clients needs, X Open Hub focuses on seamless execution, access to a broad range of instruments, and customizable technical support during and post integration.

CURRENT X OPEN HUB – KEY FEATURES

- Extensive Instrument Coverage: 5000+ products including FX & CFDs.

- Multi-Prime Liquidity Pool: Aggregate sources for deep pricing.

- Multiple API Options: FIX 4.x, xAPI, MT4/5 connectivity.

- Scalable Architecture: Supports brokers of all sizes.

- Real-Time Pricing & Execution: Competitive spreads.

- Integration Support: Onboarding & technical assistance.

X Open Hub — Pros & Cons

Pros:

- More than 5,000 assets offer a wide range of instruments.\

- Provides flexible connectivity with a multi-prime liquidity pool.\

- Supports both platform bridges and FIX.\

- Scalable to brokers of any size.\

Cons:

- Not a retail broker; rather a technology provider.\

- More complexity for newer, smaller firms.\

- Full setup may require integration resources.

6. Equiti Capital – Best Forex Brokers with Multi-Prime Liquidity Access

Equiti Capital is an FCA and CySEC regulated multi-asset liquidity provider offering tailor made prime-of-prime FX and CFD liquidity solutions.Equiti is connected to a tier 1 banks, non-banks, and ecn’s through prime xm xcore, onezero, gold-i, and fx cubic giving them low latency pricing across fx, shares, commodities, indices, and precious metals.

Brokers combine this liquidity into MT4/MT5 or other front end platforms. Technical support is provided and dedicated accounts are assigned to brokers.

Equiti Capital focuses on institutional client, providing them with custom pricing, adequate liquidity, and support during onboarding and throughout the operational phase.

Equiti Capital – Unique Selling Propositions

- Multi-Prime FX Liquidity: Tier-1 banks through technology partners.

- Multi-Asset Coverage: Foreign Exchange, Metalls, Commodities and Indices.

- Platform Connectivity: FIX API and MT4/MT5.

- Regulated Operations: Linkage with FCA & CySEC.

- Custom Pricing Models: Unique institutional conditions.

- Dedicated Support: Client, tech & onboarding services.

Equiti Capital — Pros and Cons

Pros

- Access to Tier-1 and non-bank liquidity through technological partners.

- Regulated (FCA & CySEC)

- Supports MT4/5 and FIX API.

- Pricing models are customized to fit the needs of institutional clients.

Cons

- The quality of multi-prime execution can differ by entity.

- It does not have a purely institutional exchange model.

- Access to retail may be regulated by the region.

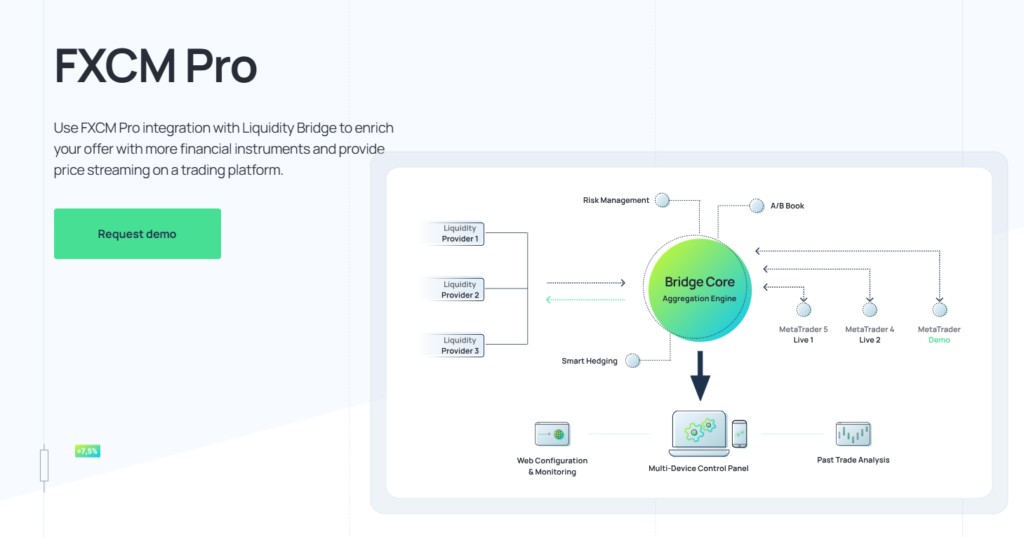

7. FXCM Pro – Best Forex Brokers with Multi-Prime Liquidity Access

FXCM Pro is the institutional side of FXCM Group providing prime brokerage and multi-prime liquidity services to brokers, funds, and professional traders.

Through partnerships with Tier-1 banks, ECNs, and LPs, FXCM Pro offers clients aggregated liquidity, centralized clearing and credit risk solutions. Via FIX connectivity and bridge integrations into top trading platforms, clients receive multi-venue execution with customized instrument-specific pricing.

Although regulatory entities and agreements dictate retail leverage and certain instruments, FXCM Pro prides itself on superior execution, liquidity, and client support, complemented by seasoned liquidity management teams.

FXCM Pro – Unique Selling Propositions

- Institutional Grade Liquidity: Aggregated ECNs & Tier-1 banks.

- Multi-Venue Execution: Robust sourcing of vivid liquidity.

- Prime Brokerage Services: Provision of credit and clearing services.

- Connectivity w/ FIX/API: Integration services for professional clients.

- Execution Quality Tools: Advanced reporting and TCA features.

- Scalable for Firms: Use by brokers & hedge funds.

FXCM Pro — Pros & Cons

Pros:

• Multi-prime FX liquidity for institutional clients.

• Prime brokerage with clearing and credit brokerage services.

• Robust tools for FIX integration and reporting.

• Decent for execution across multiple venues.

Cons:

• No focus on a direct retail brokerage.

• Some onboarding filters and complicated setup.

• Retail leverage goes down depending on the applicable regulations.

8. Match-Prime – Best Forex Brokers with Multi-Prime Liquidity Access

Match-Prime is regulated by CySEC and specializes in tailor-made liquidity solutions in forex and CFDs for institutional clients and professionals. The firm’s platform offers liquidity across multiple assets with high market depth (10 levels), and high NOP (No Operational Policy) limits, and provides FIX API for trade and account data in real-time.

For optimum liquidity management, Match-Prime has integrations with most trading systems and big liquidity distribution platforms. Match-Prime provides comprehensive onboarding assistance, risk management, liquidity concentration, and seamless execution support across forex and CFDs.

Match-Prime – Unique Selling Propositions

- Provider with CySEC Regulation: For professional clients.

- Aggregated Multi-Prime Liquidity Access.

- Up to 10 Levels of Depth: Enhanced visibility of pricing.

- APIs & Integration: Bridge & FIX connectivity.

- High NOP Limits: Ideal for institutional traders.

- Risk Management Tools: Filter pricing & controls.

Match-Prime — Pros & Cons

Pros:

• Provider of liquidity with CySEC regulation.

• Visibility of market depths of up to 10 levels.

• Connectivity with bridges and FIX.

• Execution quality for professional clients is top of the range.

Cons:

• No interface for retail trading directly.

• Platform access requires integration partners.

• A focus on institutional trading may be a disadvantage for smaller traders.

9. Global Prime – Best Forex Brokers with Multi-Prime Liquidity Access

Global Prime is an ECN/STP forex and CFDs broker with ASIC (Australia) and VFSC (Vanuatu) regulations who offers prime multi-liquidity access from non-banks ECNs and Tier-1 banks.

Traders can access more than 150 instruments such as forex, indices, commodities, shares, and crypto CFDs, all with raw spreads and ECN execution. Supported platforms are MetaTrader 4, TraderEvolution, and FIX API for advanced traders.

Leverage is up to 1:30 on ASIC and higher offshore. Global Prime focuses on competitive execution and low latency, client fund protection, and transparent trade receipts. Support is 24/5 via email, chat, and phone.

Global Prime – Unique Selling Propositions

- ECN/STP Execution Model: Direct access to LP pools.

- Multi-Prime Liquidity: Tier-1 banks and ECN sourced pricing.

- Platform Options: TraderEvolution, FIX API, and MT4.

- Competitive Spreads: Access multiple ECNs with raw pricing.

- Asset Variety: Access to FX, commodities, indices, shares & crypto.

- Client Support: Multilingual support available 24/5.

Global Prime — Pros & Cons

Pros:

• Multi-prime liquidity with ECN/STP execution.

• Low latency and competitive raw spreads.

• Multiple platforms available: MT4, TraderEvolution, and FIX API.

• Large choice of financial products.

Cons:

• Some countries allows less rigid regulation than big players in banking.

• Varying offshore leverage and terms.

• Quality of support is regional/time zone dependent.

10. Advanced Markets

Advanced Markets offers highly specialized and institutional grade prime of prime and direct market access (DMA) liquidity to banks, brokers and hedge funds.

Advanced Markets offers liquidity in deep FX, precious metals, energies and CFDs with tier-1 banks, non-banks, and ECNs with low latency and competitive prices.

Most clients connect through FIX API and can integrate Advanced Markets’ liquidity to MT4/5 through bridge partnerships.

Advanced Markets tailors data delivery, risk management, and commercial support to institutional and professional trader needs to assist brokers in improving execution and broadening multi-asset class the tradable instrument.

Advanced Markets – KEY FEATURES

- Multi-Bank Liquidity: Tier-1 bank aggregated pricing.

- DMA Execution: Direct market access with low latency.

- Multi-Asset Instruments: FX, metals, energies, and CFDs.

- FIX Connectivity: Professional API access.

- Risk Tools: Advanced pricing & risk filtering.

- Institutional Level Support: Dedicated onboarding & support.

Advanced Markets Pros & Cons

Pros:

• Multi bank deep liquidity with Direct Market Access (DMA).

• Competitive spreads with low latency execution.

• A wide range of instruments including FX, metals, energies, etc.

Cons:

• Primarily institutions, not retail traders.

• Setup involves some technical knowledge and integration.

• Stricter onboarding requirements for clients.

How to Choose the Right Broker with Multi-Prime Liquidity

Regulation & Compliance – Check the broker has gone through regulations by FCA, CySEC, or ASIC for safe, compliant trading, and protecting customer funds.

Liquidity Sources – Confirm the broker has access to multiple Tier-1 banks, non-bank LPs, and ECNs with ideal market depth and good pricing.

Execution Quality – For high-volume, scalping, or algorithmic trading, seek reliable and low-latency execution with no or little slippage.

Trading Platforms – Brokers who provide FIX API, MT4/MT5, or other sophisticated platforms with multi-prime liquidity feed are preferable.

Instrument Variety – Ensure the broker has a variety of assets like, but not limited to, the following, to increase your investment options; forex pairs, commodities, metals, CFDs, and indices.

Spreads & Fees – Ensure to examine the spread, the commission, and execution fees to provide cost-efficient trading without hidden fees.

Leverage & Margin – Make sure the broker is offering regulatory confirmable limits of NZD and a good risk score to trade to provide a good degree of flexibility.

Customer Support – Best are the brokers who offer customer service especially tech and account with no less than 5 days a week for effective trade.

Technology & Risk Tools – Provide smart order routing, risk management tools, and reporting features for professional trading supervision.

Reputation & Reviews – Analyze the reliability of the broker, quality of execution, and customer reviews to evaluate a reputable multi-prime liquidity provider.

Conclusion

For traders, brokers, and institutions looking for substantial market depth, tight spreads, and dependable execution, selecting the top forex brokers with multi-prime liquidity access is crucial.

By combining liquidity from several Tier-1 banks, non-bank market makers, and ECNs, providers like B2Broker, LMAX Global, Finalto, IS Prime, Advanced Markets, X Open Hub, Equiti Capital, FXCM Pro, Match-Prime, and Global Prime stand out.

This multi-prime structure facilitates high-volume and algorithmic trading methods, lessens slippage, and increases pricing transparency. Retail-friendly brokers like Global Prime offers comparable advantages to active traders, while institutional-focused firms offer customized solutions and sophisticated FIX connectivity.

The best option ultimately relies on trading volume, technical requirements, regulatory restrictions, and whether the user is institutional or retail.

FAQ

What does multi-prime liquidity access mean in forex trading?

Multi-prime liquidity access means a broker or provider aggregates prices from multiple Tier-1 banks, non-bank liquidity providers, and ECNs. This creates deeper market depth, tighter spreads, and more reliable execution compared to relying on a single liquidity source.

Who should use forex brokers with multi-prime liquidity access?

These brokers are ideal for institutional traders, hedge funds, proprietary trading firms, high-volume traders, and brokers. Advanced retail traders also benefit from improved pricing, reduced slippage, and stable execution during volatile market conditions.

Are multi-prime liquidity brokers better than market makers?

Yes, in most cases. Multi-prime liquidity brokers typically operate on ECN, STP, or Prime-of-Prime models, reducing conflicts of interest. Prices come directly from multiple liquidity providers rather than being internally created by a dealing desk.

Do retail traders get access to multi-prime liquidity?

Some brokers, such as Global Prime, provide retail clients with access to multi-prime liquidity through ECN/STP models. However, full institutional access (FIX APIs, custom liquidity pools) is usually reserved for professional or institutional clients.

What platforms support multi-prime liquidity access?

Multi-prime liquidity is commonly delivered through FIX API, MetaTrader 4/5 bridges, TraderEvolution, and proprietary APIs. The platform choice depends on whether the user is retail, professional, or institutional.