To learn more about the Best Monzo Alternatives for International Money Transfers focusing on speed, low transfer fees, and international coverage, please read below.

Whether you have family abroad and need to transfer money to them, pay freelancers, or need to do business transactions, these alternatives offer flexible options and provide exchange rates that don\’t hide their fees.

Ranging from digital only apps to traditional remittance services, you will find trustworthy options that make cross-border transactions easier, quicker, and cheaper than ever.

Key Point

| Service | Key Point |

|---|---|

| TransferGo | Fast and low-cost international transfers with transparent fees and mid-market exchange rates. |

| MoneyGram | Global money transfer network, ideal for cash pickups in thousands of locations worldwide. |

| OFX | Competitive exchange rates for large transfers and no transfer fees for most transactions. |

| Payoneer | Cross-border payments platform for freelancers and businesses, offering multi-currency accounts. |

| PayPal | Popular online payments platform for sending money internationally with buyer/seller protection. |

| Remitly | Focused on remittances with fast delivery options and multiple payout methods. |

| Revolut | Digital banking app offering international transfers with low fees and real-time exchange rates. |

| Wise | Transparent, low-cost transfers using real exchange rates, ideal for personal and business use. |

| Xe Money Transfer | Reliable currency exchange service with competitive rates and global transfer options. |

1. TransferGo

TransferGo is a digital remittance service designed for fast, low-cost international transfers. It supports over 160 countries and offers same-day or next-day delivery options, making it ideal for urgent payments.

Users benefit from transparent fees and competitive exchange rates compared to traditional banks. The platform is especially popular among migrants sending money home, as it provides localized support and multilingual customer service.

With its mobile-first design, TransferGo ensures convenience and reliability. For those seeking a Monzo alternative, TransferGo stands out for affordability and speed in cross-border payments.

TransferGo Pros & Cons

Pros:

- Lower than bank transfer fees.

- Same day or next day delivery.

- Over 160 countries served.

- User-friendly mobile application.

- Predictable and clear to understand fees.

Cons:

- Some areas have less service availability.

- Cash pickups are unavailable.

- Slightly varies from mid market on exchange rates.

2. MoneyGram

MoneyGram is one of the world’s largest money transfer companies, operating in over 200 countries with 350,000 agent locations. It allows users to send money online, via mobile, or in person, offering flexibility unmatched by digital-only platforms.

Transfers can be received as cash pickup, bank deposit, or mobile wallet credit. While fees may be higher than fintech rivals, its global reach and trusted brand make it a strong Monzo alternative.

MoneyGram is best suited for users who need cash pickup options or want to send money to regions with limited banking infrastructure.

MoneyGram

Pros:

- Over 200 countries served.

- Over 350,000 locations for cash pickups.

- Trusted company with several delivery methods: bank, cash, and mobile wallet.

Cons:

- High service fees.

- High costs for foreign exchange (forex) transactions.

- Scams are an increased threat.

3. OFX

OFX specializes in large-value international transfers, making it ideal for businesses and individuals moving significant sums. It offers fee-free transfers with competitive exchange rates, often better than banks.

OFX supports over 50 currencies and provides 24/7 customer service, ensuring reliability for global clients. Unlike Monzo, which focuses on retail banking, OFX is tailored for professional and corporate needs, including hedging solutions and currency risk management.

As a Monzo alternative, OFX is perfect for high-value transfers, business payments, and users seeking expert guidance on foreign exchange strategies.

OFX

Pros:

- No fees for transferring.

- Good rates for foreign exchange.

- Beneficial service for large international transfers.

- Available 24/7.

- Several services for businesses, such as hedging, foreign exchange (forex) risk, and support for transactions.

Cons:

- Transfers take 1 to 2 days.

- No cash transfer available (only bank to bank)

- Minimum transfer amount is set.

4. Payoneer

Payoneer is a global payment platform widely used by freelancers, e-commerce sellers, and businesses. It enables cross-border payments in over 200 countries and supports multiple currencies.

Users can receive payments from marketplaces like Amazon, Upwork, and Fiverr, then withdraw funds locally. Payoneer also offers prepaid cards for spending and online purchases.

Compared to Monzo, which is more consumer-focused, Payoneer excels in professional and business payments.

As a Monzo alternative, Payoneer is best for freelancers and entrepreneurs who need seamless international payment solutions integrated with global marketplaces.

Payoneer

Pros:

- Well known and used by plenty of freelancers and business owners.

- Serves more than 200 countries.

- Merger with popular marketplaces such as Amazon, Upwork, and Fiverr.

- Multiple unified cash accounts without geographical restrictions.

- Option to have a prepaid debit card.

Cons:

- Complexity of fees (withdrawal, conversion)

- Not suitable for personal remittances

- Slow customer support

5. PayPal

PayPal is one of the most recognized names in online payments, offering international transfers to over 200 countries. It allows users to send money instantly using email addresses, making it simple and accessible.

While fees and exchange rates can be higher than fintech competitors, PayPal’s global acceptance and buyer protection features make it reliable. It integrates with e-commerce platforms, making it ideal for online sellers.

As a Monzo alternative, PayPal is best for users who prioritize convenience, security, and integration with online shopping and business transactions worldwide.

PayPal

Pros

- Definitely valid globally (over 200 countries)

- Transferable instantly through an email

- Good customer protection

- Simple e-commerce plug-ins

Cons

- Extremely high fees to use

- Really bad currency exchange rates

- Not good for high-value transfers

6. Remitly

Remitly focuses on fast, affordable transfers for migrants sending money home. It offers two options: Economy (low-cost, slower delivery) and Express (instant transfers at higher fees).

Available in over 100 countries, Remitly supports bank deposits, cash pickups, and mobile wallets. Its transparent pricing and guaranteed delivery times make it trustworthy.

Compared to Monzo, Remitly is more specialized in remittances rather than general banking. As a Monzo alternative, Remitly is ideal for individuals prioritizing speed, affordability, and flexible delivery methods for family remittances abroad.

Remitly

Pros

- Super quick transfers (has an Express option)

- Has an Economy option for lower fees

- Over 100 countries

- Variety of delivery methods (bank, cash, wallet)

- Pricing is clear without any surprises

Cons

- Very high fees for Express transfers

- Focused only on remittances

- Less competitive exchange rates compared to Wise

7. Revolut

Revolut is a digital banking app offering multi-currency accounts, international transfers, and crypto trading. It supports over 30 currencies with interbank exchange rates, making it cost-effective for travelers and businesses.

Revolut also provides budgeting tools, debit cards, and premium features like airport lounge access. Unlike Monzo, Revolut emphasizes global financial services, not just UK banking.

As a Monzo alternative, Revolut is perfect for frequent travelers, digital nomads, and users who want a versatile app combining banking, FX, and lifestyle perks in one platform.

Revolut

Pros

- Accounts can hold multiple currencies

- True interbank rates for currency exchange

- More than 30 currencies

- More features (cryptocurrency, budgeting, cards)

- Good service to take on location

Cons

- Some features require a paid subscription

- Some users report problems with customer support

- Not inclusive to all countries

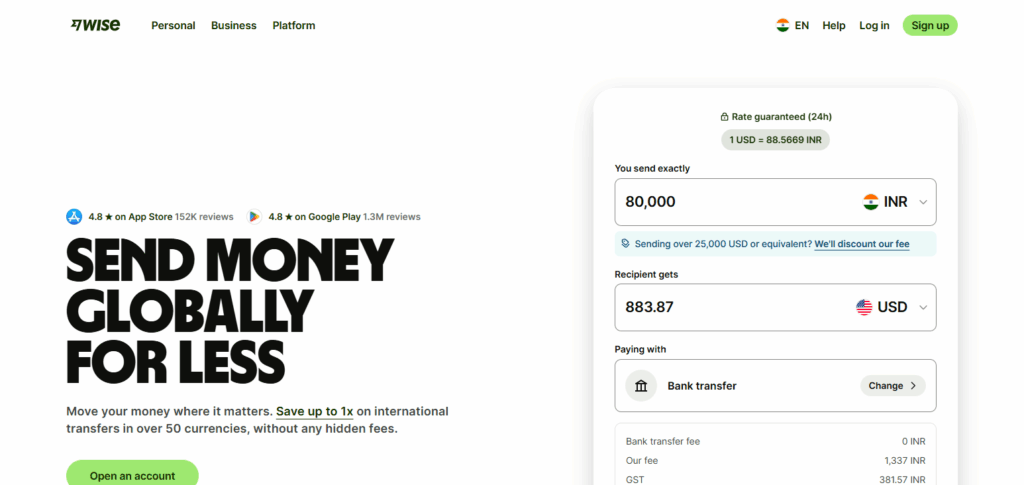

8. Wise (formerly TransferWise)

Wise is renowned for transparent, low-cost international transfers using the real mid-market exchange rate. It supports over 80 countries and allows users to hold balances in multiple currencies.

Wise’s multi-currency account and debit card make spending abroad seamless. Compared to Monzo, Wise is more specialized in FX transfers, offering unmatched transparency in fees. Its peer-to-peer model ensures fair pricing.

As a Monzo alternative, Wise is best for individuals and businesses seeking cost-effective, transparent, and reliable international money transfers with no hidden charges.

Wise (formerly TransferWise)

Pros

- Uses the real mid-market exchange rate

- Fees are clear upfront

- Over 80 countries

- Multi-currency account & debit card

- Reliable for personal and business transfers

Cons

- Funds available in 1 to 2 business days

- Cannot pick up cash

- A few competitors have lower fees for small amounts

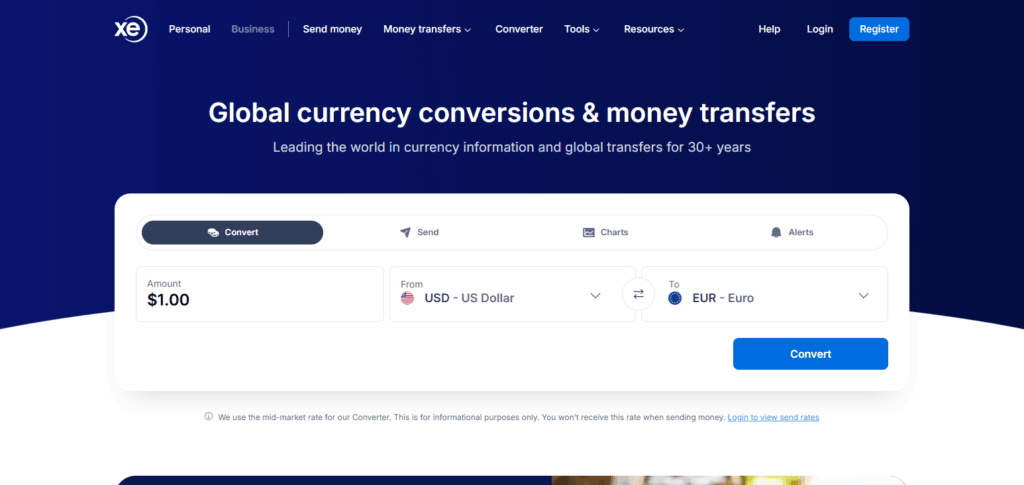

9. Xe Money Transfer

Xe is a trusted name in currency exchange and international transfers, serving both individuals and businesses. It supports over 130 countries and offers competitive exchange rates with no hidden fees.

Xe also provides currency charts, alerts, and hedging tools, making it useful for those monitoring FX markets. Unlike Monzo, Xe focuses entirely on cross-border payments and currency solutions.

As a Monzo alternative, Xe Money Transfer is ideal for users who want a specialist platform for international transfers combined with professional FX insights and tools.

Xe Money Transfer

Pros

- More than 130 countries

- Excellent market rates

- Transparent pricing

- Currency tools (alerting, charting, hedging)

- Individuals and businesses

Cons

- Transfers may be delayed

- Profit from the exchange rate

- Cannot pick up cash

Conclusion

While Monzo will carry out international payments at a low cost, and with a high level of convenience when compared to other services, there are competitors who provide a better service. Wise and TransferGo are a better service when it comes to low cost and high transparency.

For global payment reach combined with the ability to pick up cash, MoneyGram and Remitly are better options. For businesses and larger payments, professional service is offered by OFX, Payoneer and Xe.

For travelers and those in need of a multi-currency account, PayPal and Revolut are geared towards e-commerce and freelance workers. The services of Monzo competitors are highly affordable, flexible, and offer fast international payments, making these competitors better services.

FAQ

What are the best Monzo alternatives for sending money abroad?

The top alternatives include Wise, TransferGo, MoneyGram, OFX, Payoneer, PayPal, Remitly, Revolut, and Xe Money Transfer. Each offers unique strengths such as low fees, cash pickup options, or business-focused services.

Which platform is cheapest for international transfers?

Wise and TransferGo are generally the most affordable, offering transparent fees and mid-market exchange rates.

Which service is best for cash pickup?

MoneyGram and Remitly excel in cash pickup, with thousands of agent locations worldwide for recipients without bank accounts.

Which option is best for businesses or freelancers?

Payoneer and OFX are ideal for businesses. Payoneer integrates with marketplaces like Amazon and Upwork, while OFX specializes in large-value transfers and FX risk management.

Which platform is best for travelers and digital nomads?

Revolut is perfect for travelers, offering multi-currency accounts, interbank rates, and lifestyle perks like budgeting tools and crypto access.