I will be writing about the Best Payment Gateway for Secure Online Payments. For businesses, having the right payment gateway is vital for safe, quick, and dependable online transaction.

A secure gateway safeguards customer information, minimizes the chances of a fraudulent transaction, and offers a variety of payment methods. This enables businesses to gain customer trust, simplify their processes, and provide their customers with an easy worldwide checkout.

What is a Payment Gateway?

A payment gateway enables safe online transaction processing. It transmits encrypted payment information (credit/debit cards) to financial institutions and back to businesses.

It also provides real-time fraud detection and payment authorization. In addition to cards and digital wallets, payment gateways offer net banking as a payment option. Complying with PCI DSS and other security certifications is standard.

A payment gateway’s PCI DSS compliance and seamless customer experience during the checkout process are critical toward maintaining customer confidence. Payment gateways also facilitate trustworthy global online transaction processing for businesses.

How to Choose the Right Payment Gateway

Security and Compliance

- Make sure the gateway is PCI DSS compliant and has strong encryption to protect customer data.

- Have fraud detection tools and secure authentication.

Transaction Fees and Pricing

- Evaluate setup fees, monthly fees, and transaction fees.

- Estimate your business volume to select the most cost-effective option.

Supported Payment Methods

- Determine if it accommodates credit/debit cards, wallets, UPI, net banking, and overseas payments.

- More payment choices will be more convenient for the customers and will potentially increase your sales.

User Experience

- A quick and easy checkout process lowers the risk of cart abandonment.

- It must be mobile-optimized for customers accessing it through their devices.

Customer Support

- Operational and reliable 24/7 support is critical for payment resolutions.

- Contribute thorough documentation, tutorials, and live chat support.

Global Reach and Multi-Currency Support

- If selling globally, select a gateway that will accommodate multiple currencies and cross-border payment options.

Top 4 Payment Gateways for Secure Online Payments

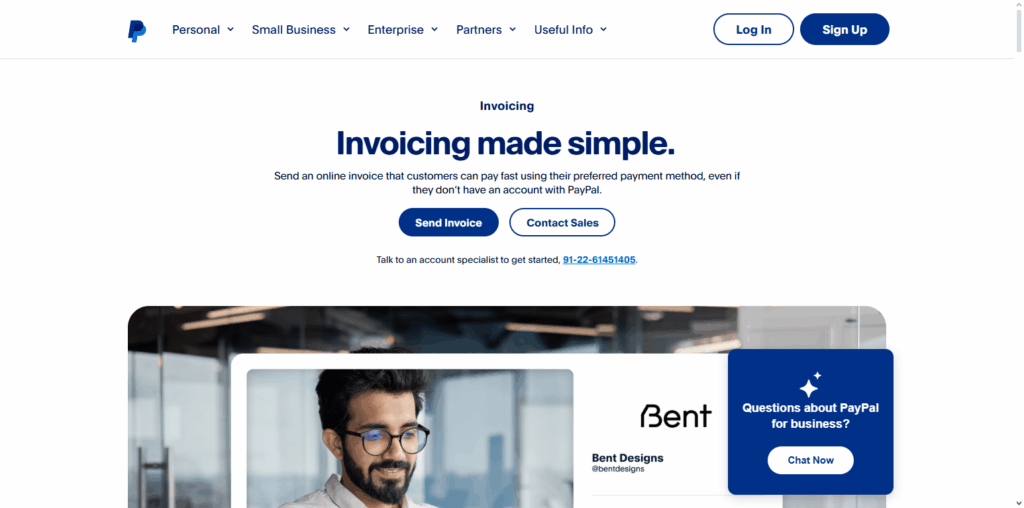

1. PayPal

One of the main reasons PayPal has become one of the most dominant payment systems is due to the high level of security it offers, along with its global presence and easy interface. It has banks of encryption and fraud detection systems which guard buyers and sellers.

It also offers businesses the ability to process payments instantly, and accept payments in the form of credit and debit cards and digital wallets.

Recognition is also a great advantage for PayPal because it increases the likelihood of more customers completing their transactions. More confidence is built for online shopping because of dispute resolution, and buyer protection policy. It even offers easy integration with all business and e-commerce systems, which increases its reliability.

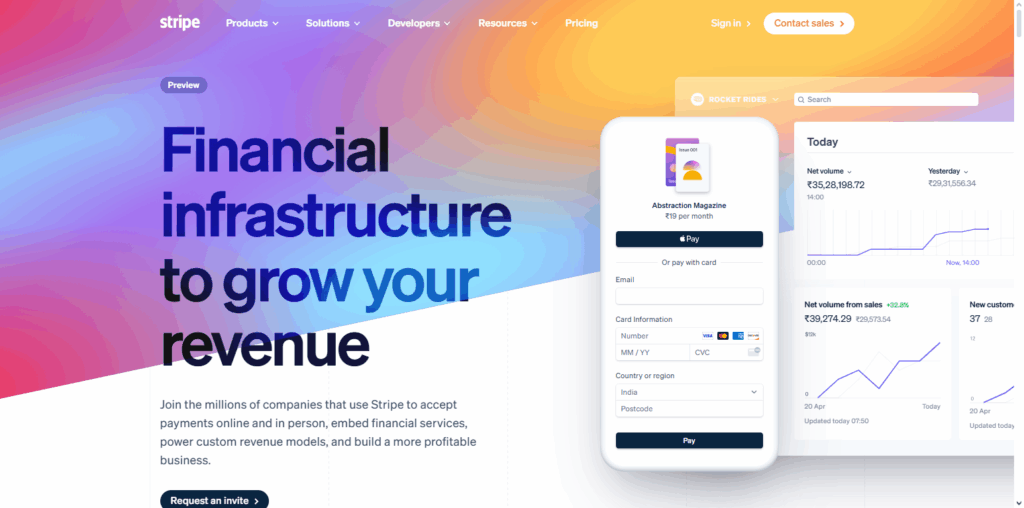

2. Stripe

Stripe is known as a very popular payment gateway. It is trusted to provide secure online payments due to its developer-friendly system and exceptional security. End-to-end encryption, tokenization, and PCI compliance guarantee that sensitive payment information is completely secure.

Stripe accommodates numerous payment methods which include credit cards, digital wallets, and multiple currencies which aids in the ease of global payments.

Its API is very adaptable which provides businesses tools to build tailor-made interfaces and offers easy integration to websites and mobile applications. Stripe provides tools to secure payments, real-time fraud detection, and analytics to help protect a business’s global reputation, optimize revenue, and maintain trust amongst customers.

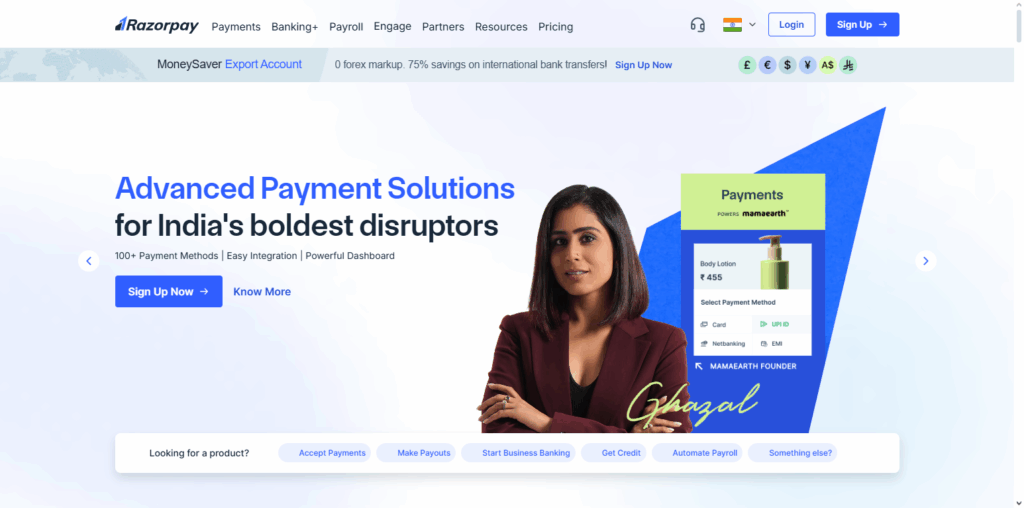

3. Razorpay

Razorpay enjoys a positive reputation as a quality payment gateway provider primarily in India and for good reason. With secured encription and PCI DSS alignment, as well as real time fraud detection for and throughout every transaction, Razorpay promises full transaction safety.

With credit and debit cards, UPI, wallets, and net banking as well as the integration with different applications, payment options are readily available. It can be used and configured by any size business, regardless of complexity, as integration with apps, sites, and across, e-commerce platforms is a simple process.

In addition to real time and reliable payment processing for clients, internationally and domestically, online payment processing offers automated settlement, analytics, and subscription management for e-commerce businesses to better align operations.

4. Square

Square has become one of the best-known and well-respected payment gateways, thanks to their all-in-one and versatile payment options and their state-of-the-art security features, which make the system best for safe transactions both online and face-to-face.

Square payment systems use advanced encryption, comply with PCI standards, and offer real time fraud protection systems, ensuring the protection of sensitive customer information. Square accommodates credit/debit cards and digital payment options like digital wallets and mobile payments, enhancing the range of all services.

Square is flexible and easy to use and integrates with online stores. Settlements, fraud protection, analytics and inventory management further enhance the system, making it fully dependable and comprehensive for modern businesses.

Benefits of Using a Secure Payment Gateway

Increased Security

- Protects sensitive customer information through encryption, tokenization, and PCI DSS compliance.

- Prevents fraud and unauthorized transactions.

Customer Trust

- Customers are confident how secure the platform is to pay.

- Increases repeat purchases and credibility.

Speed of Transactions

- Provides instant payment processing and order fulfilment.

- Improves customer satisfaction.

Various Payment Methods

- Accepts credit/debit cards, wallets, UPI, net banking, and international payments.

- Flexibility and convenience payment for customers.

Business Expansion Opportunities

- Accepts cross-border transactions and multi-currency payments.

- Businesses grow internationally and have no payment barriers.

Improved Operations Efficiency

- Streamlines the processes of payments, reconciliations, and reporting.

- Lowers the chances of manual errors.

Fraud Inspection and Dispute Management

- Keeps track of payments and other transactions to detect abnormal behavior.

- Provides automated systems for payment disputes and chargebacks.

Features of a Secure Payment Gateway

Advanced Security Measures

- Protector of customer’s proprietary information with the help of encryption, tokenization, and PCI DSS compliance.

- Authorized transaction prevention with fraud detection and real-time monitoring.

Multiple Payment Methods

- Acceptance of customer payments through credit/debit cards, digital wallets, UPI, net banking, and international payments.

- Versatile payment modes are for customer’s convenience and increasing conversion rates.

Seamless Integration

- Integration into websites, mobile apps, and e-commerce platforms is a breeze.

- Setup and customization is geared through APIs and plugins.

Fast and Reliable Processing

- Transaction approvals and settlements in quick succession.

- Opens upward customer experience through minimal downtime and failed transaction.

User-Friendly Checkout Experience

- Simple, mobile-friendly, and intuitive interfaces for seamless checkout.

- Transformed customer satisfaction with minimized cart abandonment.

Global Reach and Multi-Currency Support

- Acceptance of payments from multiple countries and currencies.

- Opportunity for international expansion for business in a barrier free manner.

Common Challenges and How to Overcome Them

Transaction Failures

- Challenge: Transactions might timeout due to temporary issues within the network, bank restrictions, or glitches with the payment gateway.

- Solution: Use a dedicated payment gateway with high uptime, include other options to facilitate payments, and inform users in real-time whenever a payment is declined.

Excessive Transaction Charges

- Challenge: Transaction fees cut into the profit margins for a business.

- Solution: Analyze multiple payment gateways fee structures to identify the most suitable option to your business volume and business plan.

Problems with Integration

- Challenge: Linking the payment gateway to a business’ website, mobile application or POS system is poorly designed.

- Solution: Choose a payment gateway which provides easy to integrate APIs, integration plugins, and developer assistance to facilitate and document your gateway installation.

Threats of Fraud and Cheating

- Challenge: Transactions on the internet are always at risk of fraud, and other malevolent cyber-attacks.

- Solution: Use a payment gateway that provides high standards of fraud protection, real-time fraud detection, and sophisticated encryption and tokenization.

Delayed Payouts

- Challenge: The payment made to the business account is delayed by the payment processor.

- Solution: Choose payment gateways with direct payout or fast payout options.

Limited Global Reach

- Challenge: Some gateways do not allow international or multi-currency transactions.

- Solution: For international customers, select a gateway with multi-currency capabilities and worldwide payment options.

Conclusion

For any business, the selection of the most appropriate payment gateway for secure online payments is an important step in ensuring seamless, safe, and dependable transactions.

With its ability to shield vulnerable gateway shield customer decisive information, minimize the chances of fraudulent transactions, and foster confidence to the clients, all while presenting various payment alternatives and easy connection with a business websites and apps.

Leading gateways PayPal, Stripe, Razorpay and Square feature high security, advanced technology, global accessibility, and easy to use attributes. With the appropriate gateway, firms enhance customer satisfaction, simplify their business functions, and grow internationally.

FAQ

What is a payment gateway?

A payment gateway is a technology that securely processes online transactions between customers and businesses, encrypting sensitive data to prevent fraud.

Which is the most secure payment gateway?

Top secure gateways include PayPal, Stripe, Razorpay, and Square, all offering encryption, PCI DSS compliance, and real-time fraud detection.

How do I choose the right payment gateway?

Consider security, transaction fees, supported payment methods, integration options, customer support, and global reach to select the best fit for your business.

Can small businesses use these gateways?

Yes, most top gateways offer easy integration and scalable plans suitable for small, medium, and large businesses.