In this article, I will talk about the Best Staking Nodes To Join. Users are rewarded for participating in the network’s ecosystem, and they equally play a part in the securing blockchain nodes.

So whether you are after a more hands-on feel from an exchange or prefer a decentralized solution, picking the right node can greatly improve your income and ultimate flexibility in the crypto system.

Key Point & Best Staking Nodes To Join List

| Platform | Key Point |

|---|---|

| Lido | Offers liquid staking for Ethereum with stETH, allowing DeFi participation. |

| Rocket Pool | Decentralized ETH staking with a low minimum and rETH token rewards. |

| StakeWise | ETH staking with dual token model (sETH2 & rETH2) for flexibility. |

| Ankr | Multi-chain liquid staking with a focus on Web3 infrastructure. |

| Figment | Institutional-grade staking services with analytics and rewards tracking. |

| Staked.us | Non-custodial staking for institutions with high-yield opportunities. |

| Binance Staking | Easy access to staking via Binance with flexible and locked terms. |

| Kraken Staking | Exchange-based staking with instant rewards and low entry threshold. |

| Coinbase Staking | User-friendly staking directly from exchange wallets with automatic rewards. |

| StakeHound | Combines staking and DeFi access with tokenized staked assets. |

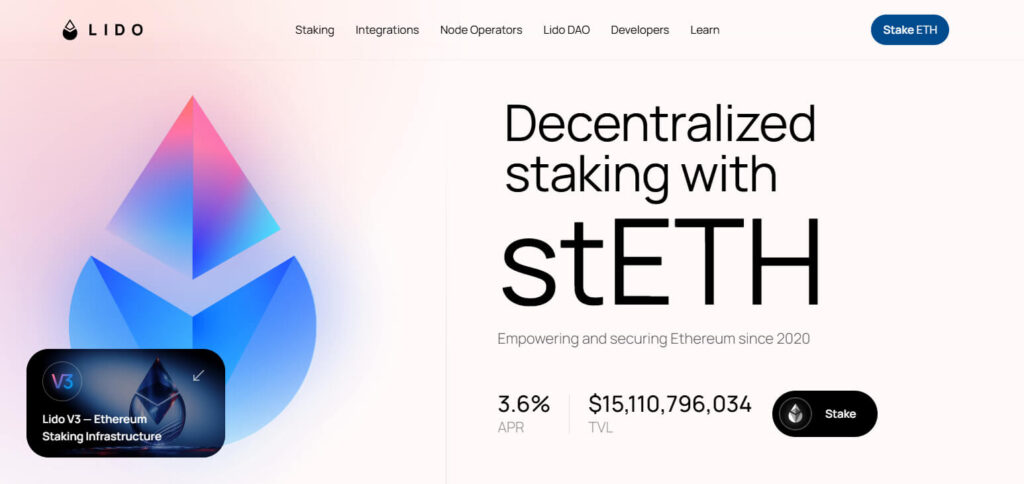

1.Lido

Lido is regarded as one of the best staking nodes to join due to its unparalleled flexibility through liquid staking.

Lido allows users to stake ETH and receives stETH in return, a liquid asset that can be utilized across diverse DeFi chains while accruing rewards.

The integration of these two functions – staking and liquidity – is what sets Lido apart from other traditional validators. Its decentralized validator set along with robust community support improves network security and reliability, thus making it a perfect choice for users who seek both, rewards and utility.

Features

- Liquid Staking – When you stake ETH you get the token stETH which is transferable.

- DeFi Integration – It can be used in lending, farming, trading and many other platforms.

- Decentralized Validators – These are defended by a range of node operators to minimize exposure.

2.Rocket Pool

Rocket Pool manages to remain one of the most effective Ethereum staking pools due to its highly decentralized service offering.

Unlike centralized services, anyone can become a node operator on Rocket Pool with a bare minimum of 16 ETH. Smaller holders can also stake with as little as 0.01 ETH.

rETH is its native token which represents assets staked on the platform and grows over time. The distinguishing feature of this platform is empowering the community to actively participate in the Ethereum ecosystem while earning passive income with very low thresholds to entry.

Features

- Decentralized Network – Individuals can operate nodes and stake with a minimum of 0.01 ETH.

- rETH Token Rewards – Get rewarded with an acknowledgement token of rETH.

- Self-Managed Nodes – Users can manage their own nodes with only 16 ETH.

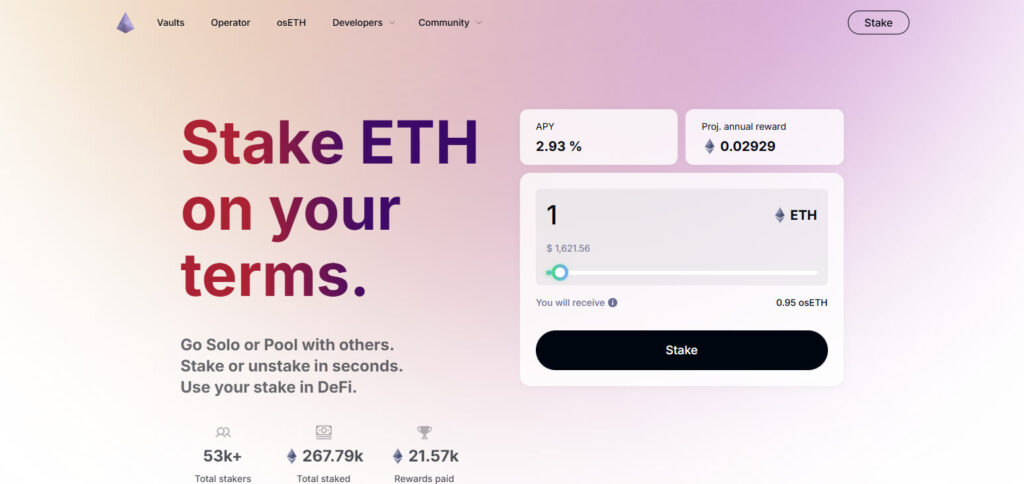

3.StakeWise

StakeWise is deemed as one of the top staking nodes to join because of its unmatched dual-token transparency and control.

Users can separately track earnings and utilize them across DeFi, by issuing sETH2 for staked assets and rETH2 for earned rewards.

Additionally, users who wish to reinvest separately or manage rewards differently, this flexibility is useful. Enhanced for beginners and experienced stakers is StakeWise’s user-friendly interface and efficient reward distribution.

Features

- Pooled validators model – They have lower fees working under an enhanced reward distributing system.

- Dual Token Model – sETH2 is staked ETH and rETH2 is the one representing earned rewards.

- Flexibility in Withdrawals – Previously stated principals means the reward can be withdrawn and spent without being attached to a staing principal.

4.Ankr

Ankr is considered one of the most profitable staking nodes to join since it merges staking with Web3 infrastructure service.

Users are able to participate in blockchain network activities while also earning rewards. Its particular advantage is multi-chain liquid staking which allows users to stake on different blockchains such as Ethereum and BNB Chain from a single platform.

Additionally, Ankr offers stakable derivatives that can be utilized in DeFi which increases yield stacking and fortified pliability for users that are looking to shift focus beyond just a single network.

Features

- Cross-chain Staking – Enable staking from Ethereum,BNB Chain and more other chains.

- Liquid Derivatives – Staking is done via aTokens that can be traded.

- Web3 Focus – Allows hosting node and other infrastructure services to app developers.

5.Figment

Joining Figment as a staking node is one of the best options available considering its enterprise-level infrastructure and powerful data tools that exceed simple staking.

This offers untapped value in the realm of sophisticated performance analytics, governance analysis, and automated API access for dApps and other end-users.

Figment enables participation in a large number of proof-of-stake networks so it caters to diversified portfolios. It also provides users great control and insights within their staking activities which makes it a pro-tier offering meant for serious investors and traders.

Features

- Institutional Grade – Acclaimed by large investors and developers.

- Analytics Tools – Provides access to governance and staking performance insights.

- Multi-Asset Support – Provides staking for numerous proof of stake assets.

6.Staked.us

Staked.us can be considered one of the most preferred staking nodes to join because it provides a non-custodial model designed specifically for institutional clients.

Its unique value proposition is it high-performance infrastructure that minimizes both system downtime and yield loss without custody over user assets.

Staked.us features automated reward optimization and it supports a multitude of proof-of-stake networks, which ensures system security and operational efficiency, making it the preferred choice for organizations aimed at a dependable and scalable institutional grade staking solution.

Features

- Non-Custodial – Stake without losing control over your assets.

- High-Yield Infrastructure – Tailored for uptime and reliable reward distribution.

- Institutional Focus – Tailored to large scale investors and businesses.

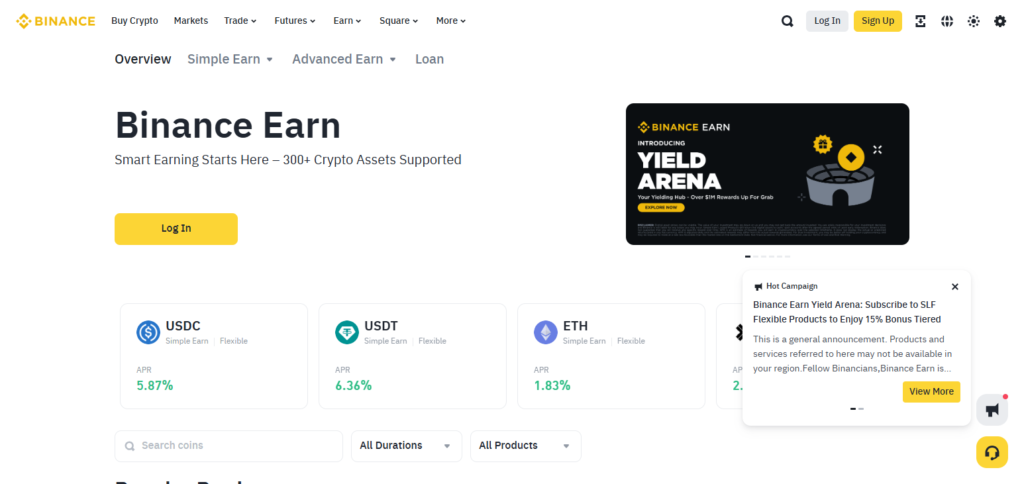

7.Binance Staking

Binance Staking is regarded as one of the leading staking nodes to join because it is so user friendly.

The best feature is the fact that users can stake numerous different assets directly through their Binance account with no requirement for any technical configuration. Participants are given options of locked or flexible terms according to their preferences.

The ease associated with earning additional rewards while leveraging a reputable and highly liquid exchange renders Binance Staking an efficient solution for passive income.

Features

- User Friendly – Easy to operate interface for all experience levels.

- Flexible and Locked Terms – Choose between flexible access or higher yield locked staking.

- Wide Asset Range – Staking offered on numerous cryptocurrencies.

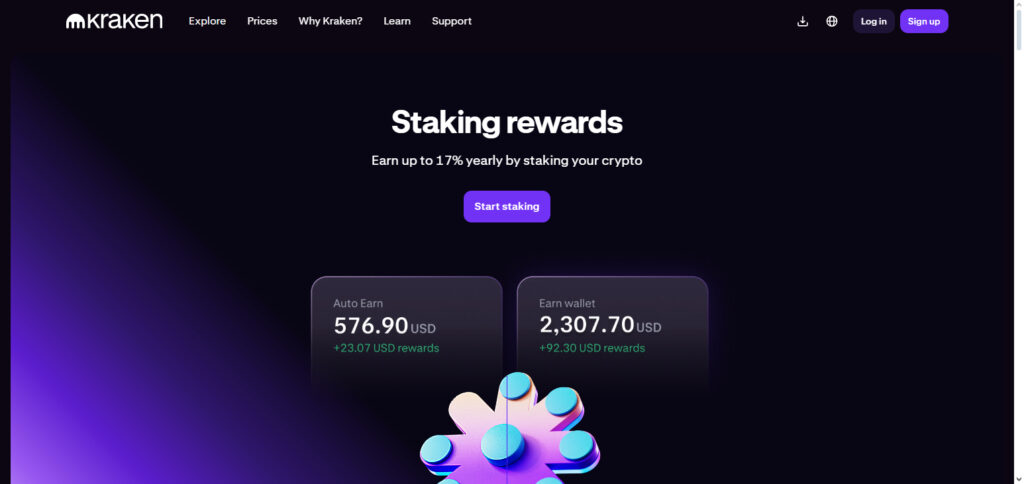

8.Kraken Staking

Kraken is one of the best nodes to join for staking because it provides instant rewards and supports off-chain and on-chain assets.

The edge it has over its competitors is the low minimum requirements which allows users to start with as little as a few dollars while earning competitive rewards.

Furthermore, Kraken’s security and transparency make its platform ideal, granting users complete control and visibility. This is especially beneficial for newcomers who wish to stake with little to no complex wallet management.

Features

- Low Minimum Entry – Minimal amounts required to start earning.

- Instant Reward Activation – Immediate reward distribution upon staking.

- Security Focused – Regulated platform can foster earning potential safely.

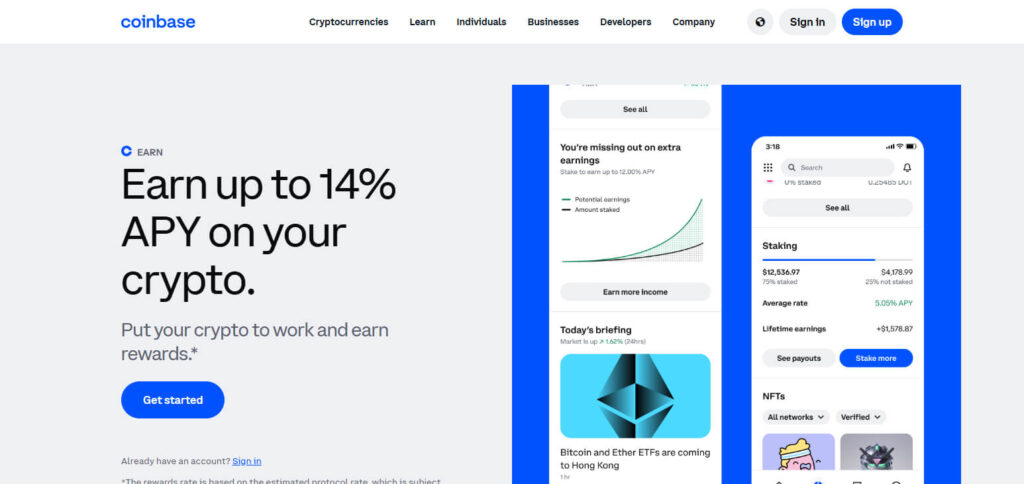

9.Coinbase Staking

Coinbase Staking is simpler to use compared to other nodes because you only need to make a few clicks from your wallet.

Aside from its convenience, the automated rewards features provides users with ease knowing that the platform is highly secured and regulated, making it attractive to users unfamiliar with cryptocurrency.

Rewards can be automatically gained with no need for complex setup which makes Coinbase particularly appealing for users who prefer not to manage validators.

Features

- Beginner Friendly – Easy staking through your accounts without prior arrangements.

- Auto Rewards – Automatic reward earning without key or node management.

- Regulated Platform – Compliant with financial regulations, based in the U.S.

10.StakeHound

StakeHound sits among the best staking nodes to join because it combines staking with full DeFi access through tokenized assets.

It offers unique value by transforming staked tokens into liquid versions—stTokens—that can be utilized in various DeFi applications without the need to unstake.

This dual advantage of earning staking rewards while having the ability to actively participate in decentralized applications provides unparalleled flexibility. StakeHound is perfect for users looking to optimize their crypto utility while contributing to network security, earning passive income.

Features

- Tokenized Staking – Get stTokens that denote staked assets with liquidity available.

- DeFi Ready – Employ stTokens for lending, trading, and other DeFi services.

- Seamless Bridge – Features the best of both worlds: traditional staking benefits and active utility of the asset.

Conclusion

In summary, the optimal staking nodes to join give more than just earning an income through staking; they allow for multi-participation on the network while ensuring security and flexibility.

Be it the decentralized options like Rocket Pool and Lido or institutional grade platforms like Figment and Staked.us or even the user-friendly services from exchanges like Binance and Coinbase, every investor is bound to find their fit.

Selecting the right node involves an understanding of one’s objectives in achieving balance between risk tolerance and liquidity.