In this article, i will discuss the Best Up and Coming Stocks to Invest In Now—identifying the most promising stocks in technology, healthcare, fintech, energy, and other sectors poised to expand.

For the forward-thinking investor, these emerging stocks present new avenues to build a diversified portfolio, capitalizing on the next wave of market leaders ahead of full development.

Key Point & Best Up and Coming Stocks to Invest In Now List

| Company | Ticker | Key Point |

|---|---|---|

| Coupang Inc. | NYSE: CPNG | South Korea’s e-commerce giant with rapid delivery model and tech-driven logistics. |

| DoorDash Inc. | NASDAQ: DASH | Leading U.S. food delivery platform expanding into groceries and retail delivery. |

| Snowflake Inc. | NYSE: SNOW | Cloud data warehousing leader enabling scalable data sharing and analytics. |

| Amdocs Limited | NASDAQ: DOX | Provides software and services to telecom and media companies globally. |

| Edgewise Therapeutics Inc. | NASDAQ: EWTX | Focuses on precision medicines for muscle disorders, especially rare diseases. |

| Dun & Bradstreet Holdings Inc. | NYSE: DNB | Provides commercial data and analytics for risk, finance, and marketing. |

| Kenvue Inc. | NYSE: KVUE | Consumer health spin-off from Johnson & Johnson, owns brands like Tylenol. |

| Valaris Limited | NYSE: VAL | Offshore drilling contractor with a global fleet of rigs. |

| Procore Technologies Inc. | NYSE: PCOR | Offers cloud-based construction management software for large-scale projects. |

| Viking Holdings Ltd. | NYSE: VIK | Operates luxury ocean and river cruises globally, newly public in 2024. |

| Affirm Holding Inc. | NASDAQ: AFRM | Fintech company offering “buy now, pay later” services at point of sale. |

| Monday.com Ltd. | NASDAQ: MNDY | Work operating system platform for project management and team collaboration. |

| GE HealthCare Technologies Inc. | NASDAQ: GEHC | Spin-off from GE, focusing on medical imaging, diagnostics, and patient monitoring. |

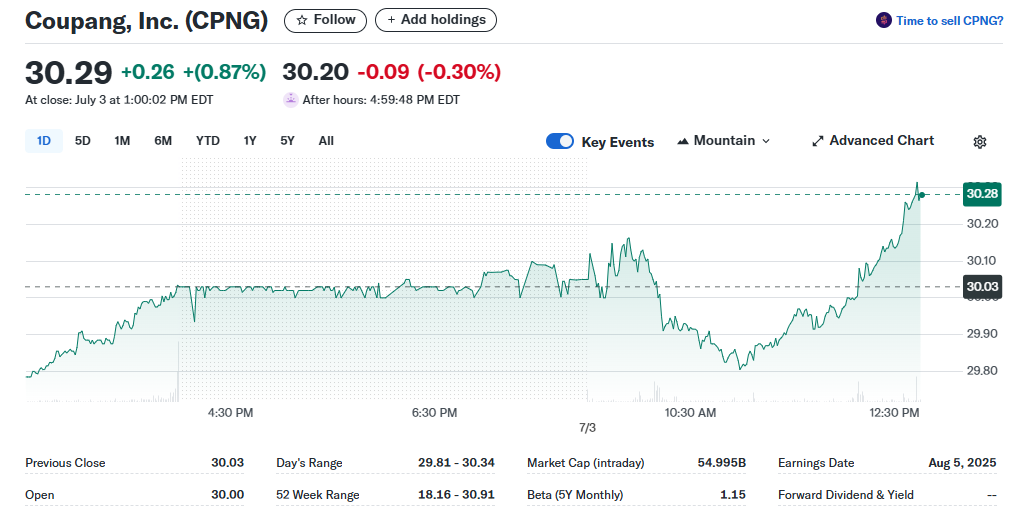

1. Coupang Inc. (NYSE\:CPNG)

With its “Rocket Delivery” methods, Coupang is changing the face of e-commerce in South Korea. The company’s proprietary logistics system allows for the delivery of millions of items within 24-48 hours.

Alongside robust customer service, Coupang’s supply chain management gives it a strong competitive advantage. Expansion into the fintech industry and other markets such as Taiwan only serve to increase this potential further.

The company is also proving its resilience in super competitive markets by strongly growing revenue and improving margins. There is abundant exposure for investors wishing to capitalize on e-commerce innovation in South Korea.

With its technological agility and infrastructure, along with rapid market capture, Coupang is definitely one of the Best Up and Coming Stocks to Invest In Now.

Coupang Inc. (NYSE: CPNG)

Pros:

- To an extent, Rocket Delivery enables next-day logistics service all over South Korea

- Confidence from investors shown through high institutional ownership (83%+)

- Revenue growth of 11.2% YoY alongside expansion into Taiwan as well as into luxury retail

- Financial stability indicated by low debt to equity ratio of 0.23

Cons:

- Profitability is limited because net margin remains low (~0.82%).

- Overvaluation is suggested by high P/E ratio (~213).

- Short term concerns may be signaled by insider selling, e.g., 30M shares offloaded.

- Potential liquidity issues indicated by quick ratio below 1.0.

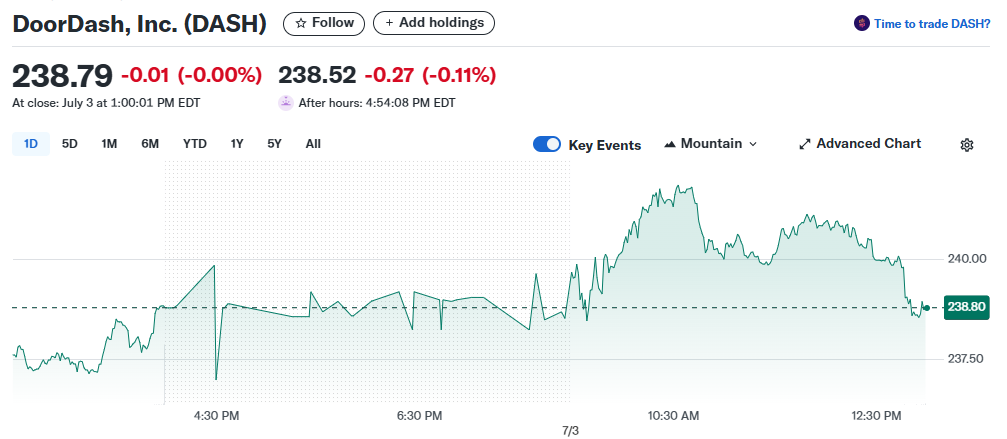

2. DoorDash Inc. (NASDAQ:DASH)

Dasher continues to lead the market in the United States for food ordering and is broadening its scope to include grocery items, alcohol, and convenience stores. The company is working to evolve into an all-encompassing logistics platform capable of supporting on-demand commerce.

With innovative DashPass subscriptions and acquisitions like Wolt, DoorDash is capturing global market share. With its user base and revenue continuing to grow, the company is seeing an increase in competition.

Unlike other companies, DoorDash is seeing benefits from the changing consumer behavior brought on by the pandemic. The company’s platform, now that it is expanding into non-restaurant deliveries, indicates long-term prospects.

Investors looking for exposure in the gig economy and logistics technology should consider DoorDash is one of the Best Up and Coming Stocks to Invest In Now.

DoorDash Inc. (NASDAQ: DASH)

Pros:

- Dominant in US food delivery, now expanding into groceries, retail as well as drug stores

- Significant revenue growth of 25% YoY alongside improving margins.

- Rapid scaling supported by flexible gig model.

- Broader reach due to strategic partnerships e.g. Walmart Canada, Home Depot.

Cons:

- Unpredictable profitability accompanied by high valuation (P/S ~5.94).

- Regulatory risks regarding classification of gig workers.

- High delivery fees coupled with restaurant markups discourage some users.

- Competition from Uber Eats, Grubhub and local players.

3. Snowflake Inc. (NYSE\:SNOW)

Companies are enabled by Snowflake’s cloud-based data warehousing to store and analyze data sets across multiple platforms. It is quite flexible because of its Amazon, Google and Microsoft integrations as well as its usage-based model.

More and more companies are relying on Snowflake’s platform for collaboration and advanced AI analytics. It holds ever-increasing annual revenue, a strong rate of customer retention, and continues to gain market share in the rapidly growing cloud data industry.

Snowflakes innovations with machine learning tools and data sharing place the company strategically for disruption in technology.

Due to its strong model of SaaS growth and importance within the infrastructure of AI data, it is easily one of the Best Up and Coming Stocks to Invest In Now.

Snowflake Inc. (NYSE: SNOW)**

Pros:

- Multi-cloud agility and elastic scalability.

- Databricks, AWS, and Azure partnerships.

- High customer retention and increased use (AI, ML, data sharing).

- Pricing model – pay-as-you-go based on customer spend.

Cons:

- Expensive stock; high P/S and P/B ratios.

- Limited proprietary machine learning tools.

- Smaller community than AWS or Azure.

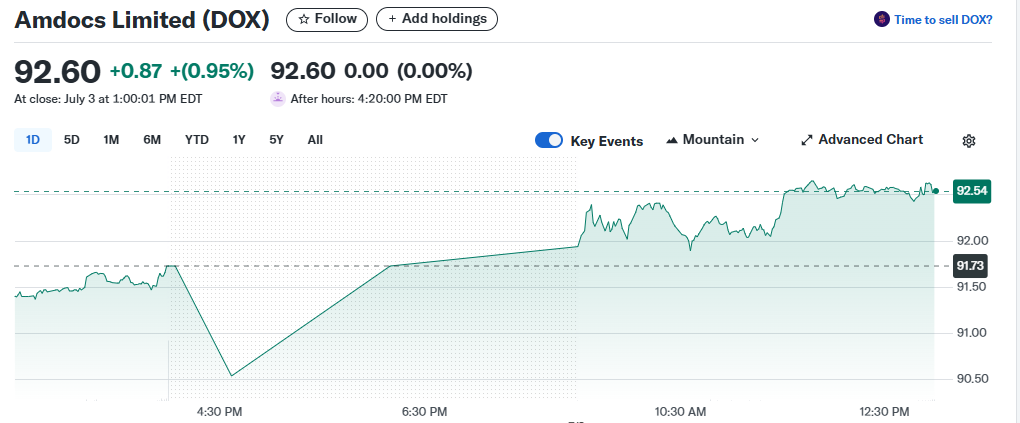

4. Amdocs Limited (NASDAQ\:DOX)

As a global software and services provider to telecom and media firms, Amdocs supports customer experience systems, billing solutions, and digital transformation for major service providers.

Amdocs stands to benefit from the growing demand for 5G and cloud services. Its stable revenue and strong partnerships with AT\&T and T-Mobile underscore operational strength.

Even in uncertain markets, Amdocs maintains recurring revenue, solid cash flow, and resilience through a focus on R\&D.

For investors looking to capitalize on the transformation of digital infrastructure, Amdocs ranks as one of the Best Up and Coming Stocks to Invest In Now.

Amdocs Limited (NASDAQ: DOX)

Pros:

- Top provider of telecom billing and customer care management systems.

- Significant managed service revenue stream (66% of total).

- Moving into AI and platforms for 5G monetization.

- Dividend yield of 2.3% with a history of increasing payouts.

Cons:

- Phasing out low-margin services results in slower top-line growth.

- Limited presence outside the telecom industry.

- High insider ownership (15%) but minimal recent purchases from insiders.

- Competitive pressure from newer SaaS entrants.

5. Edgewise Therapeutics Inc. (NASDAQ\:EWTX)

Edgewise Therapeutics is a clinical-stage biotechnology firm focusing on developing precision therapies for rare muscle disorders, including Duchenne muscular dystrophy (DMD). EDG-5506, the lead candidate, has demonstrated positive results in early trials pertaining to muscle enhancement.

While the biotechnology industry is known for its volatility, Edgewise’s specialization and expanding pipeline offer promise for the long-term. There may be significant partnership or acquisition interest as the company moves closer to Phase 2/3 trials.

Edgewise performs in a data-driven manner in a high-need niche market, making the company a highly asymmetric bet with a lot of upside. Biotech-focused investors, Edgewise Therapeutics is undoubtedly one of the Best Up and Coming Stocks to Invest In Now.

Edgewise Therapeutics Inc. (NASDAQ: EWTX)

Pros:

- Targeting rare diseases with a promising pipeline, such as Duchenne and Becker muscular dystrophy.

- Low debt and strong cash position (~$436M).

- Positive results from Phase 2 trials for EDG-5506 and EDG-7500.

- Significant upward adjustment from analysts on price targets (avg.

Cons:

- Approved products are non-existent; company has not generated revenue

- High cash flow negative and R&D burn

- Volatile stocks having 13%+ short interest

- Biotech industry regulatory and trial risks

6. Dun & Bradstreet Holdings Inc. (NYSE\:DNB)

Dun & Bradstreet gives out commercial data analytics and insights to help businesses evaluate credit, manage risk, and facilitate growth. Its global database spanning over 500 million businesses is critical to financial institutions, insurers, and marketing firms.

The company continues to modernize its platform while pursuing international expansion through strategic acquisitions. As businesses increasingly turn to big data and compliance, Dun & Bradstreet becomes more critical.

The company’s consistent cash flow and subscription-based revenue model offer stability. B2B data and risk analytics in the digital economy make Dun & Bradstreet one of the Best Up and Coming Stocks to Invest In Now.

Dun & Bradstreet Holdings Inc. (NYSE: DNB)

Pros:

- Established business data and analytics firm

- Recurring revenue with 96% retention rate

- Expanding offerings in AI and compliance

- Recently acquired by Clearlake Capital which might indicate underperformance relative to peers

Cons:

- Loss making and weak ROE/ROA

- High debt to equity ratio (~108%)

- Organic growth stagnation

- Underperformance relative to broader market

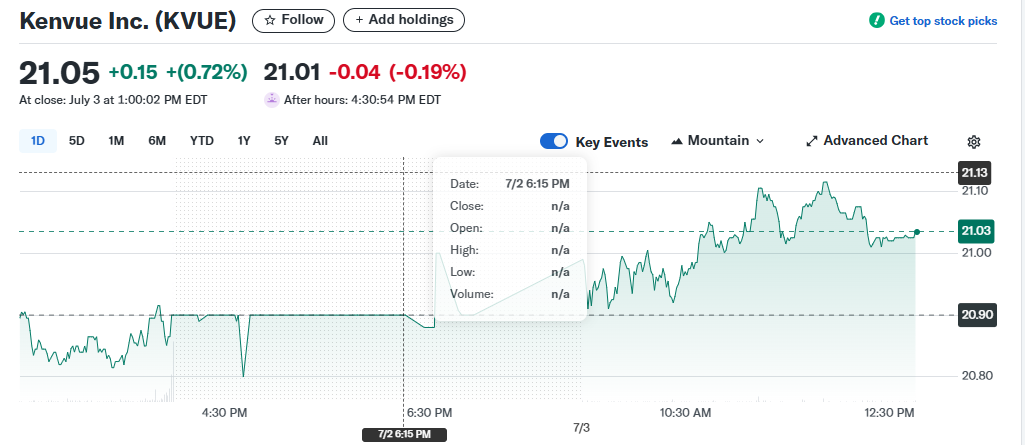

7. Kenvue Inc. (NYSE\:KVUE)

Kenvue is a consumer health spinoff from Johnson & Johnson which contains well-known brands such as Tylenol, Neutrogena, and Listerine. Kenvue provides steady cash flow from over-the-counter medications and skincare and personal care products because of their decades of brand recognition.

Now, they operate independently focusing on innovation and growth what they like to call M&A (mergers and acquisitions) agility. Their global market presence gives them recurring income and defensive stability.

Though Kenvue is not a hyper growth tech stock, they offer substantial steady stock value through strong brand equity and consumer products. For those looking for consistent growth in the healthcare industry, Kenvue is certainly one of the Best Up and Coming Stocks to Invest In Now.

Kenvue Inc. (NYSE: KVUE)

Pros:

- Spins off from J&J’s consumer health segment, owning strong brands like Tylenol and Listerine.

- Cash flows are stable within the sector.

- Consistent yielding dividend payer.

- Strong global distribution coupled with brand recognition.

Cons:

- Growth is slower compared to peers in tech or biotech.

- Litigation claim risks (e.g. talc claims associated with J&J).

- Inflation and supply chain costs driving lower margins.

- Innovation limited in comparison to pharma peers.

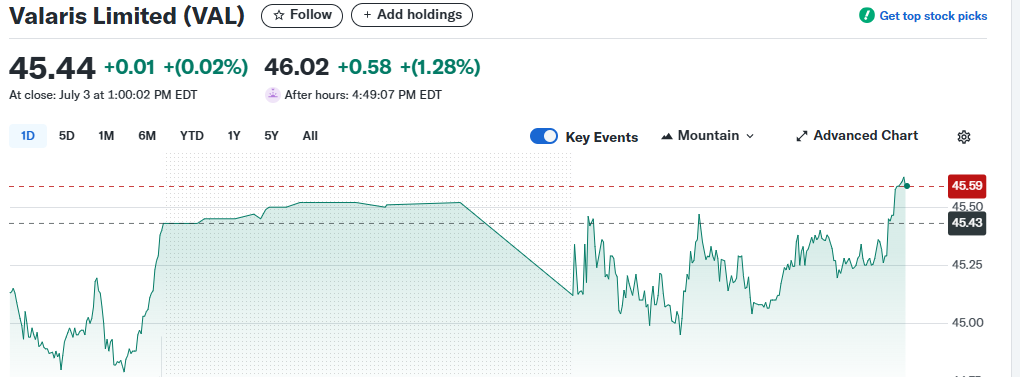

8. Valaris Limited (NYSE\:VAL)

Valaris ranks as one of the largest offshore drilling contractors in the world with ultra-deepwater and jack-up rigs. Offshore drilling demand is increasing as global oil prices stabilize and exploration activities resume.

With its modern fleet and strong customer contracts, Valaris is positioned to take advantage of this recovery. The company emerged from bankruptcy having a much cleaner balance sheet, competitive cost structure, and modern fleet.

Operational safety and efficiency makes Valaris much more appealing to energy majors. With an increasing capital expenditure in the energy sector, Valaris becomes an attractive investment. It positions them as one of the Best Up and Coming Stocks to Invest In Now for those focused on the energy sector.

Valaris Limited (NYSE: VAL)

Pros:

- Leading offshore drilling contractor with global fleet

- Benefits gained from increased oil prices and demand for offshore drilling

- Day rates are improving alongside a strong backlog.

- More efficient balance sheet after bankruptcy.

Cons:

- Oil price fluctuations heavily impact the industry.

- Operations are capital-intensive and incur high maintenance costs.

- Concerns regarding environmental impact and ESG policies.

- Focused on offshore drilling with little other diversification.

9. Procore Technologies Inc. (NYSE\:PCOR)

Procore’s construction management software aids personnel in managing complex construction projects collaboratively in the cloud. It integrates bidding, design, budgeting, and execution on the field.

Given the construction industry’s historic lack of digital transformation, Procore is a game changer. The company is now focused on expanding its international footprint and integrating AI to improve efficiency further.

The customer base and revenue continue to grow alongside a strong SaaS recurring revenue model, indicating sound business fundamentals.

Procore stands to gain as global infrastructure spending increases. For investors interested in companies leading the digital shift in traditional sectors, Procore Technologies is one of the Best Up and Coming Stocks to Invest In Now.

Procore Technologies Inc. (NYSE: PCOR)

Pros:

- high user adoption and utilization of the cloud-based construction management platform.

- Growth of Annual Recurring Revenue (ARR) and international presence.

- High customer retention leading to a sticky clientele.

- Digital transformation benefiting construction industries.

Cons:

- High Operating Expenses (OPEX) not making profit.

- Presence of competitors such as Autodesk and Oracle.

- Fluctuations in interest rates impacts the construction sector most.

- Emerging and smaller firms tend to be slower adopters.

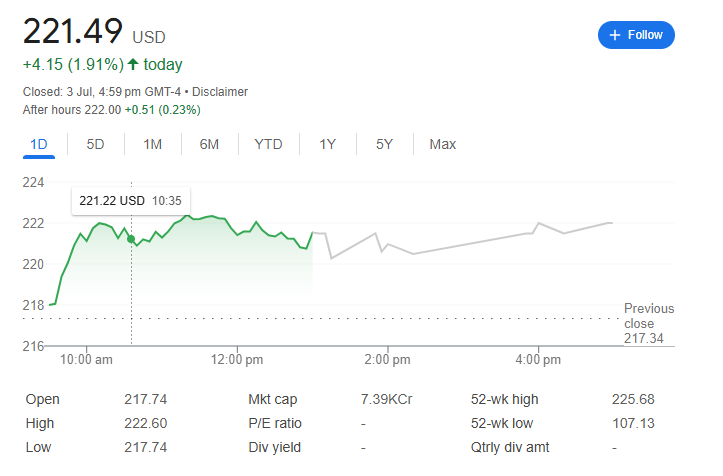

9. Viking Holdings Ltd. (NYSE\:VIK)

With unparalleled offerings in both ocean and river cruises, Viking Holdings is a leading cruise operator. With high-value cruises offered and a well-off clientele, they are poised to take advantage of market recovering post-pandemic.

They went public in 2024 which helped further leverage the brand synergistically boost fleet expansion plans as well as global routes. Viking leads the pack in strategic positioning, especially as travel demand rises, due to their older demographic targeting and premium travel offerings.

Their loyal, repeat clients appreciate their focus on cultural and destination visits. Investors that are interested in premium tourism and luxury travel should note that Viking Holdings is absolutely poised to perform as one of the Best Up and Coming Stocks to Invest In Now.

Viking Holdings Ltd. (NYSE: VIK)

Pros:

- Affluent customer base leads to premium branding of cruise operators.

- Strong forward bookings lead to high occupancy rates.

- Expansion into river and expedition cruises.

- Long-term charter agreements offer an asset-light model.

Cons:

- Travel disruptions and economic downturns affect business.

- Debt from fleet expansion leads to high fixed costs.

- Stricter regulations and scrutiny from environmental parties.

- Recent IPO means limited financial data is available to the public.

10. Affirm Holding Inc. (NASDAQ:AFRM)

Affirm is one of the foremost “buy now, pay later” (BNPL) payment systems issuers that allows its customers to split payments at the checkout. It works with well-known retailers as Amazon, Walmart and even Shopify.

Unlike traditional credit, Affirm offers no-late-fee clear installment plans. Affirm continues to grow as embraced by more consumers because of its unique financing. The company is also venturing into virtual cards, high-yield savings, and other financial services.

Though challenging, profitability, top-line growth, and expansion of the ecosystem are promising. Investors betting on the disruption of consumer finance and credit should consider Affirm as one of the Best Up and Coming Stocks to Invest In Now.

Affirm Holdings Inc. (NASDAQ: AFRM)

Pros:

- One of the leading Buy Now, Pay Later (BNPL) companies partnering with Amazon, Shopify, and others.

- Well recognized by Gen Z and millennial consumers.

- Also offering debit and savings accounts.

- Revenue growth remains strong (30%+ YoY).

Cons:

- Widening losses and negative free cash flow.

- BNPL regulatory scrutiny.

- Funding costs impacted by higher interest rates.

- Competitive pressure from Apple Pay Later, Klarna, Afterpay.

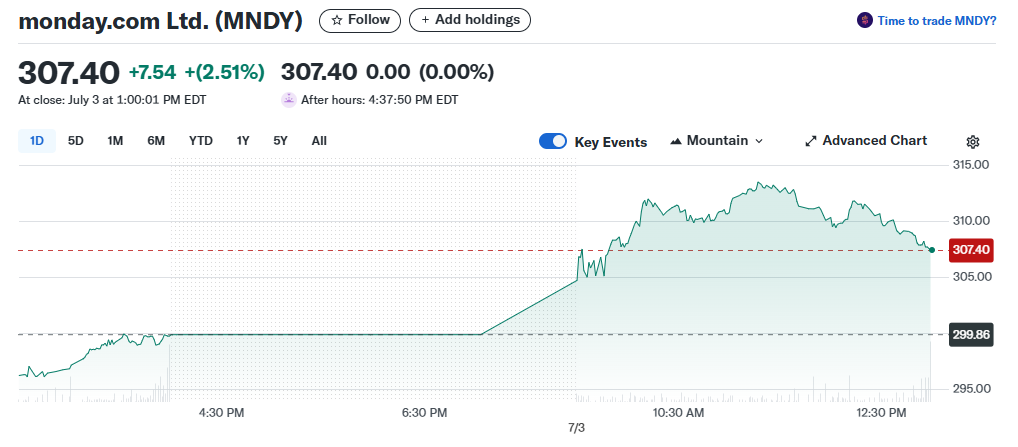

11. Monday.com Ltd. (NASDAQ\:MNDY)

Monday.com provides a customizable Work OS system that businesses can utilize to manage workflows, projects, and collaborations at a team level. Its no-code platform is appealing to both enterprises and SMBs across various sectors.

The company is adding automation and AI features at an increasing pace, enhancing client productivity. Monday is scaling efficiently with increasing enterprise adoption and a high net revenue retention rate.

The demand for productivity tools is rising as remote and hybrid work expands. Innovation coupled with global expansion makes the company one of the tech growth stories to watch.

For investors in SaaS and enterprise tools, Monday.com is undeniably one of the Best Up and Coming Stocks to Invest In Now.

Monday.com Ltd. (NASDAQ: MNDY)

Pros:

- Work OS platform is fast-growing with strong engagement.

- Strengthened enterprise adoption leads to high net revenue retention.

- Strong balance sheet (no debt).

- Rapid innovation across product lines (CRM, Dev, Projects).

Cons:

- Unprofitable company with high marketing and sales spend.

- Competing with (Asana, Atlassian, Notion).

- Earnings valuation keeps climbing over lowered profits.

- Risk of currency fluctuations given operations based out of Israel.

12. GE HealthCare Technologies Inc. (NASDAQ\:GEHC)

Focuses on imaging, diagnostics, and patient monitoring, GE HealthCare came from a spin-off of General Electric.

With technologies such as MRI, Ultrasound, and x-ray systems, GEHC plays a critical part in hospital operations. Innovations from the company aiding in operational effectiveness are a positive in the growing global healthcare demand.

GE HealthCare is strategically investing in AI-powered diagnostics and advanced smart healthcare technologies. As populations age and require more diagnostics, GEHC is greatly poised to take advantage of these macro shifts.

Stalwart brands and disciplined finances support necessary stability and growth, which coupled with GEHC’s pipelines makes the firm a powerful contender.

Looking for investment into healthcare technology? GE HealthCare is issued among the the Best Up and Coming Stocks to Invest In Now.

GE HealthCare Technologies Inc. (NASDAQ: GEHC)

Pros:

- Spun off from GE with strong imaging diagnostics and portfolio.

- Stable cash flows along with a global hospital presence.

- Aging population and AI tech in imaging provide tailwinds.

- Dividend payer and profitable firm.

Cons:

- Medtech peers have faster growth, losing competitive edge.

- Supply chain constraints with inflation impacts.

- Elevated R&D requirements to remain competitive

- Integrating operations after the spin-off still remains to be done

Conclusion

Finding the Best Up and Coming Stocks to Invest In Now in today’s very dynamic market requires a careful blend of innovation and resilience.

For instance, Coupang, DoorDash, and Snowflake are spearheading growth in retail, logistics, and cloud computing, while Edgewise Therapeutics and Affirm provide high-risk, high-reward plays in biotech and fintech, respectively.

Additionally, stable, growing companies such as Kenvue, GE HealthCare, and Dun and Bradstreet offer solid long-term defensive growth potential. From emerging technology and healthcare to global infrastructure, this diverse array of stocks pose strong upside potential.

Forward-thinking investors building a diversified, multi-faceted portfolio that is poised for the future would greatly benefit from considering these stocks since each one offers distinct prospects.

FAQ

What are up and coming stocks?

Up and coming stocks are shares of companies that show strong potential for future growth but may still be in the early or mid stages of expansion. These stocks often belong to innovative, disruptive, or high-growth sectors such as tech, biotech, fintech, and green energy.

Why should I invest in up and coming stocks?

These stocks offer the chance to invest early in companies poised for substantial growth. While riskier than established blue-chip stocks, they can yield higher returns if the company succeeds and scales.

Are up and coming stocks risky?

Yes, they typically carry higher volatility and uncertainty. Many are unprofitable or still developing their market share. Proper research, risk tolerance, and portfolio diversification are essential when investing in them.