In this article, I analyze whether linking Coinbase to Fidelity is possible.

As cryptocurrency and the traditional financial markets gain traction, a number of investors wish to manage both asset classes.

While there is no direct integration between Fidelity and Coinbase, transferring funds in either direction is possible through linking a common bank account.

Let’s analyze the current state of affairs and contemplate the possibilities of integrating these platforms in the future.

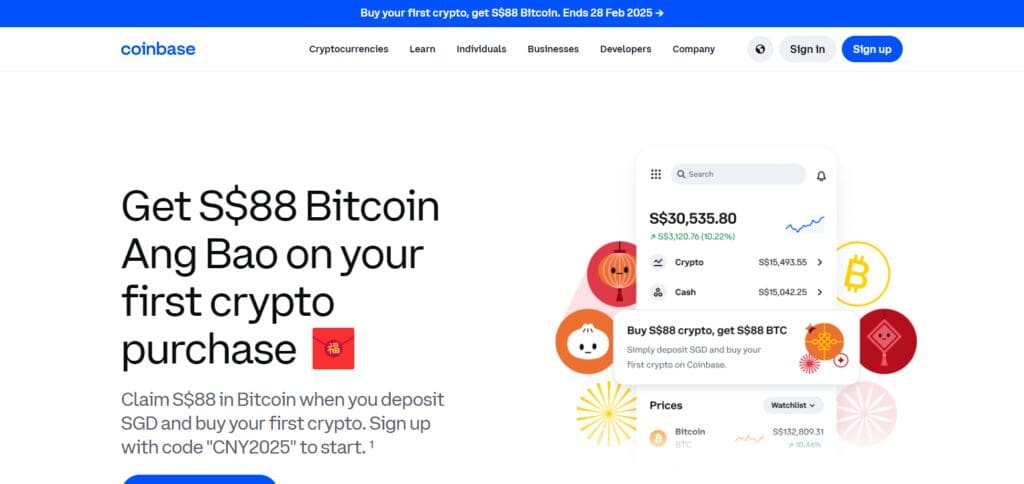

What is Coinbase?

Coinbase is one of the most used cryptocurrency exchange platforms in the world where users can trade and store Bitcoin, Ethereum, and a number of altcoins. Founded in 2012, Coinbase has since made a name for itself as one of the most user friendly and trusted platforms amongst both beginner and advanced crypto users.

Users can rest easy as Coinbase puts to aide the worry of loss by providing them with a secure wallet and different trading functionalities through their Coinbase account.

Moreover, the platform is revered for its strict adherence to security policies, regulatory obligations, and providing comprehensive guides for new users. In addition to serving individual crypto investors, Coinbase also offers businesses and developers APIs and other tools for integrating crypto transaction into their business processes.

Can You Connect Coinbase to Fidelity?

In Fidelity, you would most likely be linking your fidelity investment account, so to link your Coinbase account to Fidelity, you would need to link your bank account and transfer funds.

Although these two do not have a direct integration, transferring funds between Coinbase and Fidelity can be done by linking your bank account. Here’s a step by step guide on how to do this:

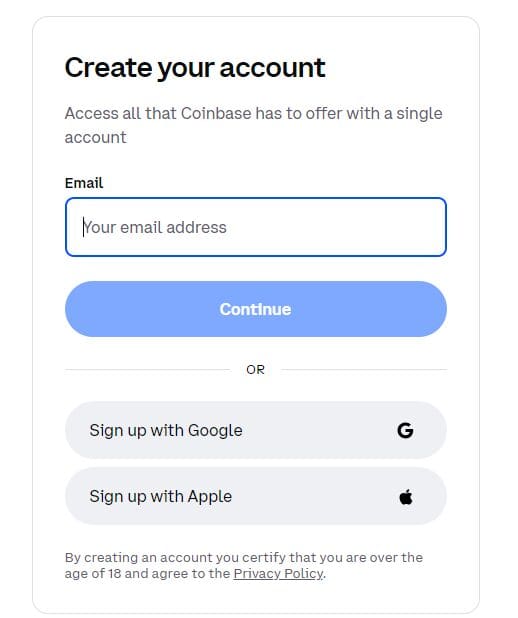

Step 1: Link a Bank Account to Coinbase

Log into Coinbase: Access Coinbase via its website or app and log in.

Go to Settings: Click your profile pic or menu and look for settings.

Add a Bank Account: Click on payment methods, choose a new payment method and select a bank account.

Verify Bank Account: Follow the prompts to verify your bank account. You will likely need to provide your routing and account numbers along with verification of small deposits made by Coinbase into your bank account.

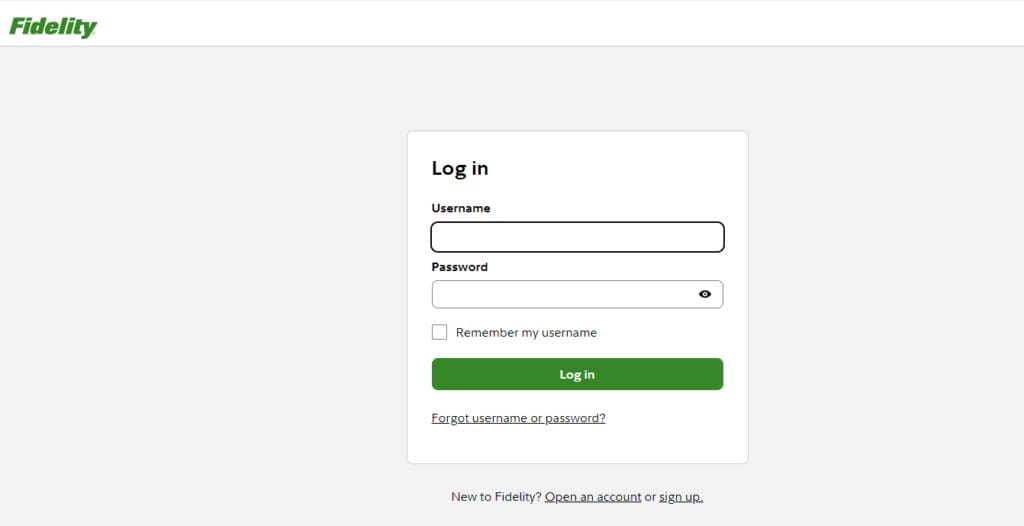

Step 2: Link a Bank Account to Fidelity

Log into Fidelity: Access Fidelity via its website or app and log into your account.

Go to Profile Section: Settings or account options should contain this information.

Add Bank Account: Search for Interface for an external bank account and provide the relevant details (the same bank account linked with your Coinbase).

Verify Bank Account: Fidelity might require you to verify your bank account, usually performed by authenticating a small deposit.

Step 3: Bridge Coinbase Funds To Fidelity Account.

Sell Crypto on Coinbase: Access your Coinbase account and convert the cryptocurrency ( Bitcoin or Ethereum ) to a fiat currency of your choice (USD).

Withdraw To Bank: After your selling of cryptocurrency is completed, transfer the amount to the designated bank account.

Deposit To Fidelity: After the money shows in your bank, visit Fidelity and make a deposit in your Fidelity account. Funds can be manually provided or transferred from your bank and deposited in terms of.

Step 4: Make Investments And Trades On The Fidelity Platforms.

Once you receive the amount on your Fidelity account, you can trade it for stocks, ETFs or any other financial instrument you desire.

While this method does not enable a direct link with Coinbase and Fidelity, it does permit transactions and fund movement between both sites by way of the established local bank account.

Why Connect Coinbase to Fidelity?

Assets Made in Traditions & Crypto

Linking Coinbase (crypto) to Fidelity (stocks, ETFs, and other traditional assets) allows for easy management of a more diverse investment portfolio that incorporates cryptocurrencies as well as traditional assets like stocks and bonds.

Managed Risks

Mitigating risks where there are cryptocurrencies can be achieved if you diversify investments into both traditional and digital assets.

Account Fund Transfers

A bank link between family accounts enables seamless movement of funds for investment purposes. This is useful if you have crypto investments on Coinbase and traditional investments on Fidelity.

Reinvestment & Cashing Out

Having both accounts linked through a shared bank facilitates the smooth process where crypto assets can be cashed out and reinvested in traditional markets, and vice versa.

Streamlined Tax Reporting

Linking both accounts makes tracking and reporting portfolio value informative because it is easier to monitor capital gains, losses, and other taxable events during tax season and tracking investments made in either traditional assets or crypto.

Tax Strategy

A portfolio which contains a wider variety of investments can also help manage taxes because it allows for tax-loss harvesting strategies.

Comprehensive Illustrative Investment Choices

Fidelity enables the use of several investment instruments consisting of retirement accounts, managed portfolios, and advisory services. When Coinbase is linked, you use the money in your crypto account to take advantage of the more traditional investment vehicles.

Investment Capital Management

Higher grade assets and customer support for wealth management will be offered by Fidelity and should be integrated with the cryptocurrency assets to improve financial planning.

Transfer Safety

With Fidenity, security is increased significantly with these transfers. The well established financial institution adds an extra layer of security when transferring large amounts of money especially when cashing out from Coinbase and transferring to a more reputable investment platform.

Financial Management from a Single Source

Linking up Coinbase with Fidelity is particularly useful in case you would like to manage all your assets in one place – cryptocurrency and traditional investments. This helps eliminate the need to keep track of each platform individually.

Future Prospects for Integration

Asset Tokenization

Fidelity may choose to partner with Coinbase to offer tokenized versions of specialized assets such as real estate and stocks. These tokenized assets would be traded on a blockchain, making it possible for Coinbase users to invest in real-world assets and enjoy the transparency and liquidity of the blockchain

Yield Generation and Staking

Fidelity may open passive income opportunities for investors by allowing them to stake cryptocurrency. Whereas DeFi investors could use Coinbase’s already established staking services, traditional investors could now be offered new ways to earn by selling the stakes.

Unified Market Analysis Tools

Both platforms can build innovative market analysis tools that enable the user to assess traditional market patterns and crypto market activity in a singular dashboard. Such tool could employ big data as well as AI for market predicting, thus empowering the investors to devise strategic actions on both sides of their portfolio.

Real-Time Crypto Market Insights

Fidelity would utilize Coinbase’s data and insights on cryptocurrency markets and use it to aid better assessment of market volatility. This way, Fidelity would incorporate real-time crypto analysis into traditional market models, enabling wider investment strategies for their clients.

Blockchain-Powered Payment Systems

It is within the realm of imagination that Fidelity would begin using blockchain solutions for traditional payment systems. This would allow for quicker and cheaper cross-border transactions through cryptocurrency. This particular move could decrease reliance on dated financial infrastructure while ushering in advanced global payment systems.

Credit And Loans With Cryptocurrency Collateral

With the inception of blockchain technology, Fidelity could leverage its services into credit and lending services backed with cryptocurrency. Coinbase could have the needed infrastructure for Fidelity’s clients and assist in providing crypto-backed loans, thus blending the further the world of cryptocurrency and traditional finance.

Global Crypto Policies Are Needed

Coinbase and Fidelity might collaborate to try to change policy for cryptocurrencies in the world’s bigger economies. While legislations for crypto are at the infancy stage in most countries, these platforms can work towards setting international guidelines to make traditional investors more comfortable allocating money towards crypto.

Engaging with Multiple Regulations Technology Together

They might partner with each other to develop RegTech tools that are designed to cater to the needs of compliance for all asset classes including crypto and for investment institutions and market participants that require greater portability of holdings.

Liquidity Pooling

Fidelity and Coinbase can create liquidity pools that span across both platforms which allow capital from conventional investments to be transferred effortlessly into the cryptocurrency markets and vice versa. This could enhance the liquidity available on both platforms, thus breaking down the walls between the two worlds of investing.

Smart Contracts for Cross-Platform Trading

With the aid of smart contracts, Fidelity could automate cross trading between cryptocurrency and traditional assets in a secure manner. This would facilitate trading and enhance the liquidity in both markets as it makes it much simpler for investors to manage their portfolios dynamically.

Conclusion

To summarize, there is no direct, native integration between Coinbase and Fidelity. However, it is possible to link the two platforms indirectly through a common bank account.

This enables the movement of funds between your Coinbase cryptocurrency holdings and Fidelity’s standard investment offerings, creating a way to allocate assets within your investment portfolio across both cryptocurrency and traditional assets.

As the line between cryptocurrency and traditional finance continues to blur, we may witness even more profound integrations in the future such as direct deposits, improved portfolio management, and novel investment products that integrate both worlds.

For now, linking the two platforms through a bank account seems to be a reasonable solution for investors interested in both types of asset classes.