In this article, I will discuss the Best Bitcoin Self-Custody IRA Accounts that allow full tax-free self custody of Bitcoins for retirement. These accounts have taken customer privacy to a whole new level by eliminating third party custodians which drastically enhances financial sovereignty, self security, and privacy.

I will review the most popular self-custody bitcoin IRA service providers so that you can make the most informed choices when investing in cryptocurrencies and planning for retirement.

10 Best Bitcoin Self-Custody IRA Accounts

1. Alto IRA

With Alto IRA, investors can seek Bitcoin and other cryptocurrencies while availing of tax benefits in retirement accounts. It charges no hidden costs making it beneficial for both novice and seasoned investors alike. Users can securely buy, sell, and hold digital assets through integrations with Coinbase, and the platform is easy to use.

Through Alto IRA, investors can gain exposure to various alternative investments besides cryptocurrencies like real estate or even start-up companies. In addition, the unique investments offered on the platform have low account minimums and easy setup rules.

Moreover, although some self custody of digital assets isn’t provided, being exposed to Bitcoin in a regulated structure is suitable for long-term investors.

Alto IRA Features

- Bitcoin and altcoins are supported through Coinbase.

- Easy to set up and low minimum balance requirements.

- Accessible other non-crypto assets.

- Retirement accounts with tax benefits.

Fees

- 1% is charged as the trading fee on each transaction.

- No account charges on a monthly basis.

- Other investments may incur extra charges.

2. iTrustCapital

iTrustCapital is a self-directed IRA service provider for crypto as well as iGold accounts and is one of the top performers in the Bitcoin IRA industry. It also provides trading facilities in the IRA, which can be done free of charge using advanced trading platforms.

For maximum security the platform trades with Fireblocks known for institutional self-custody. Users can also access Bitcoin and other assets in heir IRA 24/7. There are high fees due to limited self-custody on the platform account, however, the account is under intense protection by self custodians.

iTrustCapital’s user friendly platform enables tax-efficient investing in Bitcoin while being compliant, thus making it perfect for people wanting to save for retirement.

iTrustCapital Features

- Instant purchasing and selling of cryptocurrency and precious metals anytime in the day unsupported by any time restrictions.

- Safe storage through Fireblocks.

- Tax benefits with self-directed IRA.

- No upkeep charges.

Fees:

- Crypto trading is charged at 1% fee.

- There are no monthly or custodial fees.

- There are no surprise fees.

3. BitIRA

BitIRA allows customers to invest in cryptocurrencies, such as Bitcoin, via an IRA account while taking advantage of tax benefits. Customers’ assets are secured using multi-signature wallets and cold storage in order to prioritize protection.

Along with protecting from hacks and fraud, BitIRA also provides complete coverage against internal theft. Although full self-custody isn’t permitted, BitIRA gives users more freedom than other custodians.

Their exceptional regulatory compliance is advantageous for investors who are experiencing regulatory constraints. Encrypted BitIRA accounts coupled with dedicated customer support makes the company ideal for investors wanting enhanced security for their retirement funds.

BitIRA Features

- Digital assets insured with industry-leading sophisticated multi-signature cold storage.

- All digital assets lose no value due to economic changes.

- Direct support for all clients.

- Growth without tax and tax can also be deferred.

Fees:

- One-time fee for account creation ranges from $400 to $500.

- Monthly fee for asset storage is 0.05% of account value.

- Depends on the asset for the trading fees.

4. Equity Trust Company

Investors can manage a self-directed IRA funded with Bitcoin, other cryptocurrencies and a range of other assets with incredibly flexible tax treatment with Equity Trust Company. Self custiding is not directly offered, but the firm has IRS compliant protections and institutional security measures.

Equity Trust Company is ideal for investors searching for a sophisticated financial entity that gives them access to cryptocurrency integrated into their retirement account. After spending decades in self-directed investing, Equity Trust Company enables self-directed investors to experience a mix of traditional financial services and modern digital asset opportunities.

Equity Trust Company Features

- Provides self guided IRA accounts with Bitcoin inclusion.

- Diverse asset base including real estate and investments in metals.

- Controlled by institutional compliance.

- Spend less tax.

Fees

- Setup charges amounting to $50.

- Annual deposits ranging from $225 to $2,000 depending on the account type.

- Charges applicable for buying and selling remain undetermined.

5. Bitcoin IRA

Giving a rough estimate, Bitcoin IRA is softly carved to be one of the most easy crypto retirement platforms. The key features incorporated include easy to use interface for trading Bitcoin, Ethereum and other cryptocurrencies.

Assets are stored in cold storage vaults which ensures high level security features. Even though Bitcoin IRA does not allow custody self-management, leading custodians are on board which guarantee the security of assets. The platform incorporates an intelligent mobile application that gives users the ability to trade in real time.

Also, Bitcoin IRA provides educational materials and customer service that ensures investors are well informed. This makes it easier for people who want to include cryptocurrency into their retirement plan.

Bitcoin IRA Features

- Intuitive system equipped with advanced trading features.

- Advanced cold wallets.

- Provides training to investors.

- Retirement plans with tax exemption.

Fees & Plans:

- Initial payment from $250 to $1,000.

- Charges for account management: 0.08% per month.

- Charges incurred for buying and selling range from 2% to 5%.

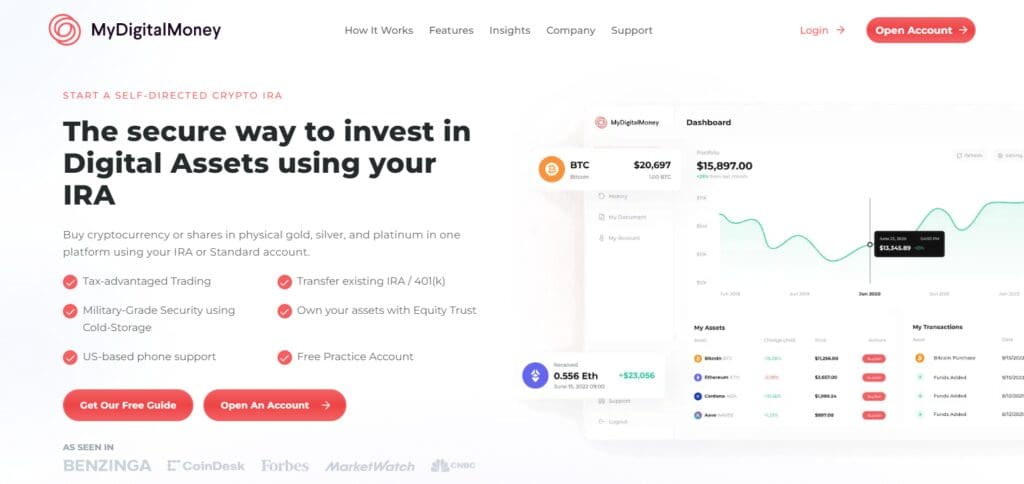

6. My Digital Money

My Digital Money permits investors to trade Bitcoin and other cryptocurrencies within a tax-advantaged retirement account. The primary focus always remains on top notch security, customer service and simple usability which makes it a great provider of cryptocurrency IRA.

The platform has an inbuilt demo account for trading practice and offers secure storage options like cold wallets. While self-custody is unsupported, My Digital Money guarantees IRS compliance whilst enabling investors to self-custody My Digital Money assets.

This is perfect for those who seek an outstanding platform that proficiently harnesses security with intuitive user experience when making crypto retirement investment.

My Digital Money Features

- Advanced cold wallets for digital assets.

- Users can open a demo trading account.

- Customer friendly platform with a focus on basic users.

- Long term investment receive a tax advantage.

Fees & Plans

- No charges for opening an account.

- Service charges based on account type.

- For Buying and Selling, between 1.5% and 2.5% is charged.

7. Swan Bitcoin IRA

Swan Bitcoin IRA has one single purpose, and that is to simplify and secure Bitcoin investments for retirement. It places more focus on self custody than most platforms, enabling users to control their private keys. Swan Bitcoin uses automatic dollar cost averaging by making reocurring purchases for long term investors.

The platform serves beginners in Bitcoin best since there are a lot of educational materials. Because of the emphasis on self sovereignty and secure Bitcoin custody, Swan Bitcoin IRA is among the best for people looking to add Bitcoin to thier retirement funds without relying on other custodians.

Swan Bitcoin IRA Features

- Individual ownership of Bitcoin wallets.

- DCA enabled for effortless investment.

- Multi-sig wallets used for secure Bitcoin custody.

- Avoids all non-bitcoin altcoins.

Fees & Plans

- Buying and selling incurs charges between 0.99% and 1.49%.

- No routine or custodial expenses.

- Premium services tend to be more expensive.

8. Choice App

The Kingdom Trust’s Choice App provides a dynamic Bitcoin IRA platform with custodian or self custodian features.

These digital assets can be invested in tax-free and support various cryptocurrencies at the same time. The platform supports insurance for crypto holdings and trading with top exchanges for effortless trading.

Choice app permits investors to manage their retirement funds in a self-directed manner, thus ensuring that IRS requirements are still met.

It works well for those who prefer more freedom and less restriction in choosing custody solutions and is a good fit for investors who seek greater control of their Bitcoin retirement assets.

Choice App Features

- Supports self custody and custodian accounts.

- Digital assets are insured.

- Support for a large number of cryptocurrencies.

- Supports all major exchanges.

Fees

- There’s a fee of $95 per year for account maintenance.

- Different types of assets have different trading fees.

- Storage options determine custody fees.

9. Coin IRA

Coin IRA allows investors to add Bitcoin and a handful of other cryptocurrencies easily and in a tax compliant manner. This platform is more convenient to go along with the more secure methods with cold storage and real time trading for crypto investors.

Coin IRA, while lacking full self-custody, does ensure that the assets are guarded by reputable custodians. Coin IRA has a friendly customer service department which aids and makes it easy for investors to set up and maintain their bitcoin IRA’s.

For those looking to invest in bitcoin for retirement, Coin IRA offers a secure and low tax way to do so.

Coin IRA Features

- Cold storage can support retirement accounts.

- Provides Bitcoin along with other crypto investment options.

- Supports retirement plans along with other investments.

- Investments grow tax free until withdrawal.

Fees:

- Charging Windows installment from 250 dollars to 500 dollars.

- Each month, there is a charge of 0.05% of the amount set aside as the storage fee.

- The fee for trading assets is calculated based on the type of the asset.

10. Unchained Bitcoin IRA

A unique incorporation of self-custody provisions allows an investor to keep copper keys of their Bitcoin and still reap the tax benefits Unchained Bitcoin IRA offers.

Unchained, unlike other service providers who depend on custodians, allows users to fully control their assets with a multi-signature feature. This improves security and meets the IRS standards for an IRA.

For example, the platform also offers financial services such as loans secured by bitcoins, which makes it appealing to some investors. These features make the Unchained Bitcoin IRA one of the best choices available for long-term investors who value self-custody and the ability to manage their own bitcoins.

Unchained Bitcoin IRA Features

- Full control of Bitcoin with self supervision.

- Allows for using Bitcoin as collateral for loans.

- Investment incurs lower taxes.

- Security is advanced with multi-sig accounts.

Fees

- The fee is variable for trading above a certain volume.

- The setup fee for accounts is not fixed.

- Based on the method of storing the investment, there is a fixed monthly charge.

Conclusion

The investment world is becoming more appealing to many people, especially with the emergence of cryptocurrencies like Bitcoin. Not only can people invest in Bitcoin through IRAs, but they also have total custody over the assets. Unchained and Swan offer IRA services where individuals have complete control over their Bitcoin and their private keys.

On the other hand, iTrustCapital and Bitcoin IRA have custodian regulated accounts, meaning that an institution owns the keys and thus has control over the assets, but offers higher levels of security.

Each compute service provider has a different security measure, trading approach, and fee structure which means different investment goals can be achieved.

Those looking for low liquidity and passive entry and exit points will benefit from using Unchained and Swan accounts. If you want to liquidate your investment profit easier, more controlled accounts will be suitable. Ultimately it depends on an investor’s goals.