In this piece, I will focus on Errante, a multi-faceted forex broker that offers a considerable diversity of trading instruments, a variety of accounts, and well-known platforms such as MT4, MT5, and cTrader.

I will analyze Errante’s fees and spreads, as well as their security and reliability so that traders can determine if this broker is a secure and reliable choice for new and seasoned traders.

What is Errante Forex?

Errante Forex is a brokerage firm that specializes in online trading for a multitude of financial products such as Forex, CFDs, commodities, indexes, metals, and cryptocurrencies and is trading internationally with global markets. Errante was established in 2019 and is internationally licensed with the brand name Errante Securities (Seychelles) Ltd and Errante Ltd (Cyprus) .

As such Sekellies and Cyprus, both as Retail and Professional Traders. The Broker has financial and investor protection regulations and standards laid out from the Seychelles Financial Services Authority (FSA) and Cyprus Securities and Exchange Commission (CySEC).

Errante offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms and clients benefit from automated trading, rapid trade execution, advanced charting tools, etc.

They also offer various account types such as Standard, Premium, and Tailor-Made, and clients can choose the one that suits their trading experience level and investment amount. Clients also benefit from highly competitive spreads, leverages of 1:500, and flexible funding options (bank cards, e-wallets, and bank cards).

Besides the trading services it offers, Errante places significant focus on client support and education through webinars and market analysis, complemented by 24/5 multilingual customer support.

Errante aims to foster a secure and open trading atmosphere by implementing modern risk management techniques and keeping segregated client funds. All in all, Errante serves the clientele as a trustworthy and easy-to-use forex broker with robust trading tools, regulatory protection, and market access on a global scale.

Overview

| Category | Details |

|---|---|

| Broker Name | Errante Forex |

| Founded | 2019 |

| Headquarters | Nicosia, Cyprus |

| Global Entity | Errante Securities (Seychelles) Ltd |

| Regulated By | – CySEC (Cyprus Securities and Exchange Commission) – License No. 383/20 – FSA (Financial Services Authority of Seychelles) – License No. SD038 |

| Type of Broker | STP/ECN Forex & CFD Broker |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, Mobile Apps (iOS & Android) |

| Tradable Instruments | Forex, Commodities, Indices, Metals, Cryptocurrencies, and CFDs |

| Account Types | Standard, Premium, VIP, and Tailor-Made Accounts |

| Minimum Deposit | $50 (varies by account type) |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0.0 pips (depending on account type) |

| Deposit Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, Crypto, and Local Payment Options |

| Withdrawal Methods | Same as deposit methods (processing within 24 hours) |

| Customer Support | 24/5 Multilingual Support via Live Chat, Email, and Phone |

| Educational Resources | Webinars, eBooks, Trading Articles, Market Insights, and Video Tutorials |

| Mobile Trading | Yes – Available on iOS and Android |

| Website | www.errante.com |

| Security of Funds | Client funds held in segregated accounts; SSL encryption and regulatory oversight |

How to Open an Errante Forex Account

Step 1: Visit the Errante Official Website

- Go to the official Errante website: https://www.errante.com

- Make sure you are on the correct website to avoid phishing scams.

Step 2: Click on “Open Account”

- Look for the “Open Account” or “Sign Up” button on the homepage, and click it to start the registration process.

Step 3: Choose Your Account Type

- Errante offers multiple account types such as Standard, Pro, and VIP accounts.

- Compare features like minimum deposit, spreads, leverage, and trading platforms to select the account that matches your trading style.

Step 4: Fill in Personal Information

- For your account, you must enter your full name, email address, phone number, and country of residence.

- Make sure to design a strong password.

- Check Errante’s terms and conditions and privacy policy and agree to them.

Step 5: Verify Your Identity (KYC)

- Upload valid identification documents (passport, driver’s license, or national ID).

- Upload proof of address (utility bill, bank statement, or government-issued document).

- Errante will usually review and verify your documents within 1-2 business days.

Step 6: Fund Your Account

After verification, access your dashboard and select Deposit. You can choose the payment method that suits you:

- Bank Transfer

- Credit or Debit Card

- E-Wallets like Skrill and Neteller

- Cryptocurrency (if this is an option)

Type in how much you wish to deposit and click confirm.

Trade On All Global Markets

Gain access to a world of trading opportunities with Errante. From forex and stocks to commodities and cryptocurrencies, explore and trade in global markets, anytime, anywhere. Empower your trading journey with a seamless experience and unmatched market coverage.

Fees, Spreads & Commissions

Errante gives traders a selection of account types with varying fees. For the Standard account, the spreads begin around 1.5 pips for currency pairs like the EUR/USD, and no additional commission is applied.

For the Premium account and VIP accounts, spreads are tightened further, going down to 1.0 and 0.8 pips respectively, with no commission applied as well. Tailor‑made accounts and ECN‑style accounts do come with a spread of up to 0.0 pips, with a commission charge per lot for example, around $3 per lot.

As for non-trading fees, deposits are free, withdrawals and inactivity fees are applicable under some conditions as well as the fees the broker can impose for withdrawals with little trading. (DailyForex)

As a whole, the pricing model is clearly explained, reasonably priced and it allows traders to pick the pricing model they want to use.

Is Errante Forex a Safe & Trusted Broker?

Errante Forex is seen as a legitimate broker, especially under its CySEC-regulated EU entity, which guarantees client fund segregation, segregation, investor compensation, and adherence to strict EU regulations.

For international clients, it also operates under a Seychelles FSA license, but this provides weaker investor protection. As for security, the broker has basic measures like KYC, law encryption, and SSL Encryption.

Most of the clients see Errante Forex as reliable but there are reviews mentioning delays in the withdrawal of funds and no consistent support from the help center. It is safe and trusted for trading, especially with the regulated EU arm, but it is better to be careful with offshore accounts.

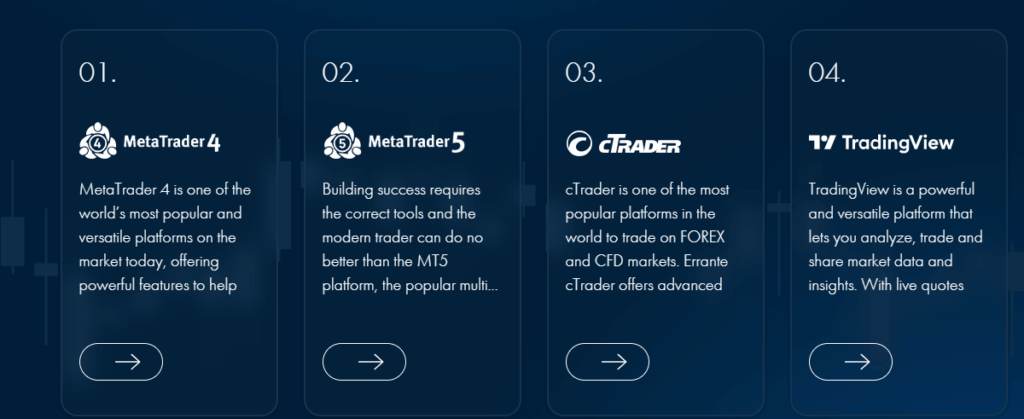

Choose Your Platform

Trade the way you want with Errante’s powerful and versatile trading platforms. Each platform is designed to offer fast execution, seamless navigation, and professional-grade tools to enhance your trading experience. Choose the platform that best suits your trading style and take control of your financial future with Errante.

Safety and Security of Errante

Regulation

Errante is regulated under licence no. 383/20 as to its EU operations by the Cyprus Securities and Exchange Commission (CySEC).

Offshore entity

Outside the EU, they operate under the Seychelles Financial Services Authority (FSA) licence no. SD038 — a weaker regulatory regime.

Client funds segregation

They claim to hold client funds in “top‑tier, well‑capitalised banks” and separated from the company’s operational funds.

Investor compensation

For the CySEC‑regulated arm, they are participants in the investor compensation scheme (ICF) for eligible clients.

AML / KYC

Errante has published and made operational its AML/KYC policies for which identity and address are to be verified.

Mixed feedback

Numerous third‑party reports contain complaints (withdrawal delays, order manipulation) and highlight the possible lack of effective oversight in relation to non‑EU clients.

Errante Features

Multi-asset offering

Errante supports trading of currencies, stocks, commodities, metals, indices and bitcoins, thus enabling clients to diversify their investments.

Multiple trading platforms

Errante caters to different types of traders by offering MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Account types

Errante has different tiers of trading accounts (Standard, Premium, VIP, Tailor-Made) with different features like deposit amounts, spreads, commission responsiblities and client perks.

Technology and established funding methods

Errante has claimed state of the art technology and claimed technology and funding methods like cards, e-wallets, and crypto.

Security and Transparency

Errante insures funds up to €1,000,000, segregates fund of clients, and has claimed industry awards like the “Most Transparent Broker Global 2023”.

24/5 customer support

Errante provides customer support on all trading days and in various languages.

Social/copy trading and MAM/IB partner programmes

Errante has features of strategy copying, multi-account management, and an advanced Introducing Broker (IB) partner programme.

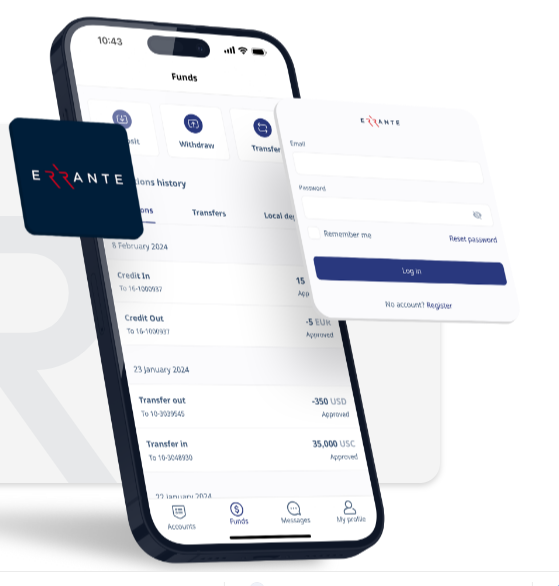

Mobile App

Download the Errante Client Portal App now and unlock a seamless account management experience.

Register, verify, and fund—it’s that simple!

Pros & Cons of Errante Forex

| Pros | Cons |

|---|---|

| Regulated by the Cyprus Securities and Exchange Commission (CySEC) for its EU arm, providing stronger investor protection. | Outside the EU, operations fall under the Seychelles Financial Services Authority (FSA) where protections are weaker. |

| Offers multiple popular trading platforms (e.g., MetaTrader 4, MetaTrader 5, cTrader) giving choice and flexibility. | Some user reviews report poor customer‑service experiences, especially around withdrawals or hidden fees. |

| Low minimum deposit – making it relatively accessible for beginners or smaller traders. | Inactivity fees and withdrawal fees/conditions apply in some cases (especially outside EU) which may catch users unaware. |

| Broad range of instruments / account types (CNC, ECN, shares, FX, etc) and more advanced features like copy‑trading or MAM/PAMM in some jurisdictions. | Spread and trading costs in the basic accounts are slightly higher than the very lowest in the industry; some promotions may have restrictions. |

Conclusion

Errante Forex is a versatile broker offering multiple account types, a wide range of trading instruments, and popular platforms like MT4, MT5, and cTrader.

Its CySEC-regulated EU arm ensures strong investor protections, while the offshore FSA entity provides access for international clients but with weaker safeguards. Spreads and fees are competitive, with options for low‑spread ECN-style accounts.

The broker emphasizes security through client fund segregation, AML/KYC policies, and investor compensation for EU clients. While some user reviews note withdrawal delays and inconsistent support, overall, Errante is a safe and reliable choice for cautious traders, especially those trading via the regulated EU entity.

FAQ

How do I open a live trading account?

You click “Join” or “Register” on the Errante website, fill in personal details, then upload verification documents. The process takes under 5 minutes for registration and up to 24 hours for verification.

What documents are required for account verification?

You’ll need a proof of identity (passport, driver’s licence, national ID) and proof of address (recent bank statement or utility bill dated within the last 6 months). Mobile phone bills are not accepted.