I Want to discuss the article How Many Ethereum Are There (ETH), its issuance history, and the changes expected after the advent of Ethereum 2.0.

Currently, where approximately 120.38 million ETH are in circulation, changes to this are expected due to the candle visors adopted by one of the most recent upgrades up.

What Is Ethereum?

Ethereum is a decentralized open-source blockchain system with its cryptocurrency, Ether.

ETH works as a platform for numerous other cryptocurrencies, as well as for the execution of decentralized smart contracts.

Ethereum was first described in a 2013 whitepaper by Vitalik Buterin. Buterin and other co-founders secured funding for the project in an online public crowd sale in the summer of 2014.

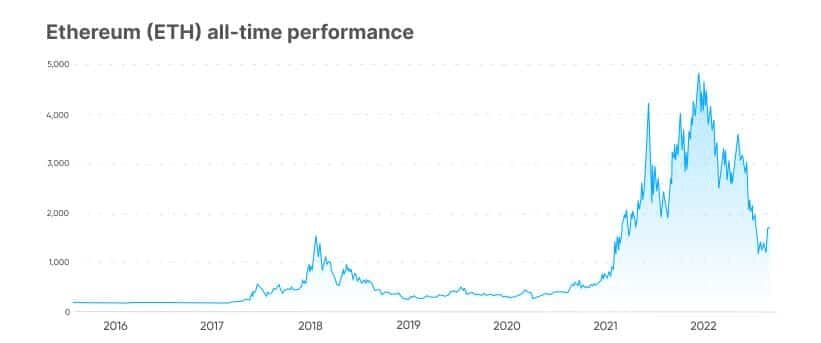

The project team managed to raise $18.3 million in Bitcoin, and Ethereum’s price in the Initial Coin Offering (ICO) was $0.311, with over 60 million Ether sold.

Taking Ethereum’s price now puts the return on investment (ROI) at an annualized rate of over 270%, almost quadrupling your investment every year since the summer of 2014.

How Many Ethereum Are There

Ethereum is unique among cryptocurrencies because its supply is elastic and can be altered due to mining rewards and network upgrades. Here’s an overview:

Total Supply

Currently, the number of ETH is limited to about 120 million thereabouts. Ethereum, unlike Bitcoin, does not possess a maximum supply turnover.

Even though the supply of ETH is waning, there is a chance that it will be accelerated.

EIP-1559 and Fee Burning

The EIP-1559 was included in August 2021 during the London Hard Fork. This allowed a portion of transaction fees to be ‘burnt’ rather than included in the total supply quantity.

When clients facilitate a transaction on the Ethereum network using the base fee, a portion of the transaction fee is charged, which is later removed.

All these events, taken together, allow the issuance of Ethereum to become, at times, deflationary.

Transition to Proof of Stake

With Ethereum joining from the proof of work to the evidence of stake network, the issue rate of Ethereum also dropped.

There is less new issuance of ETH, which means the Ethereum supply will grow slower.

Daily Issuance

At present, almost 1,700 units of ETH are issued daily. However, when accounting for fee burning, the actual growth in Ethereum’s

Ethereum 2.0 and its Impact on Supply

September 2022 was the first successful transition period from a proof-of-work model of Ethereum 1.0 to a proof–of–stake model popularly called ‘The Merge’ or Ethereum 2.0.

The change has affected the supply of Ethereum in a big way. For example, new issuance of ETH under PoS has plummeted to zero, and the network currently consumes more ETH than it creates.

Over time, this deflationary technology is also anticipated to reduce the total volume of ETH, which will help increase the value of ETH as a long-term holding.

Ethereum Supply Explained

Because it is essential to mention European tokenomics, they can define that the amount of ETH in existence is not limited.

Therefore, at any time, the theory behind the maximum supply of Ethereum would be infinite.

This stands in contrast to a cryptocurrency like Bitcoin, in which there is a stated limit to the number of coins that can be produced (21 million BTC in the case of Bitcoin)

However, for most people, in theory, Ethereum’s sizeable maximum supply does not justify the worry of hyperinflation in the Ethereum supply.

The supply of ETH started reducing steadily about a year ago.

As seen in Ethereum’s supply chart, after the launch and until September 2022, as witnessed by the Ethereum supply growing, the number of new coins being issued continued diminishing, even as new ones continued coming into supply.

For instance, in June of 2016, a daily circulation of block rewards of approximately 30,000 ETH per day existed.

Three months ahead of the Merge in June 2022, for example, only around 13,000 ETH was coming into circulation every day.

On the chart, they may have watched an increase in the growth of the ETH supply, which happened to occur for the first time in September of 2022 after the successful implementation of the new Proof-of-Stake consensus algorithm of the Ethereum network.

Who Are the Founders of Ethereum?

Ethereum has eight co-founders — a massive number for a crypto project. They first met on June 7, 2014, in Zug, Switzerland.

- Russian-Canadian Vitalik Buterin is perhaps the best known of the bunch. He authored the original white paper describing Ethereum in 2013 and is still working on improving the platform. Before ETH, Buterin co-founded and wrote for the Bitcoin Magazine news website.

- British programmer Gavin Wood is arguably the second most crucial co-founder of ETH, as he coded the first technical implementation of Ethereum in the C++ programming language, proposed Ethereum’s native programming language, Solidity, and was the first chief technology officer of the Ethereum Foundation. Before Ethereum, Wood was a research scientist at Microsoft. Afterward, he moved on to establish the Web3 Foundation.

Among the other co-founders of Ethereum are: – Anthony Di Iorio, who underwrote the project during its early stage of development. – Charles

Hoskinson played the principal role in establishing the Swiss-based Ethereum Foundation and its legal framework. – Mihai Alisie, who assisted in establishing the Ethereum Foundation

Joseph Lubin, a Canadian entrepreneur, who, like Di Iorio, has helped fund Ethereum during its early days and later founded an incubator for startups based on ETH called ConsenSys. – Amir Chetrit, who helped co-found Ethereum but stepped away from it early into the development.

Where Can You Buy Ethereum (ETH)?

Given the fact that Ethereum is the second-largest cryptocurrency after Bitcoin,

it is possible to buy Ethereum or use ETH trading pairs on nearly all major crypto exchanges. Some of the largest markets include:

Conclusion

In summary, the total issuance of Ethereum supply has changed from 72 million tokens at first, with how its circulation supply was formed through additional minting and block reward sharing.

At present, there are around 120.38 million ETH in the market. The last transition to Ethereum 2.0, with the issuance decrease and deflationary developments, is bound to change this supply even further, making ETH even rarer and arguably more valuable in the future.