In this article, I will cover the How to Earn Interest on USDC, a stablecoin that is pegged to the USD.

You will be informed about the best platforms, both CeFi and DeFi, interest rates, and essential strategies to maximize earnings.

This guide is useful for everyone, beginners and experienced investors alike, allowing them to safely grow their crypto holdings.

What is USDC Interest?

Interest earned from USDC refers to the income earned from keeping the USD Coin (USDC) in an interest earning account, or on a lending platform.

Numerous centralized (CeFi) and decentralized (DeFi) financial services offer interest on USDC by lending it to a third party, staking it in a liquidity pool, or employing other strategies that generate revenue.

Different payment platforms will have different interest rates because of demand, how the platform operates, and other associated risk levels.

While CeFi platforms like Nexo and Binance Earn tend to offer fixed or flexible interest rates, DeFi protocols like Aave and Compound USDC have great variable return rates based on demand and supply.

While USDC interest can be converted into passive income at little to no effort, concerns of platform security, regulatory shifts, and other risks should be contemplated.

USDC is available on several blockchains such as Ethereum, Solana, and Polygon which allows transactions to be processed quickly and cheaply.

It is used extensively for trading, making payments, and even earning interest through lending and DeFi protocols. Crypto investors prefer USDC due to its transparent nature and compliance with regulatory frameworks.

How to Earn Interest on USDC

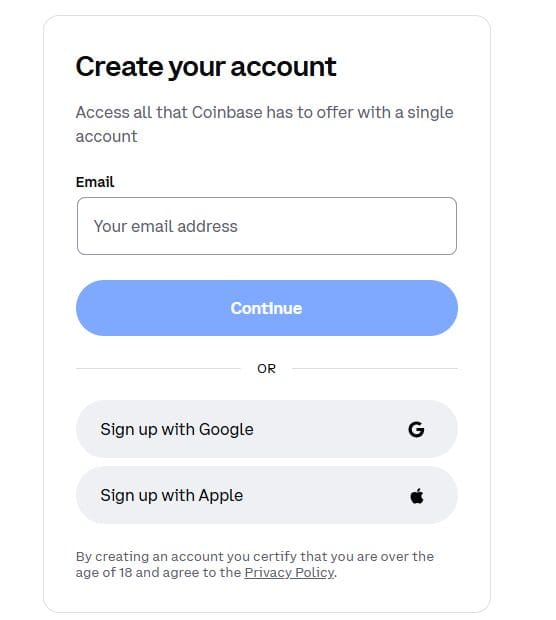

Set Up an Account with Coinbase

Make an account on Coinbase by entering your email and selecting a secure password alongside some personal information that completes your registration.

Identity Verification Needed

For KYC, upload a government-issued identification alongside other documents to gain full access to Coinbase services such as interest earning rewards on USDC.

Buy or Deposit USDC

You can transfer USDC from other wallets above or purchase it directly on Coinbase with fiat currency to earn interest on it.

Rewards With USDC Enable

If you qualify, USDC rewards will passively be activated in your account, meaning no extra deposits or staking is required, earning you interest effortlessly.

Passive Interest Earnings

Funds in your account are a hassle-free stablecoin balance that earns you interest on a monthly basis with rates changing according to the market. The interest is accumulated daily and paid out monthly.

Other place where Earn Interest on USDC

Kraken

Your USDC can earn APY of 6.5% with opt-in rewards. There is no minimum requirement for balance, and funds are always secure with Kraken’s strong infrastructure.

Binance

Offers flexible and locked savings options for USDC where payment terms dictate the interest rates. Offers passive income opportunities alongside more than 300 supported crypto assets6.

Nexo

Offers the highest APY out of all where USD can earn 12% with daily payouts. Flexible and fixed term savings and higher rates for loyalty program members is also available.

Is Earn Interest on USDC Worth It?

Stable Returns – Receive yield of up to 10% APY with no market risks.

Multiple Earning Options – Earn passively with CeFi (Nexo, Crypto.com) or DeFi (Aave, Compound) .

High Liquidity – Transfer and withdraw USDC with ease at any time.

Safer than Volatile Crypto – Unlike Bitcoin and Ethereum, there are no price fluctuations.

Platform Risks – CeFi has withdrawal limits, while DeFi has smart contract risks.

Regulatory Uncertainty – Restrictions may come from governments regarding stablecoin lending.

Key Factors to Consider

Interest Rates and APY – These should be checked on both CeFi (Nexo, Crypto.com) and DeFi (Aave, Compound) platforms.

Platform Security & Risks – Check if platforms have adequate security measures, insurance, and a strong history.

Compliance Risks – Using unregulated platforms may impose legal uncertainties; thus, pick regulated ones.

Withdrawal Terms & Lock-up Periods – Determine the fund’s flexibility and minimum term investment period.

Smart Contract Risks (DeFi) – Due Diligence is required on DeFi platforms for hacks and other vulnerabilities.

CeFi vs. DeFi Preference – While DeFi has higher risks, it provides greater potential rewards when compared to CeFi.

Tips to Maximize Earnings

Check Interest Rates

Put in some time checking Nexo, Crypto.com, Aave, and Compound for the best interest rates on APY.

Spread the Funds

Spread the risk by investing in both CeFi and DeFi options.

Make Use of Multiple Interest Plans

Some platforms offer better rates for larger deposits or for participation in loyalty programs.

Maximize Reinvestment

To optimize long-term growth, withdraw and reinvest interest.

Follow Key Market Changes

Keep an eye for changes in the battery interest rates, platform changes, or regulatory developments.

Look for Low Withdrawal Fee Platforms

Choose a platform with low withdrawal/transaction fees so you maximize your earnings.

Pros & Cons

Pros:

Steady Earnings – Earning on USDC does not require activities of optimization given that the returns are generated passively and there is lack of volatility, unlike in the stock market.

Different Earning Methods – Relying on either CeFi (Nexo, Crypto.com) or DeFi (Aave, Compound) platforms yields positive results.

High Liquidity – USDC can be deposited, withdrawn or even transferred at any moment. These processes do not take a long time.

Higher Yields Than Banks – Online accounts yield 3% to 10% APY, a rate far greater than that of standard savings accounts.

Flexible Terms – Select some platforms for instant withdrawals. Other platforms have flexible conditions with no lock-up periods.

Cons:

Risk In Platforms – CeFi withdraw limitations and DeFi has risks concerning smart contracts are presented.

Uncertain Regulations – Lending against a stablecoin inherently is exposed to the risk of governmental policies.

Interest Rate Changes – Variables APY rates attached to such accounts can decrease along with time.

Counterparty Risk – Due to lower risk standards offered, some platforms lack FDIC coverage therefore posing greater risk than conventional banking.

Conclusion

In conclusion, earning interest on USDC is a flexible strategy that is passive and safe in the current global economic landscape.

Regardless of whether you select CeFi platforms for their ease-of-use or go with DeFi protocols for their superior yield, remember to evaluate all elements of interest rate security, risks, and regulatory developments.

Participating in various platforms while reinvesting profits can ensure easier diversification and minimized risk exposure. With the right approach to earning interest on USDC, the potential gains can be significant.