In this article, I will discuss the How to Identify Whales On-Chain. Tracking the activity of whales is critical since these entities have the power to move markets in the world of cryptocurrencies.

Knowing how to follow their transactions and wallets with certain tools can greatly improve one’s market awareness which impacts trading decisions. Let’s examine easy ways of fishing whales in the blockchain ocean.

What is Crypto Whales ?

“Whales” in the crypto market mean people or institutions who own a considerable amount of cryptocurrency that could alter market valuations. Usually, crypto whales possess tens of thousands of coins and or tokens like Bitcoin or Ethereum.

Crypto whales include: Initial coin offering (ICO) participants, hedge funds, and crypto exchanges. Tracking whale behavior can help traders better prepare themselves based on sudden price changes, trends in speculation, and possibly provide signals for an upcoming shift in bullish or bearish tendencies.

How to Identify Whales On-Chain

Spotting whales on a blockchain network includes monitoring big transactions and movements of the wallets. This is how to identify a Bitcoin whale using on-chain analysis:

Example: Identifying a Bitcoin Whale

Use Blockchain Explorers

Websites like Etherscan (for Ethereum) or Blockchair (for Bitcoin) lets you follow a wallet’s activity.

Look for Large Transactions

Whales usually execute transfers of over 1,000+ BTC in one go. Keep an eye on movements of significant financial transfers between wallets or exchanges.

Check Exchange Deposits & Withdrawals

A significant volume of BTC sent to an exchange usually indicates someone is getting ready to sell.

Monitor Whale Alerts

Services such as Whale Alert monitor large movements of cryptocurrency and offer instant alerts notifying users of the transactions.

Analyze Holding Patterns

The intelligence of a few whales is to hold BTC for longer durations, while others prefer short or long term trades. Monitoring them aids in predicting the movement of the market.

Other Place Where to Identify Whales On-Chain

BscScan

BscScan aids users in eagle identifying whale accounts by tracking large wallet addresses and their transactions in real-time. Its main strength lies in facilitating seamless viewing of balances, token movements, and wallet contract engagements.

Users who monitor BscScan’s sizable wallet transition spikes and accompanying activity surges are able to detect immobile whale activity ahead of time which makes BscScan a great asset for market comprehension and informing users of possible huge price changes.

Glassnode

Glassnode is an advanced on-chain analytics platform which offers detailed breakdowns of wallet distributions, exchanges, and large transactions enabling the identification of whale movements.

Its unique component resides within the meticulous classification of wallets which simplifies the processes of detecting patterns of whale accumulation or distribution. Following these indicators allows the traders to act proactively, using market changes triggered by major stakeholders to their benefit.

Nansen

Nansen is a blockchain analytical tool that provides aquarium-like perks by mapping addresses with dot labels onto chain data. Nansen’s greatest strength is labeling the wallets as “funds,” “exchanges,” or “smart money” making it easier to trace whale activity.

Users are able to watch and follow discernable trends and movements of tagged wallets which aids in following important traders and taking quick actions associated with major trade flows that are likely to shift the market in relation to various tokens and protocols.

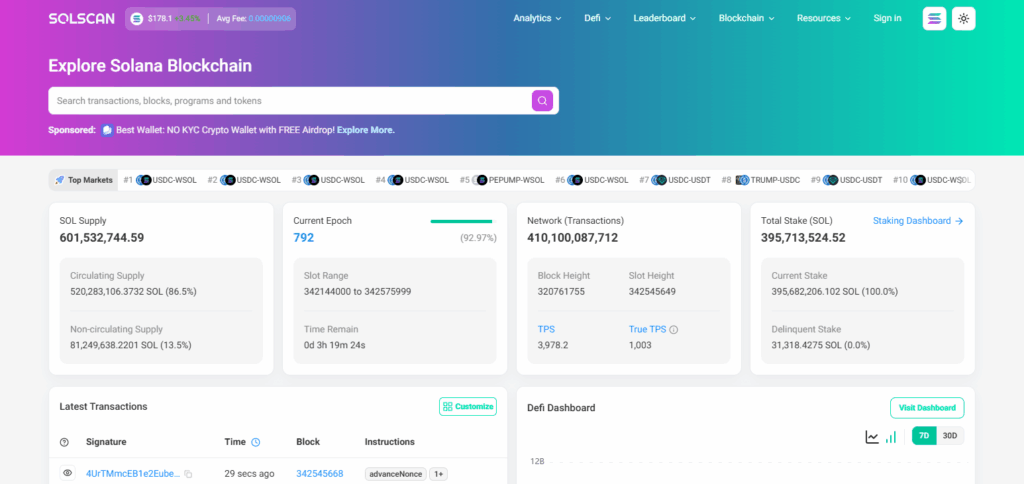

Solscan

Solscan is an explorer for the Solana blockchain which provides transparent access to wallet information, token transfers, and staking actions allowing users to track active investors.

Its main advantage is the tracking of high value wallets with accurate and timely information about their dealings in DeFi.

This enables the tracking of major token movements, identification of active wallets, and forecasting of potential price changes resulting from investor activities on Solana.

Why Track Whale Activity?

Foresee Market Changes: Significant market movements can easily be forecasted by observing whale activities since large trades will always lead to price shifts.

Prevent Being Duped: Sensing sudden changes in the price level alongside unusual trade volumes is a clear indication of possible abusive transactions or “pump and dump” schemes.

Follow Intelligent Investors: Usually, whales take strategic actions; thus tracking them can bring important information to help determine investment strategies.

Enhance Trading Methods: Whale information amplifies financial and technical analysis and attains greater relevance in determining company fundamentals.

Tips for Spotting Whale Wallets

Ewe Look 4 Large Transactions: Keep an eye out on wallets that frequently send or receive large amounts of crypto periodically.

Analyze The Activity Of The Exchange: Pay attention to large inflows or outflows to and from exchanges since these transactions are usually associated with whales.

Use Wallet Tags: Use Wallet tags with Nansen where it marks tags like funds, exchanges or ‘’smart money’’ allocated to the known whale wallets.

Check The Patterns Of Whales Holdings: Usually long-term holders of assets or strategic timed movers tend to always be whales.

Watch Out For Interactions In DeFi: Whale strategies can be uncovered by high-volume activity in staking, lending or liquidity pools.

Risks and Limitations

False Positives

These might be large transactions belonging to different users or an exchange.

Hidden Wallets

Whales may conceal their detection by spreading their holdings over numerous wallets.

Anonymity Risks

Sophisticated privacy techniques and mixing services can disguise true whale activity.

Misinterpretation

Not every significant movement indicates an impact on the market; context matters.

Over-reliance

Sole tracking of whale activity may result in a misguided biased decision on trading.

Pros & Cons

| Pros | Cons |

|---|---|

| Helps predict large market moves | Large transactions may be misinterpreted |

| Provides insight into smart money | Whales can hide activity across wallets |

| Enhances trading strategies with data | Privacy tools can obscure whale actions |

| Alerts traders to potential volatility | Over-reliance may cause biased decisions |

| Improves timing for entry and exit | Not all whale movements affect prices |

Conclusion

To wrap it up, being able to locate whales on-chain is exceptionally useful for observing and trying to predict fluctuations in the cryptocurrency market. Using blockchain explorers and analytics tools, as well as monitoring large transactions and wallet behaviors, traders can gain insights into whale movements.

Although there are risks and limitations, combining these strategies with broader market analysis improves decision-making, thus allowing for advancement in the fast-paced world of cryptocurrency.