In this article, I will discuss the How To Provide Liquidity To Bridging Pools, which are important parts to cross-chain operations in decentralized finance (DeFi).

I will walk you through platform selection, wallet connection, asset deposits, and reward collection. Also, we will look at the advantages and disadvantages of taking part in these pools.

What Are Bridging Pools?

Bridging pools are liquidity pools that help cross – chain transfers of assets in the context of decentralized finance.

Such pools enable a user to deposit tokens in one blockchain and withdraw the equivalent assets from another blockchain without the need for a conventional bridge.

Users earn liquidity transaction fees and rewards by providing liquidity on these pools. They enhance the interoperability between blockchains, but they also have the risk of impermanent loss and smart contract risks. These pools have to be chosen carefully to ensure high volume and security of the funds to maximize them.

How To Provide Liquidity To Bridging Pools

Entry To The Across Start Page:

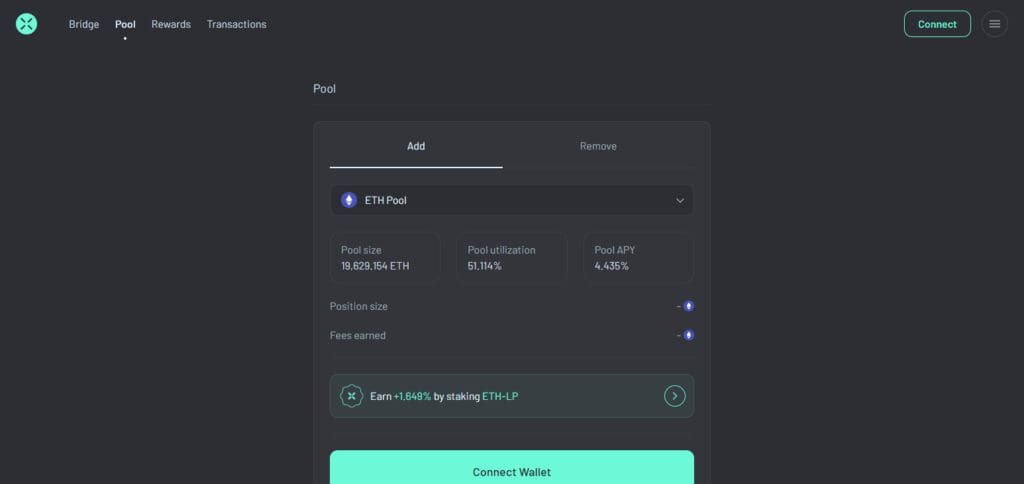

Access across.to/pool.

Link The Wallet:

On the top right corner, click on Connect Wallet and select MetaMask or other desired wallets.

Choose The Intended Pool:

Select the respective pool from the lists of pools eligible for liquidity.

Liquidize Your Tokens:

Key in the number of tokens you want to contribute to, or hit “MAX” to deposit the entire amount you have on wallet.

Confirm The Details:

Examine the information regarding the transaction and hit “Add Liquidity”.

Transaction Approval:

Confirm the transaction in the wallet to finalize the transaction.

Look Up Liquidity Positions:

To look for your positions in liquidity, visit across.to/rewards.

Choosing the Right Bridging Pool

Reputation and Security

Consider the platforms which have been in the market for a long time and their contracts have passed audits ((Stargate, Synapse, Across).

Blockchain and Asset Pools Supported

Confirm that the pool accommodates the blockchain and tokens you intend to work with.

Some pools focus only on particular assets (has Stargate is known for: stablecoins.

Volume and Liquidity

Less slippage and better efficiency for higher liquidity pools. Increased transactions on the platforms bring greater liquidity provider rewards.

Incentive Structures & APY

Look into the different pools Annual Percentage Yield (APY) and compare them. There are pools that incentivize the use of governance tokens or staking.

Charges & Withdrawal Policies

Hidden penalties and fees include deposits and the outward movement of funds. Fee taken from some pools if there are early withdrawals or when the liquidity is deemed to be low.

Risks and Mitigation Strategies

As previously mentioned, providing liquidity can be rewarding and beneficial understanding the associated risks. Here are some notable risks:

Impermanent Loss

This loss is experienced when the underlying assets in the pool increase in price significantly leading to a lower aggregate value in comparison to just holding the assets.

Smart Contract Risk

Bridging pools depend on smart contracts, which are always subject to bugs or exploits.

The user’s responsibilities involve assessing the protocol and efforts which have been put to have the contract audited and it’s other uses.

Market Risk

The price of the assets in the pool are subjected to conditions of the market which may affect the value and returns are expected.

Why Provide Liquidity to Bridging Pools?

Earn Fees

Liquidity providers (LPs) are compensated with a share of the transaction fees when users swap tokens.

Support Cross-Chain Interoperability

Providing liquidity means facilitating smoother movements of assets across different blockchains.

Incentives

Many protocols supplement liquidity provision with various additional incentivizing rewards such as governance tokens for LPs.

Conclusion

Bridging liquidity pools yielding income, can also create challenges such as impermanent loss, risk management, service fees, and safekeeping. Participating in decentralized finance (DeFi) activities can be extremely fun and easy when you provide liquidity to Bridging pools.

This aligns all the cross-chain movements and makes transactions across multiple blockchains much easier. Fulfilling the criteria for connecting your wallets to choosing the correct bridging pools as well making deposits will ensure that you start acquiring rewards and get paid in fees.

DeFi space is immense and you must do your part to aid the ecosystem by forever expanding your investment portfolio. Its easy to forget about the risks involved, but nothing comes free and for everything there is a price.

As long as you do proper research, are educated on the particular scams of the internet, and understand the risks you’re willing to take, everything will be fine.