In this article, I will discuss the How To Stake Stablecoins on Polygon Network, one of the popular Layer 2 solutions for Ethereum.

i will cover selecting the appropriate platform, integrating the wallet, and earning rewards through stablecoin staking.

This guide will help you maneuver through the effortless steps needed to start Passive Income earning on Polygon using stablecoins.

What Are Stablecoins?

Stablecoins are a class of cryptocurrency which aims to maintain a stable value in relation to a reserve asset like the US dollar or gold. Stablecoins are less volatile than bitcoin and other cryptocurrencies, which makes them suitable for saving, staking, and other transactions.

They serve other purposes in blockchain domains, known as DeFi, and are a less risk prone means for users to avoid putting their assets in fluctuating markets.

How To Stake Stablecoins on Polygon

Here’s how you can stake stablecoins on Polygon using the Aave platform:

Set Up A Wallet And Buy Cryptocurrency

Get a cryptocurrency wallet like Trust Wallet and obtain funds like USDC or USDT.

Transfer Stablecoins To your Wallet

If needed, purchase the funds on an exchange and transfer them to your cyrptocurrency wallet.

Bridge Assets to Polygon

If your stablecoins are on Ethereum or another network, use a bridge like the Polygon Bridge to transfer them to the Polygon network.

Go To Aave Website

Open the Aave platform and connect your wallet. Don’t forget to choose the market for Polygon.

Deposit The Required Amount Into The Aave Protocol

Select the stablecoin intended for staking, say USDC or USDT, and send it to the Aave protocol.

Earning Rewards

After staking your USDT and USDC, you will earn interest, and possibly extra rewards in Aave’s native token. These rewards will be denominated as (AAVE).

Withdraw Funds for Wallet Recovery

Whenever you feel it is time, you can recover your stablecoins together with the interest earned.

Why Stake Stablecoins on Polygon?

Reduced Transaction Charges

Based on hikes, Polygon layer 2 has lower gas charges when compared to Ethereum, which makes staking less expensive.

Efficient Transactions

Polygon’s staking and withdrawals can be done at any time, and its high throughput guarantees great efficiency for all interactions.

Security Along With Scalability

Polygon offers reliable staking because it uses Ethereum’s security and possesses more scalability.

Jump into Decentralized Finance Opportunities

Many users are able to earn rewards and get into other yield farming opportunities because Polygon hosts multiple decentralized finance (DeFi) platforms.

Stability of Stablecoins

Polygon enables users to passively earn income from staking stablecoins without willingly exposing themselves to the volatility that comes with more unstable assets.

Importance of Staking Stablecoins

Low Volatility

Unlike other cryptocurrencies, stablecoins which are pegged to a stable asset, show minimal price fluctuations. As a result, staking stablecoins is a safer choice compared to more volatile assets like Bitcoin or Ethereum.

Consistent Yield

As described above, staking stablecoins does offer some degree of stability, which is why its yields are more reliable, consistent and greater than other investment vehicles, like annual percentage yields (APY).

Liquidity

Staking enables ease of access for users as a large percentage of stablecoin staking systems allow for flexible staking durations, meaning any user can access their funds easier without being trapped in long-term periods to earn rewards. This balance between liquidity and earning rewards is appealing.

Security

Risks associated with decentralised platforms is that they aren’t as secure as centralized ones. However, stablecoins do offer some much needed protection and operate within DeFi (Decentralized Finance) protocols, which enables staking in highly secure settings which do provide lower risks.

Diversification

While maintaining presence in crypto markets, users can reduce overall portfolio investment risk by generating income through low-risk stablecoin staking, thus diversifying their income.

Generating Passive Income

Earning income through staking stablecoins is considered passive because it can appeal to users who do not wish to engage in trading or investing in high-risk assets.

Best Places to Stake Polygon (MATIC)

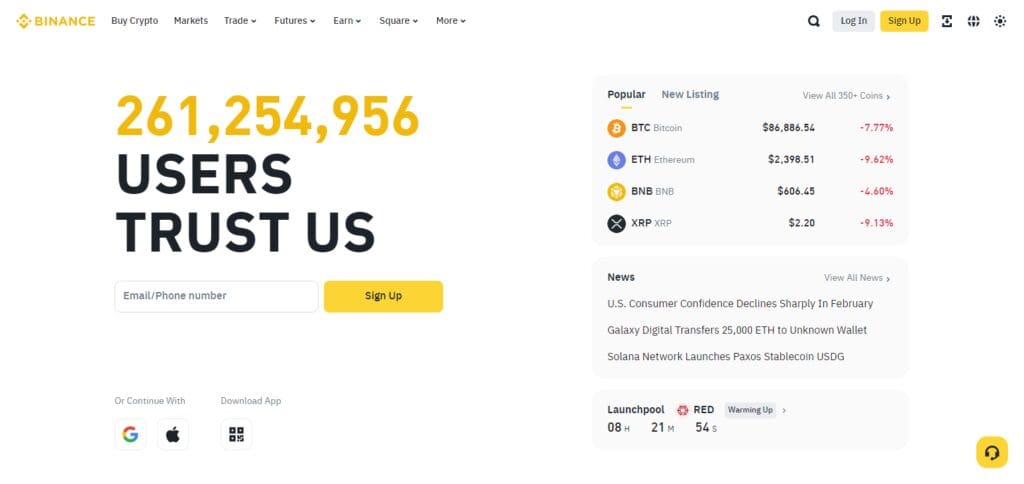

1. Binance

Binance, with it’s user-friendly interface, is ranked among the best cryptocurrency staking exchanges due to their wide variety of staking options.

Their different types of staking like Flexible, Locked, and DeFi Staking allow users to self-determine their levels of risk and required rewards. Users can also stake over 60 cryptocurrencies, including the popular Ethereum (ETH), Cardano (ADA), Binance Coin (BNB), and Polygon (MATIC).

By frequently updating features like Competitive Annual Percentage Yields (APY), Binance keeps its users well-informed and enables them to utilize the ever-changing crypto market.

Pros:

- Allows a variety of staking and investment options to cater to varying preferences.

- Liquid staking permits users to stake while still retaining access to the assets.

- Security measures robust enough to restrict unauthorized access to user funds.

Cons:

- Users seeking products like Double Win may incur massive losses due to high volatility.

- Dual Asset or Double Win users do not receive principal protection.

- The potential erosion of earnings due to regulatory shifts.

2. Lido

Lido is a Liquid DeFi staking platform that aims to simplify the liquidity pool of internal asset staking by allowing users to stake any quantity of ETH, instead of requiring the standard 32 ETH.

It consolidates users’ deposits and issues stETH which is a liquid token representing the underlying asset. This token can be used on over 100 DeFi platforms. Users get added liquidity and can still earn staking rewards at the same time.

The platform works with all major wallets including MetaMask and integrates with DeFi services like Aave, which is great for crypto investors. Its decentralized structure guarantees security with multiple validators and regular audits.

Pros:

- Use stETH to earn additional yield on over 100 DeFi platforms with no deposits.

- Begin earning staking rewards immediately upon making a deposit.

- Rewards are auto compounded and credited every day.

- stETH has no minimum, so anyone can buy.

- The platform is fully open source and decentralized, giving even greater security to its users.

Cons:

- Withdrawals take 1 – 5 days.

- Oversimplified fee structure with a 10% charge on staking rewards.

- Market conditions can affect the value of stETH on DeFi platforms.

Conclusion

In conclusion, Polygon allows users to earn passive income with minimal risk through low-fee and stablecoin staking.

Users can earn maximum rewards while enjoying DeFi’s reputable platforms and Polygon’s scalability. While there are risks to staking stablecoins, it is still reliable for asset growth.