In this article i will discuss the How to Trade on Polkadot Parachains including steps, platforms, and strategies.

I will teach you how to acquire DOT tokens, trade on assist, moonbeam, set up a wallet and much more.

This guide is hand tailored for both novice and advanced traders to better understand how to navigate through polkadot’s multi-chain ecosystem.

What is Polkadot Parachains?

Polkadot parachains are an array of rock-solid chains that function independently while parallel running within the Polkadot ecosystem.

Also, specific blockchains relay to the Polkadot Relay Chain so that they gain shared security, scalability, and have the possibility of seamless interoperability.

For instance, parachains can do cross-chain transactions which is beneficial for decentralized finance, gaming, and NFTs.

On the other hand, Polkadot architecture allows speedy processing and lower costs of transactions which is favorable for executing smart contracts and creation of decentralized applications (dApps).

How to Trade on Polkadot Parachains

Simple Steps To Trade On Polkadot Parachains

Create A Polkadot Wallet

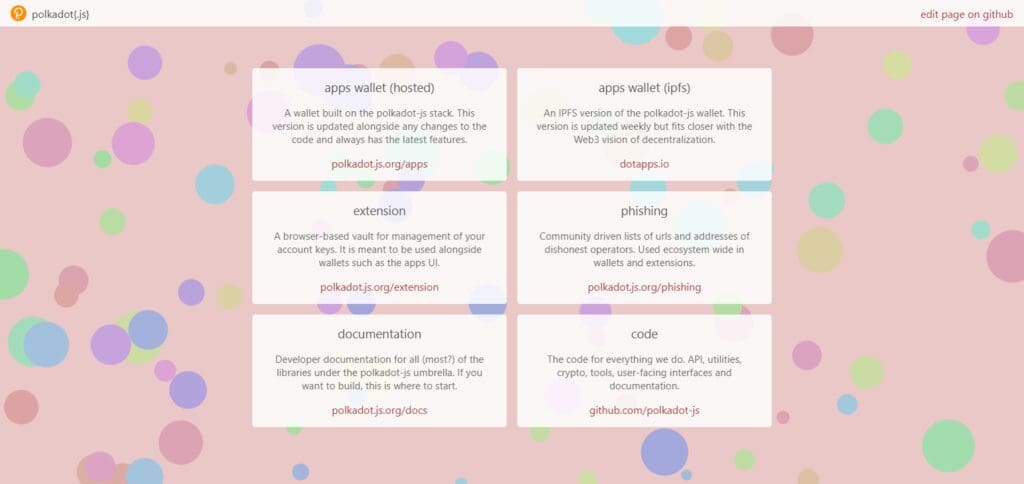

Create a Polkadot wallet by utilizing the Polkadot.js or Talisman wallet browser extensions. Both extensions feature compatibility with Polkadot and its other parachains.

Once an account has been created or imported, ensure that the seed phrase is secured. The wallet should also be funded with DOT for transaction fees. Buying DOT on exchanges such as Binance or Kraken is an option, plus that can then be sent to the wallet.

Integrate Parachain Tokens

If trading particular parachain tokens such as ACA on Acala or GLMR on Moonbeam, bridge or transfer the necessary tokens to the parachain. Tools, such as Snowbridge or Polkadot’s XCM (Cross-Consensus Messaging), are able to aid in moving tokens from different chains.

Make sure your wallet is set to the network of the parachain. Most Polkadot.js and Talisman wallets have auto detection for the majority of parachains.

Select a Parachain DEX

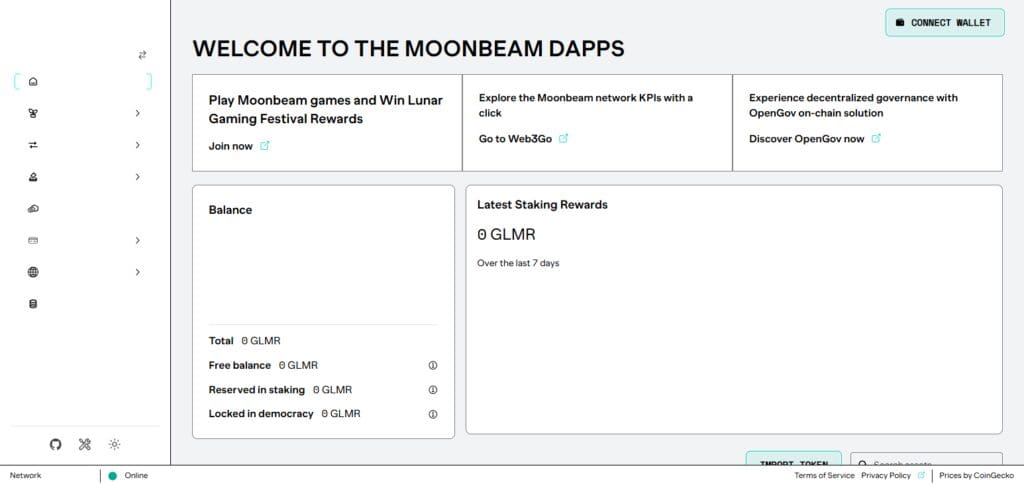

Moonbeam: StellaSwap (stellaswap.com) an Ethereum compatible DEX is also available. Simply connect your wallet (MetaMask works here due to EVM support) and trade with Glmr or wrapped ETH.

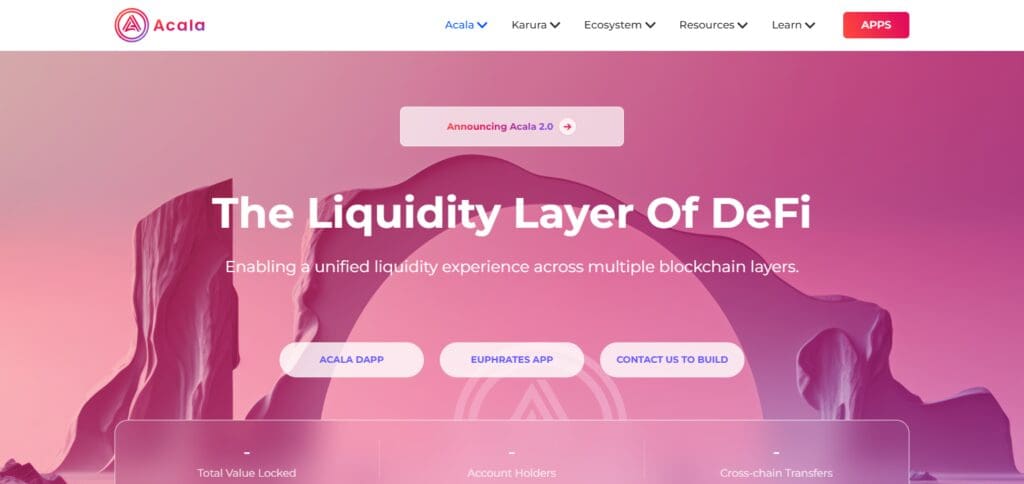

Acala: Go to Acala Apps (apps.acala.network) connect through Polakdot.js and swap ACA, aUSD, or other tokens on the inbuilt DEX.

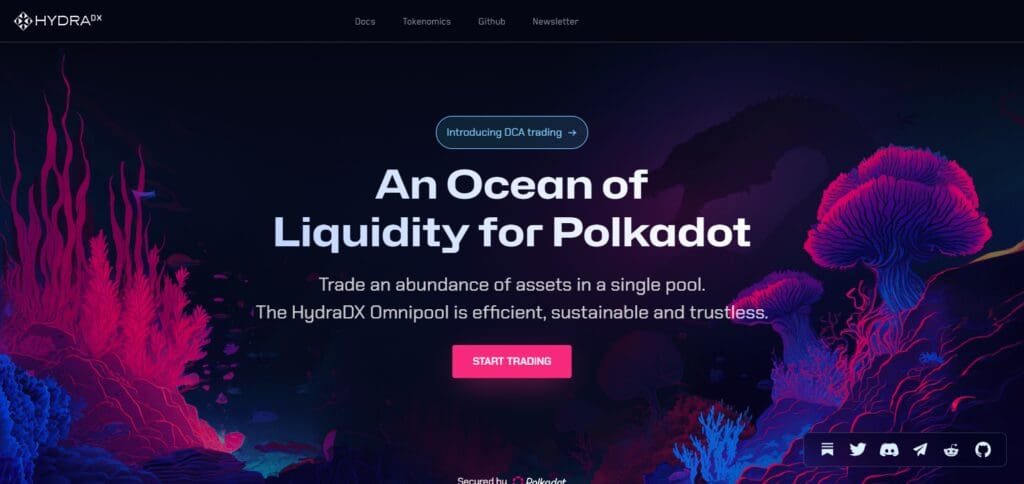

HydraDX: Goes to HydraDX’s Basilisk UI (basilisk.hydradx.io), connects using Polkadot.js, and trades his omni-pool (e.g. HDX, DOT).

Make your decision based on the tokens you want as every parachain has different offerings.

Connect Wallet and Approve

Open the DEX’s website and click on “wallet” selection. Select either Polkadot.js or Talisman or MetaMask for EVM chains like moonbeam.

Let the DEX use your tokens. This calls for a modest DOT fee (generally less than $0.10) so allow the transaction on your wallet.

Choose Trading Pair and Amount

Pick the trading pair you want to go for, for instance DOT/GLMR on StellSwap and ACA/aUSD for Acala.

Type in the amount you want to go for and then check the swap parameters, which include price, slippage which should be set to 0.5-1% for safety, and costs which are low in Polkadot and generally <0.01.

Hit the swap button or ‘trade’ button and then enable the transaction on your wallet.

Confirm & Collect

As soon as you approve the wallet, the trade moves on-chain, which usually takes seconds or a minute depending on how busy the parachain is.

Check the tokens under the specific parachain’s network tab section. For instance, GLMR can be viewed under Moonbeam in the Polkadot.js.

Other place where Trade on Polkadot Parachains

Parallel Parachain

Parallel Finance, also a Polkadot’s parachain, offers a DEX for trading PARA, DOT, aUSD, and others in the Polkadot ecosystem.

The DEX can be reached through app.parallel.fi which requires a Polkadot.js wallet. It allows fast and inexpensive swaps through XCM interoperability.

The combining feature of trading and liquid staking is by far the most impressive one that Parallel Finance offers, as it allows the users to swap tokens while staking the same assets. Such liquid locking design is perfectly diverse for a Polekdost trader.

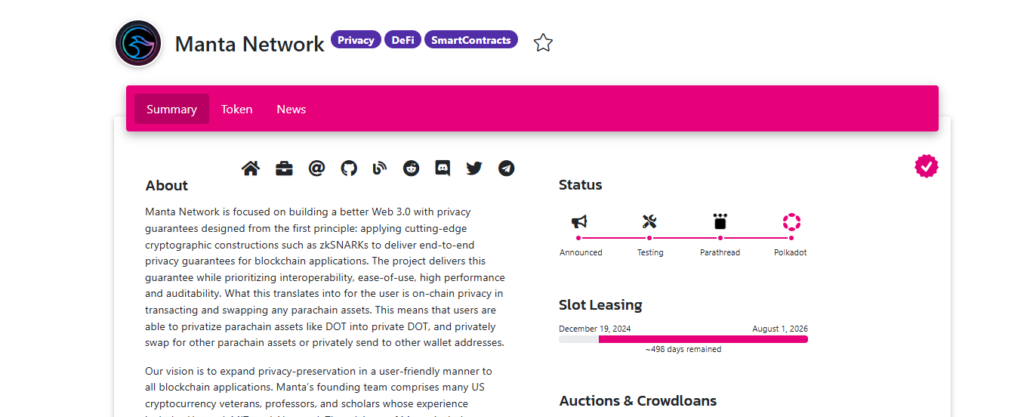

Manta Parachain

Manta.network permits users with a Polkadot.js wallet to access MANTA and DOT markets via a Polkadot parachain Manta Atlantic, which leverages XCM powered low fee and cross chain DEX (decentralized exchange) services.

What differs Manta Atlantic from standard DEX is it’s hallmark feature of private trading, tailored for the most discrete customers where even wallet addresses or trades’ history is safeguarded from being exposed through the use of zero-knowledge proofs, unlike most exchanges in Polkadot’s ecosystem.

Prerequisites for Trading on Polkadot Parachains

Polkadot Wallet

Get a vector-compatible wallet, perm Polkadot.js, Talisman, or SubWallet, and crate your Polkadot wallet to save and run your DOT tokens.

DOT Tokens

Get DOT tokens from a crypto-centralized trading platforms like Binance/Stellar or Crackin to use them in the payed transactions and trade on the Polkadot parachains.

Choose a Parachain

Select appropriate parachains which have support functionality for commercial operations like Acala, Moonbeam and Parallel Finance.

Fund Your Wallet

Deposit DOT Tokens on your software wallet and double check the value is sufficient for covering trading costs.

Network Connection

Link the wallet to the parachain platform and start trading.

Tips and Best Practices

Be Mindful of Gas Fees:

Try to execute your trades at times when the respective network experiences low levels of activity, as this will greatly reduce your transaction fees.

Ensure Maximum Security on Reliable Wallets:

Use strong and trusted wallets like Polkadot.js or Talisman and safeguard your seed phrase.

Spread Your Trading Activity Among Various Parachains:

Make use of various parachains in order to manage risks and take advantage of other trading opportunities.

Keep Track of Market Activity:

Utilize analytics services tailored for Polkadot to check on prices and liquidity.

Check Up on News Frequently:

Follow the news on the upgrades made on parachains as they will influence the trading parameters and the fees you will have to pay to trade.

Limit Your Initial Trade Amount:

Restrict your trading volume when looking at the new parachains so that if there are losses, the damage inflicted is minimal.

Risks and Challenges

Network Congestion

At peak times, the execution of transactions may get delayed and fees may increase, making trades harder to execute.

Slippage and Price Volatility

Due to market prices traders can incur slippage which results in executing at worse trading prices.

Smart Contract Vulnerabilities

Parachains are dependent on various smart contracts that are prone to bugs and security vulnerabilities that might result in hacks or loss of funds.

Liquidity Issues

Some parachains may demonstrate less liquidity while executing larger trades greatly affecting the price.

Regulatory Uncertainty

Modifications in crypto governance can guarantee or limit the functionality of the parachain or impact trading.

Conclusion

To summarize, trading using Polkadot parachains has exceptional opportunities to utilize a secure, scalable, and multi-chain ecosystem.

By comprehending the fundamentals, creating a compatible wallet, and selecting trustworthy parachain platforms, one can easily trade and delve into DeFi, NFTs, and so much more.

Nevertheless, the trading experience should always be accompanied with proper risk management, staying updated, and adhering to standard practices.

Without a doubt, we can say that as the Polkadot ecosystem expands, there will be ongoing innovative possibilities offered with parachain trading for crypto investors and enthusiasts.