In this article, I will discuss the How to Trade Stablecoins for Real Estate Tokens– a new and innovative method of investing in real estate through the blockchain.

We will cover how to convert your stablecoins into tokenized real estate assets, the advantages of fractional ownership, and important steps that need to be taken to make certain that safe and effective transactions occur in this emerging world of investment.

What Are Stablecoins?

A stablecoin is a type of cryptocurrency whose value is kept stable by using a fiat currency (like the US Dollar) or commodities (such as gold) as collateral.

Its main purpose is to provide an easy means of exchange, trading, and saving while minimizing value loss over time.

To reduce price volatility, stablecoins are collateralized using fiat reserves, algorithmically adjusted, or backed by other assets. Known examples are Tether (USDT), USD Coin (USDC), and DAI that connect crypto and traditional finance seamlessly.

How to Trade Stablecoins for Real Estate Tokens

Here’s a situation in which is possible to trade stablecoins such as USDT or USDC for real estate tokens using a blockchain marketplace.

Example: Trading Stablecoins for Real Estate Tokens on a Platform

Step 1: Choose a Real Estate Tokenization Platform

Select the platform of choice as RealT, Propy or Realtize which has tokized realestate and check whether they accept your stable coin which could be in the form of USDT or USDC.

Step 2: Create an Account

On the appropriate platform, create an account and complete the requisite KYC (Know Your Customer) identity verification as identification is often required to invest in real estate.

Step 3: Fund Your Wallet

Fill your wallet with these stable coins and most platforms will have thier own wallet or you could use a supporting crypto wallet such as MetaMask or Trust Wallet.

Step 4: Browse Available Properties

You can take a look at the tokenized real estate properties available in the platform, where all properties are divided into fractional tokens that represent ownership shares.

Step 5: Select a Property

Now you can select the property that you are willing to invest in and the investment amount. For instance, if the value of a single token is ten dollars, you could buy a hundred tokens, hence spending a thousand dollars.

Step 6: Execute the Trade.

Enter the number of tokens you wish to buy and execute the trade. Sign the transaction in your wallet to finalize it.

Step 7: Finalize The Transaction.

The stablecoins will be removed from your wallet and the real estate tokens will be deposited in your account.

Step 8: Manage Your Investment.

To keep track of your real estate tokens and any earnings from them, such as rent payments, use the token holding dashboard on the platform or check your wallet.

Other place where Trade Stablecoins for Real Estate Tokens

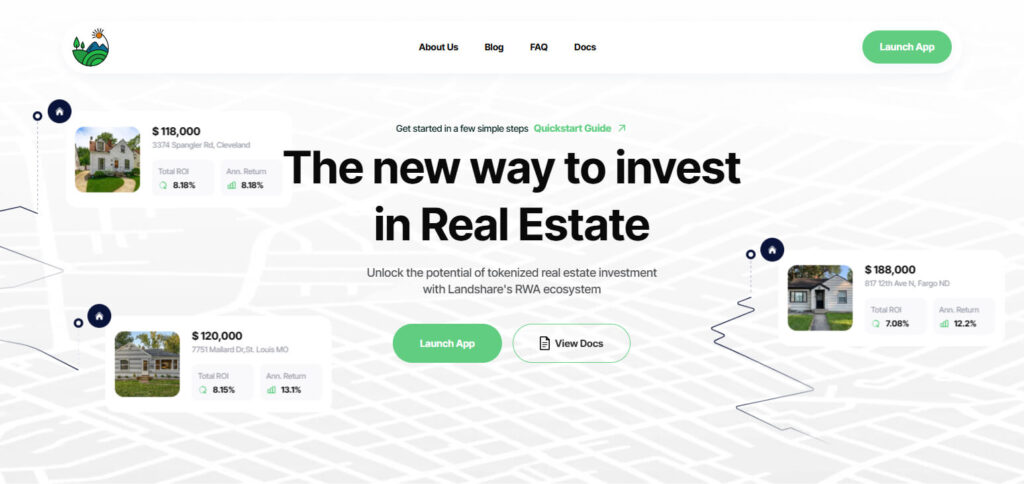

Landshare

Landshare is a blockchain based platform that allows its users to exchange stablecoins such as USDT or USDC for real estate tokens (LSRWA) which serve as fractions of ownership in properties located in America.

This platform offers rental income and asset appreciation through a blockchain coin, thus bridging cryptocurrency with real estate.

It is unique in the sense that it offers real-world property stability integrated with DeFi liquidity, meaning that holders of the token can trade or stake in liquid decentralized platforms which is impossible in normal real estate due to heavily rigid illiquid nature.

Harbor

Harbor is a platform that trades stablecoins such as USDC for real estate tokens that stand for ownership in private real estates.

It’s tailored to investors who want compliant ownership directed at both digital and legal security. Harbor’s most important characteristic is its focus on compliance, making it one of the legally tokenized real estate regulatory platforms rather than one of the other low compliance standards platforms.

This enables them to most effectively shift stablecoin reserves into professionally managed real estate assets.

PropChain

Users of PropChain can swap their USDT and USDC stablecoins for real estate tokens tied to global properties, including its PROP token. PropChain merges the speed of crypto with the value of real estate.

Its unique proposition lies in real estate tokenization and the traditional rental yields of DeFi staking rewards. It offers passive income for investors on the digital asset ecosystem. Users can have fractional ownership of various real estate properties across the globe and rent them out.

Security and Storage Tips

Use Trusted Platforms

Check the ledger reputation and the reviews on the platform’s security history, as it should offer an insurance scheme or hack protection while carrying out crypto transactions.

Enable Two-Factor Authentication (2FA)

One way of safeguarding your money is enabling 2FA, which makes it more challenging for hackers as they will need more than just the password to take over the account.

Store Real Estate Tokens in Secure Wallets

After purchasing your tokens, make an effort to take them off the exchange and transfer to a Secure Wallet, ideally, a hardware wallet. Doing so help lessen the chances of falling victim to token loss due to hacks.

Backup Private Keys and Recovery Phrases

Make sure that you do not store these files digitally or share them with anyone, rather keep them offline and ensure the copies of such information is stored in a very secure place.

Use Cold Storage for Long-Term Holdings

For long-term investors, tokens should be stored in cold wallets which are offline and provide higher levels of security than hot wallets which are online.

Monitor Transactions Regularly

Check on your wallet balance and trading activities from time to time to keep track of your tokens.

Create alerts for any unusual account activity or shifts in token value.

Stay Away From Phishing Scams

Try to stay one step ahead of scams, especially when you are on the receiving end of strange messages or emails with requests for you to hand over sensitive login information. Always double-check the origin of any communication that pertains to your trades before responding.

Protect Your Devices

The devices you use for trading (PC, phone, etc.) should be password-protected and encrypted, and an effective antivirus software installed to safeguard against unwanted access.

Know The Liquidity Of The Token

Ensure that before you start trading, the real estate tokens you are buying can easily be sold off later. Low liquidity can be a problem if you need access to the funds in a hurry.

Conduct Frequent Reviews Of The Smart Contracts

For those trading via smart contracts, ascertain they have undergone an audit by recognized security services. Do not interact with contracts that are not verified or unaudited as that exposes you to many risks.

Pros & Cons

| Pros | Cons |

|---|---|

| Stability: Stablecoins reduce exposure to market volatility, providing a secure base for transactions. | Liquidity Risks: Real estate tokens may have lower liquidity, making it difficult to sell quickly. |

| Fractional Ownership: Allows smaller investments in real estate, lowering the entry barrier. | Market Risk: Real estate token prices can fluctuate, leading to potential losses. |

| Transparency: Blockchain technology ensures transparent, verifiable transactions. | Regulatory Uncertainty: The legal landscape for tokenized real estate is still developing, which may affect your investment. |

| Global Access: Provides global access to real estate markets without geographic limitations. | Technology Risk: Platforms and smart contracts may be vulnerable to technical issues or hacks. |

| Reduced Transaction Fees: Blockchain eliminates intermediaries, lowering transaction costs. | Complexity: Understanding the technology behind real estate tokens may be challenging for new investors. |

| Security: Blockchain encryption ensures higher security compared to traditional trading methods. | Limited Marketplaces: Real estate tokens may not be available on all exchanges, limiting access. |

| Passive Income Potential: Some tokens offer returns from property rentals or dividends. | Regulatory Risk: Changes in regulations can impact token value or legality. |

| Efficiency: Fast, secure transactions with minimal delays compared to traditional property investments. | Counterparty Risk: The platform or token issuer may default or fail to deliver on promises. |

Conclusion

To conclude, exchanging stablecoins for real estate tokens is a modern investment option in real estates without heavily relying on the more traditional methods.

The perks of fractional ownership, lower fees, increasing transparency, and more, make it beneficial to a larger audience of investors.

Although, problems like liquidity issues and regulatory uncertainties are trade-offs worth considering. Investors can take advantage of the growing market and diversify into tokenized real estate features while mitigating risks and using reliable platforms.