In this article, I will explain the How to Trade Perpetual Futures in Crypto—beginning with the very basics, moving onto advanced strategies, and concluding with risk management for novice traders.

You will understand the fundamentals of contract workings, the impacts of leverage, and methods to profit in the cryptocurrency world while mitigating your risks.

What Are Perpetual Futures in Crypto?

Perpetual Futures allow traders in crypto currencies to speculate on the price of crypto currencies without actually owning the assets. Perpetual futures are a type of derivative crypto currency contract. Unlike older forms of futures contracts, they have no expiry leading to unlimited hold time of positions provided margin criteria are satisfied.

These contracts utilize the ‘funding rate mechanism’ to balance the price of the contract and actual market price. Traders have the flexibility to open positions to either go long or short enabling profit to be made in both markets and often using leverage to amplify both the gains and losses.

How to Trade Perpetual Futures in Crypto

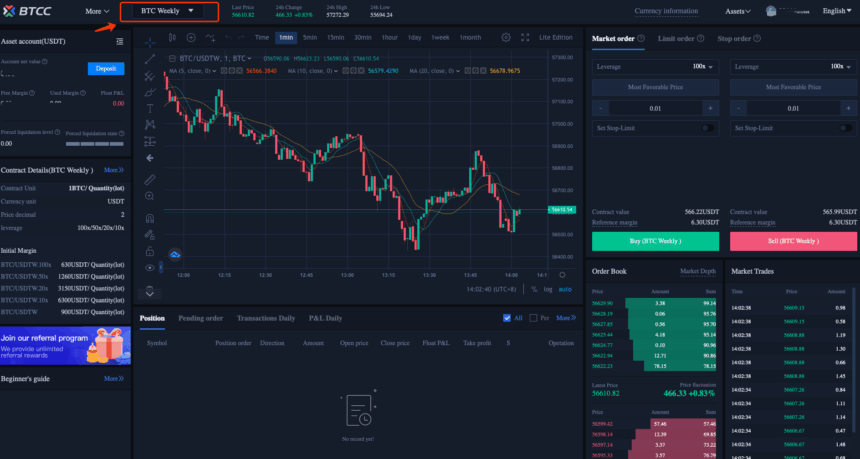

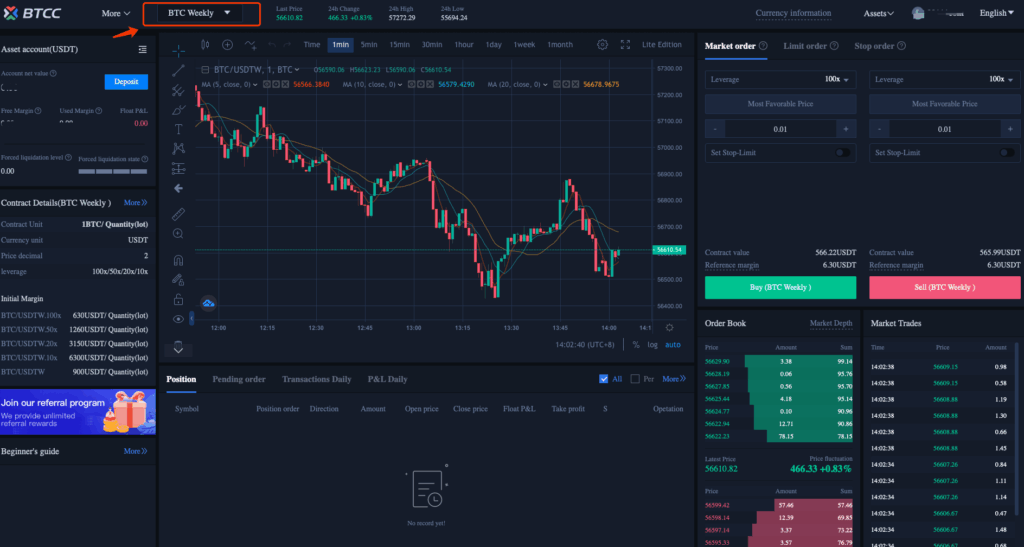

Example: Shorting BTC Perpetual Futures on Bybit

Select Your Exchange

You go with Bybit, as they are a centralized exchange with BTC perpetual contracts, and they also have decent liquidity and leverage.

Fund Your Account

You fund your futures wallet with 1,000 USDT.

Set Up Your Trade

- BTC is trading at 30,000.

- You want to short 0.1 BTC with 10x leverage.

- Your position size is 3,000, which means you need 300 as margin.

Place the Short Order

At 30,000 BTC you submit a market order to short 0.1 BTC.

Monitor Funding Rate

- The funding rate is negative, meaning you earn funding payments from long traders every 8 hours.

- This adds to the passive income you are making while your short position is open.

Set Risk Parameters

- Stop-loss: 31,000 (to limit losses to roughly 100).

- Take-profit: 28,000 (to realize profits of approximately 200).

As Anticipated, Prices Start Fallin

In a matter of hours, Bitcoin hits $28,000.Your take profit is activated.

Review & Close the Trade

- You can now withdraw or reinvest the profits into a new strategy.

How Perpetual Futures Work

No Expiry Date – Positions can be maintained for an unlimited period of time with no predetermined closing date.

Funding Rate Mechanism – Spot trading of financial instruments is driven by periodic payments made to either long or short traders.

Leverage Trading – Enables traders to open bigger positions with smaller capital, resulting with greater amount of profits and losses.

Long and Short Positions – Traders are able to profit from both an upward (long) and downward (short) market movements.

Margin Requirements – Minimum investment for opening and sustaining positions is required as collateral.

Trading Strategies for Beginners

Trend Following – Determine the pace of the market with moving averages and place trades in that direction to improve odds of success.

Scalping – Concentrate on rapid trades that last seconds to a few minutes and set strict stop-loss orders.

Hedging – Establish opposing positions to your holdings to minimize expected losses during potential downturns in the market.

Breakout Trading – Trade as the price surpasses noted support or resistance levels, as these often have considerable volume associated with them.

Range Trading – In oscillating markets, buy and sell at fixed price levels in a predetermined range.

Risks of Perpetual Futures Trading

Risk of Liquidation – A leveraged order can result in loss of capital even with a small unfavorable shift in the market.

Increased Volatility – The cryptocurrency market is exceptionally unpredictable, which makes the industry extremely risky.

Spending for Funding Rate – Costs of holding a perpetual futures contract can accumulate disproportionately relative to the profit gained.

Debt Load – Too much leveraged trading can significantly increase the amount of losses incurred, which means, recovery can get problematic.

Mental Stress – Rapid fire market changes can overwhelm the trader emotionally, which leads to poor trading decisions.

Common Mistakes to Avoid

Excessive Leverage – Over using leverage can lead to increased liquidation risk while draining your account quickly.

Ignoring Funding Payments – Neglecting to factor in funding payments can lead to reducing profits.

Failure to Have a Trading Plan – Trading without clearly defined entry and exit points along with risk management measures most likely leads to erratic outcomes.

Following the Market – Impulsive entry during and shortly after big movements in the market can lead to terrible loss and execution of unwise trades.

Not Setting Stop-Loss Orders – Volatile markets without set stop-losses exposes you to potentially unlimited risk of loss.

Pros & Cons of Perpetual Futures

| Pros | Cons |

|---|---|

| No expiry date, allowing flexible trade duration | High risk due to leverage and volatility |

| Ability to profit in both rising and falling markets | Funding rate costs can reduce profits |

| High liquidity on major exchanges for faster order execution | Complex for beginners to understand and manage |

| Leverage allows larger exposure with smaller capital | Potential for rapid liquidation if the market moves against you |

Conclusion

Participating in crypto markets through trading perpetual futures offers thrilling chances to earn money in uptrends and downtrends but comes with the risk of leverage and volatility. Beginners should take up small positions, rigidly controlled leverage, and risk management, including the use of stop-loss and take-profit orders.

A trader needs to have a firm grasp of the funding rates, the flow in the market, and the psyche of the traders for dependable outcomes. Trading perpetual futures will require a great deal of patience and resolve, a sound strategy, and a disciplined approach. The crypto market is fast-paced, but with the right approach, perpetual futures trading can help you make the most of it.

FAQ

What is the difference between perpetual and regular futures?

Perpetual futures have no expiry date, allowing traders to hold positions indefinitely, while regular futures have a fixed settlement date.

Can I lose more than my investment in perpetual futures?

Yes. High leverage can cause losses that exceed your initial margin if the market moves sharply against you.

Which exchanges are best for perpetual futures trading?

Popular choices include Binance, Bybit, OKX, and Kraken, all offering high liquidity and advanced trading tools.