In this article, I will discuss yield farming in 2025. I’ll explain its profitability, potential returns factors, and much more.

It is important for both novice and experienced investors to comprehend yield farming’s viability as an investment strategy with risk considerations and recent trends both influencing the return on investment.

Recently, experts have provided important insights on yield farming’s profitability and we will dive deep into those and other trends.

What Is Yield Farming

Yield farming is a strategy used in decentralised finance (DeFi) where investors can earn rewards by lending or staking their crypto assets in liquidity pools royalty-free.

It entails rewarding users who provide liquidity to DeFi protocols which use the provided funds for lending and trading. Participants get paid with a portion of the transaction fees or governance tokens.

While Yield farming provides high profit potential, it is not without risks like impermanent loss, smart contract failures, and volatile markets. This method has gained preference amongst crypto investors trying to passively earn income.

Is Yield Farming Still Profitable in 2025?

Absolutely, yield farming will continue to be profitable in 2025, particularly for those who comprehend the risks involved and use the right platforms. With the improvements in DeFi, multi-chain automation, and farming strategies, passive earnings can be made faster and smarter than ever.

How to Start Yield Farming Safely in 2025

To begin yield farming in a safe manner by 2025, perhaps consider undertaking the following steps.

Research and Choose Reliable Platforms: When selecting a platform, stick to reputable options like Aave, Compound, or Uniswap. Make sure to check their security audits and reputations within the community.

Use Stablecoins or Blue-Chip Tokens: Farming using stablecoins such as USDC or USDT is less risky compared to other forms of farming. Safer blue-chip tokens like ETH and BTC carry their own risks of price changes.

Diversify Across Protocols: Place your funds into multiple platforms to make certain that you are less exposed to the failure of a single protocol.

Check APY and Fees: Look at the annual percentage yield (APY) for the platforms, along with their fees. Financial gain quite frequently results in a high level of financial risk. Be mindful of the financially lesser destructive options.

Mitigate Impermanent Loss: To minimize possible losses, make sure to utilize protocols that protect against impermanent loss or offer one sided staking.

Secure Your Wallet: Storing your wallet in a non custodial one (MetaMask, Trust Wallet) while enabling multi-factor authentication (MFA) is safe along with storing recovery phrases securely offline enables safety.

Start Small and Monitor: To test the platforms reliability, withdrawing periodically while monitoring performance regularly is a smart strategy.

Stay Updated on Regulations: Keeping track of the DeFi legal curve for your region is essential to avoid legal complications.

How Much Can You Earn from Yield Farming?

Profit varies based on the platform, asset, or strategy applied. Annual Percentage Yields (APY) can vary between 5% to over a whopping 100% depending on risk and market volatility.

For instance,

Stablecoins like USDT and USDC have 5% to 15% APY

ETH and BTC have 7% to 20% APY

High risk Altcoins, 30% or higher APY

The Future of Yield Farming

You will still be able to profit from yield farming in 2025, but everything has shifted. And, the extravagant high yield of years past during the early stages of DeFi is not the standard anymore.

Rather, yield farming becomes an investment opportunity that is less volatile, but more appealing for people looking to engage more heavily.

With the growth of DeFi, something such as better management risk protocols might have new prospects for a crypto yield farmer. Capital will likely be drawn towards platforms featuring more advanced security, lower fees, more efficient liquidity pools, and greater capital.

Additionally, though this will rely on other market tendencies and regulations, the integration of DeFi within the traditional ‘finance world’ may open new scopes for yield farming.

Best Platforms for Yield Farming in 2025

1. Uniswap`s Yield Farming

Uniswap is the most popular decentralized exchange or DEX that provides these services on the Ethereum blockchain. You provide liquidity to various trading pairs by depositing them into it’s liquidity pools and earn a percentage of fees from the trades performed on the platform.

Uniswap allows these tradable pair tokens to farm, which makes it easier and positive for Aave’s yield! don’t forget that while farming, you can suffer impermanent loss from the value of the tokens in the pool over a duration!

2. Aave’s Yield Farming

Aave is a lexicon of farming loans or a lending and borrowing service that has yield farming enabled from liquidity pool lending. Users earn deposit interest on money they keep in Aave’s pools and can claim further rewards in the platform currency AAVE.

The Projects is well-known for supporting security mechanisms and their innovative instruments like flash loans which ensures farming in Aave is much more reliable.

3. PancakeSwap

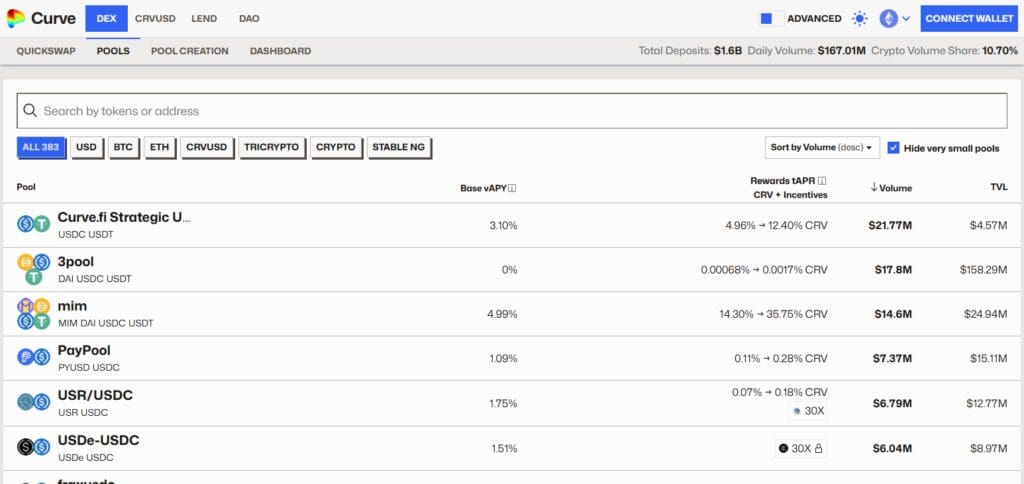

With its focus in stablecoin trades and liquidity provision, Curve Finance stands as an unmatched choice among yield farmers. Its low risk impermanent loss, along with its ability to earn rewards for providing liquidity in Curve pools makes it a no-brainer.

The optimized pools for lowered slippage and high efficiency yield further rewards in the native CRV token, which also offer staking rewards.

4. Yearn Finance

Yearn finance specializes in Yield aggregators with an extreme emphasis on user experience. The platform offers automated transfers among varied DeFi protocols.

That are within the system and goes a step further with yield farming, making it perfect for those looking to be lazy. Even yield farming is made easier with the highly valued and easy to stake YFI token.

5. Curve Finance

PancakeSwap has found huge success appeal for its lower transaction fees as compared to Ethereum for other DEX competitors, which were built on Binance Smart Chain.

Its automated liquidity pool staking also enabled yield farming rewards in the form of their CAKE token, obtained on PancakeSwap’s platform. Offering a greater variety of tokens certainly makes the growing user friendly platform stand out to many.

Yield Farming Pros & Cons

Pros of Yield Farming

The Dreams of a Profitable Farming Season: Yield farming is quite beneficial when the market is bullish since users earning interest, trading fees, and platform-native tokens pay for providing liquidity or lending their crypto. This makes it another passive income earning strategy for users.

A Reliable Source of Passive Income: Once funds are staked or added to a liquidity pool, they can be managed/maintained automatically by an algorithm like Yearn Finance, that helps carry out efficient farming by optimally strategizing yields.

Liquidity and Bonus Tokens: A lot of liquidity providers have their platforms where they incentivize farmers by paying out an additional bonus in native tokens. This boosts the total APY. PancakeSwap, for example, has CAKE tokens which providers can earn with liquidity and stake for additional returns.

Generating Exposure for New Projects: Yield farming gives an edge to emerging DeFi tokens, where farmers can benefit from early adopting Defi tokens and can gain from the appreciation of the price.

Governing and Participating Through the Defi: Farming can be on Aave and Uniswap where liquidity providers get govern tokens and can vote for protocol upgrade and decisions making them part of the ecosystem growth.

Cons of Yield Farming

Impermanent Loss (IL): While providing liquidity, users are exposed to IL when there is a significant fluctuation within the price of the tokens.

Vulnerable Smart Contracts: Yield farming is dependent on smart contacts, which makes it susceptible to bug and exploit. Even the best platforms is at risk and could lose a lot of money.

Gas Fees are Too Expensive: On certain networks such as Ethereum, the costs associated with transactions (gas fees) are high and can lead to losses, especially during periods of heavy congestion on the network. This sometimes is useful for bigger players, but it can be devastating for small farmers.

The Market is Unstable: The crypto market is very unpredictable, and being a market standard, the shifting prices will greatly affect the value of your staked assets, at some instances, destroy profit.

Risk from Outside the Company: Changes to law and policy for DeFi are still being put in order. Restrictions from the government or other rules may change the way a platform operates, how accessible it is, and what the costs of compliance is.

Conclusion

Yield farming is able to bring in profit-yielding returns for those willing to lend or stake their crypto assets on decentralized finance (Defi Platforms). Although, the profitability of yield farming is highly volatile based on market conditions as well as the farming platform and assets chosen.

Many investors reap vast profits but there are several risks that need to kept in mind like smart contract and regulatory risks, impermanent loss, etc. Yield farmers, especially newbies, need to conduct a good amount of research and analysis, to further assess their risk appetite before commencing any yield farming activity.