In this article, I will discuss the How to Do Yield Farming on Binance Smart Chain .

You will learn from the process of creating a wallet, selecting a platform, and staking your tokens, to earn rewards. With or without crypto experience, the steps provided will enable you to maximize yield farming on BSC.

What Is Yield Farming?

Yield farming is a decentralized finance strategy for earning rewards with digital assets by providing liquidity to a platform’s pool.

It consists of depositing cryptocurrencies into smart contracts which are subsequently utilized for lending, borrowing, or trading activity. Interest, transaction fees, or other native tokens of the platform’s ecosystem are allocated as rewards to the users.

Yield farming returns are based on the rewarding platforms APY (Annual Percentage Yield). Yield farming is not risk free, as it is susceptible to impermanent loss or injurious smart contracts that require great attention and understanding to manage investments properly.

How to Do Yield Farming on Binance Smart Chain

Example: Yield Farming on PancakeSwap

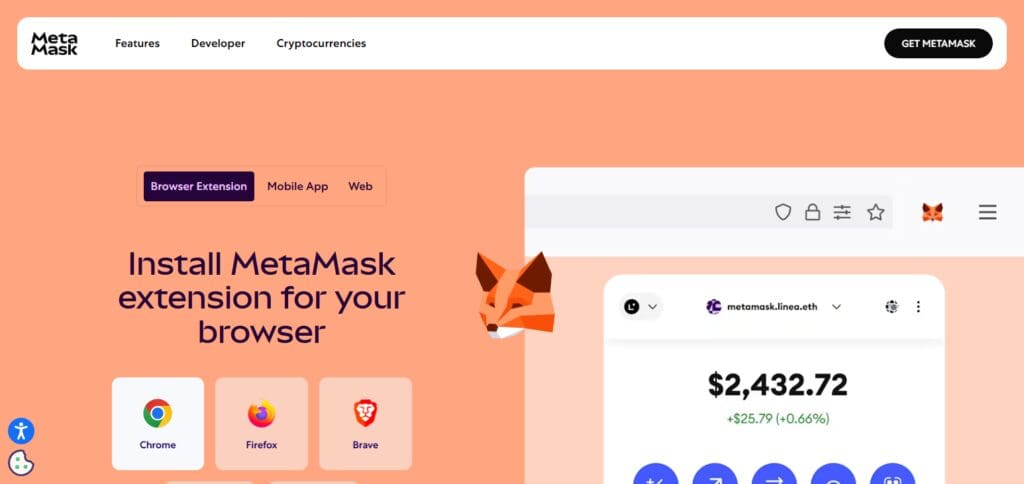

Set Up Your Wallet

Download and setup a cryptocurrency wallet of your preference. MetaMask or Trust Wallet will work.

Change the wallet settings so that it can easily communicate with Binance Smart Chain by including the network details.

Acquire BNB

Get BNB from Binance or any other exchange, make sure you save it in your wallet afterwards.

The BNB will facilitate a transaction and will also be used in suppling liquidity.

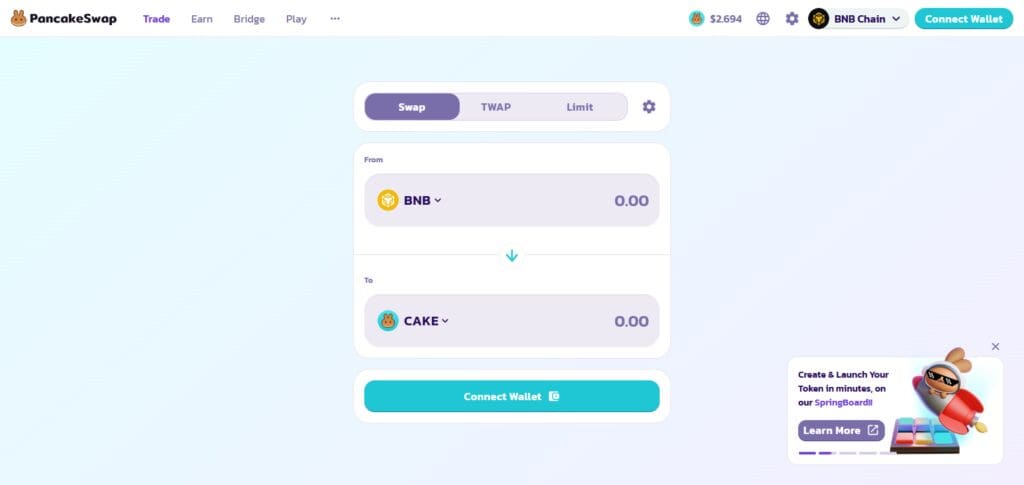

Access PancakeSwap

Go to PancakeSwap ans make sure you link your wallet.

Provide Liquidity

Pick a liquidity pool you want to join like BNB/CAKE.

For every token into the pool, input an equal amount of the two matched tokens. If, for instance you wish to contribute $100 worth of liquidity, provide $50 worth of BNB and CAKE each.

Stake LP Tokens

Staking allows you to earn liquidity provider (LP) tokens that can be used as proof of your stake.

You can go to PancakeSwap using the LP tokens and stake them through the Farm section.

Receive Your Rewards

After staking, you will earn CAKE tokens already for free.

These rewards can be harvested periodically and reinvested or withdrawn.

Watch and Control

Monitor the yield’s APY as well as any impermanent loss incurred.

Refine and adjust your strategy to maximize profit.

Other Place Where Yield Farming on Binance Smart Chain

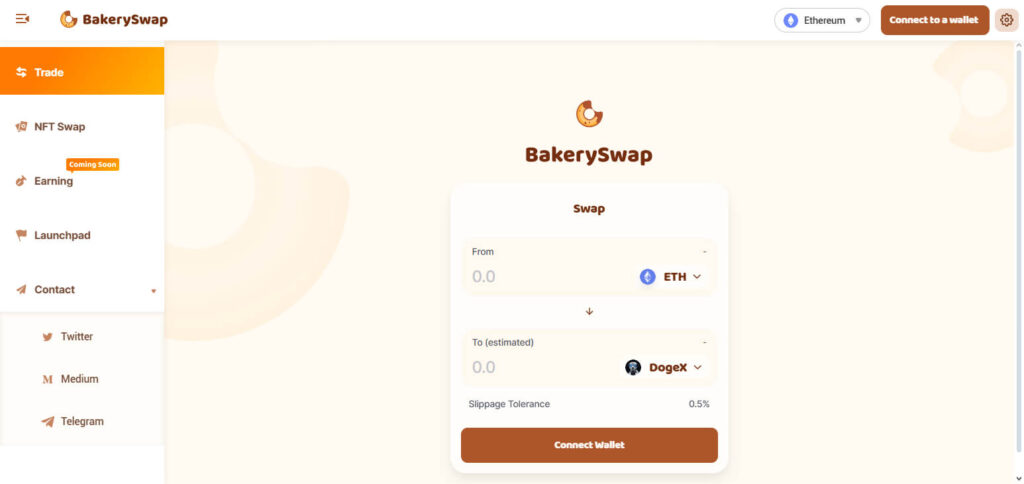

BakerySwap

BakerySwap is one of the most popular yield farming platforms on the Binance Smart Chain (BSC) owing to its automated market maker (AMM) model and cheap transaction fees.

It has novel farming options where users can farm BAKE tokens by staking them. The integration of NFTs also makes BakerySwap unique, enabling the farming and trading of NFTs together with yield farming earning it the title of a DeFi platform on BSC.

Why Binance Smart Chain for Yield Farming?

Low Gas Fees

BSC has significantly lower gas fees than Ethereum so it is cheaper to use for multiple transactions.

Fast Transaction Speeds

BSC has a shorter block time than other chains which increases the efficiency of farming.

Liquidity and Popularity

Many of the top DeFi platforms are hosted on BSC, which draws in large liquidity pools due to the high farming rewards.

Interoperability

It is easy to transfer tokens from Binance Chain to BSC and vice versa, thanks to the cross-chain compatibility.

User-Friendly

Yield farming on PancakeSwap and ApeSwap is simpler for newcomers to understand because of intuitive user interfaces.

Managing and Optimizing Your Yield Farming

Consistent Reward Reinvesment: Withdraw and reinvest your farming rewards regularly to gain maximum compound interest as well as amplify levered returns.

Monitor Adjusted Yield Pools APY: Observe the Annual Percentage Yield (APY) and think about changing to more stable or higher yielding pools when appropriate.

Utilize Diversification as a Risk Management Tool: To lessen the impact of specific risks, allocate your capital to different farms or platforms.

Manage Fees Associated with Impermanent Loss: Regularly monitor fees as well as potential loses due to farming being impermanent to ensure yields remain positive.

Select Profiable Platforms Only: Use only trusted DeFi platforms that have gone through audits to reduce smart contract security vulnerabilities.

Common Risks

Impermanent Loss: You are exposed to losses if the price of one asset in a liquidity pair moves unfavorably

Smart Contract Security Issues: Loss of funds that could occur due to being hacked due to bugs or loopholes in the Smart Contract.

Rug Pulls or scams: Some pull fraudulent schemes where they go off the radar with your money. It is very risky to trust new projects that do not have any real reputation.

Volatility: Unexpected price drops could lessen your return on investment if the value of your funds decreases.

Increased Congestion Gas Rates: While BSC has reasonably priced fees, they can increase due to heavy congestion.

Tips for Successful Yield Farming on BSC

Take Baby Steps

Invest an amount that you are comfortable with to learn the system better before putting in larger sums.

Stick to Familiar Platforms

Use trusted platforms and stick to PancakeSwap, ApeSwap, or Venus since they have audited smart contracts.

Reinvest Rewards at the Right Time

Reinvest rewards to compound your earnings but make sure that it is profitable to do so considering fees and market situations.

Spread Your Funds

To diversify, you can allocate money to other pools or platforms which minimizes the risk you are exposed to.

APY and Market Watching

Be attentive of the fluctuating APY, token price, and general market tendencies in order to maximize your revenue.

Always Make Sense Out of Risks

Always remember the risks such as impermanent loss, smart contract risk, and rug pull.

Pros & Cons

| Pros | Cons |

|---|---|

| Low Transaction Fees: BSC offers lower gas fees compared to Ethereum, making farming more cost-effective. | Impermanent Loss: Price fluctuations can reduce the value of staked tokens. |

| Fast Transactions: Faster block times result in quicker transactions and farming efficiency. | Smart Contract Risks: Vulnerabilities or bugs in contracts can lead to fund losses. |

| High APY Opportunities: BSC platforms often offer competitive APY rates, boosting potential returns. | Rug Pulls and Scams: Some DeFi projects may be fraudulent or exit scams. |

| User-Friendly Platforms: Platforms like PancakeSwap have intuitive interfaces, making them easy to use. | Volatility Risk: Crypto price fluctuations can affect the value of staked assets. |

| Interoperability: Supports cross-chain compatibility, allowing easier token transfers. | High Competition: More users mean reduced rewards as liquidity pools grow. |

Conclusion

In short, yield farming on the Binance Smart Chain (BSC) allows users to passively earn money through liquidity provision and staking.

Because of the low fees, quick transactions, and ease of use, BSC caters to both novice and advanced DeFi users.

On the other hand, there are risks like impermanent loss, smart contract flaws, and unstable market conditions. To avoid losses, start small, invest in reputable services, and check on your assets often. If you properly manage your risks, yield farming on BSC poses great benefits.