In this article, I will cover the most notable DEX platform that have emerged in the world of decentralized finance.

The reputation of these platforms stems from their exceptional security and innovative functions that effortlessly serve the users. Knowing which DEXs are most trusted allows traders to make sound decisions when participating in the DEX trade.

Key Point & Most Trusted DEX Platforms List

| Platform | Key Point |

|---|---|

| Uniswap | Leading decentralized exchange (DEX) on Ethereum, known for automated market making (AMM). |

| Hyperliquid | Decentralized derivatives exchange with high liquidity and low slippage. |

| Raydium Swap | Solana-based AMM and liquidity provider with fast transaction speeds. |

| Jupiter | Aggregator on Solana that finds the best prices across multiple DEXs. |

| dYdX | Decentralized margin trading and derivatives platform with perpetual contracts. |

| Osmosis | AMM DEX on Cosmos ecosystem focused on cross-chain liquidity. |

| Curve Finance | Specialized AMM optimized for stablecoin swaps with low fees and slippage. |

| Balancer | Flexible AMM allowing multi-asset pools and custom weights for liquidity providers. |

| SushiSwap | Popular Ethereum-based DEX and AMM with community governance and yield farming features. |

1.Uniswap

Uniswap is regarded as one of the most reliable decentralized exchange (DEX) Platforms because of its pioneering impact on automated market making (AMM). Uniswap’s transparent, permissionless protocol enables participants to provide liquidity or trade tokens through their crypto wallets without going through a centralized entity.

Uniswap’s reliability stems from its solid security measures, open source code, and deep liquidity pools. Users across the globe trust the platform and its numerous DEX innovations, especially through ongoing protocol upgrades, have made it a favorite in decentralized finance.

Features

- Automated Market Maker (AMM): Utilizes the unmapped order book system through AMM technology to facilitate token swaps, thus eliminating the need for decentralapized services or order books.

- Broad Token Support: Makes hundreds of ERC-20 tokens accessible which serves users looking for various Ethereum based digital assets.

- Liquidity Incentives: Users are able to earn transaction fee portions through providing liquidity to the transaction pools.

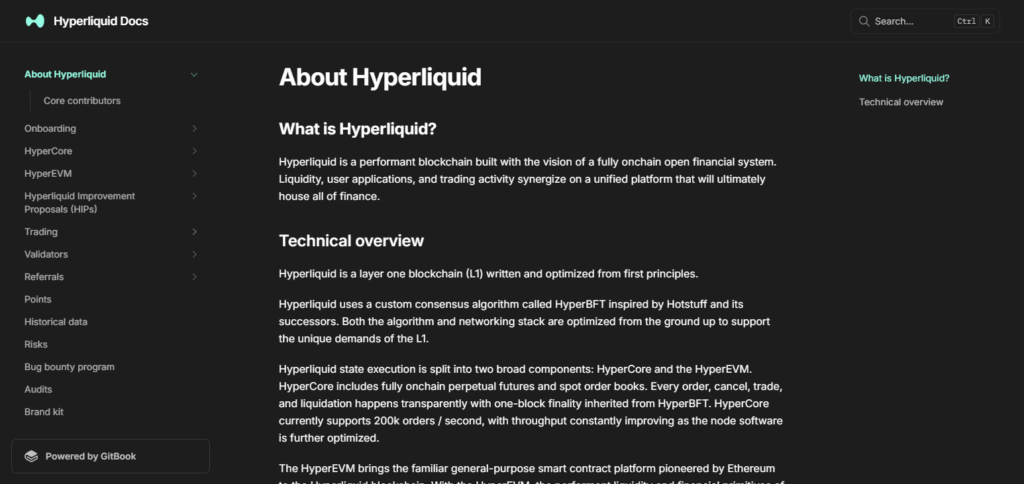

2.Hyperliquid

Hyperliquid is one of the most trusted DEX platforms because of its focus on derivatives trading with unmatched liquidity and slippage. Most DEXs steer clear of using decentralized order books together with automated market making; however, Hyperliquid utilizes both, and this improves user experience as well as the cost of trading, which gets tighter with powered by competition.

In addition, hyperliquid’s fast execution of trades paired with the platform’s reliable system security ensures protection of funds and sensitive information for traders. These features strongly user confidence, which is why Hyperliquid is used not only for spot trading but also for trading derivatives.

Features

- High-Performance Trading Engine: Incorporates a the central order book model ultra-high-frequency and ultra-low latency trading features.

- Perpetual Futures Support: Provides perpetual contracts which can be traded on-chain with no third party involvement thus, giving on-chain leveraged trading freely.

- Self-Custody Model: Allows traders full control of their assets as there is no need to deposit to a centralized exchange.

3.Raydium Swap

Raydium Swap is known as one of the most trusted DEX platforms mainly because it works on Solana blockchain with fast transaction speeds and low fee costs.

Supplementary to this, what makes Raydium different is the fusion of an AMM with Serum’s central limit order book – integrating the advantages of both the AMM model and order book trading provides more liquidity and greater price accuracy.

This amalgamated approach protects the users from slow speed altering trades while maintaining decentralization which helps Raydium build a reputation for trust and innovation within the DeFi ecosystem.

Features

- Built on Solana: Uses Solana for its blockchain which enables near instant, low fee transactions.

- Order Book Integration: Improves price discovery by combining AMM with Serum’s central limit order book.

- Yield Farming and Staking: Provides liquidity through yield farming and incentivized staking.

4.Jupiter

Jupiter is reputable for its top-tier DEX servicing because they function as a potent aggregator on the Solana ecosystem. As tradeuters interact with numerous DEXs, Jupiter strives to get the best possible prices for users.

Ensuring efficient order routing through different liquidity pools reduces slippage for traders, thus providing a better value. Traders looking for the best deals on swaps are in good hands as Jupiter streamlines intricate multi-token trades, executing them swiftly at lower fees while boosting their reputation in the DeFi world.

Features

- Best Price Routing: Crosses all liquidity available on Solana DEXs for the most optimal routes for user trades.

- Comparative Quotes in Real Time: Shows multiple swap routes and rates for transparency prior to executing a trade.

- Innovative UI: Appeals to both novice and seasoned traders alike due to its intuitive design.

5.dYdX

dYdX is trusted as a leading decentralized exchange because few DeFi platforms concentrate on advanced trading features like margin and perpetual contracts. Faster and cheaper transactions are possible due to dYdX’s rare mix of Layer 2 scaling technology while retaining complete user control over funds.

dYdX combines professional trading tools with decentralized security, offering a customizable and trustworthy environment for traders which makes the platform a leader in respect in the space of decentralized derivatives trading.

Features

- Derivatives Trading Advanced: Focuses on perpetual futures and has advanced trading options like stop-loss and limit orders.

- No Gas Fees on StarkEx: Layer 2 on StarkEx offers fast trades with no gas fees and lower costs.

- Decentralized But Still Professional: Provides professional decentralized trading.

6.Osmosis

Osmosis is well-respected as a decentralized exchange since it sits on the Cosmos ecosystem which allows effortless cross-chain asset swaps with high interoperability. Its distinct model enables users to design and implement customizable liquidity pools with flexible parameters which gives greater control over slippage and fees.

Osmosis prioritizes user governance, thus empowering the community to control how the platform evolves. The combination of cross-chain features, multi-dimensional customization and a community-driven approach makes Osmosis stand out in the world of decentralized trading.

Features

- Integration Into Cosmos Ecosystem: Designed for tokens with IBC, enabling cross-chain swaps within cosmos.

- Liquidity Pools Customizable: Users can design custom pools with adjustable fees, token weighting, and other parameters.

- Governance On-Chain: Decisions on changes and upgrades are made by the community.

7.Curve Finance

Curve Finance estesemed DEX platform is trusted for its efficient handling of stablecoin and wrapped asset swaps, minimizing slippage and fees.

Its algorithm works best for the stable and low risk assets which ensures that liquidity providers and traders enjoy greatly optimized trades.

This sharp focus lowers volatility risks, making Curve an enticing platform for users who value safety and lower trading costs. These automated governance systems in combination with high liquidity to do not allow sharp price deviations increase user trust and make Curve a more reliable platform within the DeFi ecosystem.

Features

- Optimization of Stablecoins: Specializes in providing low-slippage swaps for stablecoins and other similar assets.

- Balanced Yield Farming: Offers liquidity with CRV tokens and embedded yield strategies for balanced incentivized growth farming.

- Governance of DAO: Users are granted voting power on protocol parameters and reward distribution via Curve DAO.

8.Balancer

Balancer is known as a trusted DEX platform because of its unique method of enabling users to create liquidity pools containing multiple tokens with varying weights and adjustable ratios. Such a model allows liquidity providers to finely tune their portfolios while earning fees, a feature not available in traditional fixed ratio pools.

Unique to Balancer, self-balancing mechanisms ensure that pool ratios are maintained automatically with little manual work. The platform continues to be reputed for its efficiency and innovation in the decentralized exchange world due to its strong user autonomy focus, effective liquidity, and diversified pools.

Features

- Pools With Multiple Tokens: Enables creation of custom liquidity pools composed of 8 tokens with variable weights.

- Flexibility of Liquidity Providers: Users are able to set up and run pools according to specific strategy needs.

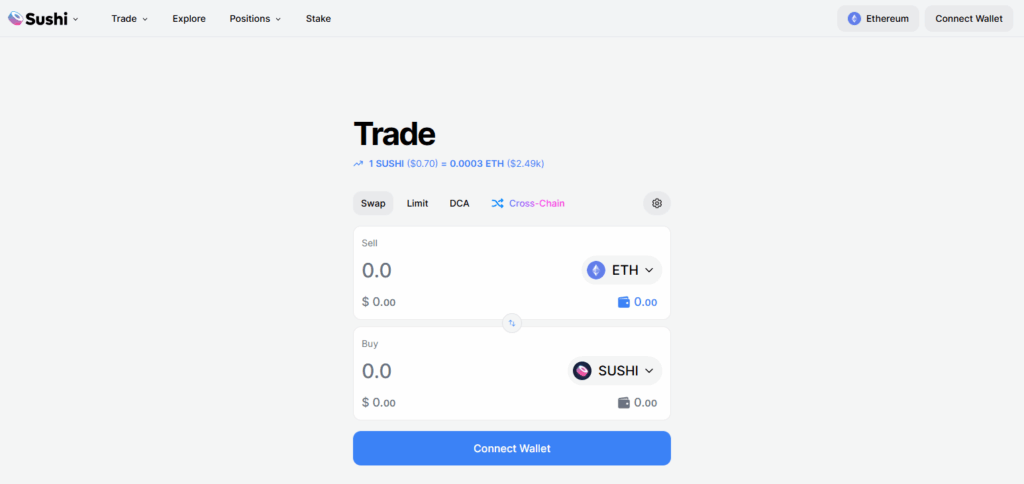

9.SushiSwap

SushiSwap has earned the trust of users as a DEX platform with a strong community governance along with a wide array of offerings in DeFi besides basic token swaps. These included features such as yield farming, staking and lending which added to the benefits of an already existing ecosystem.

The self-governing protocol of SushiSwap boosts the transparency of the platform while retaining user loyalty through its unending creative improvements and consistent rewards given to liquidity providers. This mix of development through the community and flexible DeFi tools available has made SushiSwap a well-trusted platform in DeFi.

Features

- Support for Multiple Chains: Covers multiple chains such as, Ethereum, BNB Chain and Polygon for more reach.

- All-Inclusive DeFi Offering: Provides all-in-one ecosystem with DEX, staking, farming and lending.

- Governance by Community: SUSHI token holders vote on ecosystem changes, thus making platform governance community driven.

Conclusion

To recap, the most sophisticated decentralized exchange platforms continue to earn trust while standing out for their overlapping layers of security, innovation, and user-centric features.

Be it through advanced trading tools, effortless cross-chain swaps, or agile liquidity pools—these platforms place trust, speed, low fees, and unparalleled transparency at their core. Their unmatched constant evolution fosters unparalleled user loyalty.

DFarmers’ strong community-driven governance reinforces them as steadfast beacons of decentralized finance, empowering uninhibited user-controlled trading and investing.