In the article today, I’ll talk about the DeFi Projects That Don’t Get Enough Recognition and are transforming the world of DeFi in silence.

These lesser-known projects have tremendous power and real usefulness despite being overshadowed by big-name protocols that dominate the news.

If you are an investor or someone who has a keen interest in DeFi, understanding these projects prior to their extensive publicity can help you gain unique knowledge and uncover opportunities in the advancing crypto landscape.

Key Points & Most Underrated Defi Projects List

| Project Name | Why It’s Underrated (Explanation) |

|---|---|

| Beefy Finance | A multi-chain yield optimizer that automates yield farming—quietly powerful with solid security. |

| Pendle Finance | Allows trading of future yield—a unique DeFi niche, but underexposed to retail users. |

| Lyra Finance | A decentralized options trading protocol—low visibility despite innovative risk engine design. |

| Vela Exchange | A derivatives DEX with lightning-fast transactions—overshadowed by bigger names like GMX. |

| Reaper Farm | A yield auto-compounder on Fantom—efficient and consistent, but rarely gets attention. |

| Hegic | Decentralized options protocol—pioneering product, yet lacks the hype of newer DeFi tools. |

| Tokemak | Liquidity reactor for DeFi—solves a major liquidity problem but still not widely adopted. |

| Umami Finance | Institutional-grade DeFi vaults—focuses on real yield but operates quietly compared to flashy projects. |

| Float Protocol | Adaptive stablecoin protocol—provides innovation beyond basic stablecoins like USDT or DAI. |

| Alchemix | Offers self-repaying loans—radical concept, but complex UX limits mainstream traction. |

10 Most Underrated Defi Projects

1.Beefy Finance

Beefy Finance operates as a decentralized yield optimizer that functions on multiple chains, automating strategies for yield farming. It includes BNB Chain, Avalanche, Polygon and Fantom which helps users incur maximized returns using compounding.

Along with saving gas fees for users, Beefy offers vaults that automatically reinvest rewards. Even though Beefy has endured reliable security audits and showcased a growing

Total Value Locked (TVL), it continues to be overshadowed by hyped protocols. Its strength lies in cross-chain automation oriented safety-first strategies making it ideal for passive income seekers in DeFi who prioritize low maintenance earnings.

Features Beefy Finance

- Auto-Compounding Vaults: Yield is automatically reinvested to achieve maximum returns with minimum user input.

- Multi-Chain Support: Operates on multiple blockchains like BNB, Polygon, Avalanche, and Fantom.

- Security Audits: Strength of smart contracts are checked regularly and community-reviewed.

- Low Fees: Uses optimized strategies to save gas and transaction costs for users.

2.Pendle Finance

Pendle Finance is enabling the users to tokenize and trade on future yields in DeFi which has not been explored much. It allows yield-bearing assets to be divided into principal and yield components, thus allowing for tactical trading of future income.

This is useful for more sophisticated institutional level strategies like fixed income or even yield speculation. With all its innovation, Pendle suffers from lack of awareness due to its overly complex mechanics coupled with insufficient marketing.

As demand increases over time, Pendle will grow into a more important position within the industry, especially where it provides deeper functionalities for yield management that many other DeFi platforms neglect.

Features Pendle Finance

- Yield Tokenization: Tokens can be created by slicing an asset into its principal part as well as yield generating portion.

- Fixed Yield Trading: Blocked and speculative trading on predicted future yield in DeFi is available.

- **AMM for Yield Assets: Custom AMM designed for yield-bearing instruments enables efficient swaps.

- MULTI CHAIN DEPLOYMENT: Currently available in Ethereum, expanding to other L2s too

3.Lyra Finance

Lyra Finance is an options trading platform that operates on Ethereum’s Optimism Layer 2 blockchain using a new type of automated market maker (AMM) for liquidity.

Compared to centralized options markets, Lyra has less barriers to entry because users can trade freely as well as make use of the market’s unique features like hedging and speculation strategies not available on-chain before.

Due to the perception that options are too complex alongside the perpetual DEXs’ dominance by dYdX, it tends to be overlooked. Should demand for more advanced derivatives grow, Lyra stands ready as an essential part of DeFi’s financial infrastructure.

Features Lyra Finance

- Options Trading has become easier with crypto options calls and puts being traded at a decentralized level.

- It has Optimism L2 integration which was built on Optimism therefore offers fast low cost transactions.

- Dynamic Risk Engine which improves pricing adjusts the collateral and volatility.

- Users can earn fees by providing collateral to option markets through liquidity pools.

4.Vela Exchange

Vela Exchange is another emerging decentralized perpetuals and derivatives platform focused on low-cost fast trading which also integrates self-custodial wallets.

As a powerful competitor to CEXs, Vela offers unparalleled performance within DeFi including novel liquidity constructions and user-friendly interfaces with professional-grade tools .

The combination of strong fundamentals and strategic partnerships should improve mainstream focus but currently remains underexplored compared to well-established platforms like GMX or other leapfrogging competitors.

Over time these performance incentives along with expanding ecosystems may greatly boost its standing in the decentralized derivatives market.

Features Vela Exchange

- Speed: ‘Executes transactions as fast as you would find in centralized exchanges.’

- Trading Benefits: Gives bonuses for trading more. Also provides rewards to investors that make the market liquid.

- Self-Custodial Accounts: Fully controls their asset at all time without losing custody.

5.Reaper Farm

Reaper farm is a yield auto-compounding protocol on the Fantom network. It endeavors for long-term sustainable DeFi growth with vault strategies that optimize user returns.

Unlike most auto-compounding protocols, Reaper focuses on risk management and gives more importance to transparency, with strategies being audited and reviewed regularly.

It is governed by its community and revenues collected from using the platform are re-invested in development which adds to safety features. While platforms like Yearn and Beefy get all the attention

Reaper gets the job done by providing steady competitive yields without making noise about it. The quietness in its presence stems from the lack of marketing or efforts to appear flashy; instead focusing on results rather than hype.

It is ideal for advanced DeFi users and is one of the most underrated platforms available in the market for auto-yield services.

Features Reaper Farm

- Auto Compounding Vaults: Strategic execution maximizes user yield with advanced automation.

- Fantom Native: Strong focus on ecosystem and deep integration into Fantom DeFi supports concentrated ecosystems.

- Transparent Governance: Regular community strategic oversight ensures and strengthens transparency.

- Security First: Risk tested, monitored, audited, and actively ongoing strategies ensure protective measures are in place.

6.Hegic

Hegic is an Ethereum-based trading platform that deals in cryptocurrency options and became one of the first fully decentralized protocols. The app features a user-friendly interface and allows for on-chain call and put options risk management through speculation and hedging.

Simplified strategies make educational resources less necessary, making Hegic great for newcomers to trading. Although other newer options protocols may take a larger share of the market, they will always be behind on innovations like smart contract upgrades or governance improvements

that Hegic continues to implement. Lower liquidity during its more experimental stages might not have put Hegic into the spotlight, but it allowed them to try out new ideas without worrying about competition, innovation deadlines, or time constraints.

Features Hegic

- On-Chain Options: Put and call options offered on Ethereum blockchain in a decentralized manner.

- Pooled Liquidity: Enabled through multiple users to simplify option writing through pooled liquidity providing.

- No KYC: Verification process does not exist so anyone has opportunity to access freely.

- Early Mover: Pioneering DeFi options protocols known for innovation & risk-taking early on.”

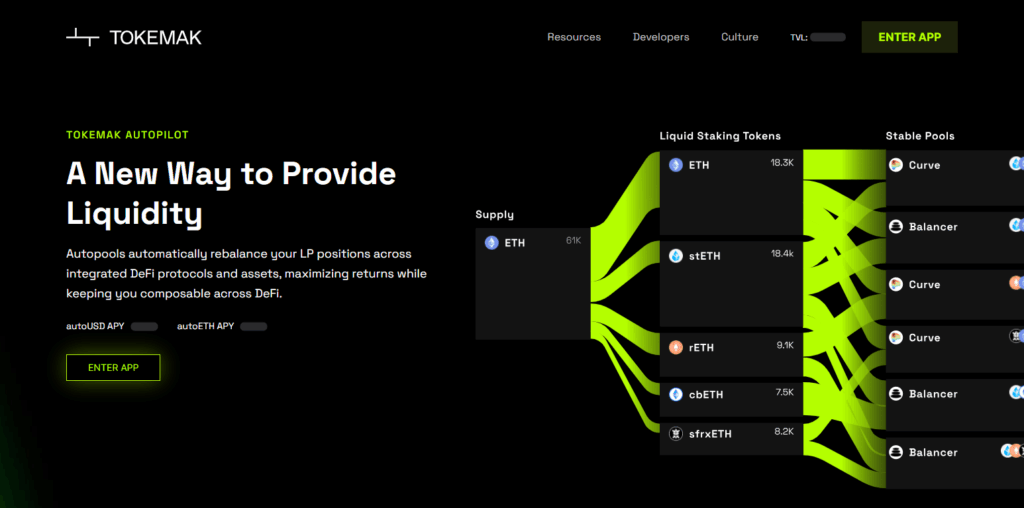

7.Tokemak

As a part of the DeFi space, Tokemak is a liquidity protocol that aims to address issues within the ecosystem such as capital fragmentation. Within this DApp ecosystem, Tokemak functions as a liquidity router so users can allocate capital to exactly where is most needed at that point in time.

It enhances capital efficiency by disassociating the asset ownership from liquidity provision through Minimal Token Liquidity Pools (MTLPs).

Suggestocrs o vote on where funds are deployed is what sets apart tokemak from other protocols; They have introduced tokenomic systems with Liquid Directors who vote and decide on asset placement control.

Features Tokemak

- “Liquidity Routing”: Efficient allocation of liquidity across various DeFi protocols.”

- “Liquidity Directors”: Owners of tokens vote on where deployed liquidity will be utilized.”,

- “Single-Sided Staking”: Users can stake a single asset instead of needing to pair it with another.

8.Umami Finance

Umami Finance offers vault strategies on Arbitrum, focusing on real and sustainable DeFi yields. Unlike most other protocols chasing APYs (Annual Percentage Yields), umami emphasizes strong risk-return profiles using delta-neutral farming and structured products.

It attempts to integrate traditional finance with DeFi by targeting institutions or high-net-worth individuals. The complexity of its strategies coupled with a lack of retail buzz keeps it low-profile, which contrasts its treasury-backed approach that provides stability.

Umami is building for the long-term sustainability of his protocols rather than short-term hype. As risk-aware DeFi strategies become more mainstream, conservative DeFi investors seeking true yield might turn to Umami first.

Features Umami Finance

- Delta neutral vaults minimizes risks from price volatility secured while generating yield.

- Real Yield Focus: Gains stem from charges, not inflationary emissions of tokens.

- Institutional Approach: Focuses on conservative investors and investment funds.

- Arbitrum Native: Uses Arbitrum for speedy transactions with minimal fees.

9.Float Protocol

Float Protocol proposes an adaptive stablecoin that reacts to supply and demand instead of strictly monitoring a \$1 peg. Unlike traditional stablecoins, FLOAT’s price target is set to a moving average which allows it greater flexibility in times of volatility.

This approach seeks to minimize the rigidness and risks associated with hard-pegged coins. Float blends both algorithmic and collateral-backed models in search of a more resilient equilibrium.

Still, despite its innovation, it doesn’t receive as much attention as other stablecoins like DAI or USDC. Its adoption has been slow due to its underlying complexity but perhaps Float is on the verge of bringing forth the next generation of stable yet adaptive on-chain assets.

Features Float Protocol

- Floating Stablecoin (FLOAT): Market forces adjust the price which decouples it from the $1 peg.

- Elastic Supply Model: Actively manages supply to ensure targeted ranges are sustained.

- Hybrid Stability Mechanism: Algorithmic components and those tied to collateral are merged in a single system.

- Built for Volatility: Constructed to be resilient during turbulent times, market shifts can vary drastically.

10.Alchemix

Alchemix offers self-repaying loans, unlike any other on a Defi platform—it combines the two features of borrowing and lending together.

In this model, users can deposit over collateral (in DAI or ETH), take out loans, and the protocol pays back automatically through interests generated from Yearn strategies.

Since no risk of liquidation exists, this auto repayment strategy offers a new way of borrowing money.

Although it’s an innovative solution, Alchemix is far from ideal due to its interdependence with other layers of DeFi which make it harder for the average user to understand and integrate. Most prefer simpler models such as Aave used by billions around the world.

Features Alchemix

- Self-Repaying Loans: By using yield derived from collateralized assets, debt effectively pays itself over time.

- No Liquidations: Users protected from forced liquidation as there is yield coverage.

- Integrated with Yearn: Participation in vault strategies allows earning yield through Yearn.

- DAI and ETH Support Offered: Access stablecoins or ETH by collateralizing yield-bearing assets.

Conclusion

To wrap up this section, we have explored DeFi projects like yield trading, self-repaying loans, and others that don’t get the attention they deserve. Self-repaying loans are an innovative approach in understanding finance, while other features such as offer auto-compounding help users grow their profits with minimum effort .

Unlike popular cryptocurrency exchange applications or meme coins which focus on pumping their price, these outlined projects follow disciplined business practices and unrecognized value. With time, as industries tend to regulate agitated cyberspaces such as Defi the ones that provided real use cases will surely be rewarded.

FAQ

What makes a DeFi project “underrated”?

An underrated DeFi project offers strong technology, unique features, or high utility but lacks widespread recognition or media attention. These projects often have lower user adoption despite solving real problems in the DeFi ecosystem.

Are underrated DeFi projects riskier than popular ones?

Not necessarily. While lesser-known projects may have lower liquidity or community size, many are well-audited and secure. However, as with all DeFi platforms, due diligence and risk assessment are essential before investing.

How do I find and evaluate underrated DeFi protocols?

Look for innovation, active development, audited smart contracts, growing user base, and real use cases. Platforms like DeFiLlama, GitHub activity, and community engagement on Discord or Twitter can also help in evaluation.