This article will help traders decide between OANDA and IG by focusing on several critical features for comparison and providing a balanced analysis. Both platforms enjoy a high degree of trust, are strongly regulated, and display competitive pricing and sophisticated tools.

I will analyze the brokers by their trading functionalities, platforms, account varieties, pricing and structures, and the measures of safety. You will have the ability to recognize which broker is best for you and your trading needs in CFDs and forex by the end.

What is OANDA?

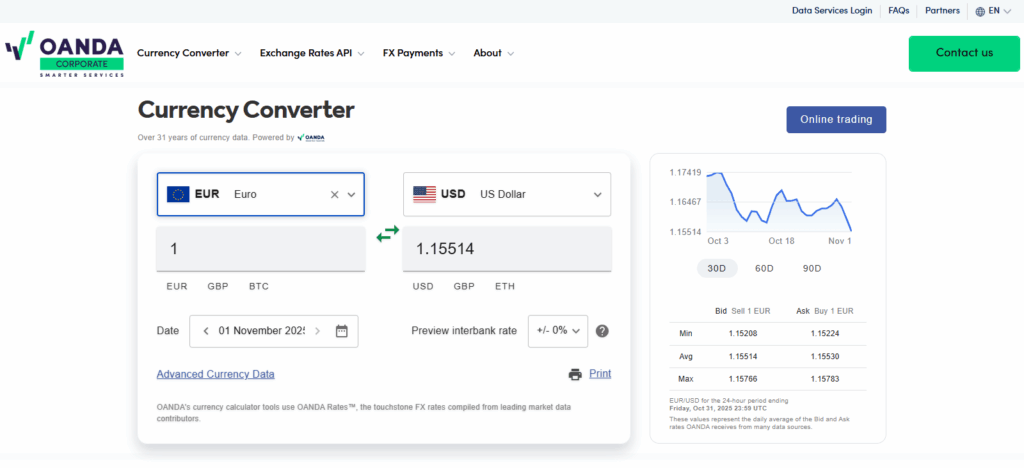

Founded in 1996, OANDA has gained a reputation as a trustworthy and innovative online forex and CFD broker due in part to its transparent pricing and regulatory compliance. OANDA also boasts a wide selection of instruments, including forex currency pairs, commodities, indices, bonds, and cryptocurrencies, so all traders–beginners and professionals alike–can find what they need to thrive.

Most importantly, OANDA is regulated by the CFTC and NFA in the USA, FCA in the UK, IIROC in Canada, ASIC in Australia, MAS in Singapore, and several others, which ensures a safe and trustworthy trading environment.

OANDA also has a well-earned reputation for low-barrier trading, as it has no minimum deposit requirement, boasts competitive spreads, and provides fast trade execution. In addition to supporting the popular MetaTrader 4 and other OANDA proprietary trading systems, including OANDA Trade and advanced charting that leverages TradingView,

OANDA also has innovative trading apps and a complete educational and market analysis trading suite. OANDA is a safe and reliable broker as it provides a wide selection of trading instruments, and is known for its transparency, regulatory compliance, and versatility.

What is IG?

IG is among the foremost and most established online trading brokers. Founded in 1974 and based in London, UK, IG has developed a robust reputation. IG brokers a wide range of financial markets, including forex, stocks, commodities, indices, cryptocurrencies, options, and in select regions, spread betting.

Of all online trading brokers, IG has the most robust reputation and the highest degree of cross-border regulatory supervision. IG is licensed by UK FCA, ASIC in Australia, NFA and CFTC in the US (through IG US), and several other first-tier jurisdictions, thus making IG brokerage an excellent trading partner for retail and professional traders.

Brokerage offers IG proprietary trading platforms for web and mobile and MetaTrader 4 along with other trading and charting tools from ProRealTime which support advanced, algorithmic, and other trading strategies.

IG is also priced competitively, praised for fast execution and deep liquidity. The firm is also known for robust educational and research offerings, market analysis, and IG Academy. With millions of clients, IG is a market leader and a foremost choice of traders in need of a dependable trading environment.

OANDA vs IG: Quick Comparison Table

| Feature | OANDA | IG |

|---|---|---|

| Founded / Legacy | Founded in 1996. | Founded in 1974. |

| Regulators & Trust | Regulated in multiple jurisdictions, transparent pricing. | Global presence, licensed in many regions, large scale. |

| Trading Platforms | Proprietary platform + MT4 + integration with TradingView. | Proprietary platform + MT4 + advanced charting tools (e.g., ProRealTime). |

| Asset/Market Coverage | Strong in forex; 68+ currency pairs listed. | Very wide range of instruments — forex, CFDs, stocks, commodities; 17,000+ markets referenced. |

| Minimum Deposit / Accessibility | Very beginner-friendly, minimal barriers. | Also accessible, though specifics vary globally; broad selection makes it suitable for many traders. |

| Spread / Fees Transparency | Known for transparent spreads and cost reporting. | Competitive spreads and wide market selection; cost structure depends on region. |

| Best Suited For | Traders focused on forex with strong platform usability and transparent pricing. | Traders seeking broad market access across multiple asset classes, more advanced tools. |

Who Should Choose OANDA?

- Would like a trusted broker with strong global regulation

- Prefer low-barrier entry — no strict minimum deposit requirements

- Mainly trade forex, with access to competitive spreads

- Need fast and easy account setup for beginners

- Use tools like TradingView, MT4, or API trading for automation

- Prefer a platform with simple yet powerful charting

- Appreciate transparent pricing without hidden fees

- Want strong mobile trading performance

- Trade small or medium lot sizes frequently

Who Should Choose IG?

- Choose a highly trusted broker who has been around for decades

- Access 17,000+ markets including stocks, indices, options & crypto

- Active trading and look for low spreads and liquid

- Expert or professional trader that needs high-level analytics

- Using ProRealTime or other high-performance proprietary trading systems

- Fast execution for scalping and day trading

- Comprehensive educational materials and market research

- Multiple asset classes for trading diversification

- 24/7 customer support available in multiple regions

Regulation & Trustworthiness

OANDA Regulation & Trust

- Regulated by top-tier financial authorities globally (FCA, CFTC/NFA, ASIC, IIROC, MAS, etc.)

- Long-standing reputation since 1996

- Transparent pricing model with no dealing desk manipulation

- Segregated client funds for investor protection

- Strong cybersecurity and negative balance protection in many regions

- Trusted by traders who prioritize safety and compliance

IG Regulation & Trust

- One of the oldest and most established brokers (since 1974)

- Regulated by Tier-1 regulators worldwide (FCA, ASIC, NFA/CFTC via IG US, FMA, etc.)

- Publicly traded company → higher transparency & accountability

- Large liquidity sources ensure reliable execution

- Advanced fund protection policies across jurisdictions

- Strong global reputation with millions of clients

Account Types & Minimum Deposit

| Broker | Account Types | Minimum Deposit / Opening Balance |

|---|---|---|

| OANDA | Standard & Elite Trader (US) Standard, Premium, Premium Plus (BVI) | Standard: No minimum deposit required. Premium/Premium Plus: Require higher criteria (e.g., deposit USD 10k or trading volume thresholds) |

| IG | CFD Account, MT4 Account, DMA Account, Spread Betting Account (regional) ) | Minimum deposit varies by region & payment method: – Bank transfer: No fixed minimum in many regions. – Card/PayPal: Often around USD 250 (or equivalent) in some regions. |

Trading Platforms & Tools

| Feature | OANDA | IG |

|---|---|---|

| Own Trading Platform | ✅ Yes | ✅ Yes |

| MetaTrader 4 (MT4) | ✅ Yes | ✅ Yes |

| MetaTrader 5 (MT5) | ✅ Yes (in many regions) | ❌ No |

| TradingView Integration | ✅ Yes (direct trading) | ✅ Yes (charting + trading connection) |

| ProRealTime | ❌ No | ✅ Yes (advanced charting) |

| L2 Dealer / DMA Trading | ❌ No | ✅ Yes (for advanced traders) |

| API Trading | ✅ Yes | ✅ Yes (with certain accounts) |

Fees & Commissions

| Fees & Commissions | OANDA | IG |

|---|---|---|

| Inactivity Fee (per month) | $12 | $18 |

| Deposit Fee | $0 | $0 |

| Withdrawal Fee | $0 | $0 |

| Rollover Fee EUR/USD (Buy 1 Lot) | -0.9 | -2.5% |

| Rollover Fee EUR/USD (Sell 1 Lot) | 2.75 | +2.5% |

| Average Spread EUR/USD (Standard Account) | 1.2 pips | 0.6 pips |

| Gold Spread | 25.3 | 30 |

| Brent Oil Spread | 4 | 3 |

| Bitcoin Spread | 51.7 | 65 |

Licenses

| Feature | OANDA | IG |

|---|---|---|

| Licenses / Regulatory Bodies (Short List) | ASIC (Australia) IIROC (Canada) JFSA (Japan) MAS (Singapore) FCA (UK) NFA/CFTC (USA) | ASIC (Australia) JFSA (Japan) MAS (Singapore) FINMA (Switzerland) FCA (UK) CFTC (USA) |

Customer Support Quality

While OANDA and IG both offer dependable client support, there are slight differences in their resource availability. OANDA provides support via live chat, email, and telephone within market hours, so traders can address account, platform, or trading tool issues in real time.

Most customers find support staff prompt and well-informed, which is advantageous for novice traders and investors who will need extra support. Unlike OANDA, IG offers more comprehensive support, which consists of 24/5 live support, local telephone support for multiple regions, and extensive self-service resources (FAQs, tutorials, community support, learning centers).

IG support is characterized by rapid turnaround times and thorough professional support, which is appreciated by advanced traders and investors with intricate market questions. In summary, customer service for both brokers is very good, but the extensive worldwide presence and support options of IG can make or break international trading operations.

Conclusion

Both OANDA and IG are highly reputable and globally regulated brokers. These brokers allow for safe environments for trading forex and CFDs.

OANDA is the better choice for beginners and forex-centric traders that appreciate straightforward platforms with no minimum deposit, like TradingView and strong charting tools. Conversely, IG is geared more for advanced/professional traders seeking wider market access, advanced trading platforms, and tighter spreads on key forex pairs.

The choice depends on trading goals. OANDA is more for simplicity, accessible accounts, and a forex-centric approach, while IG provides more diversity, advanced features, and a higher-tier trading experience. Even as we move into 2025, both still serve as top-tier funding brokers. Your own trading strategy should determine the choice.

FAQs

Are both brokers safe and regulated?

Yes. Both OANDA and IG are regulated by multiple Tier-1 financial authorities worldwide, making them both reliable and credible choices for most traders.

Which broker is better for beginners?

OANDA may be a better fit for beginners because of its simpler account setup, lower barrier to entry in many jurisdictions, and strong forex-centric focus. IG offers more advanced tools and markets, which may suit more experienced traders.

Which broker offers more markets beyond forex?

IG offers a broader range of tradable markets — including stocks, indices, commodities, currencies, and crypto — while OANDA offers a solid range but is more focussed on forex and related CFDs.

Does either broker charge inactivity or hidden fees?

Both brokers have transparent fee schedules, but you’ll want to check region-specific terms. For example, OANDA has inactivity fees in some jurisdictions and IG may also have certain region-based conditions — always check the fine print.

What platforms are supported?

Both brokers support popular third-party platforms (such as MetaTrader 4) and their own proprietary platforms. OANDA additionally offers MetaTrader 5 in many regions, while IG offers specialist platforms and tools geared towards advanced users.