This article presents Remittix, a cryptocurrency crafted to transform remittances and digital payments through blockchain technology.

Built atop the Ethereum blockchain, Remittix (RTX) delivers rapid, secure, and inexpensive transactions across the globe.

The project has a capped supply of 1.5 billion tokens and concentrates on scalable financial infrastructure, appealing to both retail customers and institutional integrations.

What Remittix?

Remittix envisions a future where financial empowerment, reliability, and transparency are accessible to everyone, regardless of their location or economic status. This vision becomes a reality through innovative technologies that seamlessly connect cryptocurrency and traditional fiat payment networks.

In today’s rapidly digitalizing global economy, the growing adoption of cryptocurrencies highlights the need for practical, secure, and efficient payment solutions for both businesses and consumers. Remittix offers a cutting-edge payment infrastructure designed specifically for users that want to send cross-border fiat payments using crypto.

By bridging the gap between digital and traditional currencies, Remittix facilitates seamless interactions between the crypto and fiat worlds. With the crypto economy now valued at over $3.2 trillion, Remittix addresses a critical gap in connecting these two financial ecosystems.

While thousands of cryptocurrencies offer innovative applications and services, their integration with traditional fiat systems remains limited, often hindering the average consumer’s ability to engage effectively with crypto assets. Remittix is here to transform this dynamic, unlocking the true potential of cryptocurrency adoption.

Remittix Overview

| Attribute | Details |

|---|---|

| Token Name | Remittix |

| Symbol | RTX |

| Blockchain | Ethereum (ERC-20) |

| Total Supply | 1,500,000,000 RTX |

| Contract Address | 0x319177997dbf0c0a7dfe0403fe132e26c0ae0eeb |

| Initial Price | $0.015 per RTX |

| Use Case | Cross-border payments, remittances, and financial infrastructure |

| Presale Allocation | 50% (750,000,000 RTX) |

| Audit Status | CertiK Audit Passed (No Critical Issues) |

| Team Transparency | Anonymous (No public team verification) |

| Market Status | Not yet listed on major centralized exchanges |

| Community Concerns | Delayed token distributions, lack of transparency, red flags reported online |

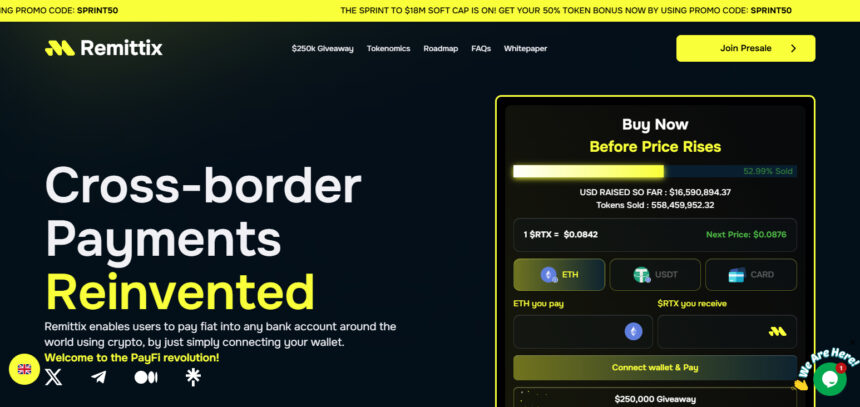

How to Buy

Follow these 3 simple steps to buy Remittix presale tokens

1. Sign-Up

Open your preferred web browser and visit official website: https://remittix.io, Click “connect wallet & pay” button and ensure you are on the Ethereum blockchain (ERC20).

Select Currency

Via the Remittix web3 dApp, select which cryptocurrency you want to use to make your purchase. If you do not have crypto you can use your card.

Buy & Claim

Verify the transaction details inside your wallet and confirm the transaction, once this is successful your tokens will automatically be sent to your dashboard within 5-10 minutes depending on network congestion.

The Remittix Token (RTX)

Welcome to the core of the Remittix ecosystem: the Remittix (RTX) token. Serving as the foundation of our platform, RTX gives the community the power to influence and shape the future of Remittix.

| Specification | Details |

|---|---|

| Token Name | Remittix |

| Token Symbol | RTX |

| Total Supply | 1,500,000,000 RTX |

| Blockchain Network | Ethereum (ERC-20) |

| Contract Address | 0x319177997dbf0c0a7dfe0403fe132e26c0ae0eeb |

| Initial Price | $0.015 per RTX |

Token Allocation

The Remittix token (RTX) has a limited supply of 1.5 billion tokens and cannot be increased. Below is a breakdown of how the tokens will be distributed during and after the presale.

| Category | Allocation (%) | Token Amount |

|---|---|---|

| Presale | 50% | 750,000,000 RTX |

| Marketing | 15% | 225,000,000 RTX |

| Exchange Listings | 12% | 180,000,000 RTX |

| Ecosystem Reserves | 10% | 150,000,000 RTX |

| Team | 9% | 135,000,000 RTX |

| Rewards | 4% | 60,000,000 RTX |

In the unlikely event that we do not sell all of the tokens allocated for the presale Remittix will conduct a token burn event to reduce the overall token supply.

Why Remittix?

Speed

Instant Transactions: Cryptocurrency payments often settle within minutes or hours, compared to traditional cross-border transfers, which can take days.

No Intermediaries: Eliminates the need for multiple correspondent banks or clearinghouses, reducing processing time.

Lower Costs

Minimal Fees: Crypto transactions typically incur lower fees than traditional methods, especially for large-value transfers.

No Hidden Charges: Transparent fee structures, unlike traditional banking systems with potential hidden costs.

Accessibility

Global Reach: Accessible to anyone with an internet connection, including underbanked or unbanked populations.

No Banking Restrictions: Removes barriers such as limited banking infrastructure or restrictive financial regulations in some regions.

Transparency

Blockchain Technology: Provides a public ledger for transactions, ensuring traceability and transparency.

Immutable Records: Ensures payment records cannot be altered, enhancing trust.

Decentralization

No Central Authority: Transactions are peer-to-peer, removing reliance on central banks or financial institutions.

Resilience to Local Restrictions: Not subject to specific national banking restrictions or geopolitical tensions.

Currency Conversion Efficiency

Avoids Multiple Conversions: Bypasses the need to convert currencies through intermediaries, reducing exchange rate costs.

Stablecoin Options: Offers the use of stablecoins to avoid volatility, allowing seamless conversion to fiat.

Security

Encryption and Blockchain: Provides robust security against fraud and unauthorized transactions.

Ownership Control: Users retain control over their funds, reducing risks from third-party intermediaries.

Financial Inclusion

Empowering the Unbanked: Crypto wallets allow individuals in underserved regions to participate in global commerce.

Alternative to High-Fee Systems: Offers a cost-effective alternative to high-fee remittance services for migrants.

Scalability

Micro-Transactions: Enables efficient small-value payments without disproportionately high fees.

Cross-Border E-commerce: Supports global e-commerce businesses with seamless international payments.

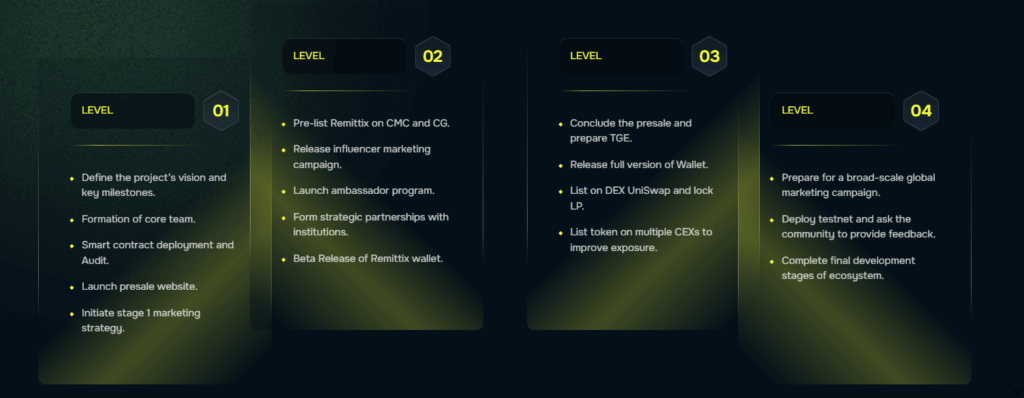

Explore Roadmap

Is Remittix Crypto safe?

Remittix Crypto ($RTX) pitches itself as an exciting bridge from digital coins to hard currency, yet its safety and bona fides raise red flags. The project has collected over $15 million from presale investors, yet it remains opaque: the team hides behind pseudonyms, and neither the promised wallet nor the payment platform has taken flight.

BlockSAFU has stamped the smart contract with an audit badge, but skeptics point out the review stops at basic token mechanics and does not touch the ambitious cross-border functions the promo material sells.

Comment sections and chat rooms keep echoing trouble, mentioning high-pressure hype, claims that stretch credulity, and dismal reviews across user-review swamps like Trustpilot, where the project sits at a feeble 2.3 out of 5. Until Remittix rolls out a functioning service and steps out of the shadows, it deserves a healthy dose of wariness.

Best Remittix Alternatives

Stellar (XLM)

Stellar is a decentralized blockchain that facilitates fast, low-cost global payments. Since its 2014 launch by Jed McCaleb, it has empowered cross-border remittances using the XLM token. Stellar’s collaboration with financial giants such as MoneyGram demonstrates measurable real-world impact.

Its open-source architecture, scalable design, and commitment to financial inclusion consistently position Stellar as a reliable choice for remittances and payment corridors.

Ripple (XRP)

Ripple utilizes the XRP Ledger to deliver near-instant, cost-effective cross-border transactions. Founded in 2012, its primary audience is banks and large payment providers. RippleNet’s instant settlement network, coupled with XRP’s liquidity provisioning, streamlines global payments.

Despite the ongoing SEC dispute, Ripple has expanded its worldwide network. Transparent governance and robust enterprise-grade features continue to position it as a secure, scalable Remittix alternative for financial institutions.

Celo (CELO)

Celo is a mobile-centric blockchain designed to promote financial inclusion worldwide. By linking crypto transactions to phone numbers, it serves unbanked and underbanked communities.

Launched in 2020, the network supports the cUSD stablecoin for price-stable remittances. CELO tokens secure governance and staking. Celo’s eco-conscious infrastructure, open development roadmap, and strategic partnerships collectively reinforce its viability as an accessible Remittix alternative.

XDC Network (XDC)

XDC Network combines public and private chain features, targeting trade finance and large-value payments. Delegated Proof-of-Stake ensures fast confirmation times and minimal transaction costs.

The XDC coin powers all network operations, meets ISO 20022 messaging standards, and is structured to appeal to banking institutions. Its open governance, flexible API connectors, and proven deployments provide a scalable and compliant choice for institutions looking to replace legacy systems like Remittix.

Final Verdict

Remittix bills itself as a next-generation payment and remittance coin designed to make cross-border payments frictionless by harnessing blockchain.

Built on the ERC-20 standard, priced low at launch, and sporting a generous total supply, it stands out to early adopters looking for upside.

Still, a few red flags merit cooler heads: a vague roadmap, unidentified developers, and staggered token vesting schedules could mask operational risk.

The roadmap sketches a bright future, but prospective users ought to weigh it against established, transparent options before committing.