I will cover the Top Bridging Aggregator For Polkadot Staking in this article. These platforms allow effortless transfers of assets between different chains.

Their fast and secure transactions greatly increase staking quality with cost-efficiency. Key players like Swing, Rango Exchange, and StellaSwap improve liquidity flow and maximize staking returns in the Polkadot ecosystem, and you will learn how these companies accomplish this.

Key Point & Top Bridging Aggregator For Polkadot Staking List

| Platform | Key Point |

|---|---|

| Rango Exchange | Cross-chain DEX and bridge aggregator. |

| StellaSwap | AMM DEX on Moonbeam, supports cross-chain. |

| Polkaswap | DEX for Polkadot ecosystem, cross-chain swaps. |

| Snowbridge | Bridge connecting Ethereum and Polkadot. |

| Interlay | BTC DeFi hub on Polkadot, cross-chain BTC. |

| Wanchain Bridge | Decentralized cross-chain bridge platform. |

| Across Protocol | Fast, low-cost L2-to-L1 and L2-to-L2 bridge. |

| Orbiter Finance | Cross-rollup bridge with low fees. |

| HydraDX | Cross-chain liquidity protocol on Polkadot. |

The Best Bridging Aggregators for Staking Polkadots

1. Swing

Swing serves as an aggregator of multi-chain bridges. It has connections to other chains and allows for efficient movement of assets, liquidity, and staking in Polkadot.

Swing’s unique design also includes the aggregation of multiple bridges, allowing for the reduction of fees and payment delays.

This serves as an advantage to new users who are unfamiliar with the system as well as to seasoned users.

For Swing’s Staking Polkadot, Swing mitigates slippage and asset idle time within set operational parameters.

The platform enables stakers to track active transactions and enhances the credibility and transparency of the system for Polkadot Stakers.

The platform’s robust security system along with fast finality of transactions makes it a preferred option among Polkadot users.

Swing Features

- Multi-Chain Aggregation: Merges different bridges into a single interchain transfer for the best routes.

- Fast and Low-Cost Transactions: Minimizes slippage while maximizing transaction efficiency.

- Real-Time Tracking: Offers real-time updates on the current status of cross-chain transfers.

- High Security: Strong encryption ensures reliable movement of assets.

- Seamless Staking Integration: Tailored for efficient cross-chain transfer of staking assets.

2. Rango Exchange

Rango Exchange enables Polkadot staking through its cross-chain liquidity aggregate, allowing users to move assets across chains effortlessly.

The platform also uses different DEXs and bridges to give users the best routes for staking tokens.

Rango’s routing system for transactions is very efficient, which helps users save on transaction fees and get better exchange rates.

For users like Rango’s customers who stake Polkadot, the DEX provides a liquidity service that allows users to easily move across chains to joining staking pools.

The platform also tracks every staking procedure in real-time and offers multi-wallet support which, combined with an intuitive interface, makes it ideal for managing cross-chain assets.

Rango Exchange Features

- Cross-Chain Liquidity Aggregation: Allows for the transfer of assets across multiple DEXs and bridges.

- Optimized Routing: Route selection is automated to lower cost and increase speed.

- Multi-Asset Support: Staking with several crypto assets is permitted.

- Secure Transfers: Verified protocols are used for safe staking across chains.

- Real-Time Analytics: Users can view estimates of fees and insights into the transactions made.

3. StellaSwap

An automated market maker DEX and a cross-chain bridge, StellaSwap operates on the Moonbeam network which is integrated in the Polkadot ecosystem.

Supported by both native and bridged assets, the platform supports token swaps and staking.

StellaSwap also aids in bridging assets for Polkadot staking and gives liquidity providers great returns.

Major bridges integrated within the platform ensure fast and secure transfers of assets into StellaSwap.

Low slippage and high capital efficiency is offered by the platform A and it’s multi-chain friendly AMM.

Polkadot stakers seeking interoperability prefer using StellaSwap also because of its simple user interface and yield farming support.

StellaSwap Features

- Cross-Chain Compatibility: Moonbeam and Polkadot parachains integrated.

- AMM Model: Offers depth of liquidity as well as low-slippage swaps.

- Yield Farming & Staking: Functionality for users to stake and earn rewards.

- Bridge Integration: Effective asset movement through major bridges is offered.

- User-Friendly Interface: Streamlined staking processes through a simplistic UI.

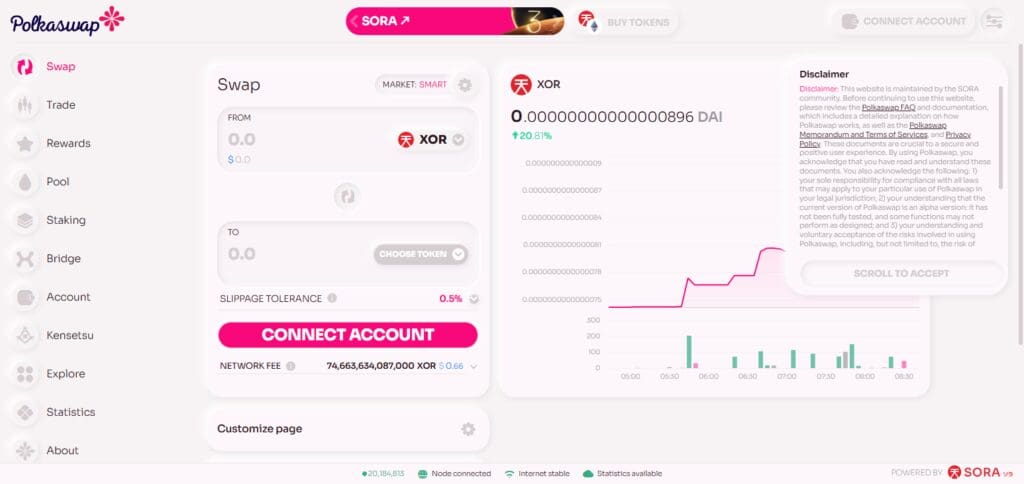

4. Polkaswap

Polkaswap is a non-custodial DEX built for trading on the Polkadot and Kusama chains. It offers trustless cross-chain swaps that are perfect for staking tokens.

The SORA network is used by Polkaswap to transfer tokens from and to Polkadot and other blockchains.

The platform’s users can also perform instant low-cost transfers and liquidity providing. With Polkaswap, slippage is minimized and prices are optimal due to its unique algorithm.

As a Polkastater, Polkaswap is your ideal partner for all automized transactions through Polkadot parachains.

The platform’s decentralization and interoperability makes it one of the most important aids in Polkadot bridging.

Polkaswap Features

- Polkadot-Native DEX: Tailored for Polkadot and Kusama ecosystem users.

- Fast and Low-Cost Swaps: Tailored for staking-related activities.

- Trustless Cross-Chain Swaps: Employs SORA network for secure transfer of funds.

- Minimal Slippage: Staking pools have efficient liquidity provisioning.

- Decentralized & Non-Custodial: User retains control over the funds.

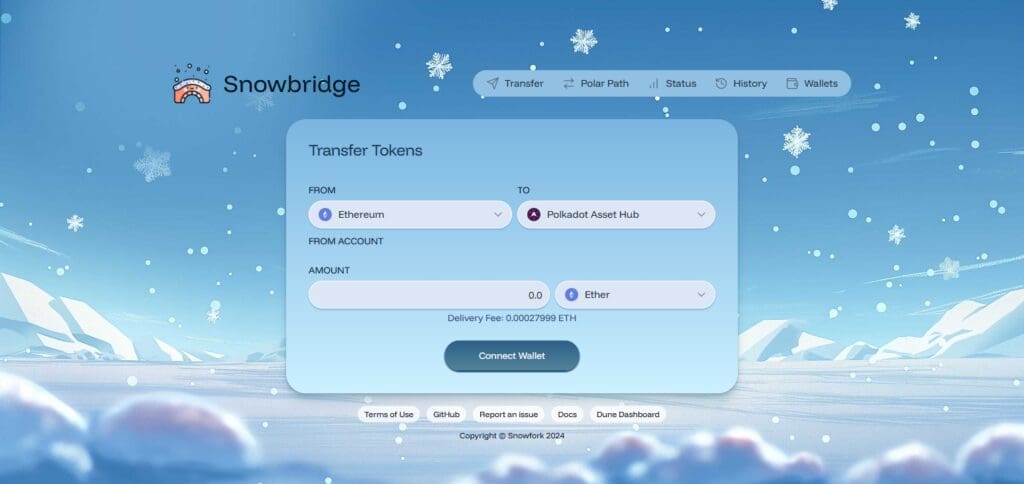

5. Snowbridge

Snowbridge is a protocol for cross-chain interactions between Polkadot and Ethereum. The protocol permits trustless asset transfer in both directions making it useful for Polkadot staking.

Snowbridge also provides the ability to transfer ETH and ERC-20 tokens to Polkadot for staked tokens. Its architecture makes sure that the bridging is done in a secure and transparent way.

Shince using Snowbridge, Polkadot stakers will benefits from better liquidity access since the transactions are faster and cheaper.

The bridge is also compatible with multiple staking platforms enabling users to switch to multichain staking easily.

Snowbridge’s security and efficiency offers a vital tool for cross-chain staking operations due to its flexibility.

Snowbridge Features

- Ethereum-Polkadot Bridge: Facilitates staking and liquidity transfer between chains.

- Decentralized Security: Secure trustless transfer.

- Low-Cost Transactions: Lesser fees for asset movement within staking.

- ERC-20 Compatibility: Allows for transfer and staking of Ethereum tokens on Polkadot.

- Efficient Finality: Quick confirmation time of transactions.

6. Interlay

Interlay is a decentralized bridge connecting Bitcoin to Polkadot. It enables BTC holders to stake on Polkadot through the issuance of iBTC, a Bitcoin backed asset that works within Polkadot ecosystem DeFi projects.

For stakers, Interlay deploys Bitcoin liquidity into Polkadot staking pools, increasing yield farming options.

The bridge leverages a collateralized vault model to secure BTC-pegged assets. Interlay is highly useful for cross-chain staking due to its smooth integration with Polkadot parachains, strong focus on decentralized interoperability, and fast transaction times. Its security-forward design philosophy allows for efficient asset transfers.

Interlay Features

- Bitcoin-Polkadot Bridge: Integrates BTC with Polkadot DeFi and staking.

- iBTC Issuance: Permits holders of BTC to stake on Polkadot.

- Collateralized Vaults: Ensures secure cross-chain transactions.

- Low Slippage Transfers: For movements of staking assets.

- Seamless Parachain Integration: Compatible with Polkadot’s ecosystem.

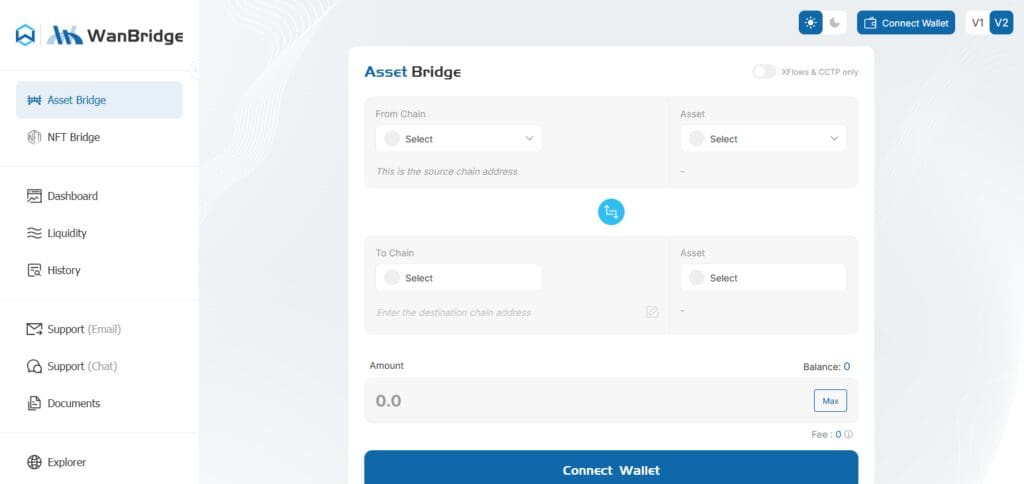

7. Wanchain Bridge

Wanchain Bridge is a Wanchain solution for seamless SDK interoperability of Polkadot and other ecosystems. It facilitates fast and secure flow of assets, which is beneficial for staking.

Users can stake on different blockchains in the network thanks to Wanchain’s interoperability protocol, widening the staking scope.

The bridge utilizes multi-chain cross crypto network transaction technology and decentralized validation through cryptography for higher security.

It allows for seamless liquidity flow to multi-chain staking pools for Polkadot stakers, making it easy to tap into cross-chain staking pools. The Wanchain Bridge stands out for its emphasis on security, efficiency, and decentralization.

Wanchain Bridge Features

- Multi-Chain Interoperability: Link to other blockchains from Polkadot.

- Decentralized Validator Network: Secure cross-chain transactions.

- Fast Transaction Speeds: Designed for rapid transfer of funds.

- Staking Asset Support: Permits transfer and staking of funds across chains.

- Low-Cost Bridge Fees: Reduced cost of transactions related to staking.

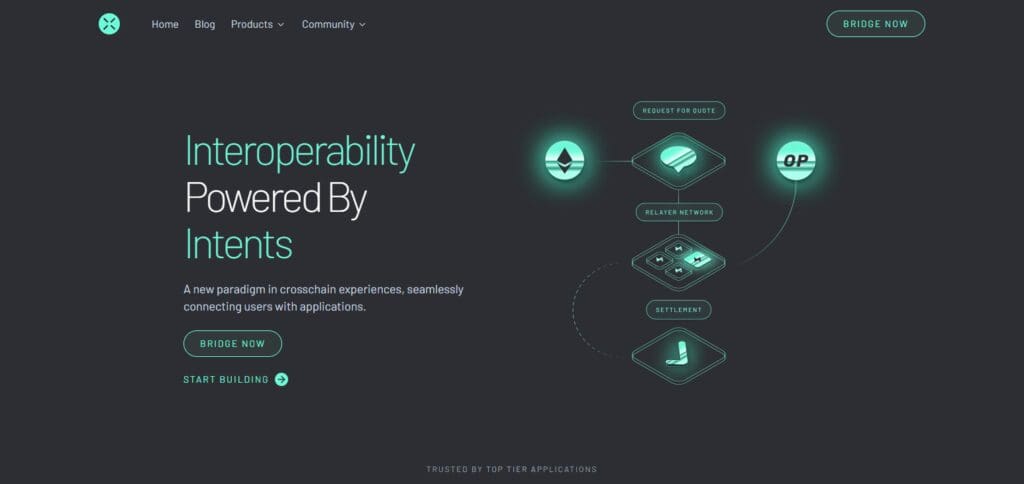

8. Across Protocol

Across Protocol serves as a cost-efficient and quick cross-chain bridge for transferring assets, including those based on Polkadot.

Its decentralized relayer network helps facilitate efficient bridging which reduces transaction fees.

Across Protocol allows Polkadot stakers to perform cross-chain staking operations with ease. Bonded relayers make sure that the protocol is able to secure transfers accurately.

The level of transaction costs and speed of finality makes Across Protocol practical for moving the assets used for staking to different chains.

The reliable security features, accompanied by the strongest efficiency of other Across Protocol services, makes it ideal for Polkadot staking.

Across Protocol Features

- Fast Cross-Chain Transfers: Instant asset movement is achieved through the use of bonded relayers.

- Low-Cost Transactions: Gas costs for staking asset transfers are reduced.

- Secure & Reliable: Fraudulent transfers are prevented through the use of bonded relayers.

- Polkadot Compatibility: Movement of Polkadot staking tokens is rendered effortless.

- Real-Time Settlements: Transactions are finalized with very little delay.

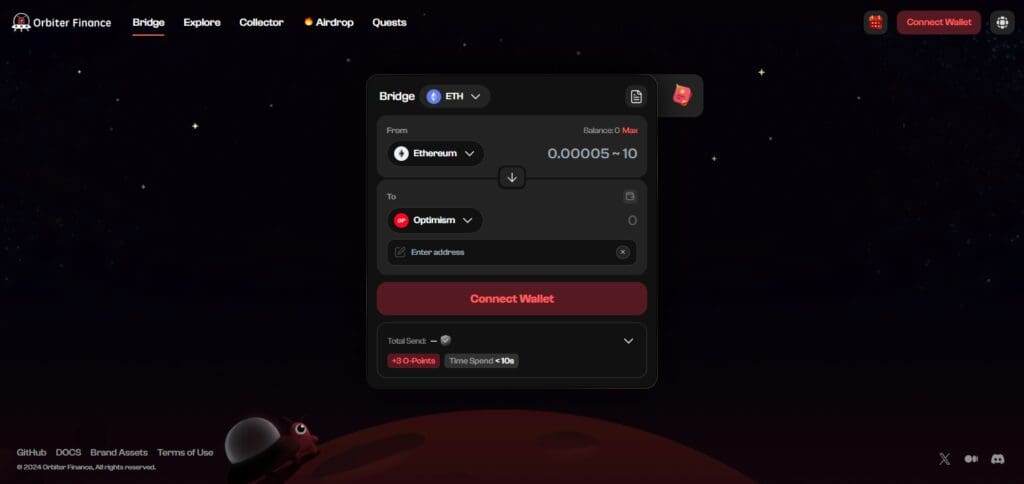

9. Orbiter Finance

Orbiter Finance accepts many networks, including Polkadot, with their decentralized cross-rollup bridge.

It allows low-cost and fast asset transfers which improves staking operations. Orbiter operates its own cross-chain liquidity network that guarantees any cross-chain operation is done easily, efficiently and safely.

For users that stake with Orbiter Finance, the interchain asset transfer performed through Polkadot is simplified which provides better accessibility to liquidity.

Many stakers that use Orbiter are in need of those features because of the incredibly low transaction fee and fast service for grant policies.

Paneulot are the customers of Orbiter that need speed and security while staking Polkadot.

Orbiter Finance Features

- Cross-Rollup Bridge: Enables multi-chain transfer of assets, Polkadot included.

- Low-Fee Transfers: Cost for staking movements is lowered.

- P2P Liquidity Network: Transfers between chains are executed securely and efficiently.

- Fast Finality: Ideal for swift movement of staking assets.

- Decentralized Security: Reliable mid-chain operations are made possible.

10. HydraDX

Polkadot’s cross-chain DEX and liquidity protocol, HydraDx, is a decentralized platform that innovates asset transfer and staking. Its rapid staking asset transfers, along with the platform-specific asset liquidity, allows effective staking on HydraDX’s HDX token.

The omnipool system, combined with efficient bridging, offers deep liquidity with minimal slippage for Polkadot’s staking.

Staking HydraDX’s native token (HDX) enhances liquidity for the platform, increasing profit potential while making it available for various decentralized finance opportunities.

Having the focus on decentralized liquidity and integration with other Polkadot parachains makes HydraDX a stakers’ favorite. Its well structured system with aggregated liquidity offers the highest ROI while staking.

HydraDX Features

- Polkadot-Native DEX: For refined interoperability, built on Dot.

- Omnipool Liquidity: High liquidity for swapping staking assets.

- Efficient Cross-Chain Transfers: Multi-chain movements of staking assets are executed seamlessly.

- Low Slippage Swaps: Losses incurred when transferring an asset are reduced to the barest minimum.

- Yield Optimization: Staking and liquidity farming incentives are given.

Conclusion

Staking in Polkadot can be enhanced by bringing aggregators, different cross-chain transfers, issues in liquidity, and economic costs all dealt with simultaneously.

Efficient multi-chain aggregation is provided by StellaSwap, Rango Exchange, and Swing due to their low transaction costs and extremely high speeds.

Like HydradX, Polkowap offers decentralization agnostic staking within the Polkadot ecosystem along with low slippage and friendly fees.

Bridgements and hybrid chains like Interlay, Wanchain bridges, and Snowbridge, aid in decentralizated but secure cross-chain interopability while expanding earning through staking.

For the movement of staking assets Across Protocol and Orbiter Finance is the most optimal in terms of cost and time efficiency.

Polkadot stakers enjoy the aggregate benefits of these protocols along with extreme flexibility and security over the blockchain.