In this article, I will cover the Top Cross-chain Collaboration Projects that are highly changing blockchain interoperability. These platforms allow smart contract execution, asset transfers and data exchanges across several networks.

They improve scalability, liquidity, and decentralization by converting blockchain ecosystems. Let’s look at the top solutions shaping the future of connected blockchain networks.

Key Point & Top Cross-chain Collaboration Projects List

| Project | Key Point |

|---|---|

| Chainflip | A decentralized cross-chain liquidity protocol for seamless asset swaps. |

| Axelar Network | A decentralized blockchain communication protocol enabling cross-chain messaging. |

| Sumer Money | A decentralized, algorithmic stablecoin focused on cross-chain interoperability. |

| Meson Finance | A decentralized finance platform providing infrastructure for cross-chain liquidity. |

| Qredo | A decentralized custody and settlement network for institutional users. |

| t3rn | A multi-chain smart contract platform focused on interoperability. |

| MultichainZ | A cross-chain platform facilitating seamless token transfers across networks. |

| Merkle Network | A decentralized network focused on secure cross-chain data storage and transfers. |

| Lootex | A decentralized NFT marketplace supporting multi-chain interoperability. |

| XY Finance | A cross-chain DeFi platform enabling asset swaps, liquidity, and yield farming.Top Cross-chain Collaboration Projects |

1.Chainflip

Chainflip is one of the most renowned projects when it comes to cross-chain collaborations.

This is because of their effortless decentralized and trustless asset swaps. Unlike other bridges, Chainflip does not need intermediaries or wrapped tokens for cross-chain liquidity.

Their JIT Automated Market Maker guarantees that all prices are deep and liquidity remains high for all networks. This ensures no intermediaries need to be relied on. This makes Chainflip truly innovative on how cross-chain interoperability is achieved.

| Feature | Details |

|---|---|

| Type | Cross-Chain Liquidity Protocol |

| Supported Assets | Bitcoin, Ethereum, Polkadot, and Other Blockchains |

| Key Tools | Decentralized Swaps, Liquidity Pools, Validator Nodes |

| Data Coverage | Real-Time Exchange Rates, Swap Fees, Network Activity |

| KYC Requirement | Minimal to No KYC for Most Transactions |

| Unique Feature | Native Cross-Chain Swaps Without Wrapping Assets |

| Accessibility | Web-Based Interface, API |

| Best For | Traders, Liquidity Providers, DeFi Users |

2.Axelar Network

Axelar Network is among the best cross-chain collaboration projects because it has a communication channel that is decentralized and is secure for interoperability across blockchains.

Unlike traditional bridges, Axelar allows for messaging and smart contract execution across various blockchains, allowing developers to easily create cross-chain applications.

Unique General Message Passing (GMP) technology guarantees efficient and trustless data transfer between chains, thus making it a critical infrastructure for the growing multi-chain ecosystem.

| Feature | Details |

|---|---|

| Type | Cross-Chain Communication & Interoperability Protocol |

| Supported Assets | Bitcoin, Ethereum, Cosmos, Avalanche, and More |

| Key Tools | Decentralized Messaging, Smart Contract Integration |

| Data Coverage | Cross-Chain Transactions, Network Security, Liquidity |

| KYC Requirement | Minimal to No KYC for Most Transactions |

| Unique Feature | Secure Cross-Chain Smart Contract Execution |

| Accessibility | Web-Based Interface, API |

| Best For | Developers, dApp Builders, DeFi Users |

3.Sumer Money

Cross-chain collaborations are best epitomized by Sumer Money, which created a new concept called a Decentralized Algorithmic Stablecoin designed for effortless interoperability between blockchains.

The project’s approach differs from conventional stablecoins as Sumer Money utilizes cross-chain liquidity and smart contracts to maintain stability without central control. Users can now transact and seize DeFi opportunities on different networks with ease making Sumer Money a frontrunner in multi-chain financial Ecosystem.

| Feature | Details |

|---|---|

| Type | Cross-Chain Synthetic Assets Protocol with Lending and Borrowing Markets |

| Supported Assets | Ethereum (ETH), Bitcoin (BTC), USD Coin (USDC), Tether (USDT), Synthetic Assets (SuUSD, SuETH, SuBTC) |

| Key Tools | Synthetic Asset Creation, Cross-Chain Lending and Borrowing, Unified Liquidity Pools |

| Data Coverage | Real-Time Asset Prices, Lending Rates, Borrowing Rates, Synthetic Asset Metrics |

| KYC Requirement | Minimal to No KYC for Most Transactions |

| Unique Feature | Credit Card-Like Experience for DeFi Users, Enabling Assets to Move Seamlessly Across Supported Blockchains While Retaining Native Yields |

| Accessibility | Web-Based Interface, API |

| Best For | DeFi Users Seeking Cross-Chain Liquidity Solutions, Traders, Investors |

4.Meson Finance

Meson Finance is one of the best in cross-chain cooperation because of its ability to transfer stablecoins quickly and cheaply to different blockchains. Instead of using traditional bridging techniques, Meson Finance focuses on liquidity routing which enables slippage free transactions at lightning speeds.

Its specialized services in stablecoin cross-chain payments means that Meson Finance is a critical part of infrastructure for DeFi users and businesses seeking effective and safe financial services in a multi-chain environment.

| Feature | Details |

|---|---|

| Type | Cross-Chain Stablecoin Bridging Protocol |

| Supported Assets | Stablecoins like USDC, USDT, BUSD across 50+ blockchains including Ethereum, BNB Smart Chain, Arbitrum, and Tron |

| Key Tools | Seamless stablecoin bridging, cross-chain swaps, Meson.to SDK for cross-chain deposits |

| Data Coverage | Real-time stablecoin exchange rates, transaction volumes, network activity |

| KYC Requirement | Minimal to No KYC for most transactions, enhancing user privacy and accessibility |

| Unique Features | – Fast cross-chain transactions completing in 1-2 minutes- Low fees due to protocol and gas optimizations- Focused on stablecoins to provide optimal speed and cost in cross-chain markets- Integrated with BNB Chain Bridge |

| Accessibility | Web-based interface, API, and Meson.to SDK for developers |

| Best For | Traders, liquidity providers, DeFi users, and developers seeking efficient cross-chain stablecoin solutions |

5.Qredo

Qredo is a leading project in cross-chain collaboration because it transforms digital asset custody through its unique Multi-Party Computation (MPC) network.

While custodial solutions are dependent on intermediaries, Qredo allows users to instantly transfer assets across chains, all while retaining complete control.

This made it attractive for businesses and DeFi platforms that require efficient and secure asset management. Qredo’s unmatched security, Multi-Party Computation network governance, and Cross-Chain Interoperability (XCI) make it incredibly attractive to use.

| Feature | Details |

|---|---|

| Type | Decentralized Digital Asset Management Infrastructure |

| Supported Assets | Bitcoin (BTC), Ethereum (ETH), ERC-20 tokens, and other major cryptocurrencies |

| Key Tools | Cross-chain atomic swaps, decentralized custody, Liquidity Hub for peer-to-peer trading |

| Data Coverage | Real-time transaction data, network activity, asset management metrics |

| KYC Requirement | Minimal to no KYC for most transactions, enhancing user privacy and accessibility |

| Unique Features | – Cross-Chain Atomic Swaps: Enables trustless over-the-counter transactions without intermediaries. |

| Accessibility | Web-based interface, API, and developer tools |

| Best For | Institutional investors, traders, developers, and DeFi users seeking secure cross-chain asset management solutions |

6.t3rn

t3rn is one of the leading projects in cross-chain collaboration because it allows smart contracts to run reversibly and interoperate across different blockchains.

Unlike other smart contract systems, t3rn offers cross-chain interactions with lowered risks by providing a way to revert transactions that did not meet certain conditions.

This mechanism makes t3rn unique providing a multi-chain execution framework as an application-level solution for developers building decentralized applications across various ecosystems.

| Feature | Details |

|---|---|

| Type | Interoperable Smart Contract Hosting Platform |

| Supported Assets | Assets across multiple blockchains, including Kusama, Polkadot, Ethereum, and others |

| Key Tools | Fail-safe multi-chain execution, composable smart contracts, attestors for cross-chain transaction validation |

| Data Coverage | Real-time cross-chain transaction data, network activity, smart contract execution metrics |

| KYC Requirement | Minimal to no KYC for most transactions, enhancing user privacy and accessibility |

| Unique Features | – Interoperability: Connects widely adopted blockchains through a unique gateway solution. |

| Accessibility | Web-based interface, API, and developer tools |

| Best For | Developers, DeFi users, and projects seeking secure and efficient cross-chain smart contract solutions |

7.MultichainZ

MultichainZ, a leader in cross-chain collaboration projects, is unrivaled in its ability to provide a streamlined infrastructure for interoperability among various blockchains. Unlike traditional bridges, MultichainZ increases decentralization by using sophisticated cryptographic proofs and consensus mechanisms to achieve trustless asset transfers.

Furthermore, MultichainZ records transactions with a focus on security and speed while remaining cost effective, providing developers and users with a fundamental solution for effecient cross-chain interactions in a rapidly evolving blockchain environment.

| Feature | Details |

|---|---|

| Type | Cross-Chain Lending Protocol |

| Supported Assets | Real-World Assets (RWAs), Non-Fungible Tokens (NFTs), Cryptocurrencies, Stablecoins, Staked ETH |

| Key Tools | Cross-Chain Lending and Borrowing, Liquid Staking Solutions, Integration with Fiat On-Ramp Services |

| Data Coverage | Real-Time Asset Prices, Lending Rates, Borrowing Rates, Cross-Chain Transaction Metrics |

| KYC Requirement | Minimal to No KYC for Most Transactions, Enhancing User Privacy and Accessibility |

| Unique Features | – Integration with STASIS EURS: Enhances liquidity and enables seamless cross-chain transactions with the EURS stablecoin. |

| Accessibility | Web-Based Interface, API, and Developer Tools |

| Best For | DeFi Users Seeking Cross-Chain Lending Solutions, Traders, Investors, and Institutions |

8.Merkle Network

Merkle Network ranks as one of the best cross-chain collaboration projects because of its ability to transfer information across multiple blockchains with minimal hassle. Instead of using traditional methods for interoperability, it uses a decentralized oracle system that ensures information cross validation and relay is done without central intermediation.

This ensures that smart contracts can communicate with each other on different networks without needing to trust each other. Because of this, Merkle Network emerges as a crucial infrastructure for developers aiming at building integrated decentralized applications and cross-chain DeFi solutions.

| Project | Key Features | Supported Chains | KYC Requirements |

|---|---|---|---|

| Merkle Network | – Web3.0 interoperability protocol | Multiple chains | Minimal KYC |

| – Cross-chain transfers of blockchain assets and data | |||

| – Decentralized validator-run network powered by oracles | |||

| – High scalability and security | |||

| Synapse Protocol | – Best overall crypto bridge platform | Multiple chains | Minimal KYC |

| Across Protocol | – High-speed, low-fee bridge powered by intents | Multiple chains | Minimal KYC |

| Portal Token Bridge | – Supports both EVM and non-EVM blockchains | Multiple chains | Minimal KYC |

| Allbridge | – Solid bridging solution for EVM and non-EVM chains | Multiple chains | Minimal KYC |

| Stargate Finance | – Facilitates one-transaction cross-chain swaps in native assets | Multiple chains | Minimal KYC |

| Orbiter Finance | – Swift transfers for Ethereum native assets | Ethereum | Minimal KYC |

| Hop Protocol | – Specialized for sending assets between Ethereum layer 2s and the Ethereum Mainnet | Ethereum, Layer 2s | Minimal KYC |

| Connext | – A bridge for EVM blockchains and layer 2s | Multiple chains | Minimal KYC |

| Multichain | – Supports a large selection of assets across multiple blockchains | Multiple chains | Minimal KYC |

| Rango Exchange | – Supports over 60 blockchains, including Arbitrum, Binance Chain, and Optimism | Multiple chains | Minimal KYC |

9.Lootex

Lootex is a leading cross-chain collaboration project due to the creation of a decentralized NFT marketplace that enables cross blockchain transactions. Unlike standard NFT platforms, users of Lootex can trade, display, and transfer assets from different networks without any difficulties.

Because of this, it makes them a significant player in the changing multi-chain NFT ecosystem and the wider decentralized digital economy. The way they approach multi-chain NFTs guarantees better accessibility, liquidity, and ownership control, allowing them to be more competitive and giving them more prominence in the industry.

| Project | Key Features | Supported Chains | KYC Requirements |

|---|---|---|---|

| Lootex | – Cross-chain game item shop for the Metaverse | Multiple chains | Minimal KYC |

| – Allows purchase of avatars, rare weapons, lands, pets, and monsters | |||

| Synapse Protocol | – Best overall crypto bridge platform | Multiple chains | Minimal KYC |

| Across Protocol | – High-speed, low-fee bridge powered by intents | Multiple chains | Minimal KYC |

| Portal Token Bridge | – Supports both EVM and non-EVM blockchains | Multiple chains | Minimal KYC |

| Allbridge | – Solid bridging solution for EVM and non-EVM chains | Multiple chains | Minimal KYC |

| Stargate Finance | – Facilitates one-transaction cross-chain swaps in native assets | Multiple chains | Minimal KYC |

| Orbiter Finance | – Swift transfers for Ethereum native assets | Ethereum | Minimal KYC |

| Hop Protocol | – Specialized for sending assets between Ethereum layer 2s and the Ethereum Mainnet | Ethereum, Layer 2s | Minimal KYC |

| Connext | – A bridge for EVM blockchains and layer 2s | Multiple chains | Minimal KYC |

| Multichain | – Supports a large selection of assets across multiple blockchains | Multiple chains | Minimal KYC |

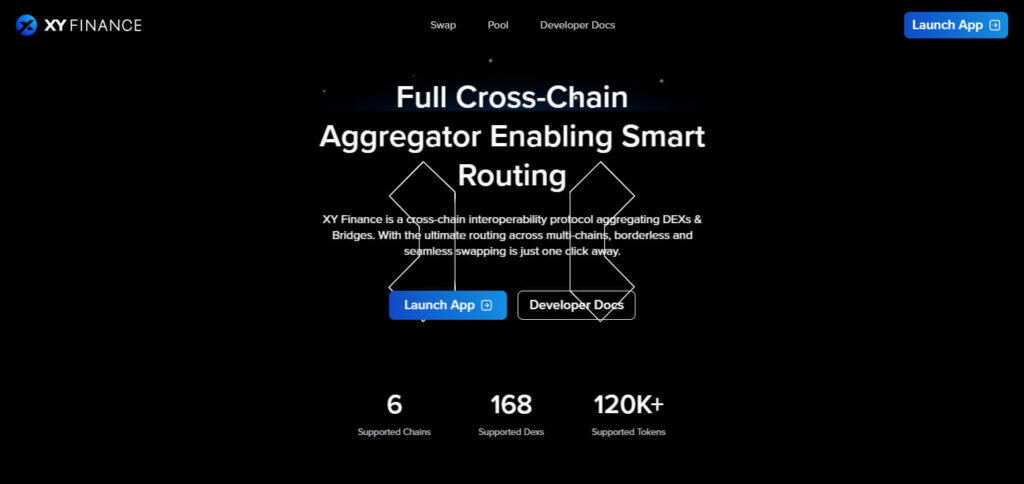

10.XY Finance

XY Finance is one of the leaders in cross-chain collaboration projects for its effortless and effective asset transfer across various blockchains. Unlike the regular bridges, XY Finance combines cross-chain swaps, liquidity aggregation, and yield farming all in one platform.

The proprietary routing algorithm guarantees fast, low-cost transactions while liquidity friendly balance is maintained. Interoperability of DeFi is simplified and user experience improved in the ever increasing multi-chain world.

| Project | Key Features | Supported Chains | KYC Requirements |

|---|---|---|---|

| XY Finance | – Full cross-chain aggregator enabling smart routing | 20+ chains | Minimal KYC |

| – Aggregates DEXs and bridges for optimal cross-chain swaps | |||

| Synapse Protocol | – Best overall crypto bridge platform | Multiple chains | Minimal KYC |

| Across Protocol | – High-speed, low-fee bridge powered by intents | Multiple chains | Minimal KYC |

| Portal Token Bridge | – Supports both EVM and non-EVM blockchains | Multiple chains | Minimal KYC |

| Allbridge | – Solid bridging solution for EVM and non-EVM chains | Multiple chains | Minimal KYC |

| Stargate Finance | – Facilitates one-transaction cross-chain swaps in native assets | Multiple chains | Minimal KYC |

| Orbiter Finance | – Swift transfers for Ethereum native assets | Ethereum | Minimal KYC |

| Hop Protocol | – Specialized for sending assets between Ethereum layer 2s and the Ethereum Mainnet | Ethereum, Layer 2s | Minimal KYC |

| Connext | – A bridge for EVM blockchains and layer 2s | Multiple chains | Minimal KYC |

| Multichain | – Supports a large selection of assets across multiple blockchains | Multiple chains | Minimal KYC |

Conclusion

The blending of different chains is introducing a new era in blockchain technology as it allows for easy transfer of assets, sharing of information, and execution of smart contracts across different networks. Many leading projects, including Polkadot, Cosmos, Chainlink CCIP, Thorchain, LayerZero, and more, have already started developing tools that solve fragmentation and blockchains’ efficiency problems.

All of these solutions are vital for increasing liquidity, lowering transaction costs, and increasing the functionality of decentralized applications, dApps. In the future, cross-chain interoperability will be crucial for growth as the industry evolves. The most integrated, secured, and decentralized blockchain networks will dominate the market.