In this article, I will analyze the top projects in DeFi and their impact on the industry as well as the prospects they hold.

The project Ether.fi, EigenLayer, Morpho, Pendle, Lido, their unique offerings, along with SparkLend, Ethena (ENA), Instadapp, and ChainGPT with their brilliant innovations in flexible staking, yield optimization, AI analytics, and lending, are indeed the standout projects in the growing DeFi space.

Why Use DeFi Projects to Watch

High-Yield Opportunities: Earn more compared to traditional finance through staking, lending, and liquidity provisions.

Decentralization & Control: No need to rely on banks and intermediaries.

Innovation & Flexibility: Pendle and ChainGPT offer yield tokenization and AI-powered advanced analytics.

Accessibility: No need to go through rigorous finances to use it.

Automation & Efficiency: Instadapp to save time and gas fees on complex strategies.

Transparency & Security: Smart contracts on the blockchain ensure minimum trust and maximum transparency.

Key Point & Top DeFi Projects List

| Platform | Key Point / Feature |

|---|---|

| Ether.fi | Decentralized staking protocol for Ethereum, offering secure and flexible staking. |

| EigenLayer | Allows Ethereum validators to restake ETH on new protocols, enabling shared security. |

| Morpho | Peer-to-peer lending protocol focused on optimizing borrowing and lending efficiency. |

| Pendle | Enables tokenization of future yield, allowing users to trade and hedge yield-bearing assets. |

| Lido | Liquid staking protocol for Ethereum and other PoS chains, providing stETH for liquidity. |

| SparkLend | Lending platform integrating DeFi strategies for optimized borrowing and yield. |

| Ethena (ENA) | DAO-based protocol offering decentralized staking and governance utilities. |

| Instadapp | DeFi smart wallet aggregating multiple protocols for optimized asset management. |

| ChainGPT | AI-powered blockchain assistant, offering analytics, smart contract generation, and automation. |

1. Ether.fi

Ether.fi is one of the top projects in DeFi for its novel interdisciplinary approach to decentralized Ethereum staking. Ether.fi is the only platform that offers secure flexible staking eth without the eth lock-up feature.

Ether.fi’s decentralization ethos ensures that no one firm can dominate the influence of the staked assets.

Ether.fi is also one of the few platforms that combine sophisticated smart contract auditing with integrated risk management to minimize user vulnerabilities. Ether.fi balances user control, security, and optimized yield, which makes it one of the most innovative projects in DeFi.

Ether.fi Features

- Decentralized Staking: Staking in Ether.fi involves no intermediary, and with fruitful active management, the assets of clients remain both inaccessible and lifeless.

- High Liquidity Access: Ether.fi provides financial tools that facilitate users to unlock and repossess the assets that have been tethered without any waiting periods.

- User-Friendly Interface: Ether.fi desktop restaking and mobile staking platform enables clients irrespective of their DeFi experience, be it novices or veterans, to stake assets without obstacles in Elliot and gas fees easily.

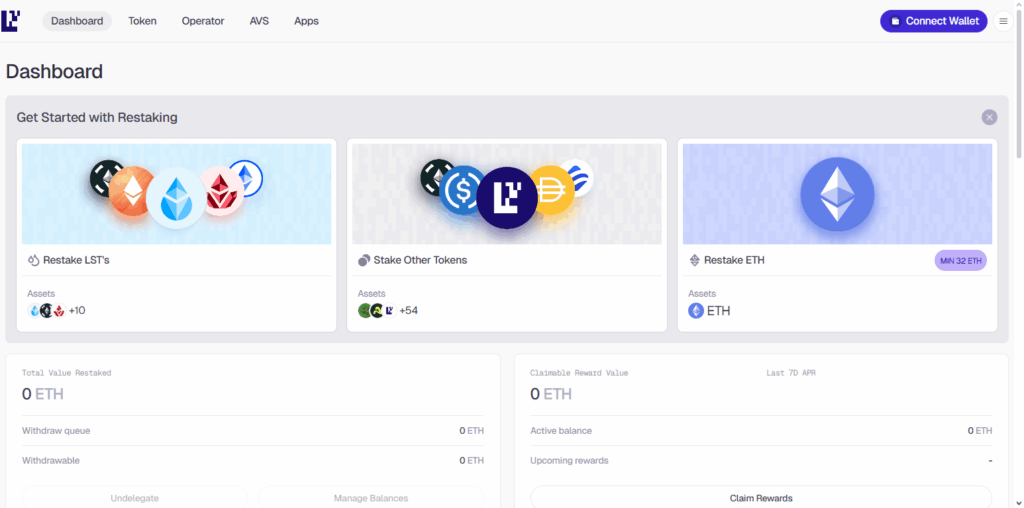

2. EigenLayer

EigenLayer is one of the focal projects in DeFi because of its unique innovation touching on participation of Ethereum validators. It enables Ethereum holders to “restake” their tokens across different protocols, thus, pouring Ethereum’s security on new emerging decentralized apps.

This adjunctive approach adds new dimensions of network utility, driving capital efficiency of the network while sustaining security. EigenLayer spurs entrepreneurial activity as developers can now launch projects with secured infrastructure as there is no need of exorbitant foundational capital.

The unique security, support for various protocols, and participation without the need of primary infrastructure makes EigenLayer one of the pioneering platforms in DeFi. It reshapes the economic as well as the validator power engagement across the Ethereum network.

EigenLayer Features

- Restaking Protocol: Users can restake their Ethereum in Etherfi to secure multiple services at the same time as to cluster or consolidate the restaking Ethereum assets.

- Enhanced Security: EigenLayer combines Ethereum validators to strengthen the decentralization and relic architecture at the same time.

- Permissionless Innovation: Everyone is free to launch their creative products on EigenLayer without waiting for the boss stamp for the sake of the ecosystem.

3. Morpho

Morpho has defined itself in the top of the DeFi projects as the decentralized lender and borrower innovator. Different from the standard lending protocols, Morpho has a peer-to-peer matching system where lenders and borrowers are connected directly.

This eliminates interest, and optimized capital. Borrowers cost are lowered, lenders yields are increased, and a strong financial ecosystem has been created. Morpho has more than a dozen DeFi partners which improve the system’s liquidity and broaden user access.

Focused on efficiency, transparency, and financial system growth, the protocol has built seamless sophisticated systems, attracting retail and institution participants alike. This streamlines and simplifies decentralized lending, making Morpho a DeFi standout.

Morpho Features

- Peer-to-Peer Lending: Morpho supplements finance and borrowing rates through the elimination of the middlemen.

- Compound & Aave Integration: Extra priced fees and decrease the borrowing rates by more effectively utilizing the DeFi lending protocols to maximize the structures.

- Gas Optimization: The lowered the transaction and gas fees using a smart matching algorithm within the lending and borrowing marketplace.

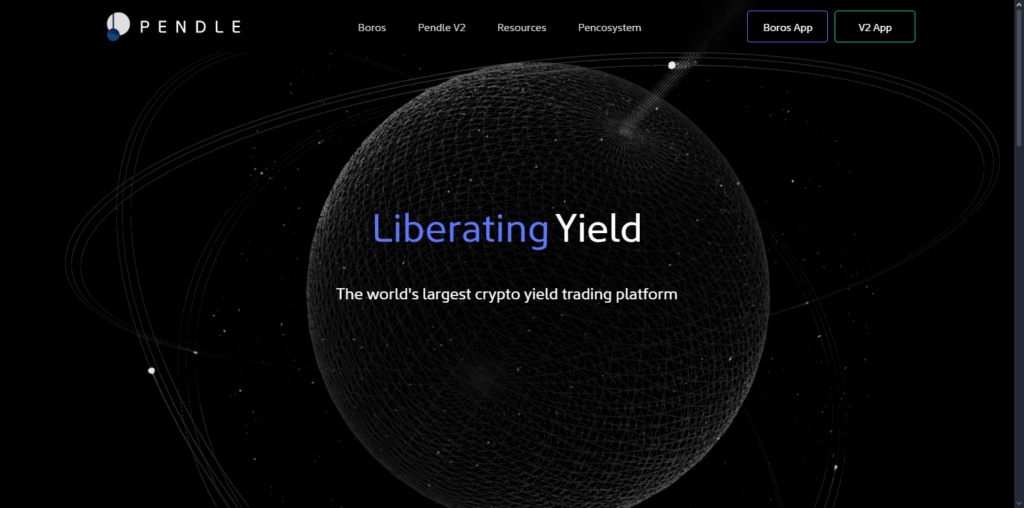

4. Pendle

Pendle is known as one of the best DeFi projects due to its innovative approach to yield tokenization. It enables users to slice the principal and future yield of their assets into tradable tokens, thus, creating tradable tokens which are time-dependent rewards.

Its potential to allow investors to trade, hedge, or speculate on yields without dealing with the protect asset is what gives its huge level of flexibility and liquidity.

Pendle users also gain access to numerous DeFi protocols to maximize yields on the assets while upholding security and clarity. Its combination of personalized risk control, yield trading instruments and optimizing capital efficiency is what makes Pendle unique, thus, making the project one of the first of its kind in the decentralized finance space.

Pendle Features

- Tokenized Yield Trading. Allows users to separate principal and yield, enabling the creation of yield-bearing derivative tokens.

- Liquidity Flexibility. Users are able to trade future yield before maturity, improving options for liquidity in DeFi.

- Risk Management. Offers new ways to mitigate interest rate risks while maximizing yield on yield-generating assets.

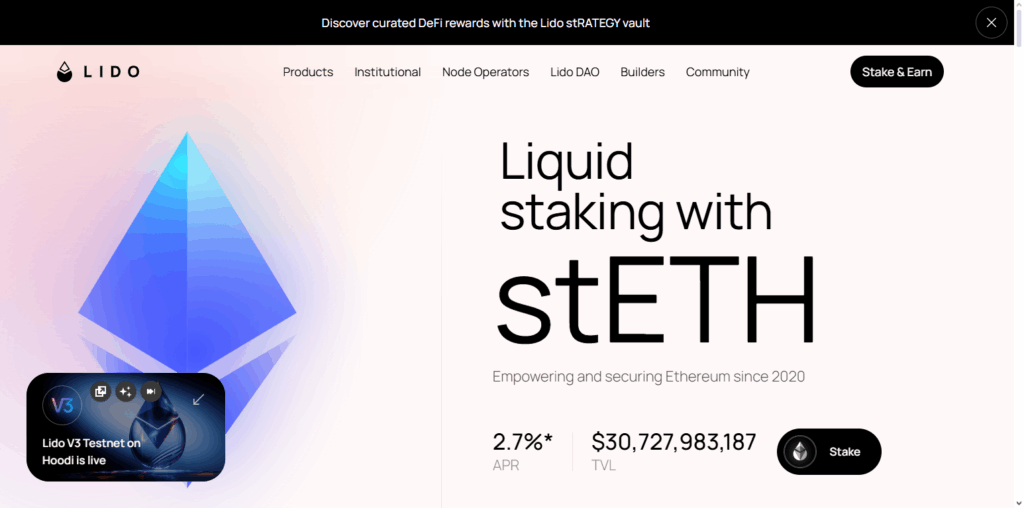

5. Lido

Lido is one of the leading DeFi projects because of its pioneering work on liquid staking for Ethereum and other PoS blockchains. Lido is different from conventional staking services because users can stake their tokens and obtain liquid derivatives like stETH which means they can stake and have liquidity simultaneously.

This enhances capital efficiency and creates additional earning opportunities without the need of an asset lock. Lido is one of the few DeFi platforms that take users’ fund security and decentralization seriously by practicing strong validator framework management.

Flexibility and ease of access to earning is what makes DeFi platforms like Lido stand out and these attributes are the reasons Lido maintains its position as the trailblazer of DeFi projects.

Lido Features

- Liquid Staking. Allows users to stake ETH and SOL and receive liquid tokens able to be used across DeFi platforms.

- High Security. Operates on numerous professional validator nodes to guarantee the security and trust of staked assets.

- Cross-Platform Integration. Lido tokens can be used across various DeFi applications, increasing the utility of staking.

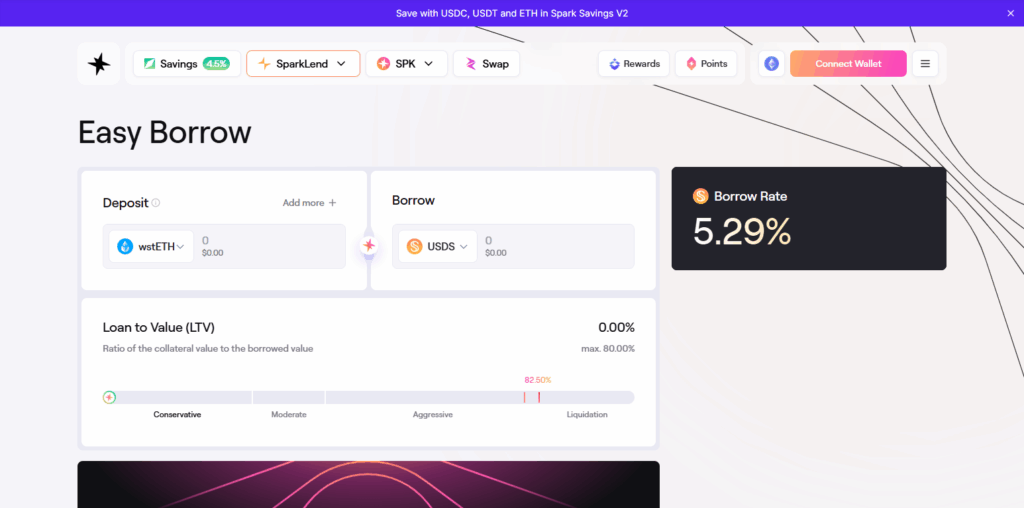

6. SparkLend

SparkLend is considered one of the top DeFi projects because of the first frontier of the automated lending and borrowing platform which aims to maximize both yield and capital efficiency. Instead of a conventional lending interface, SparkLend optimally allocates liquidity across several DeFi protocols and lending platforms to offer borrowers the best possible rates, while lenders earn the highest possible yield.

Its algorithmic interest model is a first of its kind in that it sets interest rates according to the prevailing conditions, optimizing pricing inefficiencies in the process and mitigating risks. Further, SparkLend employs computerized intelligent security systems and automated clear smart contracts, assuring customers of absolute control and safety of their SparkLend assets.

SparkLend’s unique lending approach that optimizes lending strategies, high returns, coupled with strong crypto security makes SparkLend one of the unique projects in the growing DeFi industry.

SparkLend Features

- Decentralized Lending. Provides a completely non-custodial lending platform with attractive interest rates.

- Flash Loan Support. Users can borrow collateral-free for DeFi and arbitrage strategies instantly.

- Optimized Protocol. Smart contracts adaptively change rates, collateral, and other parameters, improving capital efficiency.

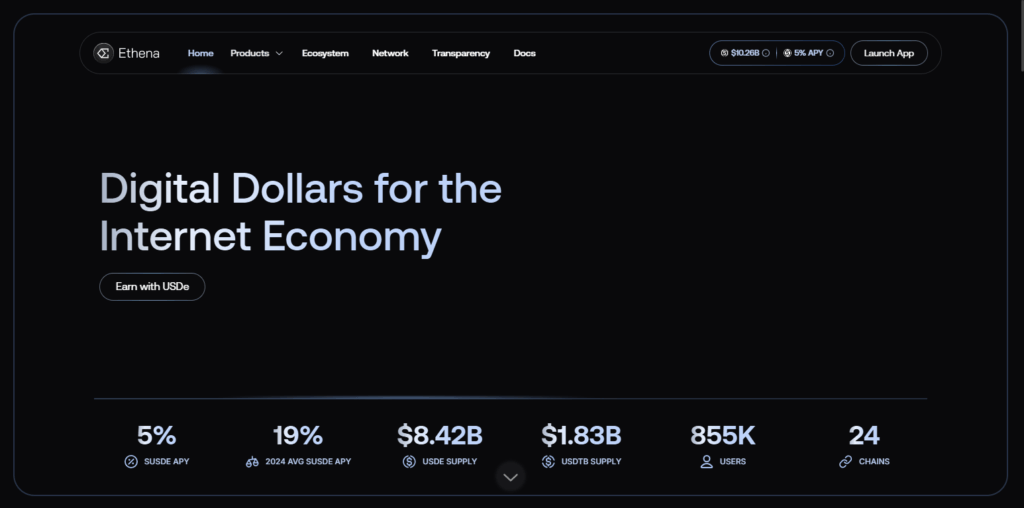

7. Ethena (ENA)

As a DeFi project, Ethena (ENA) succeeds in building a community-first, decentralized staking and governance platform. Ethena’s ETH staking is augmented by a DAO which lets holders of the governance token participate in protocol and network development which is a departure from traditional staking protocols.

Ethena’s DAO model and Eth staking permits stakers to earn competitive yields as active community members who shape the protocol’s ecosystem.

Ethena’s priorities of transparency, risk, and user governance democratizes self-custodial governance. Ethena’s unique project that combines decentralized and participative governance Ethena has truly innovative and impactful DeFi projects.

Ethena (ENA) Features

- High-Interest Yield. Offers users the ability to earn returns that are higher than traditional staking.

- Flexible Liquidity. Users are able to stake or withdraw with little to no delay, unlike traditional periods of liquidity.

- Automated Risk Management: Platfrom’s algorithms minimizes risk exposure while optimizing yield.

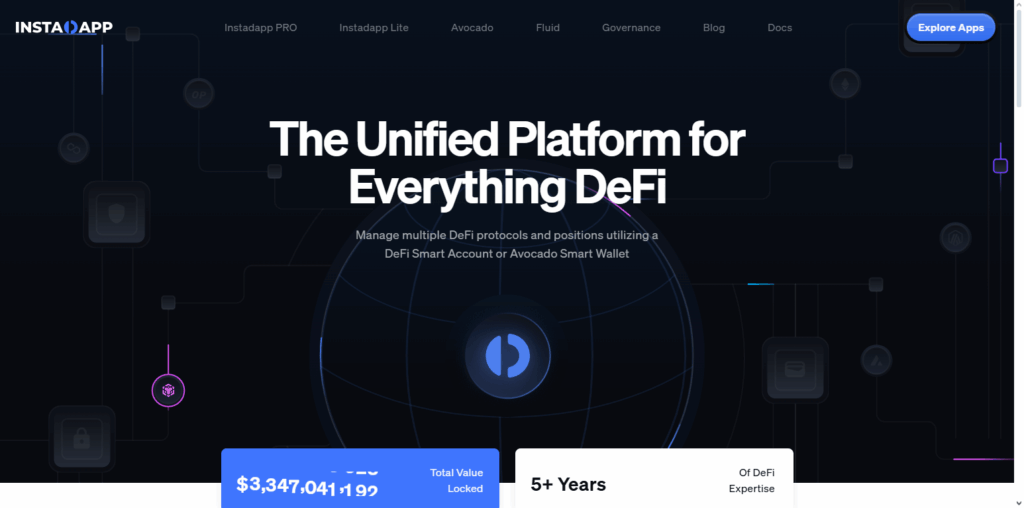

8. Instadapp

Instadapp remains one of the leading DeFi projects due to the payment smart wallet technology they’ve managed to develop and maintain the simplicity of optimizing the Defi interactions from their app. Rather than the use of separate Defi protocols, Instadapp permits users to operate DeFi from one and only one shell interface, optimizing complicated strategies such as leverage, debt refinancing, and yield farming to automation.

With the added abstraction layer, DeFi tools are instant and cheap due to the reduction of gas and lowered transaction complexity. Such tools become available at the retail and institutional level.

With a layer of integrated Instadapp keeping risk automation, effective cross protocol spaced, a user does the minimal work needed to get the maximum capital performance. With all the tools needed at their fingertips, Instadapp remains a leader in DeFi projects due to the hieh level innovation and user-friendliness of the protocols.

Instadapp Features

- DeFi Smart Layer: Gives a single pane view of various DeFi protocols and simplifies asset management.

- Automation: Implement strategies on yield farming, lending, and leveraging automatically.

- Composable Infrastructure: Enables users and developers to build complex DeFi strategies without having to code complex algorithms.

9. ChainGPT

ChainGPT is one of the best DeFi projects in the world that combines AI and blockchain technology to improve the operational efficacy of decentralized finance. Unlike other DeFi platforms, ChainGPT uses AI to provide instant overviews and analyses, create smart contracts, formulate automated trading algorithms, and provide predictive insights, and advisory services, and aid the user in decision-making with minimal effort.

The AI-enabled predictive analytics and the blockchain immutable surveillance provide Duo performance optimization and risk aversion to the developers and investors. ChainGPT is one of the first projects in DeFi to merge Machine Learning with DeFi services. It enhances operational efficiency, accuracy, and innovation. This positions ChainGPT as one of the leaders in The blockchain technology world which is ever-evolving.

ChainGPT Features

- AI DeFi Assistant: Uses artificial intelligence to perform smart contract analysis, provide trading insights, and perform predictive analytics.

- Cross Chain Compatibility: Can access and operate on a number of different blockchains, providing comprehensive insights on DeFi data across many chains.

- Developer and Trade Friendly Interfaces: Interchangeable user tools such as chatbots and robust analytics provide assistance to developers and traders in making informed decisions.

Conclusion

To summarize, the leading DeFi projects – Ether.fi, EigenLayer, Morpho, Pendle, Lido, SparkLend, Ethena (ENA), Instadapp, and ChainGPT – are the most innovative in decentralized finance.

Each has its own staking and security, yield tokenization, automated strategies, and flexible AI analytics. The projects also improve DeFi’s accessibility and usability, alongside optimal returns, robust security, and efficient capital use.

They also set blockchain’s new boundaries for user’s creativity and freedom, frictionless finance, and unparalleled openness, which adds to DeFi’s ever–growing usability and accessibility. These all demonstrate decentralized finance’s ability to transform user experiences.

FAQ

What are DeFi projects?

DeFi (Decentralized Finance) projects are blockchain-based platforms that offer financial services like lending, borrowing, staking, and trading without relying on traditional banks or intermediaries. They enable users to control their assets directly through smart contracts.

Why are these projects considered top DeFi projects?

These projects are considered top because they offer unique innovations such as flexible staking (Ether.fi), shared security (EigenLayer), yield tokenization (Pendle), liquid staking (Lido), AI-driven analytics (ChainGPT), and optimized lending strategies (Morpho and SparkLend), making them highly efficient and user-friendly.

Can beginners use these DeFi projects?

Yes, many platforms like Instadapp and Lido are designed for beginners, offering simple interfaces, automation tools, and guides, while still catering to advanced users.