In This article I will highlight the Best Small Business Loans with the goal of assisting business owners in obtaining adequate financing.

Every entreprenuer requires a reliable partner on their journey, especially a well-informed lender when starting or scaling a business venture. In this post, I will review reputable sites that provide quick and easy access to business funds.

key Points & Top Small Business Loan List

| Lender | Key Point |

|---|---|

| Lendzi | Offers a wide range of loan types with a streamlined online application. |

| National Funding | Specializes in small business loans with quick approval and flexible terms. |

| Kiva | Provides 0% interest microloans through crowdfunding, ideal for startups. |

| BlueVine | Known for fast lines of credit and invoice factoring for cash flow support. |

| OnDeck | Offers term loans and lines of credit with rapid funding for small businesses. |

| Credibly | Provides working capital and merchant cash advances with lenient requirements. |

| Bank of America | Traditional bank with a broad suite of business financing options. |

| United Capital Source | Connects businesses with multiple lending partners for custom solutions. |

| Finance Factory | Specializes in unsecured loans and credit lines with a focus on startups. |

| Rapid Finance | Provides fast, flexible funding for businesses with varied credit profiles. |

10 Top Small Business Loan

1.Lendzi

Lendzi is a new online lending platform that offers connections for small businesses to SBA loans, equipment financing, cash advances, merchant cash advances, and many more. The company works alongside several lenders to provide business funding options that help fulfill their strategic goals.

It is known for its short and simple application process, which can be done in minutes, and quick funding. It caters to both new and seasoned businesses. Lendzi practices honesty and focuses on the customer by providing expert aid throughout the entire lending process.

Features Lendzi

- Wide network of lenders offering diverse loan types (SBA, equipment, lines of credit).

- Fast and simple online application with minimal paperwork.

- Personalized loan matching based on business profile.

2.National Funding

National Funding provides small business loans and equipment financing without traditional bank hurdles, allowing for faster approval and payment scheduling.

The company focuses on aiding businesses that do not qualify for a traditional bank loan. This makes it an appealing option for individuals with low credit scores or a short time of operation. The amount loaned typically ranges from

Features National Funding

- Loans available for businesses with lower credit scores.

- Fast funding—often within 24 hours.

- Flexible repayment options tailored to cash flow.

3.Kiva

Kiva is a unique platform for 0% interest microloans. Unlike traditional funding organizations, Kiva operates through a crowdfunding model where backers lend by crowfunding pools set up by entrepreneurs to raise funds.

The platform is ideal for startups, minority-owned businesses, and social enterprises without access to financin.

Loans through Kiva are most accessible as they have no fees nor collateral requirements, allowing anyone to setup a fund and remove financial limitations.

Its mission-driven approach has helped fund thousands of small ventures around the world, focusing on makret underserved communities.

Features Kiva

- 0% interest microloans up to $15,000.

- Crowdfunded by individual lenders worldwide.

- No fees, no collateral, and ideal for startups.

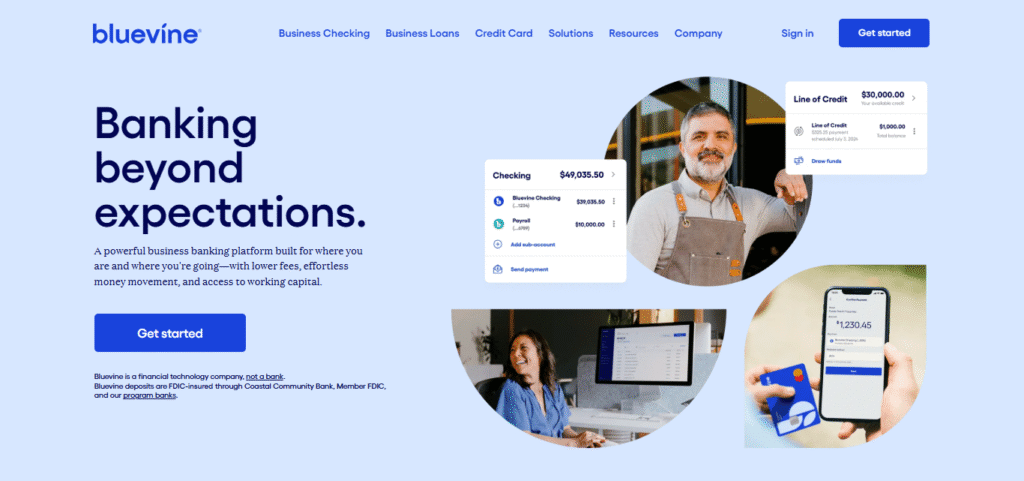

4.BlueVine

When it comes to fast and easy financing, BlueVine has a stellar reputation among small businesses. It offers an array of services, including credit up to $250,000 and invoice factoring to enhance cashflow. The application procedure is done through the internet, with results often available in a couple of minutes and the funds released in a day.

BlueVine is reputable for its convenience of not understanding the terms and pricing fully as everything is known upfront, as well as little to no forms. Businesses are able to repay on a weekly basis, and there is no penalty for repayment before the due date.

This is particularly beneficial for firms that deal with seasonal changes in demand or those that require rapid accessed funds. As of now, BlueVine has proven to be more useful for businesses that have operated for at least 6 months.

Features BlueVine

- Offers revolving lines of credit and invoice factoring.

- Quick application and funding process (as little as 24 hours).

- Transparent pricing with no hidden fees.

5.OnDeck

Largely considered a “fast” business lender, OnDeck provides short term loans and revolving lines of credit for up to $250,000. Funds are usually provided within a day, and businesses are able to apply online.

As a fast working capital lender, OnDeck specializes in helping businesses cover operational expenses, expand to new business locations, or pay for other unexpected business expenses that would need a cash infusion.

With OnDeck, payment of the loan is straightforward, and businesses that pay off loans early are rewarded with discounts on interest which boosts savings even further.

Features Kiva

- Microloans with no interest and limits of $15, 000.

- Funded by individual lenders globally.

- Best for startups with no collateral, no fees.

6.Credibly

Today, Credibly supports business such as medium and small enterprises by providing them with working capital loans, cash advances, equipment financing, and even business expansion loans. The company is unique as they have a minimum imposed credit score of 500 along with a very short time in business, making it one of the most inclusive lenders.

Credibly promises loan amounts between 5,000 to 400,000, which are accessible within 24 hours, showcasing their claim of including support for faster working capital. Unlike other lenders

Credibly uses revenue based repayment to ease the financial load and sustain growth for the business. With tailored support and easy applications, the process is faster and more efficient to let companies focus on their business rather than paperwork.

Features Credibly

- Repayment that is tied to the revenue of the business.

- Accept lower credit scores starting from 500.

- Includes MCAs and working capital in multiple loan products.

7.Bank of America

Bank of America has an all-inclusive offering of small business financing options which include term loans, SBA loans, business credit cards, and lines of credit.

Being one of the largest traditional banks in the U.S., it caters to established businesses with good credit and strong financial documentation.

Although the application process is more involved than that of online lenders, Bank of America has competitive interest rates, offers longer repayment periods, and accessible financial advisors.

It’s extensive network of branches along with digital tools improve customer experience. Businesses seeking stability, scale, and relationship based banking often become customers of Bank of America.

Features Bank of America

- Traditional term loans and SBA options.

- Competitive interest rates for qualified borrowers.

- Access to financial advisors and full-service banking.

8.United Capital Source

As a funding marketplace, United Capital Source eases the process for small businesses by connecting them to lenders who offer loans, merchant cash advances, and lines of credit. Focused on personalized service and fast approvals

United Capital Source provides funding options for various industries including construction, healthcare, and retail. It services businesses of different credit profiles and sizes, making it available for those often turned down by banks.

Advisors at United Capital Source assist clients in finding affordable options that suit their requirements. Flexibility and speed offered by United Capital Source give businesses great appreciation, with many claiming to receive funds within 48 hours of approval.

Features United Capital Source

- Marketplace with access to dozens of lending partners.

- Tailored funding solutions for all credit types.

- Quick funding, often within 48 hours.

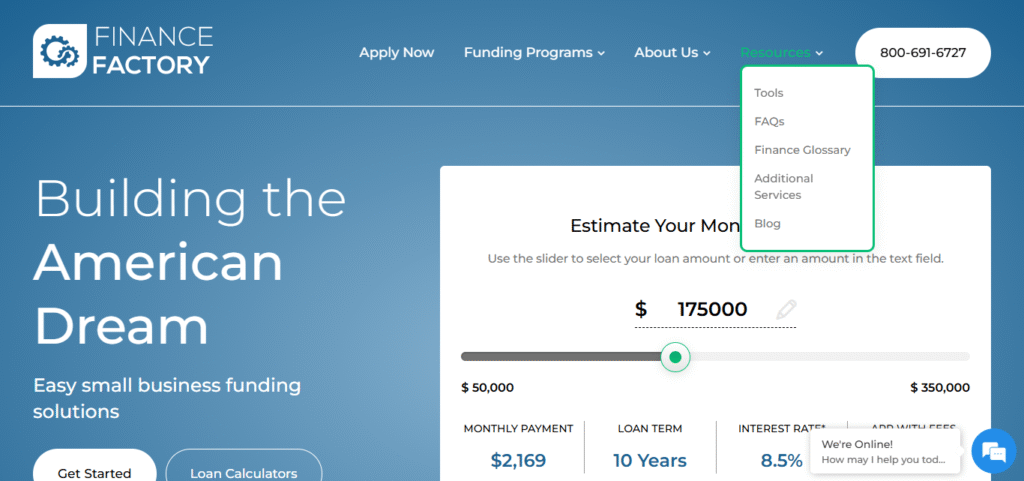

9.Finance Factory

Finance Factory is especially beneficial for startups and personally creditworthy individuals seeking to establish a business due to its ability to assist entrepreneurs with good personal credit but no business history in obtaining unsecured funding such as personal loans used for business, business credit cards, and credit lines.

It stands out in the market with its consultative approach that includes funding strategy sessions and credit optimization services.

Finance Factory strengthens its position by connecting users to various lending partners as well as being able to secure $250,000 for users.

This provides great aid for founders looking to evade risks associated with collateral while utilizing business credit in the future.

Features Finance Factory

- Concentrates on unsecured loans and business credit lines.

- Accepts strong personal credits, especially from startups, with open arms.

- Custom tailored funding plan along with credit guidance.

10.Rapid Finance

Rapid Finance is a lender that focuses on enabling small businesses and helps from its technology to provide quick and flexible funding. It offers a wide variety of loan products like short-term loans, merchant cash advances, and bridge loans.

They serve different industries and credit scores, making it easy for small and large businesses to access funds ranging from 5,000−5,000−1 million. With Rapid Finance, borrowers can complete an application online, receive approval, and have the necessary funding in less than 24 hours.

Their customer service representatives assist in customizing financing solutions to fit each business’s expectations. It’s great for companies that want to resolve immediate working capital needs to address short-term operational cash flow problems or take advantage of opportunities.

Features Rapid Finance

- Offers various products such as bridge loans and MCAs.

- Funding available in 24 hours.

- Accepts many types of credit scores.

Conclusion

In conclusion Picking a small business loan is reliant on your credit score, the amount of funding you require, and the urgency of receiving the capital.

Each provider has their strengths, from Kiva with their no-interest loans, to online lenders like BlueVine and OnDeck that offer swift loans.

These top lenders support your growth and success by providing flexible accessible financing, whether you are an established business or a startup.