In This Post I’ll be explaining the entire Venmo sign-up procedure in this article, starting from downloading the app to linking a payment method.

If you’re new to Venmo or need a quick recap, this guide will help you sign up in the most time-efficient way so that you can manage payments immediately.

What Is Venmo?

Venmo is a mobile payment application that allows its customers to send and receive payments within seconds utilizing a mobile application, and it is owned by PayPal.

In the US, Venmo is popular for sharing expenses, making transfers and payments to friends, and for low-value purchases.

Financial transactions are done safely and users can add social elements like transaction notes and emojis. A user can easily transfer money by linking his bank account, debits, or credit cards.

Venmo also allows certain merchants to accept payment through the application, thereby enabling the user to manage his day-to-day payments and peer-to-peer transactions in a fast and simple manner.

Venmo Sign Up Process Step By Step

Step 1: Get the Venmo mobile app for IOS iPhone from the App Store or Android from Google Play Store.

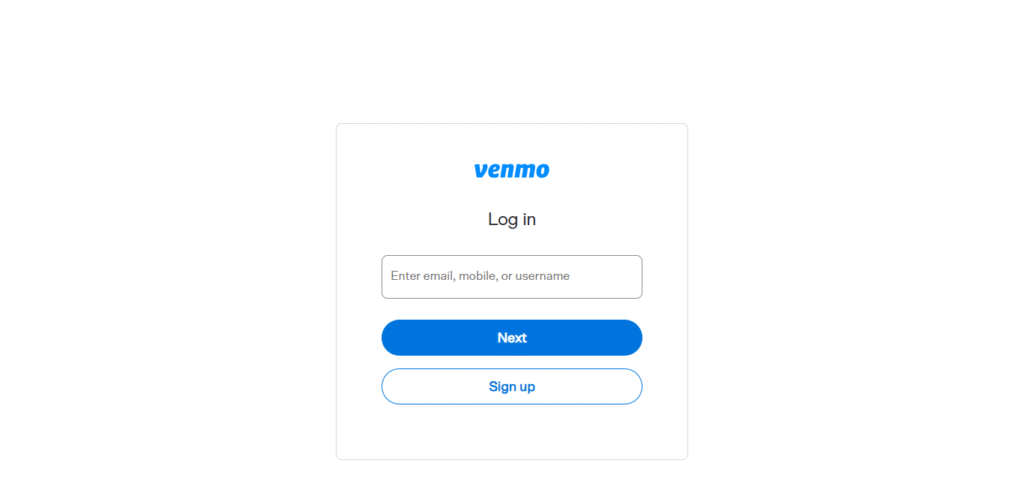

Step 2: Proceed to open the app and click on “Sign Up” option.

Step 3: Select if you would like to sign up with an email address or Facebook account.

Step 4: Supply your first name, last name, email id, and provide valid mobile number, and set a password.

Step 5: Confirm your mobile number or email by verifying it with the code sent to you.

Step 6: Choose your nickname and establish your privacy controls.

Step 7: Add your bank, debit, or credit card account (optional during sign-up).

Step 8: Activate security measures like PIN code, Face ID, or two-factor code.

Step 9: You can now begin utilizing Venmo to send, receive, or request money.

Requirements to Sign Up for Venmo

Age and Residency requirements

As a mandatory condition, you should have attained the age of 18 and should be a residing citizen of the United States. Venmo only functions within the United States and needs a bona fide phone number from the U.S.

Compatible Devices(Web, iOS, Android)

Venmo functions on iPhones ((iOS 13 and above), Android 8 and newer), and its official website. Internet-enabled devices are essential for registration.

Suggested but Not Mandatory U.S. Bank Account Linked with Debit or Credit Card

A U.S. bank account, debit, or credit card allows you to transact freely. While optional during initial registration, it’s critical for all transactions and fund transfers.

Why Venmo is a popular choice for sending and receiving money

Venmo’s popularity stems from its unique blend of fast and effortless transactions and a social-friendly interface. With a couple of taps, users can settle bills, pay friends, and shop online.

Emojis and notes can be added to each transaction, making the payments fun and friendly. Alongside instant bank transfers, the app provides strong security settings and is accepted broadly by people and certain businesses. With no fees for standard transfers and its links to PayPal, Venmo becomes easy and friendly for younger mobile users who value speed and convenience.

Troubleshooting Common Sign-Up Issues

Verification Not Working

If phone number or email verification fails, check that your number is receiving messages, and attempt resending the code. Restart the app or reach out to Venmo support if necessary.

App Not Installing

Confirm that your device’s OS is iOS 13 or newer and Android 8 or newer. Make sure there is adequate storage, a reliable internet connection, and restart your device.

Card or Bank Link Issues

Review your card or bank details for possible mistakes. Some banks have restrictions—attempt a different linking method or get in touch with your bank and Venmo support’s assistance.

Pros And Cons

| Pros | Cons |

|---|---|

| Quick and Easy Sign-Up: The process is simple and fast, taking only a few minutes. | Limited to U.S. Users: Venmo is only available to users within the United States. |

| User-Friendly Interface: The app is intuitive and easy to navigate for new users. | Verification Delays: Occasionally, phone number or email verification may fail, requiring additional steps. |

| No Fees for Basic Transactions: Sending money to friends or family through linked accounts is fee-free. | Bank or Card Linking Required: You need a linked bank account or card to send or receive money. |

| Social Features: Transaction notes and emojis make it fun and interactive. | Instant Transfer Fees: Instant transfers to your bank account incur a fee (1% of the amount). |

| Secure Payments: Offers robust security features like two-factor authentication and PIN setup. | Limited International Use: Venmo can’t be used for international transactions or with users outside the U.S. |

| Supports Multiple Payment Methods: You can link debit, credit cards, or a bank account for easy payments. | App Dependency: Venmo is app-based, and doesn’t offer a full web-based experience for some users. |

Conclusion

In summary, the Venmo registration process is simple, allowing for fast account creation and easy payment configurations.

U.S. users, for instance, benefit from linking their bank accounts, security features, and social media connections which all enhance the Venmo experience.

Even with some constraints, including no international capability or fees for immediate transfers, Venmo continues to be one of the leading mobile payment services.