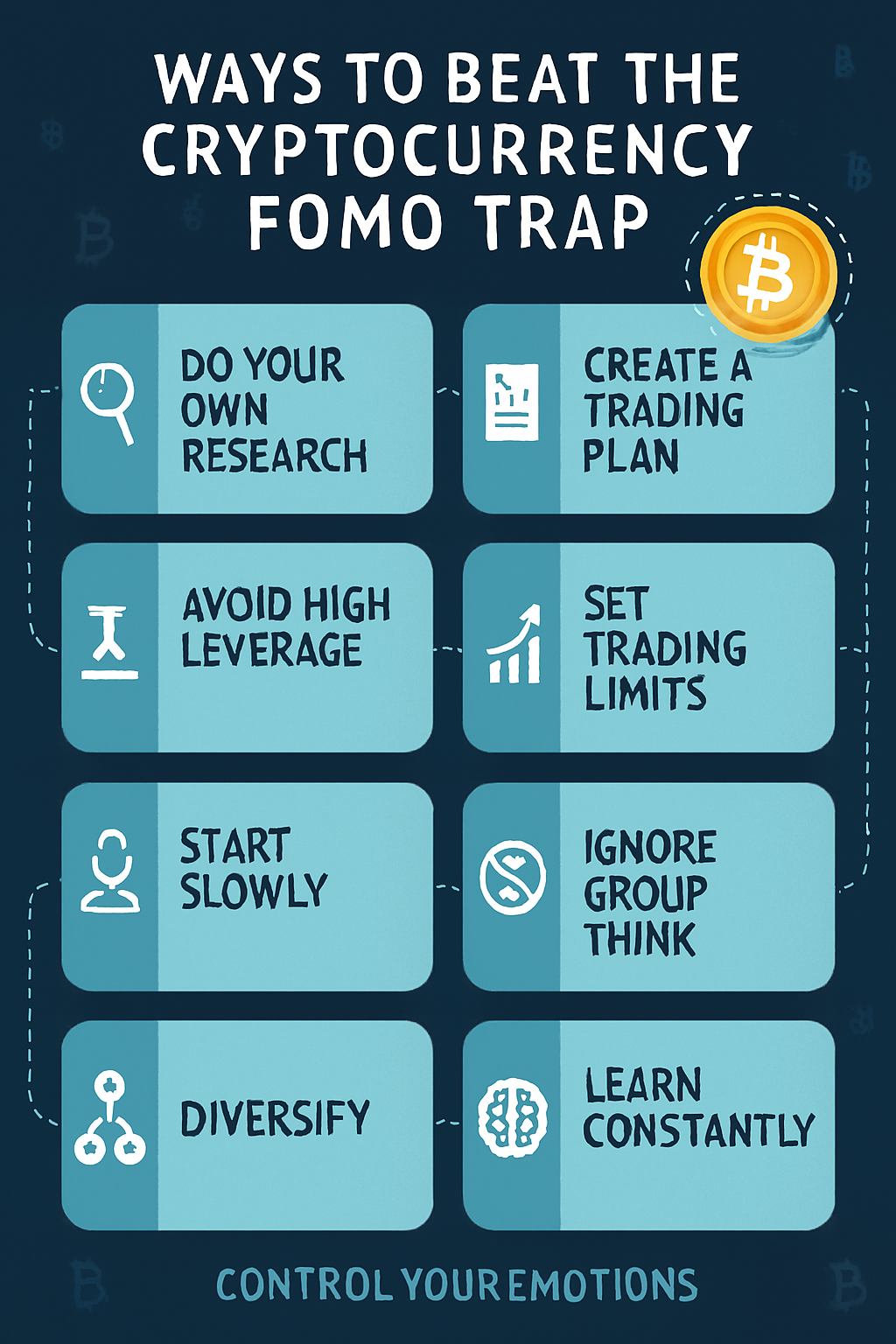

Cryptocurrency investors are often triggered by market changes and rush to make investment decisions only to realize they are victims of FOMO.

Impulsive decisions motivated by FOMO can cause substantial losses and aggravation. Develop a clear investment plan, prioritize research, and practice disciplined and mindful investing to counter FOMO and move with the market’s intrinsic volatility confidently.

What Is FOMO Trap

The FOMO trap in crypto means an impulse buying situation due to anxiety caused by Fear of Missing Out. It happens especially with cryptocurrencies that have an astronomical spike in price or are in the buzz in social networks like Twitter, Facebook or Reddit.

Investors buying due to FOMO are doing no research, are buying while the price is very high and are taking huge risks, due to the FOMO trap.

The losses are huge and FOMO weakens the overall emotional and financial situation. It is important to recognize the situation and take control of the emotional impulse in order to invest in crypto in a disciplined, strategic manner.

Key Point

| Way to Beat FOMO | Explanation / Key Action |

|---|---|

| Create a Clear Investment Plan | Define goals, risk tolerance, and time horizon before investing to avoid impulsive decisions. |

| Set Entry and Exit Points | Decide in advance the price levels for buying or selling to prevent emotional trading. |

| Use Dollar-Cost Averaging (DCA) | Invest fixed amounts regularly instead of lump sums to reduce risk from market peaks. |

| Limit Social Media Exposure | Reduce time on crypto Twitter, Reddit, and Telegram to avoid hype-driven decisions. |

| Focus on Research, Not Hype | Analyze project fundamentals and technical data rather than following viral trends. |

| Set a Maximum Loss Limit | Use stop-loss orders or predefined loss thresholds to protect capital from impulsive buys. |

| Maintain a Diversified Portfolio | Spread investments across multiple assets to reduce risk and emotional FOMO impact. |

| Practice Mindful Investing | Pause and reflect before buying; ensure decisions are research-based, not fear-driven. |

| Keep a Crypto Journal | Document every trade and decision to identify FOMO patterns and improve strategy. |

| Focus on Long-Term Value | Prioritize projects with real utility and growth potential over short-term hype. |

1. Create a Clear Investment Plan

One of the most effective ways to beat cryptocurrency FOMO is to create a clear investment plan. This involves defining your goals, figuring out your risk appetite, and how long you plan to invest before you enter the market.

Knowing what to achieve keeps your focus and prevents you from making irrational decisions, like chasing trends and getting distracted by viral novelties.

A solid plan keeps you disciplined and helps you navigate through periods of turmoil in the market and helps you stick to your plan, and prevents made the FOMO mistakes.

Creating an Investment Plan

Pros:

- Builds structure and discipline to your plan.

- Minimizes rash and emotional decisions.

- Facilitates strategy refinement and progress measurement.

Cons:

- Can be a little constraining during extreme market conditions.

- Investment plans take a while to build and require maintenance.

2. Set Entry and Exit Points

Another key way to beat cryptocurrency FOMO is to set predefined entry and exit points. This strategy involves predetermining the prices at which you will take a position in or out of a currency.

By setting these boundaries, you will take the emotional aspect of the trade, which is often the FOMO, out of the equation.

This disciplined approach ensures that you stick to the overall game plan, and helps you avoid irrational buying during rallies and selling during a price crash.

Defining Entry and Exit Points

Pros:

- Minimizes the chances of making impulsive trades.

- Helps you secure profits while also limiting your losses.

- Promotes higher-order strategic planning.

Cons:

- Can be an opportunity loss if the market hits your defined exit points.

- Can be excessively emotional during DCE and pulling the other way during DCA.

3. Invest Using Dollar-Cost Averaging

Mitigate the risk of investing during high volatility by using Dollar-Cost Averaging (DCA). Using DCA helps relieve the stress of short-term fluctuations and prevents panicking at the peaks.

DCA helps smooth the average purchase price and helps relieve the stress of perfect timing the market.

When you use DCA, you gradually accumulate the cryptocurrency and avoid the psychological extremes involved in trying to time the market.

DCA Pros & Cons

Pros:

- Smoothens the average price of your purchase during high volatility.

- Decreases the risk of poor market timing.

- Allows you to build a large holding over a long period.

Cons:

- DCA can be the weakest strategy in a bull market.

- DCA also requires a large amount of cash to flow in regularly.

4. Avoid Social Media

Avoid the cryptocurrency FOMO trap by minimizing social media exposure. Social media amplifies hype and sensationalism surrounding cryptocurrency.

Scrolling through crypto social media channels flooded with hype everyday triggers the anxiety of missing out on huge profits.

When you avoid crypto social media, you curb impulsive investments driven by hype, which leads to research based decisions instead.

Reducing Social Media Intervention Pros & Cons

Pros:

- Less emotional triggers and FOMO.

- Reduces market hype and helps concentrate on facts.

- Keeps the mental focus clear.

Cons:

- Might be the 1st to miss other triggers in the market.

- Highly complex to identify useful content in a sea of garbage.

5. Focus on Research, Not Hype

To beat the cryptocurrency FOMO trap, you must prioritize extensive research, rather than getting distracted by hype.

Before committing to any project, understand the basics – the team, the technology, the roadmap, and its real-world use cases.

Researching hype and relying on influencers can result in poor investment decisions. Informed research helps you gain the control needed to resist impulsive and rash decisions driven by fear.

Focus on Research, Not Hype

Pros:

- Enhances belief in investments.

- Identifies long-term winners.

- Shields you from pump-and-dump schemes.

Cons:

- Time-consuming and critical thinking required

- Can feel slow relative to fast-paced trends

6. Set a Maximum Loss Limit

A maximum loss limit is another form of protecting your capital and is vital to beating the cryptocurrency FOMO trap. This is a limit on how much loss you can take on a trade/investment.

Tools such as loss limit and loss step orders can assist in rationalizing emotional responses. With these in place, you can automatically exit losing positions.

Loss limit orders help rationalize emotional responses and make quick decisions in irrationally emotional and fear-driven market scenarios.

Set a Maximum Loss Limit

Pros:

- Protects capital from potential major drawdowns.

- Encourages a proactive approach to risk management.

- Eases concern during extreme volatility.

Cons:

- May trigger exits during normal fluctuations.

- Needs to be enforced.

7. Maintain a Diversified Portfolio

Keeping a diversified portfolio is a smart way to beat the cryptocurrency FOMO trap because it allows you to spread your risk across multiple assets.

When you invest in a variety of cryptocurrencies allocated across different risk levels, you diminish the emotional strain caused by a coin’s drastic increase or decrease in value.

This also counteracts the impulse of chasing a trending cryptocurrency, because your overall portfolio is stable, balanced, and not overexposed to the prevailing market sentiment.

Maintain a Diversified Portfolio

Pros:

- Spreads risk across different investments.

- Lessens the consequence of any specific loss.

- Gives access to various industries.

Cons:

- Can water-down the returns of the outliers.

- More expensive and complex to manage multiple investments.

8. Practice Mindful Investing

Engaging in mindful investing is a fundamental way to beat the cryptocurrency FOMO trap and it’s defined as the absence of intention to take a particular action.

After deciding on your next trade, take a moment and ask yourself if your decision is based on fundamental research or is a reflection of the prevailing FOMO.

By practicing mindfulness, you are able to identify triggers, avoid impulsive actions, and protect your strategy. Over time, it will enhance discipline and reduce the FOMO effect during periods of volatility.

Practice Mindful Investing

Pros:

- Increases emotional stability.

- Fosters deliberate and proactive thought.

- Lessens stress and impulsivity.

Cons:

- Requires a high level of self-discipline.

- May feel slow or passive to aggressive traders.

9. Maintain a Crypto Journal

To break free from the cryptocurrency FOMO trap, start documenting each investment decision. Note the reasons for each buy or sell, and the market conditions, so you can recognize behavioral patterns.

Analyzing previous trades will help you spot FOMO-driven errors and improve your overall strategy. This self-awareness will help you make rational, research-driven choices in the future.

Keep a Crypto Journal

Pros:

- Provides a record of actions and their consequences.

- Identifies patterns and areas of improvement.

- Enhances future planning.

Cons:

- Requires significant time and commitment.

- Can be easily abandoned during high-pressure situations.

10. Consider Long-Term Value

To break free from the cryptocurrency FOMO trap, consider long-term value to divert focus from short-term attention.

Invest in high-quality projects with long-term sustainable growth, strong technology, and real-world utility to avoid the urge to chase short-term rewards.

Long-term thinking will help you remain patient, avoid the stress of excessive market volatility, and ensure that your decisions are strategic rather than impulsive FOMO.

Focus on Long-Term Value

Pros:

- Congruent with the idea of creating lasting wealth.

- Mitigates anxiety caused by temporary volatility

- Facilitates a better grasp of the fundamentals of the projects

Cons:

- Can lead to missing short-term profit opportunities

- Patience and conviction is fundamental and required

Conclusion

Avoiding the trap of FOMO in cryptocurrency requires deliberate and thorough preparation, as well as a well-thought-out investment strategy. A well mapped-out investment strategy takes into account the setting of entry and exit points, the use of dollar-cost averaging techniques and the avoidance of hasty, impulsive decisions dictated by FOMO in the first place.

Emotional risks can be countered by reckless social media activities, hype-analysis, and the lack of a well diversified portfolio. Emotional restraint can be achieved by mindful activities such as keeping a cryptocurrency journal, adopting the Focusing on long-term objectives approach, and deliberate and calm sacrificing of immediate objectives.

The contradiction of the previous statement confirms the underlying negative mood which must be countered. Structured implementation of these activities permits rational decision-making in the pursuit of specific goal.

FAQ

What is the cryptocurrency FOMO trap?

The cryptocurrency FOMO (Fear of Missing Out) trap occurs when investors make impulsive decisions due to anxiety about missing potential profits. It often happens during rapid price surges, hype on social media, or viral trends, leading to poorly researched purchases and emotional trading.

How can I create a clear investment plan to avoid FOMO?

A clear investment plan defines your goals, risk tolerance, and time horizon before investing. By having a structured plan, you can make rational decisions and avoid impulsive actions influenced by hype or sudden market movements.

Why is setting entry and exit points important?

Entry and exit points help prevent emotional trading by predefining the prices at which you will buy or sell. This reduces panic-driven decisions and ensures your trades follow a disciplined strategy rather than reacting to market swings.

How does Dollar-Cost Averaging (DCA) help prevent FOMO?

DCA involves investing a fixed amount regularly, regardless of price. This strategy reduces the risk of entering at market peaks, smooths out volatility, and allows gradual accumulation of assets without being driven by short-term hype.

Should I avoid social media to beat FOMO?

Limiting exposure to crypto-focused social media reduces hype-driven decisions and emotional stress. While you may miss some updates, relying on verified sources for research ensures decisions are informed rather than impulsive.