Selecting an appropriate Western Union Alternatives for International money Transfers, facilitate quicker transfers, and provide more flexible payout options.

Today’s digital alternatives streamline and economically facilitate global payments while offering cross border payments at a highly competitive fee, real time exchange rates, and secure global coverage.

In today’s digital world consumers and businesses can transfer money across borders and receive cash, bank deposits, or payments directly to a mobile wallet.

Key Features of Western Union

Western Union has provided features to cater to a broad spectrum of users, including:

Cash remittances: With a large network of agents, Western Union provides great convenience and ease of access to cash remittances.

Choice of delivery: Users can select from a varied delivery options which include cash pickup and mobile wallet transfers which are completed within minutes, bank deposits which may take up to 2 days.

Reputation: With more than 150 million customers globally, Western Union has built a legacy of trust and reliability within the money transfer industry.

Compliance: Western Union, like other companies operating within the U.S., is subject to the regulatory practices of the New York State Department of Financial Services.

Key Point

| Service | Key Point |

|---|---|

| PayPal | Global online transfers with fast payouts to PayPal accounts and linked banks. |

| Wise | Low-cost international transfers using the real mid-market exchange rate. |

| MoneyGram | Large global cash-pickup network with fast remittance options. |

| Skrill | Low-fee international transfers to bank accounts in many countries. |

| Xoom | Fast transfers to bank accounts, cards, and global cash-pickup locations. |

| WorldRemit | International transfers with multiple payout options including mobile money. |

| Ria Money Transfer | Budget-friendly global remittances with a wide agent network. |

| Remitly | Speed-focused transfers with Express and Economy options for global payments. |

| XE | Reliable bank-to-bank international transfers with competitive FX rates. |

| OFX | Fee-free large international transfers with dedicated currency specialists. |

1. PayPal.

Paypal started in the United States in 1998, and is at the top of the digital line transfer service offered all around the globe. Because of Paypal’s services people can make payments in over 240 countries and regions around the globe.

Paypal’s service is not 100% free and the prices can be steep based on distance of the transfer and type of payment.

Paypal’s service is also an alternative to Western Union. Paypal’s services make it easy to pay online and also transfer money quickly. Paypal also allows instant transfer services between their users.

PayPal

Pros:

- PayPal to PayPal conduct transactions almost instantaneously.

- Over 200 countries supported.

- Buyer protection guarantees safety.

- You can fund directly from a bank, a debit card, or your PayPal balance.

Cons:

- Paying for services or goods cross border incurs high costs.

- When converting money, they take a percentage.

- PayPal accounts are required by the receiver.

- Limited to unavailable cash pickup locations.

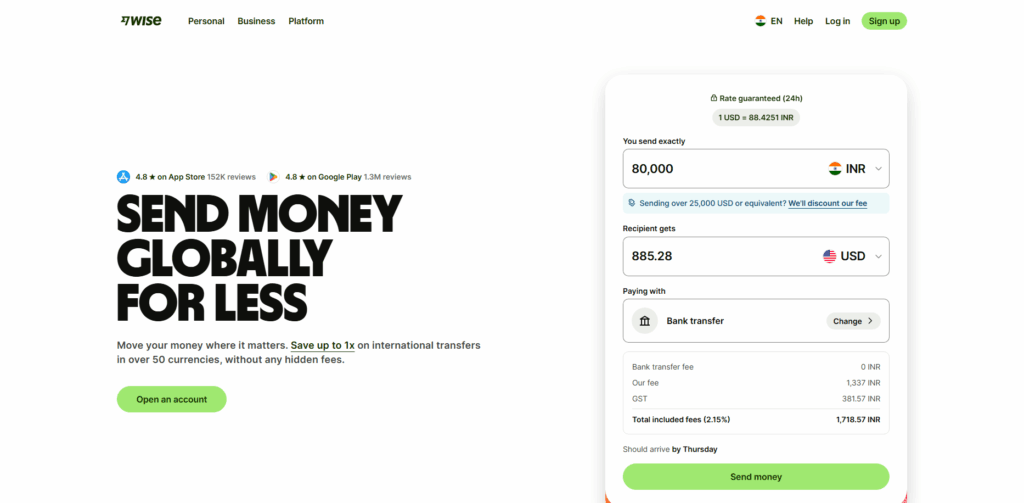

2. Wise

Wise was established in 2011 in the UK. Users make low-cost international transfers with no hidden fees. Users make transfers with bank debit/credit cards, and Wise balances. Users pay small percentage fees depending on the currencies and the payout methods.

As an affordable alternative to Western Union for international money transfers, Wise is digital-first and user-friendly. The fintech company offers multi-currency accounts and provides local bank details in multiple countries which allows for fast transfers (ranging from minutes to a few hours).

Wise is popular for their transparent pricing and uses a mid-market exchange rate. The company serves more than 70 countries.

Wise

Pros:

- Wise has no hidden costs involving converting money.

- Very low costs that are clearly shown.

- They support over 70 countries.

- You can access the money digitally within seconds and can hold multiple currencies.

Cons:

- There’s no option for cash pickup.

- Using your card to pay incurs higher costs.

- Not as useful as OFX for huge transactions.

- It might not be available in your country.

3. MoneyGram

MoneyGram is a merger-formed company established in 2004. They operate in over 200 countries and among the largest for remittances. Though their fees are more than average, depending on what payment method is used and what destination the money is going to, their costs are competitively priced for the industry.

MoneyGram is an alternative to Western Union for international money transfers with their vast pick-up network. Users can send money with a bank account, cash, debit, or credit cards to a bank deposit, mobile wallet, or cash pick-up.

MoneyGram is known for how quickly they are able to transfer money, making it a good option for international remittances, and in some cases, the transfer can be completed in a matter of minutes.

MoneyGram

Pros:

- They can send money to more than 200 countries.

- They have a significant global presence that allows for instantaneous cash pickup.

- They support payments made from a bank, cards, or cash and are often transferred within a few minutes.

Cons:

- Using a card or cash to pay costs a lot.

- They take a percentage of the total money being transferred.

- For large transactions, identify verification is required.

- Compared to digital services, they have limited transparency.

4. Skrill

Founded in the UK, Skrill is a low fee international money transfer service. It covers over 150 countries and charges nearly the same amount as international money transfer services. Skrill is a Western Union alternative for international money transfers.

Skrill allows users to pay through a debi, credit, or bank transfer. Users can fund their transfers with a Skrill wallet, or money can be deposited to the creditable transferable. Users can also quickly receive money from Skrill via their crypto wallet.

Skrill

Pros:

- International transfers with low fees.

- Widens reach to over 150 countries.

- Deposits are made quickly.

- Provides funding via bank, card, and wallet.

Cons:

- Different regions have different fees.

- FX margin is not very transparent.

- Inactive Skrill wallets and withdrawals incur fees.

- Doesn’t work for substantial business transfers.

5. Xoom

Xoom started from the beginning with the speed and flexibility in international money transfers that users needed.

Users can pay via a bank transfer, credit, or debit card, and for cashless remittance services, the money can be received via bank deposit, a mobile wallet, or cash pick-up.

Xoom is known for its reliability, especially for remwatering to Asia, Africa and Latin America. Xoom is also a Western Union alternative for international money transfers

Xoom (PayPal) – Pros & Cons

Pros:

- Very quick delivery of services.

- Several different payment options: bank transfer, cash pickup, and mobile wallet.

- Support over 130 countries.

- Great usability thanks to PayPal.

Cons:

- Higher fees for card payment.

- High margins for exchange rates.

- Cash pickup is not always available.

- Doesn’t work for substantial business transfers.

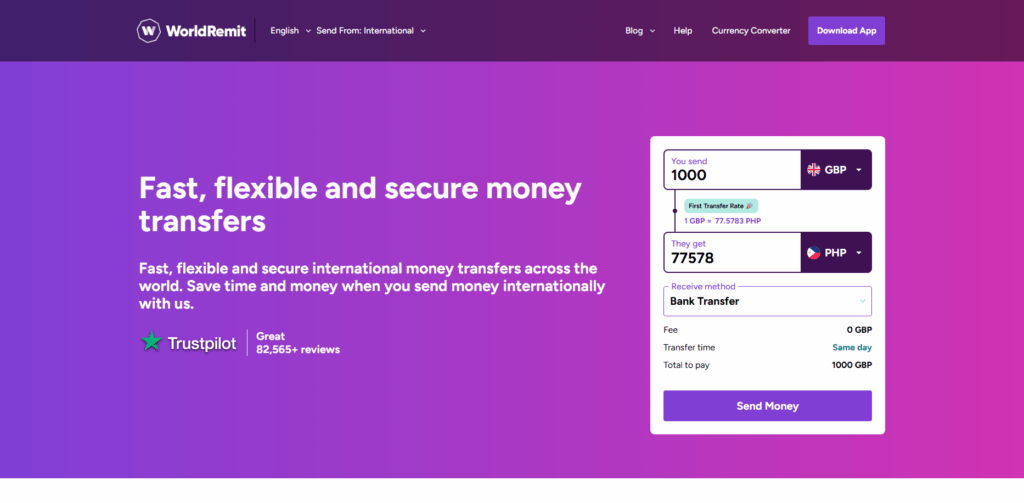

6. WorldRemit

Established in 2010 in the UK. WorldRemit helps international money transfers to 130+ countries with a 0.99 USD minimum fees and 4.99 USD maximum fees. Fees vary based on the receiving country and the payout method.

WorldRemit is regarded as Western Union alternative for international money transfers, and the reason for this is the variety of payout options available like mobile money, bank deposit and cash pickup.

Payouts can be funded via debit, credit, bank transfers, and mobile money wallets. Most of the time the transfers are instant, which is the reason why WorldRemit is best for digital remittances.

WorldRemit – Pros & Cons

Pros:

- Compared to traditional providers, fees are low.

- Supports 130+ regions.

- Mobile money is included in payment options.

- Payments are made almost instantly.

Cons:

- There are limits on how much money can be sent.

- Higher margins for exchange rate.

- Cash payment is not available in most countries.

- In some areas of the app, fees are higher.

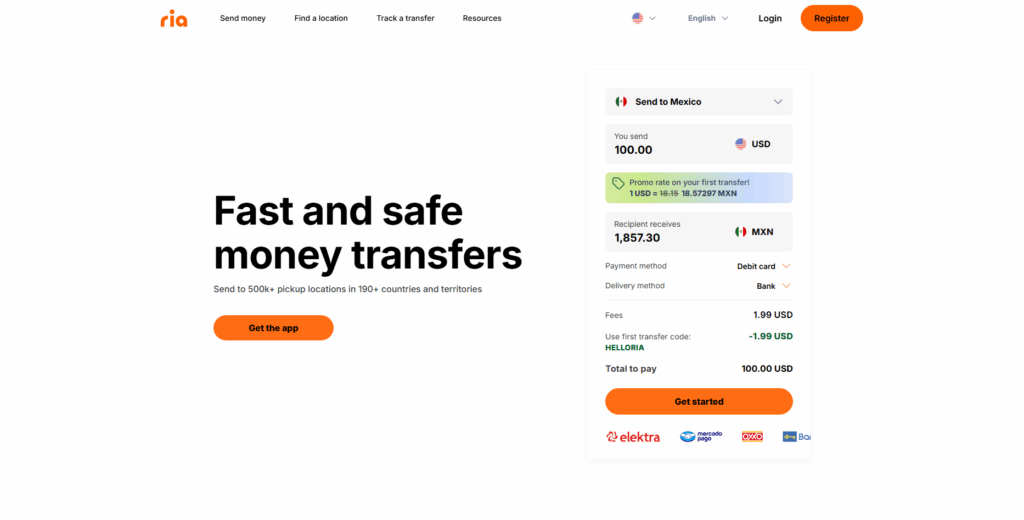

7. Ria Money Transfer

Established in the United States in 1987, Ria is one of the largest providers of remittance services and supports money transfer to 160+ countries. Fees depend on the destination and the type of payment used for the transfer, although they tend to be lower for payments made via bank.

Ria is regarded as Western Union alternative for international money transfers and one of the reasons for this is their huge network of agents around the world and the ability to do cash pickup in a matter of minutes.

Transfer funding is available via bank accounts, credit/debit cards, and cash at transfer service locations. Depending on the country, the recipient can choose to get the money deposited to a bank, picked up in cash or through a mobile wallet.

Ria Money Transfer – Pros & Cons

Pros:

- 160+ countries to send money to

- Many locations for picking up cash

- Transfer costs are low for bank remittance

- Good for remittances to developing regions

Cons:

- Higher fees for card or cash payments

- Exchange rate markups vary

- Transfer limits apply

- App and web experience less modern than rivals

8. Remitly

Remitly is an American company that has existed since 2011 and is known for international transfers within 170 countries instantly and affordably. They have two transfers, which are called Economy (low fees) and Express (faster delivery).

Though Remitly is a Western Union alternative for International Money Transfers, they care about speed and user experience more than anything. Users have the option to pay through an ACH, debit, and credit cards.

Money can be received through bank deposits, cash pick-up, mobile money, home delivery, etc. Remitly has great customer support, a well-developed mobile application, and reasonable pricing.

Remitly – Pros & Cons

Pros:

- Express and Economy options

- Supports 170+ countries

- Fast delivery, especially Express

- Wide payout methods (bank, cash, mobile money)

Cons:

- Express transfers cost more

- FX margins vary by country

- Daily transfer limits for new users

- Not ideal for large business payments

9. XE Money Transfer

XE is an International Bank Transfer and FX specialist founded in 1993 and operates in over 130 countries. They boast no fees on transfers, as they gain revenue through margins earned on the exchange rate.

Holding the same title as Western Union alternative for International Money Transfers, XE is reliable and efficient when completing transactions for both businesses and individuals. Users can fund bank transfers, and recipients always receive money in their accounts.

Founded in the FX market, they have a strong reputation for providing reliable services and tools, along with great currency tools and even rate alerts.

XE – Pros & Cons

Pros:

- No transfer fees

- Supports 130+ countries

- Good for both personal & business transfers

- Strong exchange rate tools

Cons:

- Earns through exchange rate margins

- Bank-to-bank only (no cash pickup)

- Minimum transfer amount applies in some regions

- Slower transfers compared to instant apps

10. OFX

Founded in Australia in 1998, OFX provides fee-free international transfers to over 170 countries and competitive exchange rates. OFX does not charge fixed fees, instead, OFX takes minor margins on currency exchanges, which benefit large transfers.

OFX is an alternative to Western Union for international transfers and provides personal and business transfers, and 24/7 support with support from dedicated currency experts.

Customers provide bank transfers to OFX, and recipients of transfers receive international bank deposits. OFX is notably optimized for high-value transfers across borders.

OFX – Pros & Cons

Pros:

- No transfer fees globally

- Supports 170+ countries

- Good for large-value transfers

- 24/7 customer support and dedicated dealers

Cons:

- No cash pickup option

- Bank funding only (no cards)

- Higher minimum transfer requirements

- Not ideal for transfers that are small and frequent

Conclusion

Selecting a Western Union substitute for overseas wire transfers comes down to what you value the most— price, time, available payments, or worldwide accessibility. Wise, Remitly, Skrill, XE, and OFX offer improved currency rates and lower charges, while MoneyGram, Ria, Xoom, and WorldRemit provide rapid transfer service and wide cash pickup services. Every service has different advantages, allowing you to align transfer needs with price and ease.

FAQ

What are the best alternatives to Western Union for international money transfers?

Some of the best alternatives include Wise, PayPal, Xoom, MoneyGram, Ria, Remitly, WorldRemit, Skrill, XE, and OFX. Each offers unique benefits such as lower fees, digital transfers, or fast cash pickup options.

Which Western Union alternative has the lowest fees?

Wise is known for the lowest and most transparent fees because it uses the mid-market exchange rate. XE and OFX also charge zero transfer fees but include a small FX margin.

Which service is fastest for international money transfers?

Xoom, Remitly (Express), MoneyGram, and WorldRemit often provide transfers within minutes, especially for cash pickup or mobile wallet payouts.

Which service is best for large international transfers?

OFX and XE are preferred for large-value transfers because they charge no fixed fees and offer competitive exchange rates. They also provide dedicated support for high-volume transactions.

Are these alternatives safer than Western Union?

Yes. Services like Wise, PayPal, XE, OFX, Remitly, and MoneyGram are regulated financial institutions and use advanced security measures such as encryption, identity verification, and fraud detection.

Can I send money for cash pickup without Western Union?

Yes. MoneyGram, Ria, Xoom, and WorldRemit offer extensive cash-pickup networks worldwide, making them strong alternatives for recipients without bank accounts.