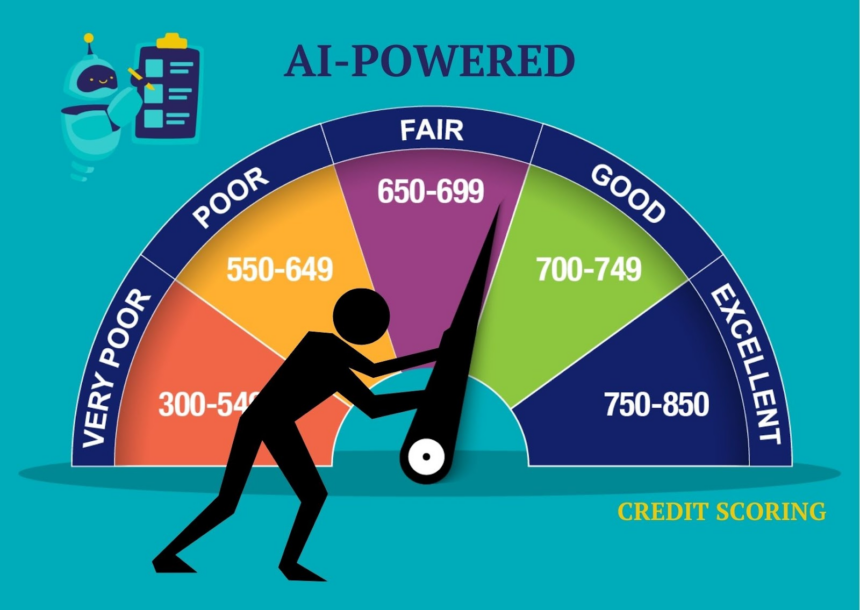

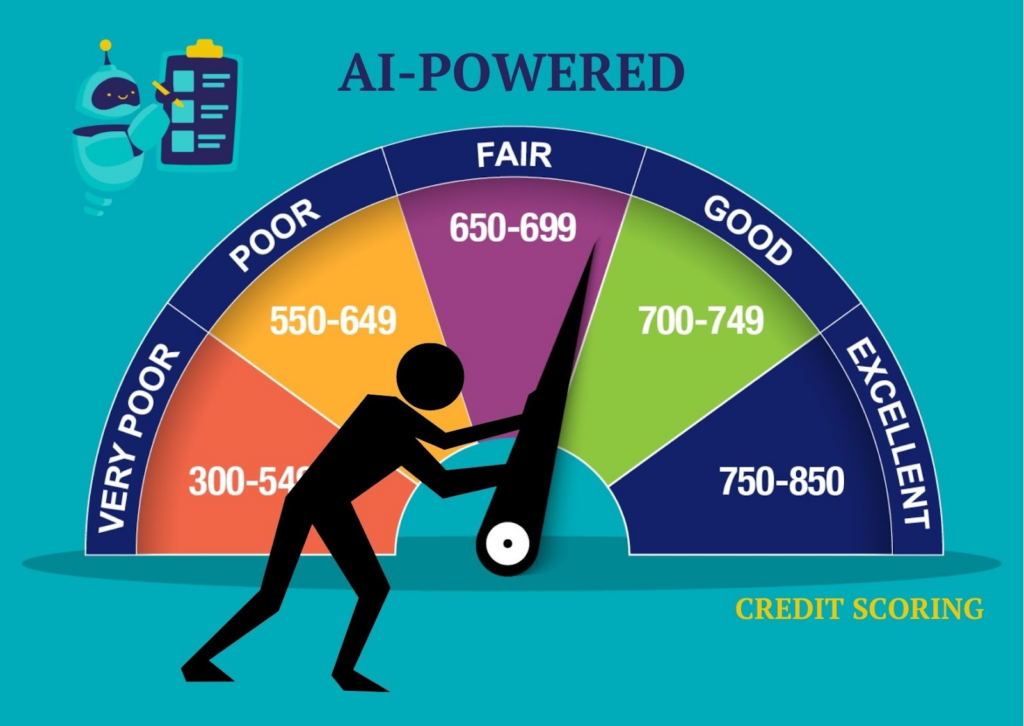

This article will cover the reasons as to why AI-driven credit scores are accurate when it comes to small businesses. Traditional credit scoring often overlooks small businesses because they have limited financial history.

AI-driven systems consider and recognise a range of different metrics over time and learn to give accurate assessments that are fair and timely. This helps small businesses get loans quickly and manage risk while making financial decisions.

What are AI-Driven Credit Scores?

AI-Driven Credit Scores represent the most recent version of credit scoring while incorporating the most recent advances in artificial intelligence.

Unlike traditional credit scores, which measure a borrower’s risk based on metrics like credit history and traditional credit scores, these scores go beyond the conventional data and assess a borrower’s risk using many additional metrics like transaction history, cash flow patterns, social data, and market data.

They are also adaptive systems that seek and identify hidden patterns in the data and are more accurate in predicting financial behavior. For small businesses these systems offer more inclusive credit risk assessments and are able to do so in a more timely manner which helps lenders to make better lending decisions and improves the financial access these businesses have.

Why AI-Driven Credit Scores Are Accurate for Small Businesses

Abundance of Information

- AI assessment compiles a variety of data, including bank transactions, payments, invoices, payment history, as well as behavioural market data.

Quick Analysis

- Unlike other conventional scores, AI doesn’t rely on old reports to evaluate credit, creditable reports are valuably aligned.

Modeling of Future Outcomes

- Algorithms in machine learning are able to reduce the number of defaults in the given time frame by forecasting the risks that can occur using patterns in finances.

Increased Fairness

- Small businesses that tend to get ignored in the older strategies of evaluation get a more fair assessment through AI.

Learning Efficiency

- With the more data, AI improves the quality of credit assessments through transactions and other interactivity over time.

Per Business Tailored Credit Values

- AI takes into account the particular industry, along with other key details to provide a credit score that is accurate and refined.

How AI-Driven Credit Scoring Works

Data Collection

- Data is gathered from files, previous records, cash flow, transaction history, invoices, finance statements. Also from social media, and market trends.

Data Cleaning and Processing

- The algorithms detect and eliminate irregularities, gaps, and discrepancies, and standardize the data to prepare it for analysis.

Feature Extraction

- The extracted data has important patterns, trends, and behaviours detected, such as a lack of punctuality for payments and volatility in revenue.

Machine Learning Algorithms

- The data is analyzed, and the algorithms calculate the probability of default or timely payments.

Scoring and Risk Assessment

- Based on the calculated probabilities the algorithm assigns a credit score and indicates the extent of financial risk of the entity.

Continuous Learning and Updates

- The models of the algorithms are refined based on new data for the system to improve the out if the system gets better.

Decision Support for Lenders

- The credit score is used to support the lending and money disbursal decisions.

Advantages of AI-Driven Credit Scores for Small Businesses

Higher Accuracy

AI’s pattern recognition is able to analyze data from a multitude of sources to create credit assessments far more accurate than what is possible through traditional methods.

Faster Decision Making

The ability to conduct real-time analyses means small businesses are able to have credit approved and access funds much more quickly than ever before.

Predictive Risk Insights

AI’s ability to spot trends and analyse behaviours means financial risks can be forecasted and businesses can plan.

Inclusive Credit Access

The traditional scoring methods often left small and emerging businesses behind. Now through AI, credit assessments can be based on a much more comprehensive data profile.

Reduced Human Bias

AI models are free from human input, judgments, and biases, leading to scores that are equitable and consistent.

Continuous Improvement

The performance of AI models will improve credit assessments by incorporating new data in real-time.

Tailored Assessments

AI scores can be based on industry and business-specific criteria, leading to more accurate assessments.

Case Studies / Examples

Small Retail Business Accessing Short-Term Loans

- A small retail business would receive working capital loans instantly for the first time due to the AI-driven technology, which traditional banks would take weeks to approve.

Start-Up Securing Development Stage Funding

- A tech start-up with virtually no credit history was able to secure financing thanks to AI technology assessing cash flow and other patterns that traditional credit score systems would ignore.

Risk Assessment Improvement for Lenders

- A regional bank implemented a new AI scoring system to accurately determine the high-risk borrowers and concomitantly decrease the loan default rate by 15%.

E-commerce Business Gaining Supplier Credit to Increase Inventory

- An online business rapidly increased its inventory by using AI-driven credit scores to secure supplier credit faster.

Financing Inclusion for Minority-Owned Businesses

- AI-driven credit scoring enabled loans access for minority small business owners who were previously denied financing access based on conventional credit history assessment.

Challenges & Considerations

Data Privacy & Security

- There is a need for strong measures in order to prevent breaches involving sensitive financial and personal data.

Quality of Data

- Accurate AI is dependent on positive data. Data that is low quality and/or insufficient will lead to errors.

Transparency of Algorithms

- Certain AI models are black boxes, and that makes it difficult for companies to know how score are calculated.

Regulatory Compliance

- AI scoring must be accompanied with law and policy adherence from financial institutions with respect to guidelines of where lending is permitted.

Over-Reliance on Technology

- Relying solely on AI overlooks contextual factors such as market shifts and the value of human judgment.

Cost of Implementation

- Smaller businesses and financial institutions may find integrating an AI-driven scoring system costly.

Bias in Data

- Advanced algorithms will not eliminate the problem. AI models will still have inequities if historical data is biased.

Future of AI in Small Business Credit Scoring

There are very few sectors within which AI has as much potential as the small business sector. AI is likely to become more advanced as it will have the ability to access more data as the technology allows it.

More data, such as social and behavioural data, will allow predictive technology to respond to market conditions in real-time. This will enable lenders to to perform more real-time personalised credit assessments, which will open up financing to more businesses, which is especially important for those businesses that are currently overlooked.

Furthermore, the technology will allow lenders and business owners to understand the decisions better which will better explain their financial positions. Ultimately, AI credit scoring will allow for faster approval and less lender risk and ultimately will drive an inclusive credit scoring system.

Pros & Cons

| Pros | Cons |

|---|---|

| Higher Accuracy – Uses multiple data points for precise credit assessment. | Data Privacy Risks – Handling sensitive financial data requires strong security measures. |

| Faster Approvals – Real-time analysis enables quicker lending decisions. | Quality of Data – Poor or incomplete data can affect accuracy. |

| Predictive Insights – Forecasts potential financial risks for better planning. | Algorithm Transparency – Some AI models are “black boxes,” making scoring unclear. |

| Inclusive Access – Small businesses often ignored by traditional methods can get fairer evaluations. | Regulatory Compliance – Must comply with financial regulations, which can be complex. |

| Continuous Learning – AI improves accuracy over time as it processes more data. | Cost of Implementation – Setting up AI systems can be expensive. |

| Reduced Human Bias – Automated scoring minimizes subjective judgment. | Bias in Historical Data – AI can inherit biases if input data is flawed. |

Conclusion

AI-powered credit scores are reshaping how small firms obtain funding, thanks to the immediacy and accuracy of credit evaluations. Businesses’ financial wellness is analysed from a variety of data points, patterns, and assessments to provide a snapshot of a company which is superior to traditional scoring systems.

The risk evaluation systems improve and end bias when companies are fairly assessed and perhaps even funded. The systems are only getting better, and small firms will be able to obtain funding to grow and succeed.

FAQ

How are AI-driven scores different from traditional credit scores?

Unlike traditional scores that rely on limited historical data, AI-driven scores use real-time, diverse data sources and predictive modeling, resulting in more accurate and inclusive assessments.

Why are AI-driven credit scores more accurate for small businesses?

They analyze multiple data points, reduce human bias, continuously learn from new data, and consider industry-specific factors, providing a precise picture of a small business’s financial health.

Can AI-driven credit scores help businesses get loans faster?

Yes. Real-time analysis and automated scoring speed up the lending process, enabling quicker approvals and access to funding.