Selecting the right service is crucial in saving time, money, and stress when sending money internationally. Wise and Xoom are two popular alternatives, each providing distinct benefits.

Wise is loved for their clear fees, mid-market exchange rates, and multi-currency accounts, while Xoom is loved for their speedy transfers, cash pick-up, and bill payment service in select countries. Knowing their differences enables the users select the service which best suits their needs.

What Is Wise?

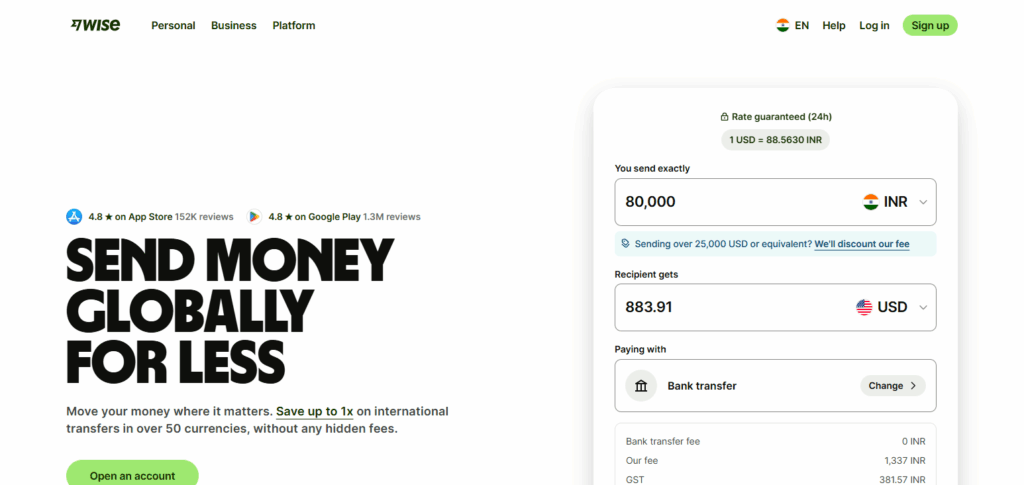

Wise (formerly TransferWise) provides cost-effective monetary transfers and delivery services to various countries, instantaneously and effectively, taking money transfer services an inefficiency and an inconvenience.

People sending money to others in different countries, individuals and businesses, and organizations globally, economically, and given the comfort of remote access, become busy customers.

No hidden fees diminish profits and lower costs. Multi-currency accounts ease the transfer of money in various currencies.

What is Xoom?

PayPal has owned Xoom since 2015, and for the past seven years, Xoom has provided remittance services to over 160 countries, enabling bank transfers and cash pickups.

The service is reliable due to the PayPal brand, but Xoom tends to charge higher fees and exchange rates compared to several other digital remittance services.

Overview

| Feature | Wise | Xoom |

|---|---|---|

| Send payments to | 80+ countries, 50+ currencies | 160+ countries |

| Multi-currency accounts | Available for 50+ currencies with Wise Multi-Currency Account | No |

| Debit card available | Yes, Wise Multi-Currency Card | No |

| Cash payout available | No | Yes |

| Mobile phone reload | No | Available in select countries |

| Bill pay | No | Available in select countries |

| Fully licensed and regulated | Yes | Yes |

| Open a business account | Yes, Wise Business Account | No |

Wise Vs Xoom: which is faster?

Most Wise payments (about 50%) land immediately, and 80%+ land within 24 hours, but delivery times depend on how you pay and the destination. You will see an estimated delivery time when scheduling a payment.

Most Xoom payments can also be available within a couple of minutes; however, they can also take 24-48 hours. This depends on the payment destination, payment method, and how the transfer will be paid out.

Xoom vs Wise: Where Are They Available?

Xoom and Wise do not share the same coverage or availability. The availability of the two services is as follows:

Xoom: Operates in all the countries/regions in which PayPal is present and facilitates transfers to more than 150 countries/territories.

Wise: Operating in The EEA, United Kingdom, United States, Singapore, Japan, Australia, New Zealand, and facilitates transfers to about 57 other foreign currencies.

Exchange Rates and Transfer Fees

International transactions usually come with two costs: exchange rate and transfer fee. Illustration of Wise and Xoom emission is presented below:

Wise:

Wise is reputed due to its marketplace strategy. It gives users exposure to the mid-market exchange rate while also allowing consumers to see the total cost due to no hidden fees. This leads to users predicting the value of the total send and knowing the value of the total receive.

This approach is different to a lot of the traditional banking systems and some of the other money transfer systems, which lead to users experiencing hidden fees. Similarly TransferGo also provides users fee transparency, allowing users to budget for their transfers.

Xoom

Xoom has a variable fee system, which can get expensive depending on the transfer destination and payment method. Fee-less transactions can occur, but other transaction methods are highly fee associated.

Monito provides analysis on the system, and Xoom is known for its extreme exchange fees due to poor exchange rate and goes on to hide about 74% of the total fees which leads to incompetence of transparency to its customers vs Wise and TransferGo.

Service Quality and User Experience

Wise: Wise has a lot of positive feedback due to ease of transactions with their efficient platform and user experience. 4.2 out of 5 on TrustPilot is a great score and users highly appreciated the transparency of the transfer system and fees associated, knowing the set fees and exchange rate prior to initiation of the transfer, with several users mentioning the ease of the process.

Xoom: The varying exchange rates and fees have received some issues as a criticism impacting overall user satisfaction.

Transfer Times

Wise

Wise is exceptionally quick with most transactions completing within just a matter of minutes. Being able to complete a transaction within minutes includes receiving and sending all countries worldwide.

This means Wise is able to complete transfers to all countries and even overseas. Essentially there is a 4-day pause for international business days in between transactions.

Xoom

Xoom is also capable of nearly instant transfers as long as the transaction is card funded. However, if a bank is funding the transfer, the transaction will take longer to complete and there is a possibility of the route being more complicated which could make the transfer take longer.

Wise Features

Countries and Currencies Supported

Wise is convenient as it supports more than 50 currencies and transfers to over 80 countries, relieving the hassle of compatible currencies and complex conversion processes.

Multi Currency Accounts

For over 50 currencies Wise allows the hold, conversion, and transfer of funds. Users of the service can best allocate funds to multiple currencies, as they can over multiple accounts.

Debit Card Availability

The Wise Multi-Currency Card allows users to conveniently spend with their Wise accounts whether it be in multiple currencies or countries, without charging excessive transaction fees.

Transfer Speed

Wise transfers can take just minutes to complete, however at worst, they take four business days to finish, and this can depend on the countries being sent from and to.

Fees and Exchange Rates

Wise has no hidden fees as they clearly outline their fees applied in the transaction. The person receiving the money should always be let known the amount they will get.

Xoom Features

Countries Supported

Users of Xoom can send money from one country to over 160 countries around the world and have numerous options to transfer and receive money.

Payment Options

Recipients can receive and choose their money from bank transfers, new mobile wallet, and cash pickup; Xoom offers variety of payment options.

Cash Payouts

Users can send money to numerous countries so that recipients can quickly and easily pick up their cash at partner locations without needing a bank account.

Mobile Phone Reload

Xoom is now offering mobile phone top-up services, where users can pay to recharge prepaid phones in one of the several countries for money to be transferred.

Bill Payments

Xoom has also created an opportunity to pay for important services and utility bills all in one place, in a select number of countries.

Transfer Speed

Sending an to an international account may be almost instantly funded from a credit card; bank transfers may take longer. There are many options based on payment method and urgency.

Fees and Exchange Rates

Relative to competitors, Xoom’s fees and exchange costs are higher. Although some payment choices might not incur fees, and some may be more favorable in exchange costs, others are not.

Security and Regulation

Xoom secures all transactions, along with personal and financial data, in accordance to their fraud prevention measures, as Xoom holds all necessary endorsements as fully regulated and licensed in all jurisdictions.

Security and Trustworthiness

Both Wise and Xoom rely on their compliance with industry regulations to operate securely. In the UK both provide services under the regulation of the UK’s Financial Conduct Authority.

TransferGo, like Wise and Xoom, builds trust with users while obtaining and following industry best practices to provide optimal protection.

Licensed as an Authorised Payment Institution by the Financial Conduct Authority, TransferGo’s comprehensive regulatory obligations ensure the protection of user funds as well as their personal and payment information, thanks to industry standard encryption and a suite of security measures that prevent unauthorized access and data theft.

Conclusion

While Wise and Xoom have great international money transfer services, Wise services are more fitting, which include, transparency, mid-market exchange rates, multi-currency accounts, and business-friendly feature, which is great for users and frequent international transfer rather than spending a lot of money.

Xoom is better for quick and adaptable services like cash pick-ups, mobile phone reloads, and bill pay, which is helpful for those without banks. Ultimately, Wise is better if cheaper and transparent rates are a priority, but for quick and adaptable rates Xoom is better.

FAQ

Which is faster, Wise or Xoom?

Wise transfers are typically completed within minutes to a few business days depending on the route, while Xoom offers near-instant transfers for card payments but slower times for bank transfers.

Which service is cheaper for international transfers?

Wise is generally more cost-effective, offering mid-market exchange rates and transparent fees. Xoom’s fees vary by payment method, with some hidden costs, making it potentially more expensive.

Can I use a multi-currency account?

Yes, Wise provides multi-currency accounts for 50+ currencies. Xoom does not offer multi-currency accounts.

Are there debit cards available?

Wise offers a Multi-Currency debit card for spending in multiple currencies. Xoom does not provide debit cards.

Are Wise and Xoom secure?

Yes, both platforms are fully licensed and regulated, using advanced encryption and security protocols to protect personal and financial information.