In this article, I will focus on the Defi Aggregator Tokens To Invest that are smart investment choices.

These tokens optimize the operation of decentralized finance platforms through liquidity aggregation across different DEXs, enabling improved execution of trades and decreased slippage.

I will analyze some the best DeFi aggregator tokens that have great investment potential along with their benefits and use cases.

Key Point & Defi Aggregator Tokens To Invest List

| Platform | Key Point |

|---|---|

| 1inch | Aggregates multiple DEXs for best swap rates. |

| Paraswap | Optimizes token swaps with low fees and slippage. |

| Matcha | User-friendly DEX aggregator by 0x. |

| Slingshot | Combines DeFi trading with real-time price discovery. |

| DexGuru | Provides advanced analytics and trading tools. |

| Uniswap | Leading decentralized exchange with high liquidity. |

| SushiSwap | Community-driven DEX with yield farming options. |

| Kyber Network | On-chain liquidity protocol for seamless token swaps. |

| Curve Finance | Specializes in stablecoin and low-slippage trading. |

| Balancer | Automated portfolio management and liquidity provider. |

1. 1inch (1INCH Token)

Out of its over 1.8 million users, 1inch serves as a leading DeFi aggregator for customers utilizing gas efficient large trades.

With over $300M in daily trading and high slippage rates, the enterprise sources liquidity from decentralized exchanges, integrating protocols like Uniswap, Balancer, and SushiSwap to virtually automate trade executions.

Its native token, 1INCH, is suitable as a key investment in DeFi space where it acts as a governance and staking reward tool.

| Feature | Details |

|---|---|

| Token Name | 1inch (1INCH) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum, Binance Smart Chain, Polygon, and other Layer-2 networks |

| Purpose | Aggregates liquidity from various decentralized exchanges (DEXs) |

| Use Case | Optimizes trade routes for better prices and lower slippage |

| Total Supply | 1,500,000,000 1INCH tokens |

| KYC Requirement | Minimal KYC for trading on supported platforms |

| Token Utility | Governance voting, staking, fee rebates |

| Current Market | Widely available on major exchanges (e.g., Binance, Uniswap, etc.) |

| Security | Audited by Certik and other security firms |

| Staking Opportunities | Yes, offers staking for yield generation |

2.Paraswap (PSP Token)

Aside from the token providing governance rights and liquidity incentive as shown by its appeal in the DeFi, PSP actively works to enhance trade.

Paraswap is noted for its multi-chain compatibility with BNB Chain, Ethereum, Polygon, Avalanche, and also offers a gas feature that reduces operational costs by 50%.

Dominating in providing over 20 billion transactions with a single automated exchange aggregation means the token is marked as efficient.

| Feature | Details |

|---|---|

| Token Name | Paraswap (PSP) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum, Binance Smart Chain, and other Layer-2 networks |

| Purpose | Aggregates liquidity from multiple DEXs for efficient price discovery |

| Use Case | Optimizes trades for the best prices and lowest slippage |

| Total Supply | 500,000,000 PSP tokens |

| KYC Requirement | Minimal KYC for trading on supported platforms |

| Token Utility | Governance voting, staking, fee sharing |

| Current Market | Available on major exchanges (e.g., Binance, Uniswap, 1inch) |

| Security | Audited by leading security firms, including Certik |

| Staking Opportunities | Yes, allows staking for passive income |

3.Matcha (ZRX Token – 0x Protocol)

0x Protocol led, Matcha serves as an easy intuitive DEX where users can swap tokens seamlessly.

To ensure best prices, it sources liquidity from platforms such as Uniswap, Curve, and SushiSwap, amongst others.

It is estimated that the platform has $100M+ in monthly trade volume, which would make it suitable for both beginner and experienced Matcha does not own a token, but active traders can consider ZRX (0x Protocol token) as it powers and governs the platform’s liquidity.

| Feature | Details |

|---|---|

| Token Name | ZRX (0x Protocol) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum and other Layer-2 networks |

| Purpose | Aggregates liquidity from decentralized exchanges for better trades |

| Use Case | Price optimization and reduced slippage for decentralized trades |

| Total Supply | 1,000,000,000 ZRX tokens |

| KYC Requirement | Minimal KYC for trading on supported platforms |

| Token Utility | Governance voting, staking, liquidity provision |

| Current Market | Available on major exchanges (e.g., Binance, Uniswap, Matcha) |

| Security | Audited by reputable firms like Certik and Trail of Bits |

| Staking Opportunities | Yes, offers staking rewards through liquidity provision |

4.Slingshot (No Native Token Yet)

As a decentralized trading platform, Slingshot enables users to trade in real-time by aggregating liquidity from multiple DEXs while providing live price comparisons.

The platform supports multi-chain trading for Arbitrum, Polygon, and Optimism.

With an emphasis on fast transactions, Slingshot is growing quickly with an estimated 500,000+ users. Having low trading fees and competitive pricing does help web3 investors.

Currently there is no official native token, but projecting future token launches may be helpful to gauge investment targets.

| Feature | Details |

|---|---|

| Token Name | No Native Token Yet |

| Type | DeFi Aggregator |

| Platform | Ethereum, Polygon, and other Layer-2 networks |

| Purpose | Aggregates liquidity across multiple DEXs for optimized trades |

| Use Case | Best price execution and low slippage for decentralized exchanges |

| Total Supply | No token issued (yet) |

| KYC Requirement | Minimal KYC for using the platform’s services |

| Token Utility | Currently none (future plans for token issuance and use) |

| Current Market | Available on major platforms for DEX aggregation (e.g., Slingshot) |

| Security | Audited by leading security firms (specific audit details pending) |

| Staking Opportunities | Not available as no native token exists yet |

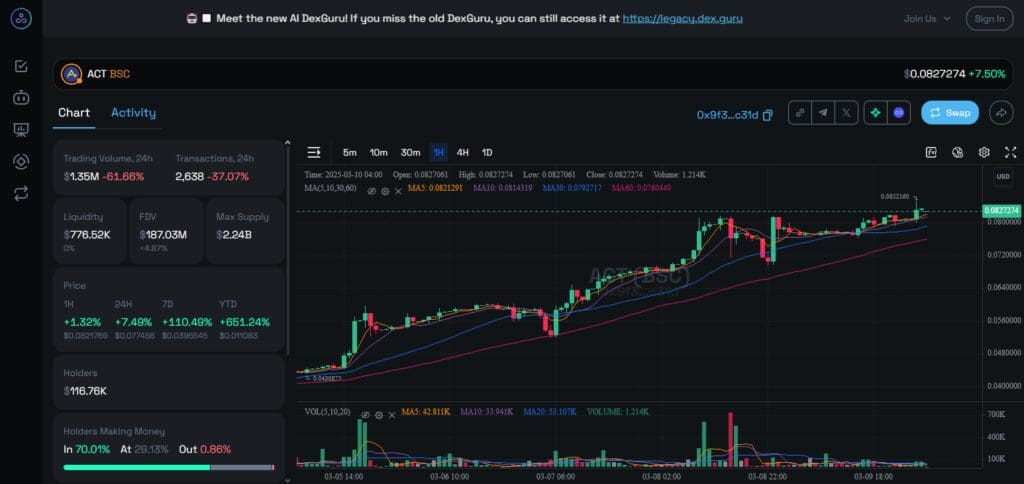

5. DexGuru (No Native Token Yet)

DexGuru is a DeFi trading terminal that allows users to make trades using a single interface that has on-chain analytics, live data, and order execution.

Users can access more than 50 liquidity sources with different networks such as Ethereum, BSC, Polygon, and more.

The platform is attractive to professional traders because of the advanced charting tools and deep market insights provided.

Although it does not have its own token yet, it does have the possibility to become attractive for investors in the future due to new token launches.

| Feature | Details |

|---|---|

| Token Name | No Native Token Yet |

| Type | DeFi Aggregator |

| Platform | Ethereum, Binance Smart Chain, and other Layer-2 networks |

| Purpose | Aggregates liquidity from multiple DEXs for optimized trades |

| Use Case | Provides best price execution and low slippage for decentralized trades |

| Total Supply | No token issued (yet) |

| KYC Requirement | Minimal KYC for using the platform’s services |

| Token Utility | None (future plans for token issuance and use) |

| Current Market | Available on major platforms for DEX aggregation |

| Security | Audited by leading security firms (specific audit details pending) |

| Staking Opportunities | Not available as no native token exists yet |

6. Uniswap (UNI Token)

Uniswap, the most prominent decentralized exchange has facilitated over $1.5 trillion in lifetime trading volume.

Commonly known for its automated market maker(AMM) it also helps in providing deep liquidity to the swap of ERC-20 tokens, which only adds to the service’s robust liquidity.

In the world of DeFi, Uniswap reigns supreme with 4.5 million users. The UNI token serves as Uniswap’s governance token, empowering its holders with voting rights on protocol changes and sharing returns from liquidity provisioning. Alongside other tokens, UNI defies the DeFi market.

| Feature | Details |

|---|---|

| Token Name | UNI (Uniswap) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum and Layer-2 networks |

| Purpose | Aggregates liquidity from decentralized exchanges for optimized trades |

| Use Case | Price optimization, governance, and staking |

| Total Supply | 1,000,000,000 UNI tokens |

| KYC Requirement | Minimal KYC for using Uniswap’s platform |

| Token Utility | Governance voting, staking rewards, and liquidity provision |

| Current Market | Available on major exchanges (e.g., Binance, Uniswap) |

| Security | Audited by leading security firms |

| Staking Opportunities | Yes, offers staking for liquidity providers |

7. SushiSwap (SUSHI Token)

SushiSwap began as a fork of Uniswap but has matured into a comprehensive ecosystem with features such as lending, yield farming, and staking.

It facilitates multichain trading on Ethereum, Polygon, and BSC, while managing an estimated Total Value Locked of $800M.

The SUSHI token possesses DeFi governance rights, earning staking rewards, and capital gain, thus making the token a favorable investment.

XSUSHI is another token issued by SushiSwap which allows the holders to earn from trading fees.

| Feature | Details |

|---|---|

| Token Name | SUSHI (SushiSwap) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum, Binance Smart Chain, Polygon, and other Layer-2 networks |

| Purpose | Aggregates liquidity from DEXs and optimizes trading routes |

| Use Case | Governance, staking, and liquidity provision |

| Total Supply | 250,000,000 SUSHI tokens |

| KYC Requirement | Minimal KYC for using SushiSwap’s services |

| Token Utility | Governance voting, staking rewards, and fee sharing |

| Current Market | Available on major exchanges (e.g., Binance, SushiSwap) |

| Security | Audited by top security firms |

| Staking Opportunities | Yes, staking for rewards and yield generation |

8. Kyber Network (KNC Token)

A multichain liquidity protocol, Kyber Network allows instant token swaps. It boasts support for Ethereum, BNB Chain, Avalanche, Polygon, and has handled $10 billion total trading volume.

Kyber’s automated liquidity market maker DMM increases slippage tolerance and liquidity efficiency.

For governance and liquidity stake rewards, users utilize KNC tokens, thus making it an appealing option for DeFi investors.

| Feature | Details |

|---|---|

| Token Name | KNC (Kyber Network Crystal) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum and other Layer-2 networks |

| Purpose | Aggregates liquidity from decentralized exchanges for optimal trades |

| Use Case | Liquidity provision, governance, and staking |

| Total Supply | 226,000,000 KNC tokens |

| KYC Requirement | Minimal KYC for using Kyber Network’s platform |

| Token Utility | Governance voting, staking rewards, and liquidity provision |

| Current Market | Available on major exchanges (e.g., Binance, Uniswap, KyberSwap) |

| Security | Audited by top security firms |

| Staking Opportunities | Yes, staking for yield generation |

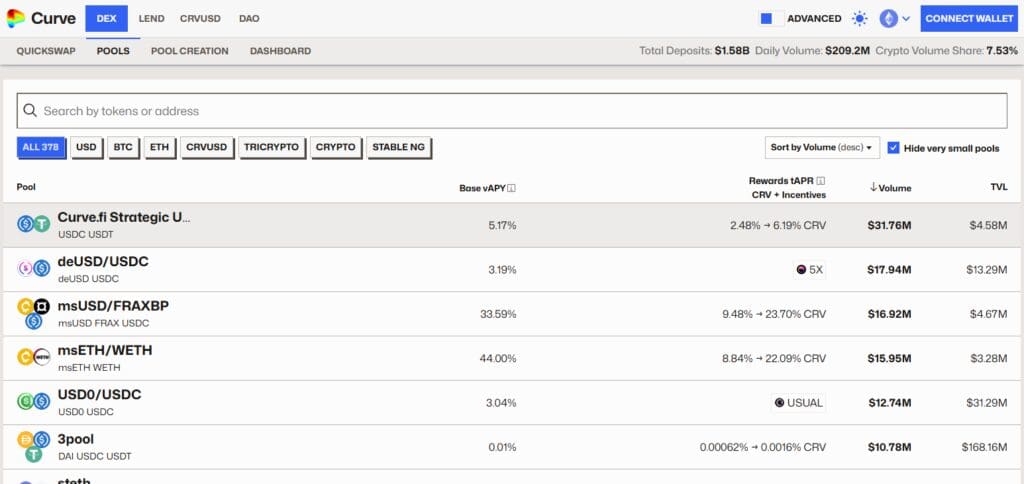

9. Curve Finance (CRV Token)

Curve Finance enables efficient trading of wrapped assets and stablecoins with minimal slippage.

With a total value locked (TVL) of over $4 billion, Curve is one of the largest decentralized finance (DeFi) protocols alongside Balancer.

Its utility token CRV is earned through governance and staking while being actively distributed to liquidity providers.

CRV becomes an essential asset through CRV lock strategies incorporated in the Yearn Finance and Convex Finance ecosystems.

| Feature | Details |

|---|---|

| Token Name | CRV (Curve Finance) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum, Polygon, Avalanche, and other Layer-2 networks |

| Purpose | Aggregates liquidity for stablecoin swaps and optimized trading routes |

| Use Case | Governance, staking, and liquidity provision |

| Total Supply | 3,303,030,299 CRV tokens |

| KYC Requirement | Minimal KYC for using Curve Finance’s platform |

| Token Utility | Governance voting, staking rewards, liquidity provision |

| Current Market | Available on major exchanges (e.g., Binance, Curve Finance) |

| Security | Audited by leading security firms |

| Staking Opportunities | Yes, staking for rewards and liquidity provision |

10. Balancer (BAL Token)

Balancer is an automated portfolio manager as well as a decentralized exchange that allows users to create custom liquidity pools.

$1.5 billion fueled Balancer’s TVL alongside support for progressive macroeconomic policies such as dynamic weight distribution which sets it apart from other Automated Market Makers (AMMs).

The BAL token is used in governance and as a liquidity reward which can be earned by staking in the protocol. BAL is one of the leading tokens in crypto, therefore remains a profitable investment alongside other DeFi platforms.

| Feature | Details |

|---|---|

| Token Name | BAL (Balancer) |

| Type | DeFi Aggregator Token |

| Platform | Ethereum and other Layer-2 networks |

| Purpose | Aggregates liquidity from multiple DEXs and optimizes trading routes |

| Use Case | Governance, staking, and liquidity provision |

| Total Supply | 100,000,000 BAL tokens |

| KYC Requirement | Minimal KYC for using Balancer’s platform |

| Token Utility | Governance voting, staking rewards, and liquidity provision |

| Current Market | Available on major exchanges (e.g., Binance, Uniswap, Balancer) |

| Security | Audited by leading security firms |

| Staking Opportunities | Yes, staking for rewards and liquidity provision |

Conclusion

To sum up, aggregator tokens of DeFi protocols provide a special chance for profit chasing investors wanting enhanced liquidity with lowered slippage. Uniswap, SushiSwap, Curve Finance and many more work to improve the services necessary for better performing decentralized trading.

Although getting started is simple with low KYC requirements, an investor must assess each token for its utility, staking possibilities, and overall security.

These DeFi aggregator tokens, as sited above, such also have huge possibilities to govern some aspects of decentralized finance and provide rewarding staking for long term holders.