In this article , I will cover the Best Defi Lending Platforms For Stablecoins, considering the available advanced options in the decentralized finance landscape.

Furthermore, these platforms facilitate unlocking stablecoins, enabling lending, borrowing, and earning interest—all tailored to specific needs. If your interest is in security, flexibility, or high yields, there are all types of platforms available.

Key Point Best Defi Lending Platforms For Stablecoins List

| Platform | Key Feature |

|---|---|

| Aave | Decentralized lending and borrowing protocol |

| Compound | Algorithmic money market protocol |

| MakerDAO | Decentralized stablecoin protocol (DAI) |

| Curve Finance | Automated market maker (AMM) for stablecoins |

| Yearn Finance | Yield optimization and aggregation platform |

| Instadapp | Smart DeFi asset management platform |

| Balancer | AMM and decentralized exchange with liquidity pools |

| Venus Protocol | Algorithmic money market and synthetic assets platform |

| Alpaca Finance | Leverage yield farming protocol |

| Cream Finance | A decentralized lending and borrowing protocol, offering a wide range of assets, including lesser-known tokens, with leverage options and a decentralized exchange for efficient market access. |

1.Aave

Aave is one of the most preferred DeFi lending platforms, due to its unique flash loans and switching between stable and variable interest rates. It enables borrowing and lending with optimal liquidity and flexibility.

The advanced security system, support of numerous assets, and the possibility of autonomous governance, diversifies Aaves appeal and stands it out in the ocean of DeFi services, especially in use of stablecoins.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Available across multiple blockchain networks, including Ethereum, Polygon, and Avalanche. |

| Supported Assets | Wide range of stablecoins like USDT, USDC, DAI, and more. |

| Interest Rates | Competitive APYs for lenders and borrowers. |

| Security Features | Open-source smart contracts, audited for transparency and safety. |

| Ease of Use | User-friendly interface with integration for popular wallets like MetaMask. |

| Governance | Decentralized governance through AAVE token holders. |

| Unique Features | Flash loans and collateral swapping for advanced DeFi users. |

| Pricing | No platform fees; transaction costs depend on the blockchain network used. |

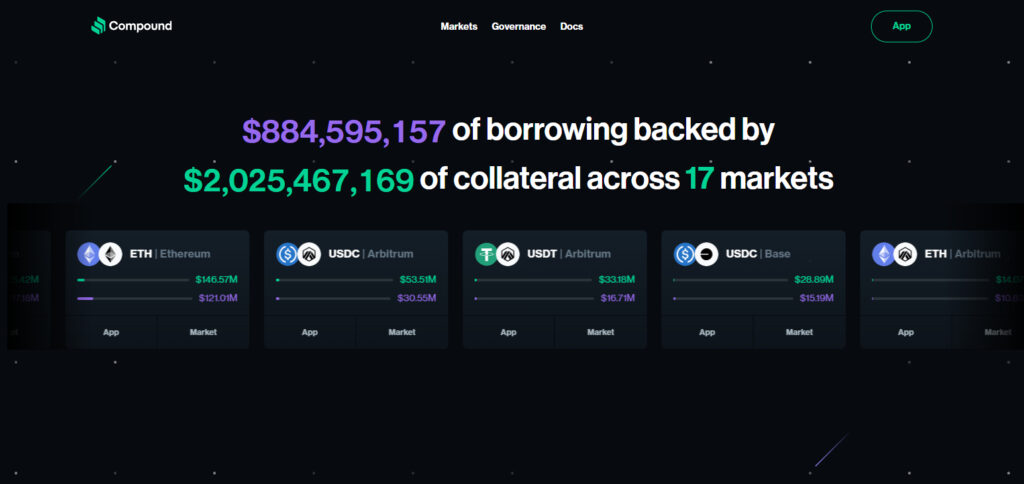

2.Compound

Compound is one of the best platforms for lending DeFi stablecoins because of its high efficiency, remarkable system, and transparency in interest earning and asset borrowing.

The algorithmic market-making model takes care of the competitiveness of the platform’s dynamically adjustable interest rates. Users decentralized governance which allows them to make protocol decision which are community driven.

With its reputation for security, Compound remains one of the most preferred platform for stablecoin lending and borrowing due to its liquidity pools and streamlined affiliation structures.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on Ethereum and supports integration with other DeFi protocols. |

| Supported Assets | Stablecoins like USDT, USDC, and DAI, among others. |

| Interest Rates | Algorithmically determined rates based on supply and demand. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | Simple interface with integration for popular wallets like MetaMask. |

| Governance | Decentralized governance through COMP token holders. |

| Unique Features | Allows users to earn interest or borrow assets directly from their wallets. |

| Pricing | No platform fees; transaction costs depend on Ethereum gas fees. |

3.MakerDAO

MakerDAO stands out as one of the top DeFi lending platforms that caters to stablecoin users, thanks to its unique system for collateralized DAI generation.

With MakerDAO, users can lock their DAI and borrow through low-interest loans, which ensures that the DAI token’s value is stable due to it’s governed by MakerDAO’s decentralization.

Stablecoin lending in DeFi ecosystems is made easier by MakerDAO’s sophisticated balance of incentivized risk frameworks and trust in its community-driven governance.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on Ethereum and integrates with over 400 DeFi platforms. |

| Supported Assets | Stablecoin DAI, backed by a variety of cryptocurrencies as collateral. |

| Interest Rates | Algorithmically determined rates based on collateral and market conditions. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface for generating and managing DAI. |

| Governance | Decentralized governance through MKR token holders. |

| Unique Features | Overcollateralization ensures stability and reduces risks. |

| Pricing | No platform fees; transaction costs depend on Ethereum gas fees. |

4.Curve Finance

Curve Finance is reputed as one of the top DeFi lending platforms for stablecoins thanks to its proprietary Adjustment Market Maker (AMM) which is fine tuned to offer minimal slippage for stablecoin swaps.

The platform helps its users trade, lend and earn stablecoins with negligible impermanent loss. Curve’s high liquidity pools and stable asset pair predominace make it optimal for stablecoin-centric defi strategies, providing users with excellent value and protection.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on multiple blockchain networks, including Ethereum, Polygon, and Avalanche. |

| Supported Assets | Focuses on stablecoins like USDT, USDC, DAI, and others. |

| Interest Rates | Competitive rates with low slippage for stablecoin trading. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface with seamless wallet integration. |

| Governance | Decentralized governance through CRV token holders. |

| Unique Features | Automated Market Maker (AMM) model for efficient stablecoin swaps. |

| Pricing | No platform fees; transaction costs depend on the blockchain network used. |

5.Yearn Finance

Yearn’s Yield Optimizer is a well-known DeFi lending/borrowing protocol. It is popular for its yield optimization strategy. Set it and forget it. Automated yield strategies allow for effortless participation while withdrawal compatibility guarantees control at any time.

Like many other DeFi lending protocols, Yearn aggregates liquidity with other protocols to provide its users the best returns.

Given its decentralized nature and focus on lending backed by stablecoin assets, it’s considered a reliable and efficient lending platform. It enables users to achieve stable returns with reduced risk.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on Ethereum and integrates with multiple DeFi protocols. |

| Supported Assets | Stablecoins like USDT, USDC, DAI, and others. |

| Interest Rates | Optimized yield strategies for competitive returns. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface with automated yield optimization. |

| Governance | Decentralized governance through YFI token holders. |

| Unique Features | Vaults for automated yield farming and liquidity provision. |

| Pricing | No platform fees; transaction costs depend on Ethereum gas fees. |

6.Instadapp

Instadapp offers one of the most sophisticated interfaces available for managing and optimizing different DeFi strategies across numerous platforms.

It is one of the most best rated DeFi lending platforms for stablecoins since users can easily add and use stablecoin lending, borrowing, and yield farming in a single dashboard.

Its specialized smart wallet allows effective asset management, while its multi-protocol support guarantees best rates. This makes it a preferred straightforward and optimized DeFi’s for stablecoin lovers.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on Ethereum and integrates with multiple DeFi protocols. |

| Supported Assets | Stablecoins like USDT, USDC, DAI, and others. |

| Interest Rates | Optimized yield strategies for competitive returns. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface with advanced smart wallet features. |

| Governance | Decentralized governance through INST token holders. |

| Unique Features | DeFi Smart Accounts for seamless cross-protocol transactions. |

| Pricing | No platform fees; transaction costs depend on Ethereum gas fees. |

7.Balancer

Yearn Finance is one of the best platforms for DeFi lending of stable coins. It’s well known for their yield optimization strategy. They not only aggregate stable coins but also automatically pull liquidity from various platforms to give the best returns to lenders, ensuring that manual efforts are minimal.

Its automated strategies and decentralized nature guarantee that users get the best yields with the least possible effort.

Bots aid in the consistent lending out of stable currencies on its network, and because it is propped by other stable assets, it allows for reliable lending to be done on its network, eliminating the worries about risks potential lenders would incur.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on multiple blockchain networks, including Ethereum and Polygon. |

| Supported Assets | Stablecoins like USDT, USDC, DAI, and others. |

| Interest Rates | Competitive rates with efficient liquidity pools for stablecoin trading. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface with customizable pool configurations. |

| Governance | Decentralized governance through BAL token holders. |

| Unique Features | Automated Market Maker (AMM) model for efficient and flexible liquidity provision. |

| Pricing | No platform fees; transaction costs depend on the blockchain network used. |

8.Venus Protocol

Venus Protocol is a decentralized lending and borrowing platform in the market. Users can synthesize assets while also borrowing or lending on this unique platform. Users are allowed to collateralize assets to borrow stablecoins with low transaction fees.

Venus runs on the Binance Smart Chain which provide efficient and DeFi friendly cost metrics along side highly scalable stablecoin lending and borrowing system. This infrastructure brings forth new opportunities for users at a greater extent with lower costs.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on Binance Smart Chain (BSC) for fast and low-cost transactions. |

| Supported Assets | Stablecoins like USDT, USDC, DAI, and the protocol’s native stablecoin VAI. |

| Interest Rates | Competitive rates determined algorithmically based on supply and demand. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface with seamless wallet integration. |

| Governance | Decentralized governance through XVS token holders. |

| Unique Features | Supports overcollateralized borrowing and minting of VAI stablecoin. |

| Pricing | No platform fees; transaction costs depend on Binance Smart Chain fees. |

9.Alpaca Finance

Alpaca Finance is an advanced DeFi lending platform for stablecoins and offers leveraged yield farming. Users can borrow stablecoins and increase their positions in yield farming strategies to yield higher returns, making Alpaca a sought-after platform.

With regard to risk management, Alpaca balances their focus of yield optimization with low borrowing costs, making it an industry leader for stablecoin lending. Its unique strategy of earning high profits while simultaneously optimizing for low costs and high security resources is unmatched in the market.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on Binance Smart Chain (BSC) and Fantom for fast and low-cost transactions. |

| Supported Assets | Stablecoins like USDT, USDC, DAI, and others. |

| Interest Rates | Competitive rates with leveraged yield farming opportunities. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface with advanced yield farming tools. |

| Governance | Decentralized governance through ALPACA token holders. |

| Unique Features | Leveraged yield farming and automated vaults for optimized returns. |

| Pricing | No platform fees; transaction costs depend on Binance Smart Chain fees. |

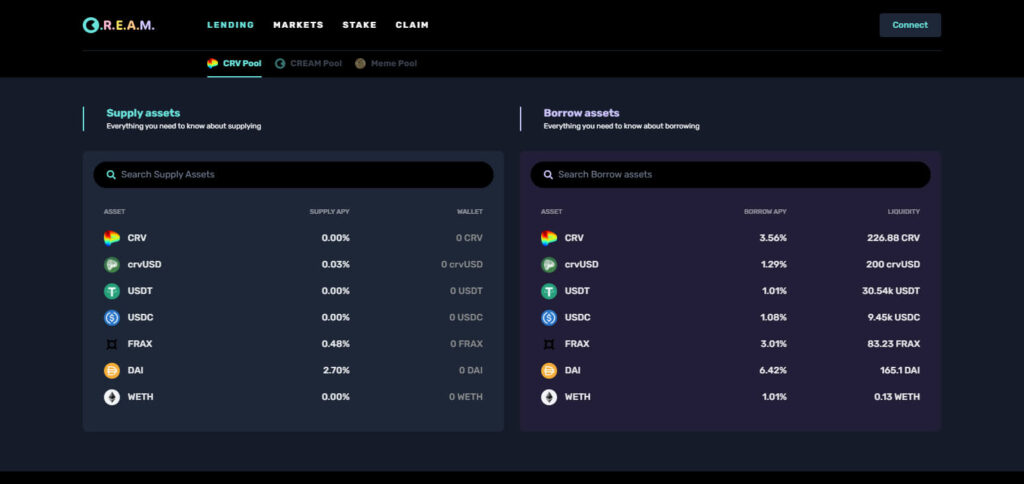

10.Cream Finance

Cream Finance is among the top DeFi lending platforms for stablecoins, gives numerous options for lending and borrowing. Its unique feature is the ability to support both mainstream and lesser-known tokens, including stablecoins, across different blockchains.

With decentralized governance and competitive interest rates, Cream Finance is best for stablecoin lending because of its flexibility. It further increases liquidity and user experience with cross-chain compatibility.

| Feature | Details |

|---|---|

| Privacy | Non-custodial platform with no mandatory KYC requirements. |

| Global Accessibility | Operates on Ethereum, Binance Smart Chain (BSC), and Fantom. |

| Supported Assets | Stablecoins like USDT, USDC, DAI, and others, along with a wide range of cryptocurrencies. |

| Interest Rates | Algorithmically determined rates based on supply and demand. |

| Security Features | Open-source smart contracts audited for transparency and safety. |

| Ease of Use | User-friendly interface with seamless wallet integration. |

| Governance | Decentralized governance through CREAM token holders. |

| Unique Features | Supports lending and borrowing of long-tail assets and LP tokens. |

| Pricing | No platform fees; transaction costs depend on the blockchain network used. |

Conclusion

To summarize, the best DeFi stablecoin lending platforms such as Aave, Compound, MakerDAO, Curve Finance, Yearn Finance, Instadapp, Balancer, Venus Protocol, Alpaca Finance and Cream Finance have unique offering for every user.

Regardless if it is yield farming, governance, or cross-chain liquidity, all platforms enable users to lend stablecoins in a secure and decentralized network. Depending on the platform, users can select placing investments according to their risk tolerance, liquidity needs, and investment objectives.