I will talk about the Top Money Transfer Services Vs. Bank Transfers and how new services are more efficient. Cross-border transfers are becoming easier thanks to companies like Wise, Revolut, and Remitly.

Their rapid fee processing, favorable exchange rates, and lower fees are a game changer in comparison to the outdated traditional methods.

Key Points Top Money Transfer Services Vs. Bank Transfers List

| Service | Key Advantage |

|---|---|

| Wise | Low, transparent fees |

| Revolut | Multi-currency accounts |

| Remitly | Fast cash delivery |

| XE Money Transfer | Fee-free transfers |

| PayPal (Xoom) | PayPal integration |

| WorldRemit | Mobile money top-ups |

| OFX | 24/7 support and forward contracts |

| CurrencyFair | Peer-to-peer rate matching |

| MoneyGram | Global reach with physical locations |

| Atlantic Money | Fixed, low-cost pricing |

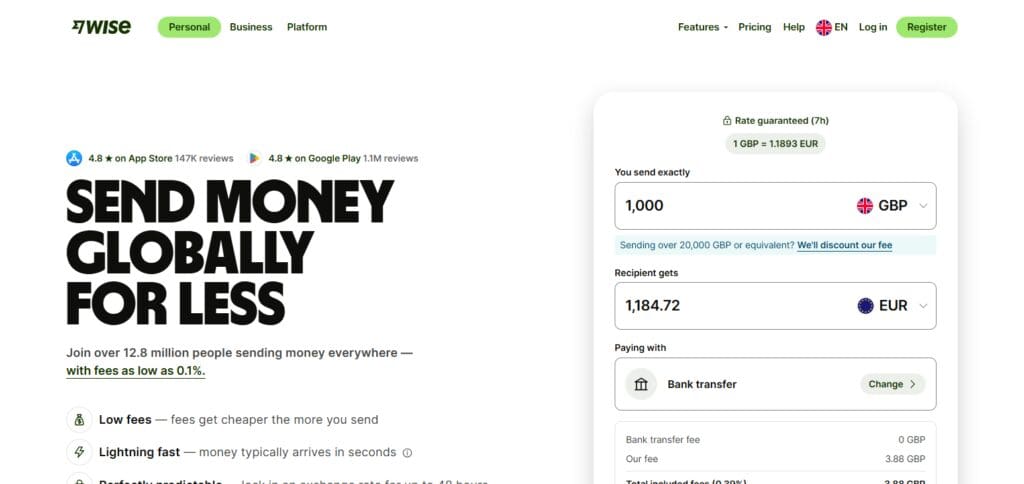

1. Wise (Formerly TransferWise)

Wise claims that banks charge unreasonable fees for transfers. The company has come up with the best solution by offering mid-market exchange rates along with simple, comprehensible fees of 0.4% to 1%.

This is significantly lower than what banks charge their customers, which is usually around 3%-5%. Customers can expect a more efficient service from Wise, as they processed their transfers within two days while banks can take 3-5 days to do the same.

Furthermore, TransWise users do not have to worry about falling prey to hidden fees whilst making ulse the transfers as Wise boasts a zero hidden fee policy.

On the other hand, banks tend to charge undisclosed mark up costs while concealing a lot of additional expenses which boost the price of each transaction.

Wise (Formerly TransferWise) Features

- Charges Fees That Are Easy to Understand and Low: Uses 0.4%-1% of their exchange rate margin compared to the banks’ margins of 3%-5%.

- Most Economical Mid-Market Rates: Real exchange rates without any hidden cutbacks are used.

- Quick Money Transfer: Transfers quicker than the banks that range between 3-5 days, where Wise transfers take 1-2 days.

- Support For Multi-Currencies: Ability to hold and convert a variety of currencies.

- User-Friendly Platform: Provides easy breakdown of fees and its information online is also concise.

2. Revolut

This is still remarked provided by industry Revolut claims that unlike banks, which charge between $20-$50 per international transfer for fee Relout does not charge anything for internal user.

In addion, Relout allows Multi Currency account that enables users from managing Retout to Retout takes an instant while other transfeerc can take one to three days, even it takes less time as compared to banks.

Besides accounts, banks users typically begin multi currency accounts with sitgult higher conversioning rate markup expenses.

Revolut Features

- No Charges Fee Transfers: Transactions between Revolut members have no fee.

- Accounts of Multi-Currencies: Over 40 currencies supported.

- Rate Of Exchange Remaining Lots: Lower than what the banks charge bluntly.

- Fast:For Revolut to Revolut users, it’s instantaneous while for others: 1-3 days.

- Mobile App: With managing money comes easy tracking of spending.

3. Remitly

Remitly provides a much more forgiving, flexible and budget friendly alternative. Customers can now expect lower transfer fees (as low as $3.99 for express transfers) compared to banks who normally charge anywhere between $25 to $45 depending on mode and speed of transfer.

With Remitly, economy transfers only take between three to five days, and express transfers are conducted instantly.

In addition, the transfers exceed the speed at which banks typically operate. Remitly outshines its competition in terms of delivery options.

Cash pickup and mobile wallet transfers, which are not available through banks, make Remitly the number one choice for users looking to conduct urgent and flexible money transfers.

Remitly Features

- Easy on the Wallet:Express $3.99 compared to the banks’ $25-$45 fee.

- Expedited Speed: As low as a couple of minutes with economy transfers taking 3-5 days.

- Various Delivery Options: Cash pickup, mobile wallet, and bank deposit options available.

- Over 100 Countries: Having availability in 100+ countries means having global reach.

- Various Modes of Payment: Debit/Credit card, bank transfers, or cash pick ups.

4. XE Money Transfer

XE Money Transfer differs from banks by removing fees on the majority of transactions, which most banks charge somewhere between $15 and $50 per transfer.

Mid-market exchange rate users utilize American XE to conduct their transfers, which in turn gives users better value.

Traditional bank wires can take anywhere from one to four days, which XE has become known for surpassing.

Another defining feature of XE is the access it provides users to over 100 currencies, a number limited by banks making it ideal for individuals frequently dealing with numerous international currencies.

XE Money Transfer Features

- No Fees Relating To Transfer: Unlike banks, is fee-free for most transactions.

- Real Mid-Market Rates: Real exchange rate are fairly close to the rates.

- Little to No Delays: Often within 1-4 days, quicker than the majorities of banks.

- 100+ Currencies: Large database from which to choose range of supported currencies.

- Transfers For Business Entities: Provides solutions for businesses and individuals.

5. PayPal (via Xoom)

PayPal’s money transfer service, Xoom, allows for easy cash transfers with a specific fee for a specific payment method such as card payments, which incur a reasonable fee of only $4.99.

Unlike banks, PayPal also does not impose a percentage-based fee. Xoom provides users with an ultra swift speed, enabling customers to pick up cash anywhere from a couple of minutes to two hours. Xoom also beats the standard processing times set by banks.

One of the things which makes Xoom stand out compared to its competition is its association with PayPal, which offers digital flexibility unlike most banks that are user unfriendly.

PayPal Features

- Flat Fees: $4.99 on card transactions with no purchase amount restriction.

- Speed: Cash pickups are quicker than bank transfers, within 2 hours.

- Integration: Link other Paypal accounts seamlessly.

- Convenient Online Platform: Highly accessible, broad market reach.

- Global Reach: Xoom service is offered in over 160 countries.

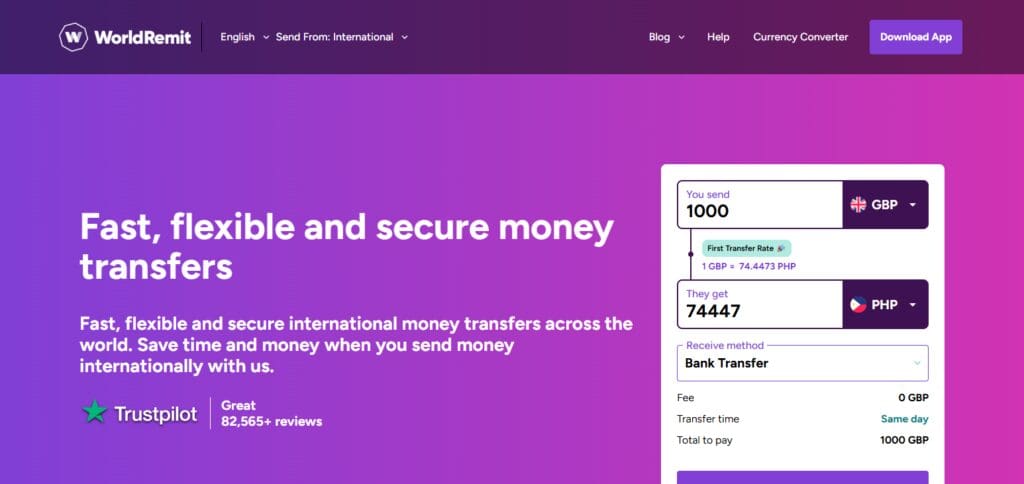

6. WorldRemit

WorldRemit charges $3-$5 dollars per transaction, making them cheaper than the banks. It allows mobile money top up which is not done by traditional banks.

The vast majority of their transfer are done instantly or in the same day for a lot of routes which makes it much quicker than bank transfers.

WoldRemit also provides for more than 130 countries with cash pickup options which make side much more accessible than banks who do not have a strong global presence.

WorldRemit Features

- Low Fees: $3 to $5 cheaper than other alternatives.

- Fast Transfers: Mony is available within the day for major routes.

- Multiple Delivery Options: Mobile money, bank deposits, as well as cash.

- Global Network: Services offered in 130 countries worldwide.

- Flexible Payment Methods: Payments accepted via cards and mobile wallets too.

7. OFX

Within the UK, OFX is a cheap alternative to the big banks as there are no fees on transfers over $10,000 unlike most banks whom impose a fee regardless of transfer size. Banks have tighter control on granule transactions.

Their process time tends to be 24-48 hours for many users they also offer a wide array of customer services available to the customers at any point in time like advanced users and non users can always benefit from having more forward contracts.

OFX Features

- No Fees on Large Transfers: Free of charge for over $10,000.

- Competition on Local Markets: Better than most banks.

- Speed: Estimated 24-48 hours.

- 24/7 Support: Customer support available all day.

- Forward Contracts: Set exchange rates ideally for planned transfers.

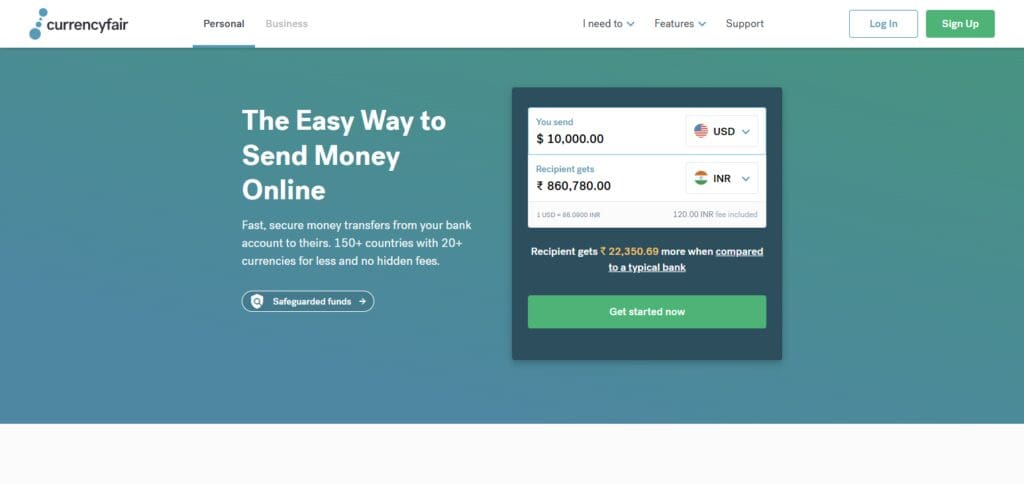

8. CurrencyFair

Unlike the banks’ $20 or more fees, CurrencyFair’s €3 per transaction is much lower for most people.

Users can effortlessly swap currencies for better rates than banks offer with the CurrencyFair P2P marketplace enabling rate setting.

CurrencyFair is comfortably placed to compete with banks on the price of transfer fees while offering a service that takes 1-5 days to complete. Transfers with CurrencyFair are also cheaper.

Fixed exchange rates offered by banks with unfavorable margins provide CurrencyFair with a competitive edge when users want to exchange money.

CurrencyFair Features

- Low Fees: €3 flat fee is cheaper than banks.

- Peer-to-Peer Exchange: Users set individual exchange rates which most of the time are lower than the bank’s.

- Speed: 1-5 days.

- Competition: Lower than the bank fixed margins.

- Multi-Currency Account Support: Can hold as well as exchange multiple currencies.

9. MoneyGram

MoneyGram currently provides one of the cheapest options available for international money transfer with their fee starting at $1.99, whereas, banks usually start at $25 or more.

MoneyGram’s greatest strength lies with the speed – pickups are done within minutes, which is much faster than bank transfers.

Moreover, in addition to enabling several digital services, MoneyGram has a large number of physical locations in over 200 countries,

Which allows people to get services with an ease that most banks don’t offer since they rely heavily on account-to-account transactions.

MoneyGram Features

- Low Online Fees: Minimum fee $1.99 opposed to $25 of the banks.

- Fast Cash Pickup: Transfer expected in minutes.

- International Traffic: More than 200 countries with physical presence.

- Variety of Payment Forms: Bank transfer, cash, credit, and debit card.

- App Designed for Ease of Use: Minimal effort required to track and manage transfers.

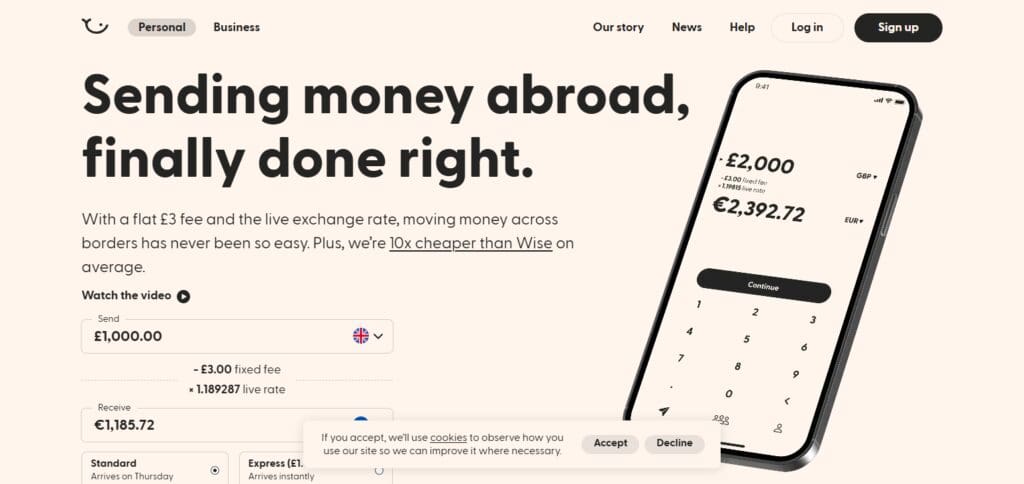

10. Atlantic Money

Atlantic Money’s pricing strategy also sets them apart. No other company offers a set transfer charge of £3 for amounts of up to 1 million.

Banks typically scale with size, this makes transfers a lot more predictable and easier to manage.

While standard transfers can last up to 3 days, users can take up instant transfers for 1 pound, a service that banks are frail to offer.

The most notable feature of Atlantic Money is its cost predictability that spares users from the often concealed and changing fees of regular banks.

Atlantic Money Features

- Charge per Transfer: £3, whether the transfer is £1 or up to £1 million.

- Close to Mid-Market Rates: Bulked up less than banks.

- Punctuality: Up to 3 days, instant for an additional £1 charge.

- Cost Certainty: Pricing tends to be fixed and clear, no hidden costs.

- User Friendly Online Platform: Simple and straight forward design.

Conclusion

While traditional bank transfers have their own advantages, money transfer services like Wise, Revolut, and CurrencyFair have made transfer dealings cheaper, faster, and flexible. Unlike the banks’ hidden costs, these platforms have lower transparent fees along with better exchanging rates.

Other services like Remitly, MoneyGram, and WorldRemit are superior in speed and accessibility. They are able to provide instant or same day cash transfers along with mobile wallet features – something traditional banks are not able to provide.

Moreover, business transactions also get ideal solutions through providers like OFX and Atlantic Money which have zero or very low fees for large transfers. PayPal (via Xoom) and XE Money Transfer are great options in terms of convenience and have an extensive global coverage making them fast and reliable.

In sum, these transfer services greatly exceed banks in all aspects provided, with ease and efficiency as aid for completing international or frequent money transfers effectively.