In this article, i will discuss the Best Online Banks With No Atm Fees they offer to clients that have no ATM fees and no extra charges whilst using their services.

These banks also posses great quality service features such user friendly banking services, having extended ATM services available, and having low interest rates which makes them highly rated among people looking for easy and affordable banking services.

Key Point & Best Online Banks With No Atm Fees List

| Bank | Key Points |

|---|---|

| Ally Bank | High interest rates, no monthly fees, robust online banking tools, 24/7 customer service. |

| Discover Bank | Cashback rewards on checking, competitive savings rates, no fees for overdrafts or monthly charges. |

| Charles Schwab Bank | High-yield checking, no foreign transaction fees, linked with Schwab brokerage for investments. |

| Capital One 360 | No monthly fees, competitive savings rates, strong mobile app features, useful budgeting tools. |

| SoFi | High interest savings, loans, no fees, financial planning tools, integrated with investment services. |

| Axos Bank | Strong mobile app, multiple types of checking accounts, competitive savings rates, low fees. |

| NBKC Bank | High-interest checking, minimal fees, strong customer service, online and mobile banking. |

| EverBank | No monthly fees, early direct deposit, strong mobile app, linked savings account. |

| Fidelity Cash Management | Investment-linked checking, competitive rates, no monthly fees, linked to Fidelity brokerage accounts. |

| Quontic Bank | No fees, high-yield savings, early direct deposit, and mobile app features. |

1.Ally Bank

With its vast network of ATMs and great customer service, Ally Bank emerges as one of the top online banks with no ATM charges. Ally has more than 43,000 Allpoint ATMs around the country, providing no-cost access to cash.

They have competitive interest rates on savings accounts and an easy-to-use mobile banking application, allowing for a seamless banking experience that isn’t burdened with costs or unexpected fees.

| Feature | Details |

|---|---|

| Platform Name | Ally Bank |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at Allpoint® ATMs; reimburses up to $10 per statement cycle for out-of-network ATM fees |

| Account Types | Savings, Checking, Money Market, and CDs |

| Interest Rates | Competitive rates on savings and CDs |

| Payment Methods | Online transfers, Zelle®, and mobile check deposits |

| Security Features | FDIC insured, two-factor authentication (2FA), and online security guarantee |

| Additional Features | 24/7 customer support, user-friendly mobile app, and no monthly maintenance fees |

2.Discover Bank

Discover Bank is the best online bank with no ATM fees as it offers more than 60,000 ATMs across the country through the Allpoint network.

Its cashback checking account is its unique proposition as customers can earn money without paying any fees.

Discover also has international access and does not charge foreign transaction fees ensuring a simple and easy to understand bank with no fees or costs hidden to customers.

| Feature | Details |

|---|---|

| Platform Name | Discover Bank |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at over 60,000 ATMs in their network; reimburses out-of-network ATM fees up to a certain limit |

| Account Types | Checking, Savings, Money Market, and Certificates of Deposit (CDs) |

| Interest Rates | Competitive rates on savings and CDs |

| Payment Methods | Online transfers, Zelle®, and mobile check deposits |

| Security Features | FDIC insured, encryption, fraud monitoring, and two-factor authentication (2FA) |

| Additional Features | No monthly fees, cashback rewards on debit card purchases, and 24/7 customer support |

3.Charles Schwab Bank

Charles Schwab Bank offers unlimited reimbursement for ATM withdrawals globally at no cost, which makes it eligible to be one of the best online banks.

It also provides services like fee-less access to cash, making it superb for frequent travelers.

Moreover, Schwab also offers their clients competitive interest rates on Checking accounts, which combines with their strong investing services and makes it convenient for people seeking versatile banking and investing solutions all charge-free.

| Feature | Details |

|---|---|

| Platform Name | Charles Schwab Bank |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at any ATMs worldwide; unlimited ATM fee reimbursements |

| Account Types | Investor Checking, Savings, and Brokerage-linked accounts |

| Interest Rates | Competitive rates on savings and checking accounts |

| Payment Methods | Online transfers, mobile check deposits, and bill pay |

| Security Features | FDIC insured, two-factor authentication (2FA), and fraud monitoring |

| Additional Features | No foreign transaction fees, seamless integration with brokerage accounts, and 24/7 customer support |

4.Capital One 360

Capital One 360 is one of the best online banks I came across that doesn’t charge ATM fees and partners with Allpoint Network to give access to over 39000 ATMs.

What makes Capital One 360 extraordinary is the efficient mobile app, effortless integration with other Capital One services, and no monthly fee.

Whether it is withdrawing cash or handling finances, everything is quite simple and affordable with Capital One 360 and their online banking services.

| Feature | Details |

|---|---|

| Platform Name | Capital One 360 |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at over 70,000 ATMs in their network, including Allpoint® and MoneyPass® ATMs |

| Account Types | Checking, Savings, and Money Market Accounts |

| Interest Rates | Competitive rates on savings and checking accounts |

| Payment Methods | Online transfers, Zelle®, and mobile check deposits |

| Security Features | FDIC insured, two-factor authentication (2FA), and fraud monitoring |

| Additional Features | No monthly fees, early paycheck access, and a user-friendly mobile app |

5.SoFi

SoFi is one of the best choices for online banks that do not charge fees for using an ATM. They have a prominent feature of no monthly fees on the account and rewards on spending with its SoFi Credit Card .

Furthermore, the integration with the Investment and loan products is done easily, providing customers a wholesome experience without the burden of ATM fees.

| Feature | Details |

|---|---|

| Platform Name | SoFi (Social Finance) |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at over 55,000 ATMs in the Allpoint® network |

| Account Types | Checking and Savings Accounts |

| Interest Rates | Competitive rates, including high-yield savings options |

| Payment Methods | Online transfers, mobile check deposits, and bill pay |

| Security Features | FDIC insured, two-factor authentication (2FA), and fraud monitoring |

| Additional Features | No monthly fees, early paycheck access, and cashback rewards on purchases |

6.Axos Bank

With Axos Bank, there’s no fee for online banking, plus they open the gate to more than 24,000 ATMs available across the USA.

Axos is best known for its checking and saving accounts that do not require a monthly maintenance fee and having an all-in-one mobile app makes banking all the more easier.

And, as an icing on the cake, it’s so affordable that you bank on the go for no extra charges at all.

| Feature | Details |

|---|---|

| Platform Name | Axos Bank |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at any domestic ATMs; unlimited ATM fee reimbursements |

| Account Types | Checking, Savings, Money Market, and Certificates of Deposit (CDs) |

| Interest Rates | Competitive rates on savings and CDs |

| Payment Methods | Online transfers, mobile check deposits, and bill pay |

| Security Features | FDIC insured, two-factor authentication (2FA), and biometric authentication |

| Additional Features | No monthly fees, early direct deposit, and a user-friendly mobile app |

7.NBKC Bank

NBKC Bank is well rated among the list of the best online banks with no ATM fees because it is part of the Allpoint network that has over 32,000 ATMs all over the country.

Its one of a kind advantage is the high interest checking account with no monthly fees offered alongside superb customer support. With NBKC, users can also enjoy hassle-free online banking services which makes the bank is a great option for customers searching for fee-free ATM access and a simple banking service at the same time.

| Feature | Details |

|---|---|

| Platform Name | NBKC Bank |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at over 37,000 MoneyPass® ATMs; reimburses up to $12 per month for out-of-network ATM fees |

| Account Types | Checking, Savings, Money Market, and Certificates of Deposit (CDs) |

| Interest Rates | Competitive rates on savings and CDs |

| Payment Methods | Online transfers, mobile check deposits, and bill pay |

| Security Features | FDIC insured, two-factor authentication (2FA), and fraud monitoring |

| Additional Features | No monthly fees, user-friendly mobile app, and 24/7 customer support |

8.EverBank

Once known as EverBank, TIAA Bank is one of the top contenders for having exceptional online banking services without any ATM fees, providing access to more than 80,000 fee-free ATMs via Allpoint and Publix Networks.

They also stand out for their high-interest checking and saving accounts, ensuring plenty of ROI for the customers’ account balances. On top of that, EverBank customers enjoy hassle-free online banking services, which means they don’t have to worry about ATM fees while managing their finances.

| Feature | Details |

|---|---|

| Platform Name | EverBank |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at any ATMs; reimburses ATM fees charged by other banks |

| Account Types | Checking, Savings, Money Market, and Certificates of Deposit (CDs) |

| Interest Rates | Competitive rates on savings and CDs |

| Payment Methods | Online transfers, Zelle®, and mobile check deposits |

| Security Features | FDIC insured, two-factor authentication (2FA), and fraud monitoring |

| Additional Features | No monthly fees, high-yield accounts, and a user-friendly mobile app |

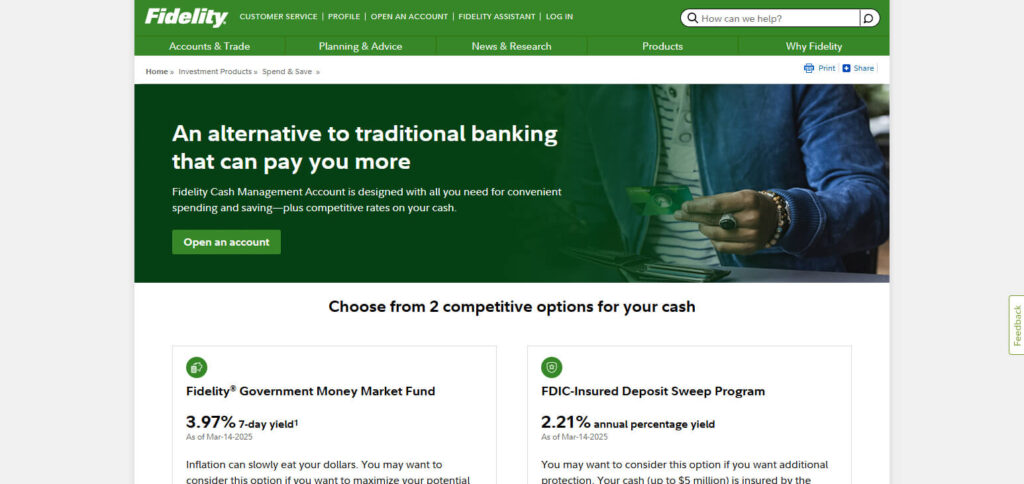

9.Fidelity Cash Management Account

Fidelity Cash Management Account stands out as one of the best online banks, offering fee-free transactions at more than 24,000 ATMs via the Allpoint network.

Its best feature has to be how well it integrates with Fidelity’s investment platform; moving funds from your cash account to your investment accounts is extraordinarily effortless.

Fidelity also offers the account holder a highly attractive interest rate with no monthly fees, which helps to cover both the banking and investment aspects.

| Feature | Details |

|---|---|

| Platform Name | Fidelity Cash Management Account |

| Type | Cash Management Account (functions like an online bank account) |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at any ATMs worldwide; unlimited ATM fee reimbursements |

| Account Types | Cash Management Account linked to brokerage services |

| Interest Rates | Competitive rates on cash balances |

| Payment Methods | Bill Pay, mobile check deposits, debit card, and electronic transfers |

| Security Features | FDIC insured (up to $5 million), two-factor authentication (2FA), and fraud monitoring |

| Additional Features | No account fees, no minimum balance, and integration with Fidelity investment accounts |

10.Quontic Bank

Quontic Bank is proving to be one of the best online banks that do not charge ATM fees. This is because they provide unlimited access to over 32,000 ATMs through the Allpoint network.

What particularly stands out about Quontic is its innovative high-yield checking account and Bitcoin rewards feature, which enables clients to receive cryptocurrency for purchases. Additionally, Quontic has no monthly charges which is beneficial for people seeking modern banking services without fees.

| Feature | Details |

|---|---|

| Platform Name | Quontic Bank |

| Type | Online Bank |

| KYC Requirements | Minimal KYC for account opening |

| ATM Fees | No fees at over 90,000 ATMs in their network; reimburses out-of-network ATM fees |

| Account Types | Checking, Savings, Money Market, and Certificates of Deposit (CDs) |

| Interest Rates | Competitive rates on savings and CDs |

| Payment Methods | Online transfers, mobile check deposits, and bill pay |

| Security Features | FDIC insured, biometric authentication, and fraud monitoring |

| Additional Features | No monthly fees, innovative Pay Ring for contactless payments, and a user-friendly mobile app |

Conclusion

To sum up, the top seven online banks with no ATM fees enable clients to conveniently and affordably manage their finances with mobile and ATM banking.

Ally, Discover, Charles Schwab, Capital One 360, SoFi, Axos, NBKC, Chime, Fidelity, and Varo are some of the best banks that users can capitalize on due to their unique offerings like high-yield savings accounts, cashback policies, and even investment services.