In this article, I will discuss the Best Index Coop Defi Index Coins that provide automated, efficient, and diversified exposure across the sectors of the crypto ecosystem.

These indices aim to enhance returns while making it easier to invest into DeFi. Regardless if you’re focused on growth, yield, or balanced exposure, Index Coop has smart, theme-driven index tokens to suit your strategy.

Key Point & Best Index Coop Defi Index Coins List

| Index | Key Point |

|---|---|

| DeFi Pulse Index (DPI) | Tracks top DeFi tokens, providing diversified exposure to the DeFi sector. |

| Metaverse Index (MVI) | Represents assets in virtual worlds, NFTs, and gaming economies. |

| Data Economy Index (DATA) | Focuses on tokens driving data economies like storage, computation, etc. |

| Bankless BED Index | Equal-weight exposure to BTC, ETH, and DPI for a simple crypto portfolio. |

| ETH 2x Flexible Leverage (ETH2x-FLI) | Offers 2x leveraged exposure to ETH with automatic rebalancing. |

| BTC 2x Flexible Leverage (BTC2x-FLI) | Provides 2x leveraged exposure to BTC, dynamically adjusted. |

| Polygon Ecosystem Index (PEI) | Captures key projects and tokens within the Polygon network. |

| Interest Compounding ETH (icETH) | Enhances ETH yield through leveraged staking strategies. |

| High Yield ETH Index (hyETH) | Combines ETH with high-yield strategies for optimized returns. |

| Diversified Staked ETH (dsETH) | Diversified exposure to major liquid staking tokens for ETH. |

1. DeFi Pulse Index (DPI)

The DeFi Pulse Index (DPI) is the best Index Coop DeFi index because it offers a carefully curated selection of top-performing DeFi tokens, providing users with diversified exposure to the most impactful protocols in one asset.

What makes DPI unique is its dynamic composition—regularly adjusted to reflect the evolving DeFi landscape—ensuring it always represents innovation and relevance. For investors seeking simplified access to decentralized finance with reduced risk and strong upside potential, DPI stands out as a strategic and adaptive solution.

DeFi Pulse Index (DPI)

Purpose: Tracks pivotal decentralized finance (DeFi) protocols.

Composition: Market cap weighted composite of top DeFi tokens (ex. Uniswap, Aave, Maker) maintained by DeFi Pulse.

Key Feature: The index serves as one single vector for investment exposure to the DeFi sector without needing to manage multiple tokens.

Rebalancing: Monthly to account market cap and relevance shifts.

Accessibility: Easy passive investment into DeFi via a single token denominated in ERC-20.

2. Metaverse Index (MVI)

The Metaverse Index (MVI) captures the growth in the digital experience economy the best when compared to other digital indices offered by the Index Coop DeFi.

It integrates assets from gaming, virtual worlds, and NFT infrastructure which makes it a one-stop shop for getting into the metaverse sector.

MVI is different because of the long-term value and cultural relevance of the tokens selected—those that sustain and foster active engagement and digital stewardship. MVI offers a diversified solution those interested in the next phase of the internet evolution.

Metaverse Index (MVI)

Purpose: Captures growth of the metaverse ecosystem including gaming, NFT’s, and other virtual worlds.

Composition: Tokens like Decentraland (MANA), Sandbox (SAND), and Axie Infinity (AXS) are included and weighted by market cap.

Key Feature: To diversified exposure to the developing metaverse trend in crypto.

Rebalancing: Regular adjustments to stay aligned with the evolving metaverse space.

Use Case: Great for investors deeply bullish on the blockchain-based economy and virtual entertainment.

3. Data Economy Index (DATA)

The Data Economy Index (DATA), in our opinion, is the most efficient Index Coop DeFi index at capturing the emerging value of decentralized data infrastructure.

It centers on tokens enabling data storage, sharing, and computation which are the foundations of a more open internet. What sets DATA apart is the focus on true utility—project selection that facilitates data monetization, enabling privacy, and granting sufficient access.

For investors with vision, DATA provides tactical investment in the protocols designing the architecture of information interchange and security in Web3 environments.

Data Economy Index (DATA)

Purpose: Focuses on protocols that are driving the decentralized data economy.

Composition: Tokens such as The Graph (GRT), Chainlink (LINK), and Filecoin (FIL) are featured based in data storage, oracles, and indexing.

Key Feature: The Index provides exposure to the infrastructure powering Web3 and other data services.

Rebalancing: The Index is shifted periodically to reflect the change in demand in the data market.

Innovation: Connecting data’s significance within blockchain ecosystems.

4. Bankless BED Index

The Bankless BED Index is the best Index Coop DeFi index for balanced, beginner-friendly crypto exposure. It comprises Bitcoin, Ethereum, and DeFi Pulse Index in equal ratios, providing a single token investment that is straightforward, yet powerful.

What differentiates BED is its mix of store-of-value, programmable money, and decentralized finance, encapsulating crypto innovation’s foundational elements. For those looking for a “set it and forget it” approach to crypto, BED is a single asset that offers stability, diversification, and alignment with market movements.

Bankless BED Index.

Purpose: Merges exposure to Bitcoin, Ethereum, and DeFi constituents for optimized diversification.

Composition: Constituents of BTC (via wrapped BTC), ETH and DPI at equal weights.

Key Feature: Marked as set and forget index, captured with basic crypto market investment strategy.

Stability: Anchors high-growth DeFi with BTC and ETH to provide moderate stability.

collaboration With Bankless, a leading crypto content and media house.

5. ETH 2x Flexible Leverage Index (ETH2x-FLI)

The ETH2x-FLI offers the best value for users of Index Coop DeFi as it provides automated leverage to Ethereum without the complexities involved in managing the margins or dealing with liquidations.

Its most distinct advantage is in the automated rebalancing that changes leverage during times of heightened fluctuation in the market, tertiary attempting to mitigate losses while maximizing profits.

Investors with deep convictions regarding the future value of ETH will find value in the ETH2x-FLI as it offers a set-it-and-forget-it approach to diversifying investments while improving profits through passive risk management.

ETH 2x Flexible Leverage (ETH2x-FLI)

Purpose: Offer 2x exposure on Ethereum price movement.

Mechanism: Obtained by using collateralized debt on lending protocols like Aave.

Key Feature: Automatic rebalancing to sustain targeted 2x leverage ratio for reduced liquidation risk.

Flexibility: Optimize target and cost for dynamically adjustable leverage.

Risk Profile: Exposed to higher risk/reward compared to non-levered indices, classed as sophisticated traders.

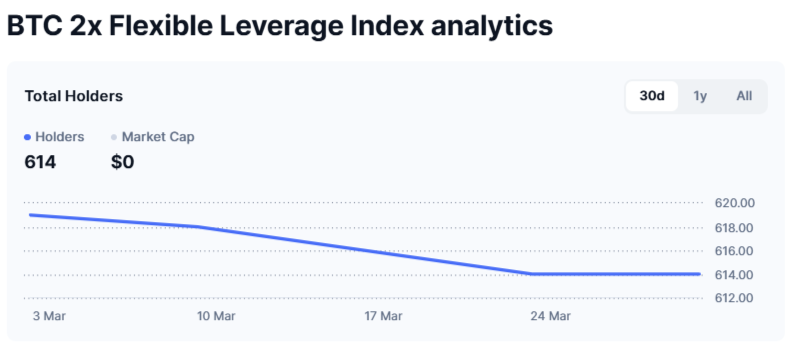

6. BTC 2x Flexible Leverage Index (BTC2x-FLI)

The Index Coop DeFi index that allows for exposure to Bitcoin’s price movements while keeping risk management simpler than other instruments is BTC 2x Flexible Leverage Index, or BTC2x-FLI. It is optimized by automated leverage change mitigation which reduces risk of liquidation and maintains 2x exposure.

With the lowest risk, it appeals to those who are confident with Bitcoin’s price and wish to eliminate barriers of collaterals, complex trading, and maneuvering through various strategies—all while taking advantage of BTC2x-FLI’s value and low operational demands.

BTC 2x Flexible Leverage (BTC2x-FLI)

Purpose: Provide 2x exposed coverage on Bitcoin price.

Mechanism: Purchase BTC at a price in excess of the market price.

Key Feature: Automated batched updating of collateral and leverage. Emergency debt pay down to protect positions.

Efficiency: Less frequent rebalancing to reduce gas and slippage.

Target Traders: Those looking to amplify their BTC exposure without having to actively manage their positions.

7. Polygon Ecosystem Index (PEI)

The Polygon Network and its Layer-2 ecosystem is rapidly growing, and the Polygon Ecosystem Index (PEI) was created to target these developments.

Unlike other indices, this one tracks the native projects and provides access to the ecosystem’s applications which facilitate real adoption and qualified transactions.

A key distinguishing feature for PEI is the single, emerging ecosystem that fosters innovation, which can easily be captured with this index.

For those investors who would like to capitalize on the Ethereum scaling use case, PEI serves as a focused and diversified access point to the central hub.

Polygon Ecosystem Index (PEI)

Goal: Monitor the activities and performance of the key Polygon (MATIC) projects.

Blend: Contains tokens from Polygon such as MATIC, QuickSwap (QUICK) and others, proportional to their market cap.

Distinctive Attribute: Shows performance of the Ethereum Layer 2 scaling solution polygon on which DeFi projects are building.

Rebalance: Changes made on Polygon Ecosystem DeFi and NFT’s evolving parameters.

Cost Optimization: Inline with polygon network transaction cost, the PEI is optimized for lower cost.

8. Interest Compounding ETH Index (icETH)

The Interest Compounding ETH Index (icETH) is the most advanced Index Coop DeFi index for ETH yield optimization through sophisticated DeFi strategies.

It automatically manages complex positions behind the scenes while exploiting collateralized staking and lending protocols to maximize returns from staking.

What sets icETH apart is how it smartly applies leverage for yield enhancement rather than speculative trading. icETH provides effortless, passive income that continuously develops through Ethereum’s unique yield-bearing growth structures—unlike any other DeFi position—making it ideal for holders looking to passively grow their wealth.

Interest Compounding ETH (icETH)

Goal: To earn on staked ETH and pay out interest.

Process: Packs WETH coins to be lent on Aave and paid interest for the stake.

Distinctive Attribute: They can claim the interest and ERC20 token will be paid out automatically.

Security: Guaranteed through over collaterals debt positions used to hedge the assets.

9. High Yield ETH Index (hyETH)

The High Yield ETH Index (hyETH) is the best Index Coop DeFi index for earning elevated returns on ETH while maintaining on-chain transparency and security. It allocates ETH across multiple high-frequency earning and staking protocols to optimize their risk-adjusted returns.

Liquid staking alongside yield farming makes hyETH stand out with its efficiency- maximization from a diversified yield strategy. For ETH holders looking to generate passive income without heavy reliance on a single platform, hyETH provides a sophisticated, multi-platform exposure solution in a single token.

High Yield ETH Index (hyETH)

Goal: Use advanced DeFi techniques to optimize yields for ETH.

Blend: Allocate ETH to stake, lend, provide liquidity, or any other high yield activity.

Distinctive Attribute: Managed actively for optimal sustainable performance.

Agility: Responsive to market conditions in DeFi to optimize yield performance.

Risk/Reward: Higher returns with added risk and tighter controls spend defended rules.

10. Diversified Staked ETH Index (dsETH)

The dsETH, or the Diversified Staked ETH Index, is arguably the most DeFi index for Index Coop whose goal is to provide safe and balanced coverage for the entire Ethereum staking ecosystem.

It contains an assortment of the most important liquid staking tokens, lowering dependency on any single protocol and mitigating smart contract risk.

What makes dsETH different is the emphasis on decentralization and robustness—guaranteeing that ETH stakeholders are able to reap the benefits of staking ETH while retaining agility and safety. For believers of ETH in the long run, dsETH is a great secondary source of income without asset collateralization.

Diversified Staked ETH (dsETH)

Goal: The purpose is to allow staked ETH to be exposed over different protocols hence exposing the asset passively diversified.

Composition: Contains liquid staking tokens such as stETH (Lido), rETH (Rocket Pool), and ankrETH.

Key Feature: Mitigates single protocol risk by distributing staking across different providers.

Yield Generation: Achieves liquidity through ERC-20 token while earning staking rewards.

Conclusion

To sum up, the top-ranking coins on the Index Coop DeFi index provide different value propositions which align with specific goals within the DeFi ecosystem.

From diversified sector exposure using DPI through thematic growth investing with MVI and DATA, to simplistic portfolio strategies like BED, and yield-optimized investments like icETH, hyETH, and dsETH, there is something for everyone.

The assets provided by the Index Coop are diversified, automated, and meticulously carved out. These indices democratize access to and the strategic planning needed for investing in DeFi, enabling users to seamlessly engage in Web3 innovation with minimal complexity and greater assurance.