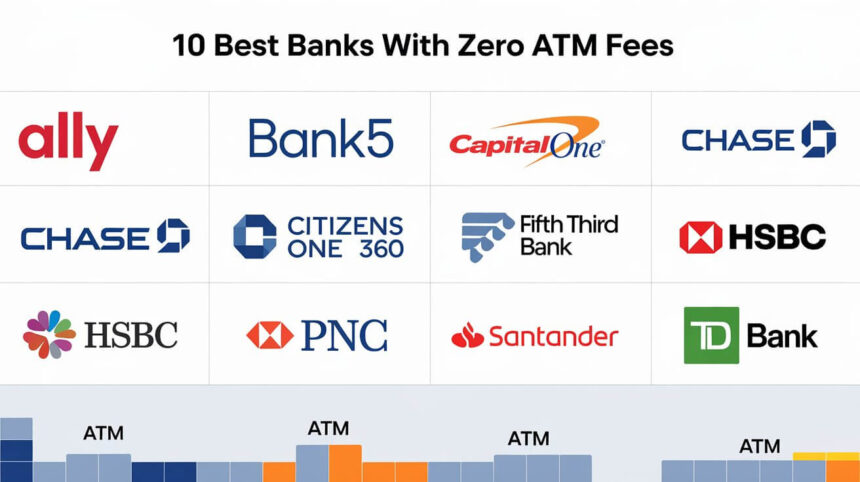

In this article, I will discuss the Best Banks With Zero Atm Fees. I will ensure I apply the right strategies to make it banking helpful.

These banks and credit unions provide fee-free access to ATMs located across the country or around the globe, as well as reimbursements for fees incurred at out-of-network ATMs.

Whether you are a traveler or someone who loves online banking, withdrawing cash will be free of stress and without extra fees.

Key Point & Best Banks With Zero Atm Fees List

| Bank/Credit Union | Key Point |

|---|---|

| Axos Bank | No monthly fees, high-interest checking. |

| Connexus Credit Union | Competitive rates, nationwide access. |

| Charles Schwab Bank | No foreign transaction fees, free ATM rebates. |

| Navy Federal Credit Union | Exclusive to military members, great loan rates. |

| Betterment | Automated investing with cash management. |

| Ally Bank | No fees, high-yield savings. |

| Capital One 360 Checking | No overdraft fees, online-friendly. |

| Discover Bank | Cashback rewards on debit purchases. |

| Fidelity Investments Cash Management | FDIC-insured, ideal for investors. |

| Alliant Credit Union | High APY savings, extensive ATM network. |

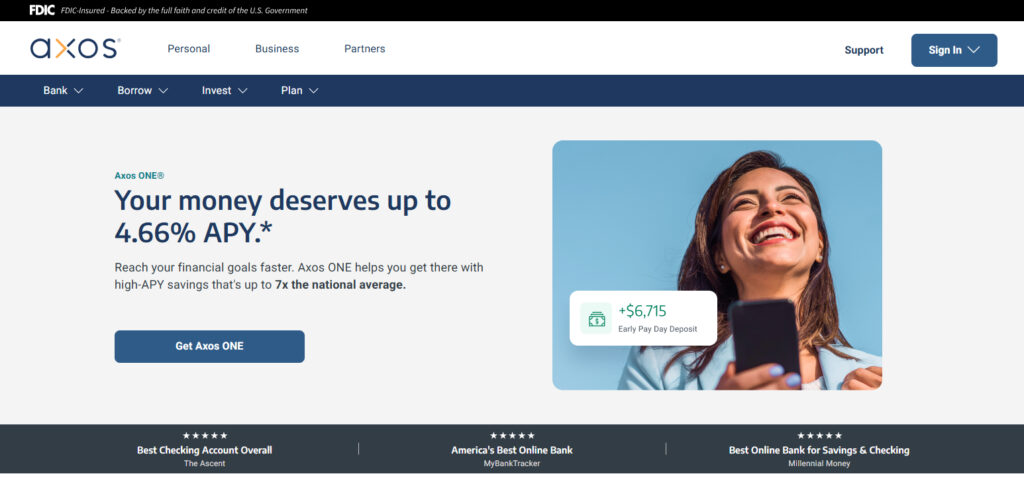

Axos Bank

Axos Bank differentiates itself as one of the best banks with no ATM fees owing to unlimited domestic ATM reimbursements. Unlike most banks that only waive fees at network ATMs, Axos refunds fees at any U.S. ATM, providing full flexibility to customers.

This makes it useful for travelers and those needing access across the country without restrictions. In addition, Axos provides high-interest checking accounts with no maintenance fees, providing modern banking solutions in a more affordable and convenient way.

| Feature | Details |

|---|---|

| Bank Type | Online bank offering comprehensive financial services |

| ATM Fees | Unlimited domestic ATM fee reimbursements |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | Rewards Checking, Essential Checking, and High-Yield Savings Accounts |

| Interest Rates | Competitive APY on checking and savings accounts |

| Accessibility | Fully online banking with mobile and desktop platforms |

| Customer Support | 24/7 support via phone, email, and live chat |

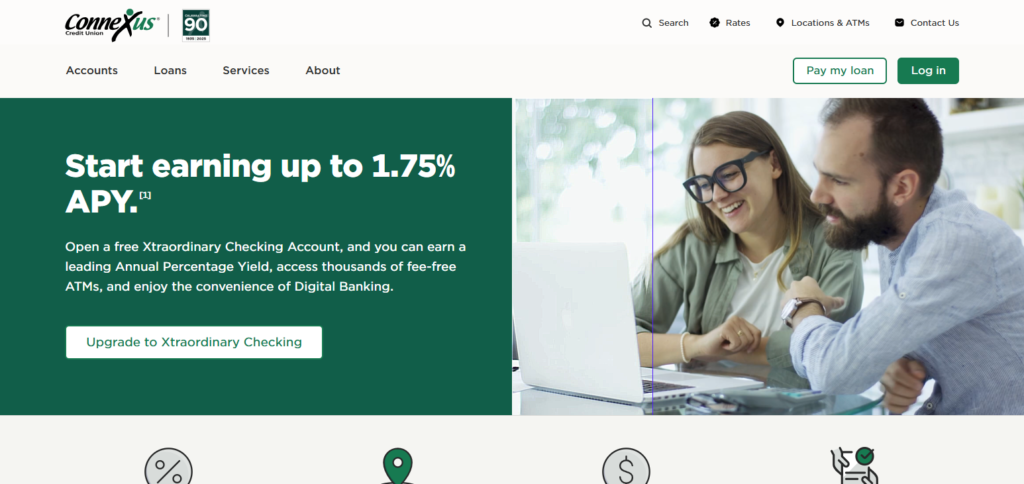

Connexus Credit Union

Connexus stands out as one of the best financial institutions due to having no ATM fees and access to more than 54,000 surcharge-free ATMs through the CO-OP and MoneyPass networks.

Like many other banks, Connexus does not restrict free cash withdrawal access on a national level, thus making cash access convenient for members. In addition, members are provided with competitive interest rates on checking and saving accounts which increases overall value.

Connexus supports its members greatly by providing the best interest rates on savings along with cost-free digital banking services which enables a hassle-free and convenient nationwide banking experience without fees.

| Feature | Details |

|---|---|

| Bank Type | Credit union offering comprehensive financial services |

| ATM Fees | No Connexus ATM fees; unlimited surcharge-free transactions at CO-OP and MoneyPass® ATMs |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | Xtraordinary Checking, Simply Free Checking, Teen Checking |

| Interest Rates | Up to 1.75% APY on Xtraordinary Checking |

| Accessibility | Nationwide access to 67,000+ surcharge-free ATMs |

| Customer Support | Active support via phone, email, and live chat |

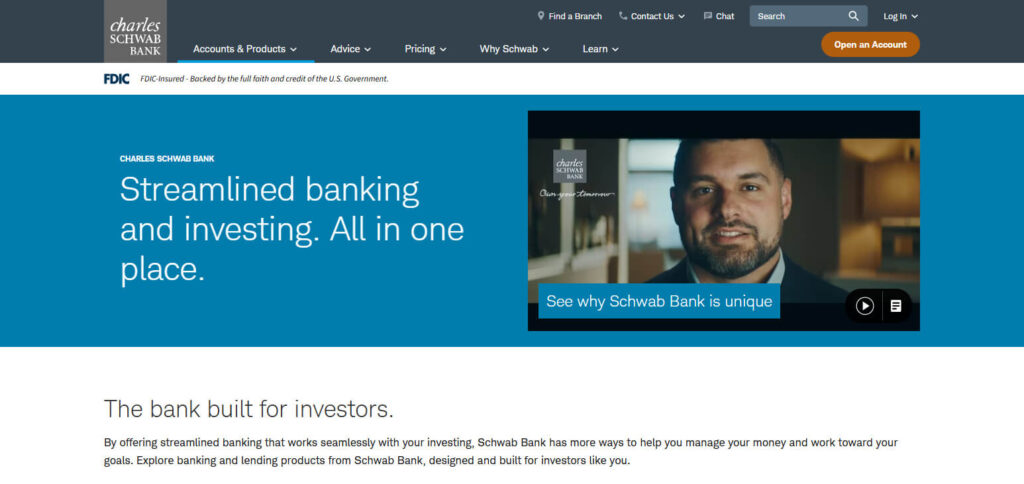

Charles Schwab Bank

Charles Schwab Bank is among the finest banks with no ATM fees, as it provides unlimited worldwide ATM fee reimbursements.

Unlike other banks who only cover domestic fees, Schwab reimburses all ATM fees internationally which is suitable for travelers.

Additionally, the High-Yield Investor Checking account offers no monthly fees, and and easy linking to Schwab brokerage accounts. These features make Charles Schwab Bank the best option for those looking for reliable, convenient banking.

| Feature | Details |

|---|---|

| Bank Type | Online bank offering comprehensive financial services |

| ATM Fees | Unlimited ATM fee rebates worldwide |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | Investor Checking Account linked to Schwab One Brokerage Account |

| Interest Rates | Variable interest rate with competitive APY |

| Accessibility | Fully online banking with mobile and desktop platforms |

| Customer Support | 24/7 support via phone, email, and live chat |

Navy Federal Credit Union

Navy Federal Credit Union is considered one of the top financial institutions because it has no ATM fees, gives free access to more than 30,000 ATMs through CO-OP and Navy Federal networks, and even refunds ATM withdrawal fees. It refunds up to $10 monthly in ATM fee rebates.

Unlike a lot of other banks, Navy Federal ensured cost free access to almost anywhere. It is tailored for military personnel and their families. It also has competitive rates as well as strong member benefits which makes it a top provider for those looking for low cost and flexible banking.

| Feature | Details |

|---|---|

| Bank Type | Credit union offering financial services for military members and families |

| ATM Fees | No fees at Navy Federal ATMs; rebates up to $20 per statement cycle for out-of-network ATMs |

| KYC Requirements | Standard KYC required for account setup |

| Account Types | Free Active Duty Checking, Flagship Checking, and Savings Accounts |

| Accessibility | Access to 30,000+ fee-free ATMs through the CO-OP network |

| Customer Support | 24/7 support via phone, email, and live chat |

Betterment

Betterment is one of the leading banks with no ATM fees for customers as it offers unlimited foreign ATM fee reimbursements.

Betterment’s Cash Reserve and Checking Accounts automatically refund any ATM fees, regardless of the country, unlike other banks which makes it convenient for travelers and users of digital banking.

There are also no monthly maintenance fees, overdraft fees, or minimum balance limits. For managing money in the modern world without fees, Betterment integrated automated investing with high yield savings while providing banking tailored toward comfortable experiences.

| Feature | Details |

|---|---|

| Bank Type | Online financial platform offering checking and investment services |

| ATM Fees | Unlimited ATM fee reimbursements worldwide |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | Betterment Checking and High-Yield Cash Accounts |

| Interest Rates | Competitive APY on cash accounts |

| Accessibility | Mobile-first platform with Visa® Debit Card for global use |

| Customer Support | Active support via app, email, and phone |

Ally Bank

Ally Bank is one of the best with its zero ATM fees and free access to more than 43,000 Allpoint ATMs across the country.

Ally is set apart by its out-of-network ATM fee reimbursement policy—up to $10 per statement cycle—allowing low-cost access to cash from virtually anywhere.

Unlike other banks, Ally is fully online which enables them to offer better interest rates on their checking and saving accounts. Ally does not charge a monthly maintenance fee which combined with their digital banking features means a customer friendly experience.

| Feature | Details |

|---|---|

| Bank Type | Online bank offering comprehensive financial services |

| ATM Fees | No fees at Allpoint® ATMs; reimburses up to $10 per statement cycle for out-of-network ATM fees |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | Savings, Checking, Money Market, and CDs |

| Interest Rates | Competitive rates on savings and CDs |

| Accessibility | Fully online banking with mobile and desktop platforms |

| Customer Support | 24/7 support via phone, email, and live chat |

Capital One 360 Checking

Capital One 360 Checking secures its position among the industry leaders because of the lack of ATM fees and offers access to over than 70,000 ATMs with the Allpoint and MoneyPass networks.

It distinguishes itself by being ideal for both domestic and international uses due to no foreign transaction fees.

Also, no monthly fees and no minimum balance increases its appeal as cost-effective banking. With a strong mobile app, overdraft protection options, and seamless digital tools, Capital One 360 Checking offers hassle-free and zero cost banking.

| Feature | Details |

|---|---|

| Bank Type | Online and branch-based bank offering flexible financial services |

| ATM Fees | Access to 70,000+ fee-free ATMs through Capital One, MoneyPass®, and Allpoint® networks |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | 360 Checking Account |

| Interest Rates | Competitive APY on checking balances |

| Accessibility | Mobile app, online banking, and in-person support at Capital One Cafés |

| Customer Support | 24/7 support via phone, email, and live chat |

Discover Bank

Discover Bank has gained considerable recognition as one of the best service providers that doesn’t impose ATM fees, allowing access to over 60,000 ATMs for free through Allpoint and MoneyPass networks.

What sets them apart is the unique Cashback Debit account, which enables customers to earn 1% cashback on debit purchases up to $3,000 each month. This accounts offers features seldomly seen in checking accounts.

The account has no monthly maintenance fees, no overdraft fees, and no minimum balance restrictions. The combination of the rewards program and fee-free ATMs with Discover Bank ensures customers utmost convenience partnered with additional financial advantage.

| Feature | Details |

|---|---|

| Bank Type | Online bank offering comprehensive financial services |

| ATM Fees | Access to 60,000+ fee-free ATMs through the Allpoint® and MoneyPass® networks |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | Cashback Debit Checking Account |

| Interest Rates | No interest on checking accounts |

| Accessibility | Fully online banking with mobile and desktop platforms |

| Customer Support | 24/7 support via phone, email, and live chat |

Fidelity Investments Cash Management Account

Fidelity Investments Cash Management Account gives you an edge with unlimited international ATM fee reimbursements and zero ATM fees.

Fidelity also stands out from other banks, refunding all ATM fees which is great for investors or travelers. Also, funds are FDIC-insured across multiple partner banks which enhance the security of funds.

The account is free of monthly fees and balance requirements while effortlessly linking with Fidelity brokerage accounts, making it a flexible banking option for users that want fee-free access and features tailored for investing.

| Feature | Details |

|---|---|

| Bank Type | Cash management account offered by Fidelity Investments |

| ATM Fees | Unlimited global ATM fee reimbursements |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | Cash Management Account |

| Interest Rates | Competitive rates on cash balances |

| Accessibility | Fully online platform with mobile app and debit card |

| Customer Support | 24/7 support via phone, email, and live chat |

Alliant Credit Union

Alliant Credit Union is one of the few to provide free access to over 80,000 Allpoint and CO-OP ATMs without charging ATM fees.

What makes Alliant unique is the out-of-network ATM fee reimbursement of up to $20 a month, which increases flexibility in cash withdrawal options.

In addition, Alliant has high-yield checking and saving accounts with no monthly fees. With strong digital banking and extensive ATM access, Alliant Credit Union offers affordable and convenient banking services.

| Feature | Details |

|---|---|

| Bank Type | Credit union offering online and nationwide financial services |

| ATM Fees | Access to 80,000+ fee-free ATMs through Allpoint® and MoneyPass® networks; up to $20/month in ATM fee rebates for out-of-network ATMs |

| KYC Requirements | Minimal KYC required for account setup |

| Account Types | High-Rate Checking, Savings, and Teen Checking Accounts |

| Interest Rates | Competitive APY on High-Rate Checking |

| Accessibility | Fully online banking with mobile app and debit card |

| Customer Support | Active support via phone, email, and live chat |

Conclusion

To summarize, selecting a bank that does not charge ATM fees can cut costs and increase your financial flexibility.

The most notable options include Charles Schwab Bank and Fidelity Investments Cash Management, as they offer unlimited worldwide ATM fee reimbursements which is ideal for frequent travelers.

Others like Alliant Credit Union and Ally Bank also offer extensive ATM networks and reimbursement for out-of-network withdrawals. Whether you prefer a digital bank or a credit union, these options guarantee access to your funds without any restrictions at any time.