This article covers the Best Automated Market Maker (Amm) Coins that have emerged as relevant components of the decentralized finance (DeFi) ecosystem.

These coins power decentralized exchanges by providing trustless and efficient trading through liquidity pools. I will outline the distinctive attributes of leading AMM tokens in regard to innovation and user experience, as well as their contribution to the restructuring of digital finance.

Key Point & Best Automated Market Maker (Amm) Coins List

| DEX | Key Feature |

|---|---|

| Uniswap | Leading Ethereum DEX, liquidity pools, token swaps |

| PancakeSwap | Binance Smart Chain, low fees, yield farming |

| SushiSwap | Community-driven, yield farming, staking |

| Balancer | Multi-token liquidity pools, automatic rebalancing |

| Kyber Network | On-chain liquidity, token swaps, aggregation |

| 1inch | DEX aggregator, best price finder |

| Biswap | BSC-based, low fees, yield farming, referrals |

| QuickSwap | Polygon-based, low-fee decentralized trading |

| Bancor | Liquidity provision with impermanent loss protection |

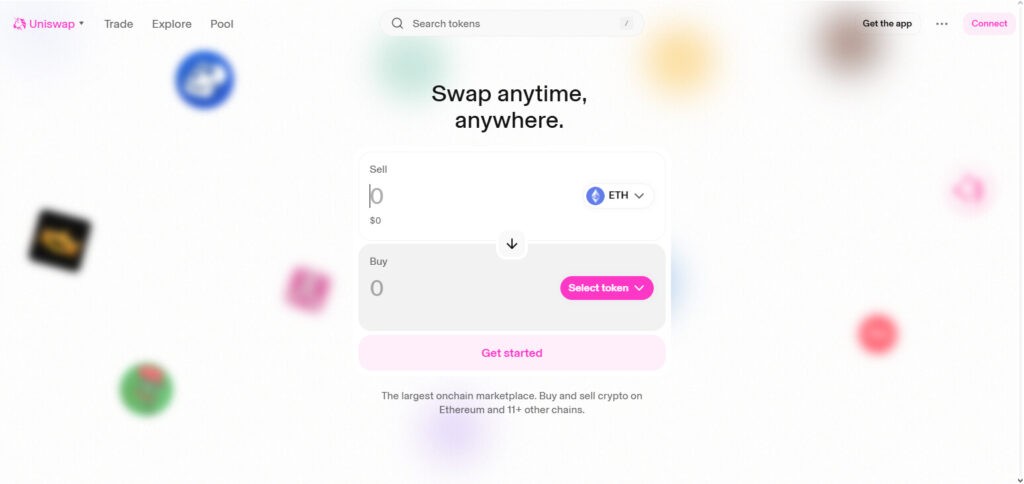

1.Uniswap (UNI)

Uniswap (UNI) is noted as one of the best Automated Market Maker (AMM) coins due to its impact in decentralized finance (DeFi). Users are able to directly trade from their wallets with the help of the automated Uniswap exchange without the need for centralized exchanges because of the added liquidity.

The protocol runs on the Ethereum mainnet ensuring security and decentralization. For traders and liquidity providers, the platform is user-friendly, characterized by low slippage and price efficiency.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on network congestion |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, and decentralized trading |

| Governance | Governed by UNI token holders |

| Liquidity Pools | Users can provide liquidity to earn fees |

| Security | Smart contract-based with open-source code |

| Supported Assets | Thousands of ERC-20 tokens |

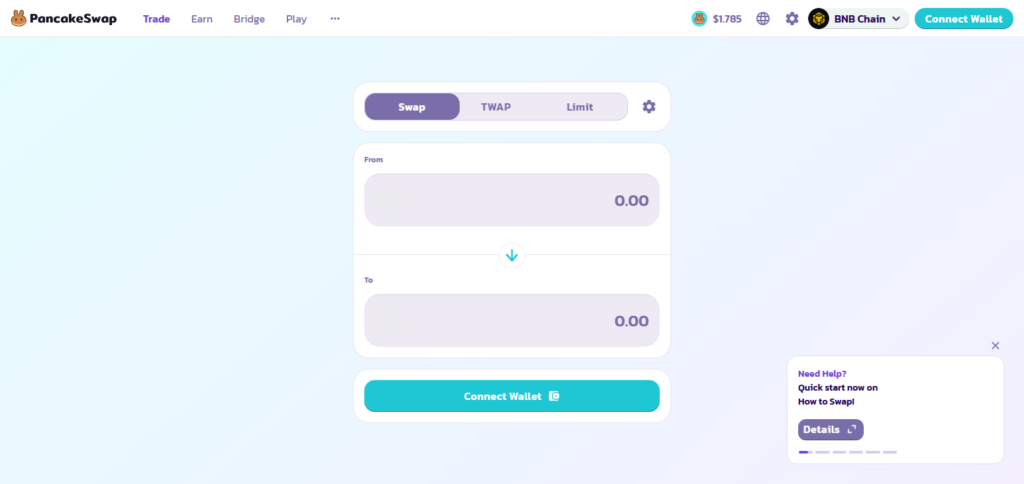

2.PancakeSwap (CAKE)

PancakeSwap (CAKE) is one of the leading AMM coins considering its operation on the Binance Smart Chain BSC, which offers quicker and cheaper transactions than Ethereum. Moreover, its low fees and quick transaction times draw in traders and liquidity providers on both BSC and Ethereum.

With reluctance, it must be noted that tokens differentiating themselves from PancakeSwap face extreme challenges. Advanced Yield Farming and Staking features, in conjunction with an intuitive interface, go above and beyond what one expects from a cost-efficient decentralized exchange.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on BNB Chain |

| Transaction Fees | Low fees starting at 0.01% |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, yield farming, and decentralized trading |

| Governance | Governed by CAKE token holders |

| Liquidity Pools | Users can provide liquidity to earn fees |

| Security | Smart contract-based with audits by reputable firms |

| Supported Assets | Wide range of BEP-20 tokens |

3.SushiSwap (SUSHI)

SushiSwap (SUSHI) is reputable as one of the best Automated Market Maker (AMM) coins due to its community-driven model and unique offerings. Apart from simple token swaps, SushiSwap enables yield farming, staking, and governance which provides users the ability to participate in protocol decision making.

Its multi-chain expansion on other regions such as Ethereum, BSC, and Polygon guarantees reach, while its concentration on decentralization, security, and user experience elevate its standing in the AMM space.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on network congestion |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, yield farming, and decentralized trading |

| Governance | Governed by SUSHI token holders |

| Liquidity Pools | Users can provide liquidity to earn fees |

| Security | Smart contract-based with open-source code |

| Supported Assets | Wide range of ERC-20 tokens |

4.Balancer (BAL)

Balancer (BAL) reigns among the best Automated Market Makers (AMM) coins because of its capability to maintain multi-token liquidity pools.

AMMs, in general, work with two tokens. With Balancer, users can create custom pools with up to eight tokens, which enhances capital efficiency.

Also, with Balancer, the efficiency of liquidity across all assets is maintained with the smart rebalancing mechanism. Users can vote on protocol decisions using the governance token BAL, which strengthens community participation and decentralization.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on network congestion |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, and decentralized trading |

| Governance | Governed by BAL token holders |

| Liquidity Pools | Users can create customizable pools with up to eight tokens |

| Security | Smart contract-based with open-source code |

| Supported Assets |

5.Kyber Network (KNC)

Kyber Network (KNC) is one of the foremost AMM coins owing to its on-chain liquidity protocol which permits the automated swapping of tokens on different chains.

What makes Kyber special is the liquidity aggregation feature that pulls liquidity from many pools to provide the optimal price.

Moreover, decentralized applications (dApps) make use of Kyber’s liquidity seamlessly, so tokens can be exchanged in real time. With the KNC token, holders participate in governance of the protocol which decentralizes control and allows the community to determine the direction of future developments.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Liquidity Hub |

| Technology | Multi-chain liquidity aggregation |

| Transaction Fees | Variable fees based on network and liquidity |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, and decentralized trading |

| Governance | Governed by KNC token holders through KyberDAO |

| Liquidity Pools | Users can provide liquidity to earn fees |

| Security | Smart contract-based with open-source code |

| Supported Assets | Wide range of tokens across multiple blockchains |

6.1inch (1INCH)

1inch (1INCH) remains among the best Automated Market Maker (AMM) coins because of its functions as a DEX aggregator.

It searches different AMM platforms for the best prices and optimizes trades, providing users with the best prices and lowest slippage.

1inch’s “Pathfinder” algorithm splits trades across multiple liquidity pools to maximize efficiency. It improves trading experience by providing efficient and cost-effective trading which in turn increases liquidity and decreases trading costs on decentralized exchanges.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Liquidity Aggregator |

| Technology | Multi-chain aggregation protocol |

| Transaction Fees | Variable fees based on network and liquidity |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity aggregation, and decentralized trading |

| Governance | Governed by 1INCH token holders through DAO |

| Liquidity Pools | Users can provide liquidity to earn fees |

| Security | Smart contract-based with open-source code |

| Supported Assets | Wide range of tokens across multiple blockchains |

7.Biswap (BSW)

Biswap (BSW) is recognized as one of the top Automated Market Maker (AMM) coins due to its low fees and concentration on the Binance Smart Chain (BSC).

Its liquidity pools are based on a 3-Token model, providing more flexibility and trading efficiency.

Biswap has some of the lowest fee structures on the market and offers considerable yield farming and staking incentives. With its intuitive design, cutting-edge elements, and low trading fees, the platform is ideal for DeFi traders.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on Binance Smart Chain (BSC) |

| Transaction Fees | Low fees starting at 0.1% |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, yield farming, and NFT marketplace |

| Governance | Governed by BSW token holders |

| Liquidity Pools | Users can provide liquidity to earn rewards |

| Security | Smart contract-based with audits by reputable firms |

| Supported Assets | Wide range of BEP-20 tokens |

8.QuickSwap (QUICK)

QuickSwap (QUICK) is remarkable as an Automated Market Maker (AMM) coin because of its low-fee, ultra-fast trading on the Polygon network.

QuickSwap utilizes Polygon’s layer-2 scaling solution to offer lower transaction fees and faster speed when compared to Ethereum-based AMMs.

It also features liquidity mining and staking, rewarding users with the QUICK token. The combination of low fee transactions, scalability, and efficiency of decentralized trading makes QuickSwap stand out among other options in the market.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on Polygon blockchain |

| Transaction Fees | Near-zero fees due to Polygon’s Layer 2 scaling solution |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, and decentralized trading |

| Governance | Governed by QUICK token holders |

| Liquidity Pools | Users can provide liquidity to earn fees |

| Security | Smart contract-based with open-source code |

| Supported Assets | Wide range of tokens across Polygon ecosystem |

9.Bancor (BNT)

Bancor (BNT) stands out from the rest of the AMM space due to its unique impermanent loss protection. Unlike most AMMs, Bancor permits liquidity providers to earn fees without incurring the risk of impermanent loss, making it far more attractive for long-term liquidity provisioning.

Its single-token liquidity pools make for more efficient and simpler trading. With cross-chain integration, governance focused on decentralization, and a user-friendly interface, Bancor ensures a secure experience in DeFi, which makes it one of the best AMMs out there.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Low fees with impermanent loss protection |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, and decentralized trading |

| Governance | Governed by BNT token holders through BancorDAO |

| Liquidity Pools | Users can provide liquidity with single-sided exposure |

| Security | Smart contract-based with open-source code |

| Supported Assets | Wide range of ERC-20 tokens |

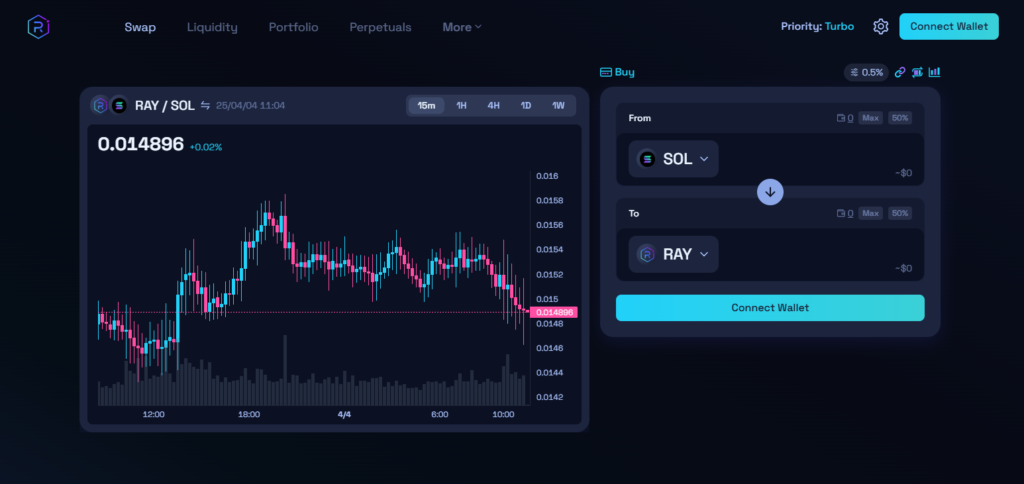

10.Raydium (RAY)

Raydium is an automated market maker coin that stems from the Solana blockchain, making it distinguish itself from others due to its exceptionally quick and cost-efficient transactions.

The coin has a hybrid model, meaning it uses both an order book and AMM system which allows for greater efficiency in trading and liquidity management.

Deep liquidity is guaranteed for Raydium-equipped Solana assets because of the serum DEX integration. Raydium’s proprietary trading platform is known for its speed, low trading costs, and ample liquidity.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange (DEX) and Automated Market Maker (AMM) |

| Technology | Built on Solana blockchain |

| Transaction Fees | Low fees due to Solana’s high efficiency |

| KYC Requirements | No KYC required for trading or liquidity provision |

| Use Cases | Token swapping, liquidity provision, and decentralized trading |

| Governance | Governed by RAY token holders |

| Liquidity Pools | Users can provide liquidity to earn rewards |

| Security | Smart contract-based with integration into Serum’s order book |

| Supported Assets | Wide range of tokens within the Solana ecosystem |

Conclusion

To summarize, the leading Automated Market Maker (AMM) coins stand out because of their particular attributes which improve decentralized trading.

Uniswap, PancakeSwap, and SushiSwap, among others, have come up with novel ideas that include low costs and quick transaction times, liquidity pooling, as well as governance features.

They focus on efficiency, scalability, and security whether on Ethereum, Binance Smart Chain, or Solana. Their comprehensive offerings serve different preferences and requirements of users and are critical to the development of DeFi, fostering the growth of traders and liquidity providers.