I’ll go over how cryptocurrency exchanges guard against chargeback fraud and safeguard users and their platforms in this post.

Chargeback fraud is when a person reverses a valid payment in order to retain bitcoin, resulting in monetary loss. We will examine the main tactics used by exchanges to successfully lower fraud, such as multi-factor authentication, secure payment mechanisms, real-time transaction monitoring, and improved KYC verification.

What is Chargeback Fraud?

A customer engages in chargeback fraud by making the transaction, receiving the product/service, and reporting the transaction to the bank to get their money back. For example, in crypto exchanges, users buy crypto and then lie to the bank to take back the payment.

The fraudster may charge back using a stolen card, a fake ID, or a hacked account. The fraud crypto chargeback loses crypto exchanges money, increases operating costs, and loses exchanges their reputation. Unlike traditional banking, transactions in the crypto world are irreversible.

This makes companies that do not protect themselves from chargebacks fraud more susceptible to the losses that come from chargeback fraud. Some of the things that can protect exchanges and honest users from chargeback fraud are strict payment policies, real time transaction monitoring, and advanced identity checks.

How Crypto Exchanges Prevent Chargeback Fraud

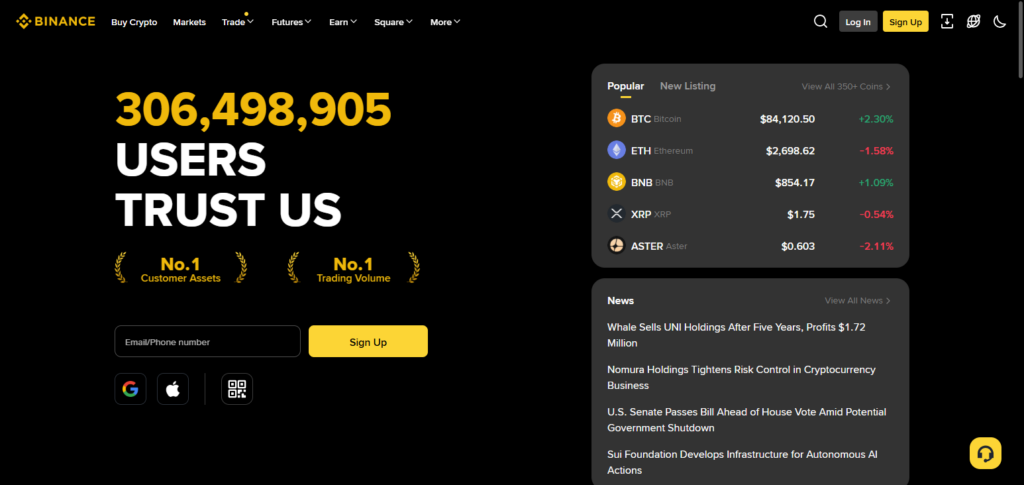

Example: Binance Chargeback Fraud Prevention

Step 1: Sophisticated Fraud Prevention KYC & Identity Checks

- At account creation, Binance performs strict KYC, requiring a valid gov’t-issued ID, and in some cases, a photo selfie.

- This guarantees that an account belongs to a real individual, making it considerably more difficult for a fraudster to use a stolen identity.

Step 2: Blocking Certain Payment Methods

- Credit cards & other payment methods that are easily ‘chargebackable’ are not permitted.

- Binance encourages users to make payments via bank transfers & crypto deposits, as these are irreversible once made.

Step 3: 24/7 Transaction Monitoring

- Binance utilizes AI-based systems that automatically flag suspicious transactions, such as large single transactions, or a string of payments that have failed.

- Once a transaction is flagged, it is placed on hold for further review.

Step 4: Multifactor account security measures

- Users are required to have 2-factor authentication in place, and no withdrawal actions can occur unless an email is confirmed, or an alert via the app is sent.

- This keeps unauthorized accesses to the account from fraudsters and keeps unauthorized purchases from occurring.

Step 5: Chargeback processing

- If a chargeback is attempted by a user, Binance processes no refunds until the transaction records, IP, and device are confirmed to match for that allegedly fraudulently charged user.

- Insurance and internal company policies minimize fraud while covering small losses.

Step 6: Continuous Learning & System Updates

- Binance revises chargeback fraud detection algorithms as new fraud patterns are identified.

- The platform remains secure, and the likelihood of fraud recurrence is mitig through audits and risk assessments.

Why Crypto Exchanges Are Vulnerable

Anonymous and Pseudonymous Transactions

- Different users are able to transact using different cryptocurrencies without revealing full identities.

- This anonymity is taken advantage of by fraudsters who create fake accounts and keep doing the chargeback.

Irreversible Nature of Crypto Payments

- Once a crypto transaction is confirmed, it cannot transact/reverse the transaction, as opposed to a credit card payment.

- This situation can create difficulties to get back lost money on a fraudulent transaction without the right checks.

Rapid Growth and Popularity

- The rise in the popularity of crypto attracts both groups of traders.

- When it comes to fraud, it focuses on new users as well as high-volume transactions.

Fiat-to-Crypto & Crypto-to-Fiat Conversion Risks

- Exchanges are usually the intermediaries between the crypto world and the fiat world.

- Chargebacks are fraud by the bank that withdraw the payment while still providing the crypto.

Cross-Border Transactions & Regulatory Gaps

- The crypto world is borderless and so are the exchanges. This also extends to different regulations and laws around the world.

- No laws in certain regions can make it easier for people to commit fraud and harder for others to stop it and punish it.

Account Takeovers and Social Engineering Attacks

- Weak security and phishing attacks can let hackers break into the victims’ accounts.

- Accounts that have been compromised can start to trade or withdraw funds inappropriately, causing possible disputes.

Core Strategies Used by Crypto Exchanges

KYC and AML

- Exchanges request user identity verification before they can deposit or start trading.

- This minimizes the chances of fraudulent user accounts being created.

- Chargeback fraud tied to fake or stolen identities is less likely to occur.

Transaction monitoring and Risk Scoring

- By tracking user transactions, the exchanges can identify strange or suspicious activity.

- Any potentially high-risk transactions can be flagged for manual review.

- Using AI, the risk scoring models combined with past transactions, can identify fraudulent transactions in real time.

Payment Method restrictions

- The exchange may choose to limit payment methods that may potentially cause a chargeback (like credit cards and PayPal)

- Safer methods such as bank wire transfers or stablecoins will be encouraged.

- Restricting the use of reversible payment methods will lessen the chances of fraud attempts.

MFA and Account Safety

- The exchanges may implement additional layers of verification such as SMS, Email, and authenticator apps in order to secure logins and withdrawals.

- Excessive fraudulent activity will be less likely to occur.

- Stolen credentials will not be enough for the attacker to cause a triggering transaction.

Dispute Resolution and Policies

- Reasonable and accessible to the consumer chargeback and cancelation policies will result in better relations.

- Having a clearly stated and accessible set of policies for the consumer to review will definitely cut down on unnecessary disputes.

- Customer Support will reverse certain transactions but will defend claims before doing so.

- Automated contracts will streamline and reduce the possibility of conflict with rules and make fraudulent behavior more difficult.

Challenges in Chargeback Fraud Prevention

Balancing Security with User Experience

- User frustration can occur due to the implementation of strict verification processes and anti-fraud measures.

- Exchanges need to find the balance between offering a smooth experience and implementing robust barriers.

Managing Cross-Border Transactions

- Due to the operation of crypto exchanges globally, the focuses on various systems of banking, international currencies, and different regulations on fraud.

- Due to the lack of consistent regulations, implementing globally preventive measures against chargebacks is complex.

Advanced Techniques of Fraud

- To have as much chargeback fraud and the losses that come with it, Exchanges need to invest in constantly evolving systems to detect the sophisticated and evolving methods of fraud.

Disadvantages of the Common Fraud Prevention Tools

- In the realm of crypto, the common chargeback fraud prevention methods used in traditional banking systems are largely inapplicable.

- Most of the protections to prevent reversible fraud payments are null for the transactions made on the blockchain, for they are irreversible.

Gaps in Compliance and Regulatory Ambiguity

- Merely a lack of regulations on a global scale leads to vague enforcement and difficult resolution of disputes.

- Due to the lack of established international regulations, issues for cryptocurrencies can remain unresolved, and Exchanges can find their hands tied against international fraud in the absence of defined borders.

Speed of Transactions

- Transactions in the crypto World take place in a matter of seconds.

- The speed of transactions greatly diminishes the possibility of a fraud-detection system being able to intervene to block a transaction.

Benefits of Effective Chargeback Fraud Prevention

Low Financial Impact

- Prevents unauthorized refunds. Safeguards the exchange’s revenue.

Trust From Users

- Users are confident that their money and transactions are secure.

Reputation of the Platform

- Fraud free exchange attracts and entertains more number of users.

Let the users relax

- Less chargeback frauds means less time on which users have to spend to investigate.

Enhanced Security of the Platform

- Improved fraud prevention altogether improve the security of the platform.

Fraud Prevention Regulations

- Helps the exchanges not violate the regulations of anti money laundering and of smart fraud.

Defensible Growth

- Less fraud means platform can work without concerns and grow.

Tips For safe Crypto Exchanges Prevent Chargeback Fraud

Implement Advanced KYC Methods

- KYC should be completed using government-issued identification, selfies, and proof of address to eliminate the chance of account fraud.

Use Multi-Factor Authentication (MFA)

- Logins and withdrawals should require 2FA to limit access to authorized users only.

Restrict Certain Payment Methods

- Credit card payment acceptance should be avoided and offering bank transfers or crypto-to-crypto exchanges should be encouraged to eliminate chargeback risks.

Conduct Real-Time Transaction Monitoring

- Implement AI and machine learning to identify patterns of unusual behavior, e.g., excessive purchases or large deposits.

Establish Withdrawal Limits for Unverified Accounts

- New accounts should be limited on a temporary basis as a fraud reduction tactic.

Maintain Thorough Transaction Histories

- Detailed logs of internet addresses, devices, and transactions should be kept to dispute chargebacks.

Provide User Security Training

- Users should be informed of phishing scams and account compromise prevention to mitigate the risk of system attacks.

Update Security Switches Regularly

- The latest fraud detection software should be utilized and outdated inner fraud processes should be streamlined regularly to combat outdated countermeasures.

Establish a Risk Management Policy

- Safeguard chargeback dispute with internal policies or insurance.

Work with Banks and Payment Providers

- Partner with your financial institutions to identify and address chargeback claims promptly.

Risk & Considerations

Financial Losses

- Fraudulent chargebacks cause financial damage to the exchanges.

Reputation Risk

- Fraud losses can damage the reputation of the brand.

Operational Strain

- Resource allocation to mitigate fraud losses results in operational inefficiency.

User Friction

- Authentic customers may be annoyed by the KYC and other security protocols.

Fraud Risk Compliance Challenge

- Insufficient fraud prevention may result in non-compliance with AML and other financial regulations.

Monitoring Gaps

- Insufficient fraud detection technology may not prevent modern fraudulent.

Disputes Risk

- There is a high probability of slow and complex disputes with payment partners.

Adaptable Risk

- Security should be continuously altered to meet the challenges fraud brings; it is ever-present.

Pros & Cons

| Pros | Cons |

|---|---|

| Reduces Financial Losses – Protects the exchange from fraudulent refunds and revenue loss. | User Friction – Strict KYC and security measures may slow onboarding or frustrate users. |

| Enhances User Trust – Builds confidence that funds and transactions are secure. | Operational Costs – Requires investment in fraud detection systems and manpower. |

| Improves Platform Reputation – Low fraud rates attract more users and partners. | Complex Dispute Management – Resolving chargebacks with banks/payment providers can be time-consuming. |

| Minimizes Fraud Risk – AI monitoring and verification reduce fraudulent activity. | Technological Limitations – Outdated systems may fail to catch sophisticated fraud attempts. |

| Regulatory Compliance – Helps meet AML and financial security regulations. | Evolving Fraud Tactics – Continuous updates needed as fraudsters adapt their methods. |

Conclusion

Crypto exchanges must prevent chargeback fraud in order to safeguard their earnings, uphold consumer confidence, and guarantee seamless platform operations. Exchanges can successfully lower fraudulent activity by putting multi-factor authentication, enhanced KYC verification, real-time transaction monitoring, and safe payment options into place.

The advantages—improved security, regulatory compliance, and a solid reputation—far exceed the risks, even though stringent security measures may necessitate investment and cautious management. In the end, proactive fraud prevention makes trading safer and more dependable for users and exchanges alike.

FAQ

What is chargeback fraud in crypto exchanges?

Chargeback fraud occurs when a user buys cryptocurrency and then disputes the payment with their bank or card provider to reverse the transaction while keeping the crypto.

How do exchanges prevent chargeback fraud?

Exchanges prevent fraud through advanced KYC verification, AI-driven transaction monitoring, multi-factor authentication, secure payment methods, and strict withdrawal policies.

Why is chargeback fraud a problem for crypto exchanges?

It causes financial losses, damages reputation, increases operational costs, and can affect regulatory compliance if not properly managed.

Can users be affected by these anti-fraud measures?

Yes, stricter KYC and security protocols may slightly slow account setup or transactions but ensure a safer trading environment.