I’ll go over the top Admirals substitutes for traders in 2026 in this post. These brokers offer dependable and affordable solutions, regardless of your preference for reduced spreads, quicker execution, or sophisticated trading tools.

These Admirals alternatives serve both novice and expert traders looking for improved trading conditions, offering everything from stocks and cryptocurrencies to Forex and CFDs.

What is Admirals Alternatives?

Other respectable online brokers that offer comparable trading services to Admiral Markets (Admirals), including Forex, CFDs, stocks, indices, and cryptocurrencies, are referred to as Admirals Alternatives.

These substitutes serve traders seeking different features such as stronger leverage choices, faster execution, reduced spreads, sophisticated trading platforms, or more comprehensive educational materials.

Investors can get competitive pricing, diversify their options, and take use of specialized tools tailored to their trading style by selecting an Admirals alternative. Some of the greatest Admirals substitutes for novice and expert traders are brokers such as IC Markets, Pepperstone, IG Trading, RoboForex, and OANDA.

Key Point & Best Admirals Alternatives

| Broker | Key Point |

|---|---|

| IC Markets | Offers ultra-low spreads and deep liquidity for professional traders. |

| Pepperstone | Known for fast execution and multiple trading platforms including MT4/5. |

| IG Trading | Regulated globally with extensive market research and educational tools. |

| RoboForex | Provides diverse account types and competitive leverage options. |

| Alpari | Popular for flexible account types and strong Forex community support. |

| Eightcap | Low-cost trading with tight spreads and multiple platform options. |

| Exness | High leverage offerings with reliable execution and 24/7 support. |

| FP Markets | Wide range of instruments and strong ECN/STP trading infrastructure. |

| AvaTrade | Regulated across multiple regions with copy trading and CFD options. |

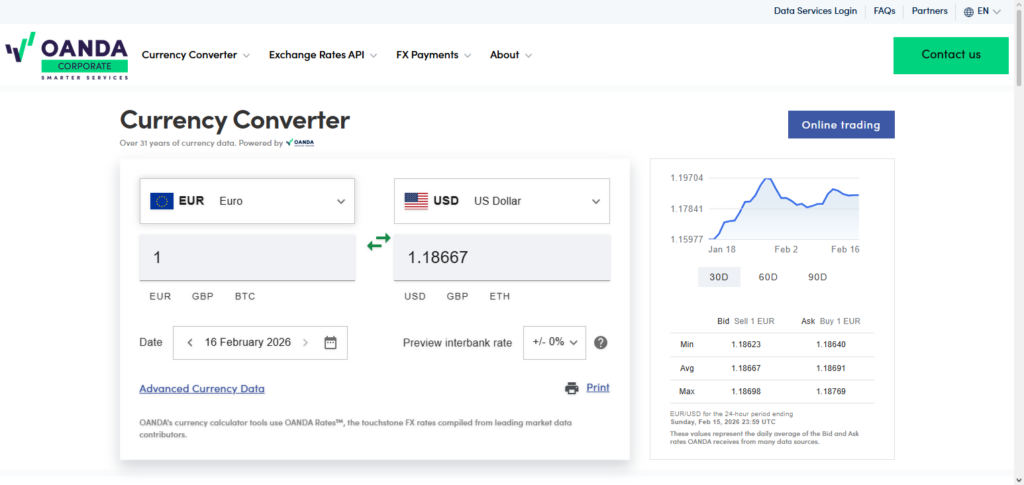

| OANDA | Trusted broker with transparent pricing and advanced trading tools. |

1. IC Markets

IC Markets was founded in 2007 and provides online trading in currency pairs, contracts for difference (CFDs), and commodities. IC Markets is an Australian based trading firm and therefore offers trading in many jurisdictions worldwide. They have provided trading services for more than a decade and have won many awards.

They provide a range of trading platforms including, Meta Trader 4 (MT4), Meta Trader 5 (MT5), and have their own in-house developed platform called cTrader. One of IC Markets strongest points is their tight spreads (and therefore low trading costs) which enhances the trading experience. IC Markets is also in the group of Best Admirals Alternatives. Traders can expect algo trading and cTrader Maor, or Platinum) levels of low trading costs.

IC Markets Features, Pros & Cons

Features:

- Raw spreads with ECN-style pricing.

- MT4, MT5, and cTrader are supported.

- Fast execution and deep liquidity.

- Forex spreads are competitive.

- Registration with ASIC & CySEC.

Pros:

- Spreads are ultra-low, ideal for scalping.

- Tools for advanced charting and execution.

- All strategies are accommodated with multiple platform options.

- Good regulatory oversight.

- Great for professional trading.

Cons:

- Educational resources for beginners are insufficient.

- Platform mobile proprietary platform lacking.

- Some instruments incur overnight swap fees.

- Research tools are not sophisticated.

- Advanced accounts have an increased minimum deposit.

2. Pepperstone

With quick trade execution and low cost trading pressures, Pepperstone is a great choice for Forex and CFD traders. Also, this broker lets you build algorithms with multiple sites, like MT4, MT5, and cTrader.

Moreover, your funds and personal info are safe with Pepperstone, as they are fully transparent with the information and are regulated by ASIC and FCA. Because of their competitive leverage, low latency trading, and pro tools, Pepperstone is an efficient option for novice and expert traders. It also has flexible and great performance and is one of the Best Admirals Alternatives.

Pepperstone Features, Pros & Cons

Features:

- Trade execution speed is fast.

- Available MT4, MT5, and cTrader.

- Supported EA and Algo auto-trading.

- FCA, DFSA, SCB, and ASIC regulated.

- Spreads on Forex and CFDs are competitive.

Pros:

- Algorithmic traders are excellent.

- Peak hours have tight Razor spreads.

- Safety means multiple regulation.

- Customer support is great.

- Good integration with tools from 3rd parties.

Cons:

- Some markets have higher fees on CFDs.

- Researching is lacking in the house.

- Crypto offering is not as large as competitors.

- Fees for overnight positions and inactivity will apply.

- Not all services are available in all countries

3. IG Trading

As one of the Best Admirals Alternatives, IG Trading has a presence in multiple developed countries, allowing traders to access more than 17,000 markets that trade in Forex, other indexes, and commodities. Because this broker is regulated by ASIC, the FCA, and other subsequently top regulators, this trading option is a safe choice.

Out of many trading brokers, IG has the most developed education and research, as well as the best trading brokering platform for charting, which makes it easy to develop any trader’s long-term strategy. Because of the low selling price, numerous insights, and uncomplicated platforms, they are able to guide retail and professional traders to become better.

IG Trading Features, Pros & Cons

Features

- 17,000+ global markets

- MG proprietary + MT4

- Research & analytics

- FCA, ASIC, CFTC & other regulation

- Educational webinars

Pros

- Reputable broker

- Trading & market tools

- Educational materials

- Suitable for beginners to advanced users

- Access to a broad range of markets

Cons

- High spreads on exotic pairs

- Less leveraged than some competitors

- Not ideal for scalping

- Smaller accounts incur higher fees

- Fees are structured complexly

4. RoboForex

RoboForex has a wide variety of account types that include ECN, standard, and cent accounts, making it suitable for beginners as well as advanced traders. It has a wide variety of trading platforms, including MT4, MT5, and cTrader, as well as an option for high leverage which caters to more aggressive trading.

RoboForex is a broker regulated by IFSC which offers moderate safety to traders around the world. When looking for a trusted option, RoboForex is ranked as one of the Best Admirals Alternatives. It also offers wide range of instruments, competitive spreads, and fair execution, which is ideal for traders who want low priced Forex and CFD trading along with advanced copy trading and selection of trading technologies.

RoboForex Features, Pros & Cons

Features

- Various accounts (ECN, Prime, Pro)

- Supports MT4, MT5 & cTrader

- High leverage

- Copy trading available

- Regulation through IFSC

Pros

- Broad choice of trading instruments

- Good ECN account commission

- Good leverage for experienced traders

- Flexible account structures

- Good demo environment

Cons

- Limited top-tier global regulation

- Limited educational materials

- Slow support

- Fees may apply for withdrawals

- Platforms are outdated to some users

5. Alpari

Alpari offers a wide variety of Forex services with account types including micro, standard, and ECN accounts. It offers MetaTrader 4 and 5 and has a variety of trading manuals and tutorials for beginner traders. The broker seeks to increase global client access and has easy to use platforms.

Alpari has been recognized for many traders looking for acceptable choices other than Admirals and is one of the Best Admirals Alternatives. It offers a unique combination of low spreads, favorable trading conditions and high leverage. Alpari has built a strong community of Forex traders and is sustained by years of consistent service. It is excellent for those looking for flexible, transparent and dependable trading.

Alpari Features, Pros & Cons

Features

- Accounts available: Micro, Standard & ECN

- Supported by MT4 & MT5

- EAs & automated trading

- Availability of high leverage

- Supported in multiple languages

Pros:

- Great for beginner and mid-level traders

- Aggressive strategy high leverage

- Clear fee structure

- Strong focus on Forex

- Support & community forums

Cons:

- Limited regulation in some areas

- Variability in competitiveness of spreads

- Less advanced tools than larger brokers

- Asset classes beyond FX are limited

- Support in customers feedback is limited

6. Eightcap

Eightcap is an Australian broker that is good for quick trade execution and low spreads. They are also good for having a variety of accounts to choose from like Standard and Raw ECN accounts. They offer MT4 and MT5 along with trading tools and options for trading algorithms. Eightcap is regulated by both ASIC and SCB which makes them a safe broker for trading.

They also provide good options for traders wanting to switch from Admirals, making them one of the Best Admirals Alternatives. The professionalism of executive services along with competing pricing and good ranges of instruments all contribute to traders being able to execute their trading plans. Having low-cost trading and trust from regulators makes Eightcap a good option for scalpers, Forex traders, and people looking for good options for low-cost trading.

Eightcap Features, Pros & Cons

Features:

- Standard & Raw ECN accounts

- Supports MT4 & MT5

- Regulation in SCB & ASIC

- Raw spreads that are competitive

- Algo-trading enabled

Pros:

- Costs are low for trading, spreads are tight

- Speed of execution is reliable

- Scalping and hedging are allowed

- Strong framework of regulation

- Forex and CFD traders are good

Cons:

- Limited content educators

- Market small lists tradable

- Limited offerings in crypto

- Platform proprietary trading not available

- Limited service hours in customer

7. Exness

Exness offers high trading leverage, rapid execution speed, and multiple types of user accounts, such as Standard, Pro, and Zero. The broker supports trading through MT4 and MT5 and offers automated trading and copy trading. Exness is regulated by FCA, CySEC, and other organizations, creating a safe trading environment.

Exness is also admired for being one of the Best Admirals Alternatives, with reasonable pricing and up to 2000 currency pairs, as well as 24/7 customer service. The platform is designed for facilitated trading regardless of one’s user level. The platform is designed with user-friendliness to facilitate trading and with the optimal goal of improving the user’s trading experience.

Exness Features, Pros & Cons

Features:

- High leverage is available

- MT4 & MT5

- Support available 24/7

- Multiple types of accounts

- Regulated by FCA, CySEC, and others

Pros:

- Highly flexible trading conditions

- Account creation is very easy

- Is transparent with their pricing

- Is excellent for trading Forex

- Is strong for trading with mobile

Cons

- Increased risk due to high leverage

- Variations in regulation, depending on the entity.

- Without guidance, it is not ideal for beginners

- Proprietary tools are limited

- The research resources are not great

8. FP Markets

FP Markets is a broker providing ECN, and Standard accounts, providing low spreads and rapid execution. With access to MT4, MT5, and IRESS, the broker ensures several choices for algorithmic, manual, and professional trading.

With its regulation by ASIC and CySEC, FP Markets ensures strong client protection. For customers looking to change brokers, FP Markets is one of the Best Admirals Alternatives. Its low-cost, quality execution, and wide range of trading instruments, such as Forex, indices, and commodities, it offers an environment of trading reliability to traders and greater flexibility.

FP Markets Features, Pros & Cons

Features

- Have Standard & ECN accounts

- Platforms are MT4, MT5 & IRESS

- Regulated by ASIC & CySEC

- 10,000+ instruments

- With low spreads and fast execution

Pros

- Pricing is very competitive

- FP Markets is very good for professional traders

- Availability of multiple platforms

- Good for Scalping

- Good for wide market access

Cons

- Extra fees for the IRESS platform

- The interface is too complex for beginners

- The customer service quality varies by region.

- FP Markets have little to no training

- The withdrawal times are very slow

9. AvaTrade

AvaTrade is widely-regulated and provides numerous CFDs, including Forex, stocks, indices, and cryptocurrency. They offer MT4, MT5, and AvaTradeGO, which gives multiple options for trading on the go. Regulations strengthen several areas, which provides the traders with security and transparency.

This broker is also considering for the Best Admirals Alternatives and is suitable to those traders that are focused more on the education, automated trading, and risk management tools. AvaTrade provides intuitive, highly innovative, Execution, wide variety of trading instruments all which create a highly balanced trading environment.

AvaTrade Features, Pros & Cons

Features

- MT4, MT5 & AvaTradeGO trading platforms

- Copy & social trading

- CFDs on assets are in the market

- Regulated by ASIC, FSCA, CBI

- Have risk management tools.

Pros

- Is highly safe and credible

- Is good for beginner

- Has auto & copy trading

- Dedicated mobile trading platform

- Strong tools for risk and order management.

Cons

- Spread of some products is higher

- Cryptocurrency options are limited

- Less options of accounts

- In certain areas, tighter restrictions on leverage

- Average research tools

10. OANDA

OANDA is a reputable broker that has great low spreads, and great pricing for several instruments, such as the Forex, indices, commodities, and bonds. They also offer MT4, and their proprietary trading platform called fxTrade. Their platform provides numerous features for research and analysis.

They are also regulated by the FCA, the CFTC, and the ASIC, providing the added security. This broker has also been noted as a more flexible and safe alternative for OANDA which is why they are also noted as Best Admirals Alternatives. They are excellent for retail or professional traders, as this is a trustworthy broker with great tools for strategic trading.

OANDA Features, Pros & Cons

Features:

- MT4 + fxTrade

- Pricing Transparency

- Regulation by FCA, CFTC, ASIC

- Pricing Analytics and Charts

- Multiple Forex Pairs

Pros:

- Global brokerage with high trust

- Pricing transparency is excellent

- Strong research tools

- Good for FX

- Orders tools are more flexible

Cons:

- Compared to ECN brokers, the spreads are wider

- The regional restrictions on leverage are more

- Compared to rivals, fewer CFDs

- Laggy mobile app

- Not suitable for aggressive scalping

Conclusion

In conclusion, there are many excellent options available to traders looking for trustworthy, productive, and affordable options outside of Admirals. While RoboForex, Alpari, and Exness provide large leverage and a variety of account types for a range of trading methods, brokers like IC Markets, Pepperstone, and IG Trading are notable for their professional-grade platforms, quick execution, and low spreads.

Strong regulation, cutting-edge tools, and broad market access are all combined in platforms like Eightcap, FP Markets, AvaTrade, and OANDA, which make them perfect for novice and experienced traders alike. All things considered, these brokers are the Best Admirals Alternatives, guaranteeing safe, open, and flexible trading options for all kinds of investors.

FAQ

What are the best Admirals alternatives for low spreads?

Brokers like IC Markets, Pepperstone, and FP Markets are ideal for traders seeking ultra-low spreads, fast execution, and ECN pricing, making them top choices among the Best Admirals Alternatives.

Which brokers are safest as Admirals alternatives?

IG Trading, OANDA, and AvaTrade are regulated by multiple top-tier authorities such as FCA, ASIC, and CFTC, ensuring fund security and transparency, positioning them as reliable Admirals alternatives.

Can beginners use these Admirals alternatives?

Yes. Brokers like RoboForex, Alpari, and Eightcap offer user-friendly platforms, demo accounts, and educational resources, making them suitable for novice traders exploring Admirals alternatives.

Which alternatives offer high leverage like Admirals?

Exness and RoboForex provide high leverage options for more advanced strategies, allowing traders to maximize positions while maintaining risk control, making them strong Best Admirals Alternatives.