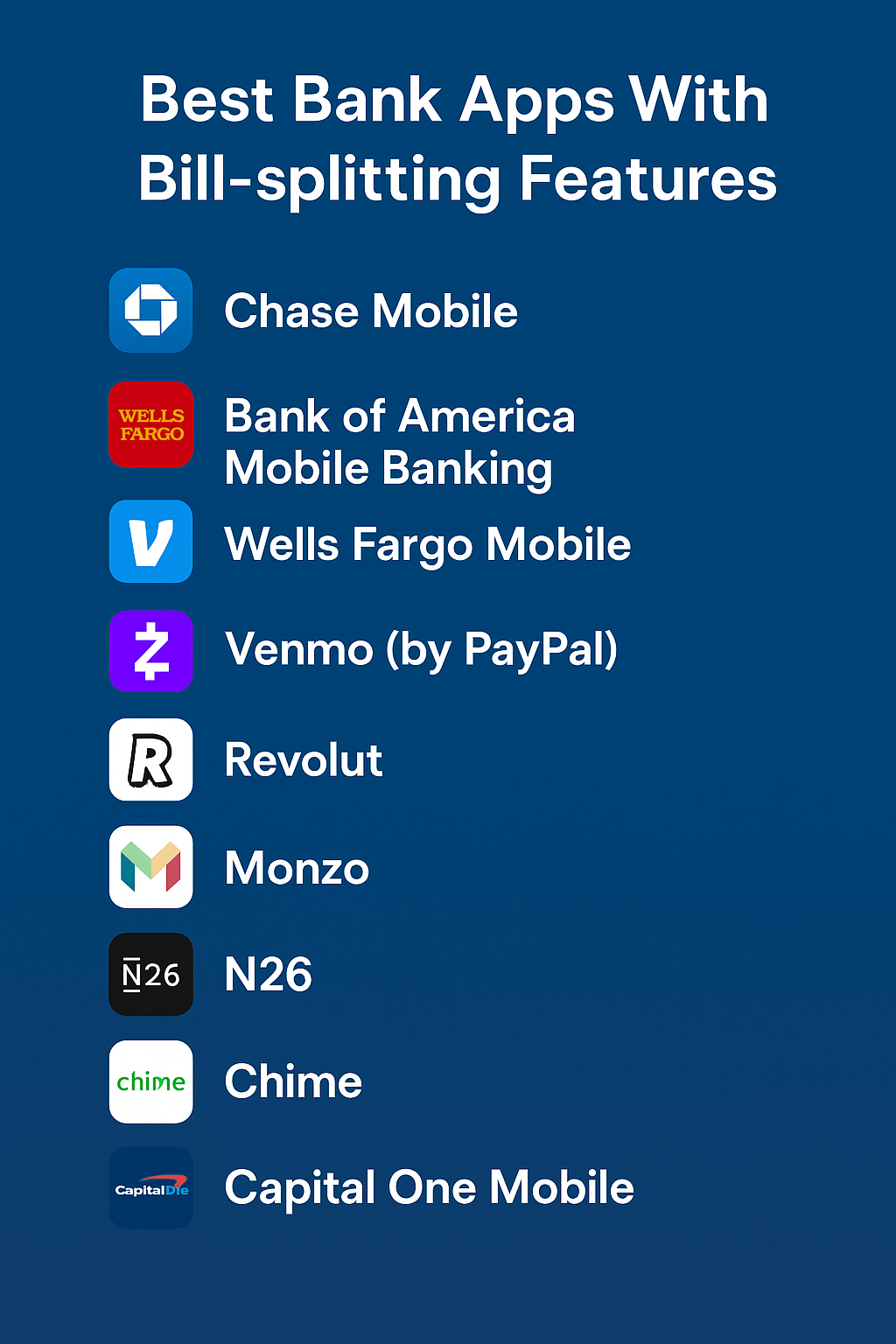

In this article, I talk about the Best Bank Apps With Bill-splitting Features which allow users to share expenses in a hassle-free way.

From splitting rent to utility bills or even dining out, these apps automate payments with immediate payment capabilities and sophisticated monitoring mechanisms.

Zelle-powered bank apps, as well as fintech apps such as Venmo and Revolut, allow users to share expenses effortlessly, making financial management secure and simple.

Key Point & Best Bank Apps With Bill-splitting Features

| Mobile App | Key Point |

|---|---|

| Chase Mobile | Offers comprehensive account management with advanced fraud protection. |

| Bank of America Mobile Banking | Includes Erica, a virtual financial assistant for budgeting insights. |

| Wells Fargo Mobile | Features robust bill pay and mobile deposit capabilities. |

| Venmo (by PayPal) | Simplifies peer-to-peer payments with social feed integration. |

| Zelle | Enables instant money transfers directly between bank accounts. |

| Revolut | Offers global spending with real-time currency exchange and analytics. |

| Monzo | UK-based app with instant spending notifications and budgeting tools. |

| N26 | Provides a sleek interface with fee-free international transactions. |

| Chime | Delivers early direct deposit and no overdraft fees. |

| Capital One Mobile | Allows credit score tracking and secure card lock/unlock features. |

1. Chase Mobile

Chase Mobile is equipped with a full suite of digital banking features which include mobile check deposit, balance and fraud alert notifications, as well as secure logins through fingerprint and Face ID.

It also provides the ability to manage credit cards, pay bills, and transfer funds seamlessly. Chase offers person-to-person transfers through QuickPay with Zelle, one of the premier features of the application.

While built-in tools for bill splitting are absent, payments can be shared through Zelle integration among close circles.

Chase enables personal finance management through its budgeting features, credit score monitoring, and comprehensive reputation among US banking apps adds its appeal.—

Chase Mobile Features

- Bill-splitting through Zelle: Fee free instant transfers.

- Budgeting tools: Assist in tracking expenses and provide valuable insights.

- Security: Alerts for fraud, biometric login and other anti-theft measures.

- Card controls: Action to turn a card on or off, set spending ceilings.

- Scheduled payments: Management of recurring expenses.

2. Bank of America Mobile Banking

The Bank of America Mobile Banking app does not disappoint as it incorporates the Erica virtual assistant, enabling users to view account transactions, spending, and even receive suggestions for improvement.

Mobile check deposits, account alert notifications, and scheduled bill payments are effortless. Users are able to send and receive money almost instantly through Zelle, making it convenient for group purchases or splitting expenses.

Even though the app does not have a specific tool for bill splitting, its sophisticated features overall effortless shared payments, which are normally cumbersome.

Credit score access, rewards tracking, and outstanding security features such as biometric login are also provided. It is one of the most advanced and secure mobile banking applications in the USA.

Bank of America Mobile Banking Features

- Payment Integration with Zelle: Fast bill-splitting without incurring extra fees.

- Spending alerts: Alerts catered to shared funds expenditures.

- Personalized budgeting: Creation of saving plans constitutes relevant spending categorization.

- Fraud protection: Defense against fraud.

- Recurring payments: Particularly suited to rent and utility bills.

3. Wells Fargo Mobile

With Wells Fargo Mobile, customers can manage their bank accounts seamlessly from their mobile devices. Users can manage their finances using mobile deposit, card controls, and bill payment functions.

Fast money transfers through Zelle can be used for less formal bill-sharing. Zelle does not have a built-in-calculator for bill-sharing, but many people use Zelle for sharing costs like rent, dinner, and other expenses.

Users can also track their investments and manage multiple accounts through the app. Digital security is also a priority for Wells Fargo with features like biometric login and real-time fraud alerts.

Customers are able to control their financial lives without much effort, thanks to the intuitive interface that comes with regular updates.

Wells Fargo Mobile Features

- Fee-free bill splitting through Zelle: Quick transactions without charges.

- Automatic budgeting tools: Helpful to categorize spending on shared expenses.

- Secure authentication: Alerts on transactions and biometric login to ensure secure authentication.

- Account integration: Enhanced control over personal finances by linking several accounts.

- Expense tracking: Actionable insights regarding expenditures intended for grouped bills.

4. Venmo By PayPal

Venmo is famously known for its social-style payment system which enables users to send and receive money along with notes and even emojis. It is tailored to person-to-person payments and is a great app for bill splitting.

Users can effortlessly split payments for rent, dinners, or even group trips and request certain amounts from different contacts.

The application connects to a user’s bank account or credit card, and funds may be withdrawn or spent directly through a Venmo debit card. Venmo also allows for limited in-app purchases from selected merchants.

With entertaining and interactivemfeatures, community-driven interface, and seamless cost-sharing, social spending remains fun, flexible, and free-spirited. Pode is a great part to it.

Venmo (by PayPal) Features

- Social Payments System: Commented or noted splitting of bills.

- Free direct bank transfers: Transfer money without charge from Venmo to linked accounts and vice versa.

- Group payments: Collaborative collection of funds from a number of people.

- Cashback rewards: Save money on selected transactions.

- Security options: Utilization of run-time authentication safeguards.

5. Zelle (supported by various U.S. banks) Zelle

Supports is directly built into several U.S. bank applications like Chase, Bank of America, and Wells Fargo. It enables people to instantly transfer funds through email or phone contact.

Although Zelle does not provide an integrated option for bill splitting, it is commonly used for settling shared payments.

Because Zelle is linked with users’ accounts, no additional wallet or application is required. Its most important feature is speed and compatibility with many banks.

For those who do not wish to incur costs such as added software, spending sharing becomes uncomplicated through Zelle. Zelle has shown to be one of the most optimal methods for transferring funds within the USA.

Zelle (used by multiple U.S. banks) Features

- Instant transfers: Immediate payment processing without delays or extra costs.

- Bank integration: Functional inside pre-existing banking apps.

- Easy bill-splitting: Effortlessly request payments from others.

- Security encryption: Safeguards digital money movement.

- Fraud monitoring: Monitors account activity for unusual changes.

6. Revolut

Popular for international use, the Revolut app is a digital banking app that offers currency exchange, budgeting, and even cryptocurrency trading.

One of its best features is the ability to split bills, allowing friends to divide costs, calculate their shares, and track who has paid. Users can set reminders and pay off debts all within the app.

Moreover, Revolut provides spending analytics that helps users manage their budgets. As an added advantage, the app allows fee-free global transactions which is a great benefit for travelers and expats.

With disposable virtual cards, savings vaults, and advanced controls, Revolut offers personal and business accounts. The app’s real-time notifications and modern tools for financial planning make it a go-to for personal finance management.

Revolut Features

- Advanced bill-splitting tools: Shared expenses are monitored in real time.

- Multi-currency support: Useful for cross-border transactions.

- Group payments: Settle payments for social events or trips.

- Budget automation: Provides insights into spending patterns through AI.

- Virtual card security: Eliminates fraudulent and unauthorized payments.

7. Monzo

Monzo is best known as a mobile bank in the UK, which has an appealing app design and offers customer-centric services like budgeting. Unlike other banks, it also provides instant notifications for transactions and spending analysis.

Monzo’s bill-splitting feature is truly unique as users can not only split expenses with their friends but also track individual payments made, and get pleasant reminders for payments due.

Users can customize Monzo by opening joint accounts, saving pots, and applying for overdrafts. Monzo’s transparent system without hidden fees is especially appealing for young people looking to engage with fully digital banking.

The app’s high standards of security along with growing customer satisfaction also help boost client numbers.

Monzo Features

- Built-in “Split the Bill” feature: Effortless bill splitting.

- Payment requests: Simple follow-up for outstanding payments.

- Expense analytics: An overview of spending habits by category.

- Automated savings: Encourages saving by managing collective financial resources.

- Biometric security: Protects users from unauthorized transactions.

8. N26

In comparison to traditional banks, N26 has integrated technology in an effort to improve the user’s banking experience. Additional benefits include no-fee international transfers, immediate notifications of account activity, and detailed analysis of user spending patterns.

The N26 application includes budgeting tools and Spaces feature, which allows users to create sub-accounts for specific saving objectives.

Although N26 doesn’t offer native bill-splitting functionality, it works well with Splitwise, allowing shared expenses to be, organized, paid, and reimbursed without hassle.

Users are able to instantly lock their cards for security purposes and also create virtual cards. Premium accounts have additional features including travel and other insurances.

With N26’s clear-cut interface, coupled with the ability to hold multiple currencies, the platform is appealing to frequent travelers and digital nomads. N26 has the minimalism approach and achieves simplicity in the banking experience.

N26 Features

- Real-time bill-splitting: Immediate notification for shared expenses.

- Smart budgeting tools: Tailored financial advising.

- Secure authentication: Identifying users with face and finger for login.

- Expense tracking: Tracking expenses for savings with AI tools.

- International transaction support: Enables global cooperation on bill payments.

9. Chime

Along with having no monthly fees or overdraft fees, Chime, a neobank based in the U.S, offers banking through a mobile app. The app includes features such as early direct deposit, automatic savings, and tools for credit-building.

Though there is no bill-splitting feature, customers can send money to friends through Chime’s peer-to-peer payment service, Pay Anyone. This enables informal bill-splitting to be done rapidly and easily.

Chime has a variety of other features including real-time alerts, a secure interface with biometric authentication, and no fees. Chime also focuses on users with less complicated banking systems which makes it attractive for younger users.

Users looking for mobile-first banking services would greatly benefit from the simplicity and bank-account empowering features Chime offers.

Chime Features

- Peer-to-peer payments: Fast payment transfers without fees.

- Expense categorization: Identifying and tracking shared expenses.

- Instant alerts: Immediate notifications for all transactions.

- Automatic savings: Put money away in advance for bills.

- Fee-free transactions: Sending payments comes with no additional costs.

10. Capital One Mobile App

The mobile application provided by Capital One Mobile offers powerful tools for managing personal finances. Users have complimentary access to manage their credit cards, bank accounts, auto loans, as well as monitoring their credit score.

The application allows for locking and unlocking of cards, offering additional security options. Through Capital One Mobile’s integration with Zelle, users can send money quickly, though it doesn’t have a dedicated bill-splitting feature.

Users receive alerts for transactions with Capital One which along with provided budgeting features enables users to keep tabs on their finances.

Users praise the app’s performance, design, security, and convenience, making Capital One Mobile a great option for mobile banking.

. Mobile Capital One Features

- Zelle integration: Fast payments for bill splitting.

- Shared expenditure management: Helps users manage collective spending.

- Custom notifications: Alerts for pending payments.

- Secure transactions: Protection against fraud and transaction encryption.

- Rewards system: Increased returns for certain expenditures.

Conclusion

For ease of managing shared expenses, bill-splitting is crucial. Chase Mobile, Bank of America, and Wells Fargo Mobile apps allow for the streamlined payment of bills using Zelle, secure and instant money transfer. Shared payments becomes far more enjoyable using Venmo which is well known for its social features.

Revolut, Monzo, and N26 serve globetrotting users with support for multi-currency and detailed transaction tracking. Chime and Capital One Mobile done offer fees, but other intuitive budgeting tools make the payment experience seamless.

Whether one prefers instant fund transfers, insights on budgeting, social payments, or whichever else, app selection varies based on user needs. These banking apps take the stress and hassle out of managing shared costs providing swift, simplified, and stress-free financial collaboration.