In this article, I will elaborate on the Best Bank for Digital Transactions, paying special attention to banks that provide comprehensive and reliable digital banking services.

With increased usage of online capabilities in managing finances, selecting a digital bank has become a necessity. I will discuss the prominent features, advantages, and why they stand out for optimal online and mobile banking.

Key Point & Best Bank For Digital Transactions

| Bank Name | Key Point |

|---|---|

| Ally Bank | Offers a fully online experience with no monthly fees and 24/7 mobile access. |

| Quontic Bank | Known for innovative digital offerings like tap-to-pay debit cards. |

| Revolut | Provides instant international transfers and multi-currency digital wallets. |

| N26 | Offers real-time spending insights and in-app budgeting tools. |

| Bluevine | Designed for businesses with high-yield accounts and seamless digital payments. |

| Discover Bank | Strong digital banking with cashback rewards and mobile-friendly services. |

| Varo Bank | 100% mobile banking with early direct deposit and no hidden fees. |

| Alliant Credit Union | Provides digital-first banking with high savings rates and easy mobile access. |

| Monzo | UK-based app-first bank with real-time spending notifications and budgeting. |

| Chime | Mobile-first bank offering early paydays, no fees, and automatic savings tools. |

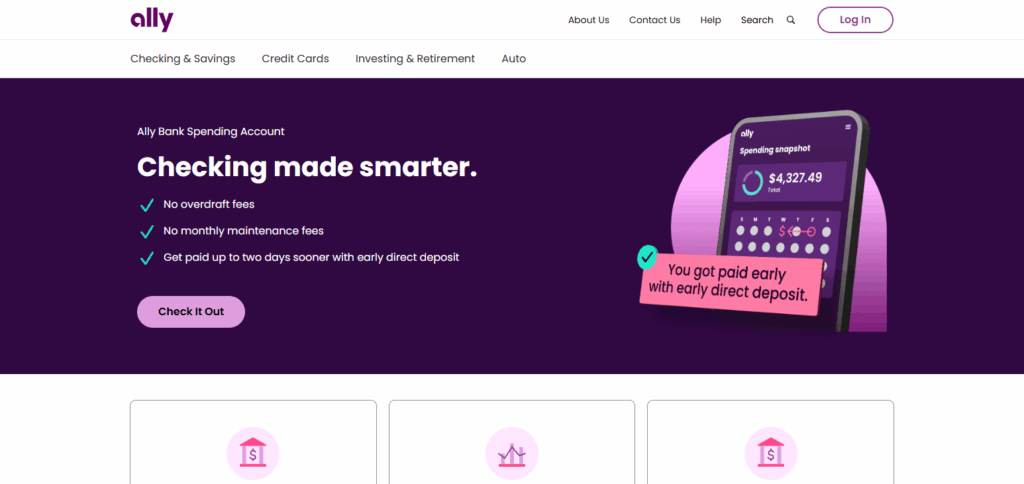

1. Ally Bank

Completely online with no physical branches, Ally Bank is a leader in the online banking industry. It allows its users to access their accounts online or via mobile 24/7 and offers free ATM access nationwide with no monthly maintenance fees.

Moreover, its app allows users to deposit and transfer funds as well as pay bills with ease. Ally provides customer service over chat, email, and phone around the clock, demonstrating its robust digital infrastructure.

Moreover, its FDIC-insured savings and checking accounts come with competitive interest rates. Ally also provides budgeting and goal-tracking tools. Transparency, low fees, and high ease of use put Ally among the most user-friendly options for everyday digital banking in the U.S.

Ally Bank – Best for Overall Digital Banking

- Online banking only; no branches available.

- No monthly fees or minimum balance restrictions.

- Live chat and customer service available 24/7.

- Free savings and interest earning checking account.

- No cost for using over 43,000 ATMs across the country.

2. Quontic Bank

Quontic Bank captures attention with its inventive methods in the digital banking realm which include benefits such as tap-to-pay debit cards and reward credits in cryptocurrency.

Quontic Bank holds a “digital first” stance, providing checking accounts, savings accounts, and even mortgages online. Transactions are also contactless as Quontic enables Apple Pay, Google Pay, and Samsung Pay.

Usually offered by traditional banks, Quontic’s High Interest Checking account has an APY which gives it a competitive edge. The bank is also commendable for it’s social responsibility and provides banking services for the disabled and other marginalized groups.

Its mobile application allows all customers to manage their accounts with the bank on the go. While newer than most competitors, Quontic promises a reliable experience to consumers interested in a non-traditional, tech-driven bank with its innovative thinking.

Efficiency Bank – Best for Tech-Based Business Innovations

- Contactless payment debit cards.

- Crypto rewards through debit cards.

- High interest savings account and checking account.

- Digital banking covered by FDIC.

- Supports Apple Pay, Google Pay, Samsung Pay.

3. Revolut

Revolut serves as a universal financial app for digital interactions across borders. It can track currency exchange in over 30 currencies and in real time which is highly beneficial for remote workers and global travelers.

Users can send and receive money instantly globally, split bills, and track their spending all in one app. Besides virtual cards and crypto trading, Revolut offers budgeting tools and fee-free ATM withdrawals up to a defined limit.

Its security features include one-off payment cards which make online shopping much safer. Premium plans offered come with extra perks, including insurance for travel and lounge access at the airport.

With presence in various countries, Revolut is breaking the borders in banking. For users sustaining multi-currency lifestyles, it comes particularly handy, and matures as one of the most flexible digital banks in the landscape of fintech.

Revolut – Best for Sending and Receiving Money Internationally

- Transfer money globally and instantaneously in 30+ currencies.

- Disposable and virtual cards for enhanced online protection.

- Trade company stock and cryptocurrency directly on the app.

- No fees for ATM withdrawals up to a specified limit.

- Budgeting and analyze spending tools available.

4. N26

The N26 app currently offers its users a simple but effective mobile banking interface that includes real time payments notifications, budgeting, smart categorization of expenses. N26 is a Germany based neobank that operates like a bank with branchless banking alongside a personal accounting software.

Payments can be done in person or remotely and users can send money across borders effortlessly. N26 allows users to instantly toggle their cards on and off, see their balance in real time and enjoy a plethora of other benefits without the shackles of additional and/or unused fees.

With spaces, users are able to set aside money to save and with services like Wise, money can now be transferred seamlessly. N26 Serving the European market mainly strives to attract users interested in efficient ways to manage their finances and those who are tech savvy.

As an industry leader, N26 strives to boost digital banking innovation with new application security features and user insights.

N26 – Best For European Residents Looking to Bank Digitally

- Automatic real-time transaction updates and statistics on spending.

- Track budget and have savings “Spaces.”

- No foreign exchange fee.

- Integrated money transfer feature with Wise.

- Modern UI and sleek looks.

5. Bluevine

Designed specifically for small businesses and freelancers, Bluevine features a robust online banking platform with no monthly fees and high-yield checking accounts. Its interface is designed to optimize invoice management, bill pay, and even vendor payments.

Invoice management is simplified as business owners can schedule payments, track their balances, and carry out ACH payments via the mobile application or online.

For businesses, Bluevine’s calling card is its offering—it provides up to 2.0% APY on checking accounts with balances up to $250,000 which is remarkable considering the focus on business banking.

The convenience of integration with QuickBooks and other accounting software is premium. While Bluevine lacks personal banking features, its digital services for business clients are unparalleled—especially for those who want to avoid cumbersome widgets of modern business banking and have straightforward and secure transactions.

Bluevine – Best Picks for Business Digital Banking

- Business checking accounts feature 2.0% APY on balances up to \$250,000.

- No monthly fees or overdraft fees.

- ACH and wire payments are included.

- Syncs with QuickBooks and other software.

- Mobile check deposits and invoice management.

6. Discover Bank

The trust of a brand is combines with digital-first banking efficiency at Discover Bank. The Bank’s Online Savings Account, Checking Account, and CDs have no monthly fees and offer highly competitive APYs. With the Discover mobile app, customers can deposit checks remotely, transfer funds instantly, pay bills, and manage their cards.

The debit card issued by Discover also cashback rewards for purchases made using the card, which offers unique advantages in the banking sector. US-based customer support is offered 24/7, which further improves the business’s experience.

Though Discover lacks physical branches, its secure and user-friendly online platform is ideal for customers who prefer remote banking. The institution is also known for avoiding customer hidden fees, proving its commitment to transparency.

Discover Bank doesn’t operate physical branches but its operational efficiency combined with traditional reliable service proves the institution’s flexibility towards customers’ needs.

Discover Bank – Best for Cashback Rewards

- Offers cashback on debit card purchases.

- No monthly maintenance fee and no minimum balance.

- Maintains high interest savings and CDs.

- Offers 24/7 customer service in the U.S.

- Mobile app allows bill payments, transfer, and budgeting.

7. Varo Bank

Varo Bank is distinguished as one of the first fully digital banks within the United States that has received a national banking charter. This means that it operates independently and is not a mere fintech partner like many other banking apps.

Varo offers features such as early direct deposit, no overdraft fees, and high yield savings of up to 5.00% APY under certain conditions. Its mobile app is robust, allowing for transfers, bill pay, mobile check deposits, and real-time spending alerts.

To add value to its digital ecosystem, Varo Advance provides cash advances to eligible users. With no minimum balance requirements and clear-cut fee policies, Varo becomes attractive for young adult and gig economy workers seeking financial flexibility.

As a pioneer among mobile-only banks, Varo delivers a secure, accessible, and rewarding digital banking experience.

Varo Bank – Best for High-Yield Savings Accounts

- Competitive APY of up to 5.00% for qualifying an conditions.

- Allowing early access to direct deposits.

- Up to \$200 fee-free overdraft.

- No monthly fees or minimum balance requirements.

- Offers Varo Advance for cash before payday.

8. Alliant Credit Union

Alliant Credit Union combines a member-oriented credit union with offering digital services. Members enjoy high-yield savings accounts, fee-free checking, and mobile banking facilities any time of the day.

The Alliant mobile app allows members to deposit checks, transfer funds, obtain Zelle, and even create budgets. Unlike most credit unions, Alliant has digital services which have the same quality as large commercial banks.

It offers ATM fee reimbursement and convenient access to thousands of surcharge free ATM’s all over the country. Alliant’s advertising and help in promoting financial literacy along with member benefits makes them much more attractive.

Membership is not open to everyone, but the requirements can easily be obtained through partner organizations. For a person looking for a credit union that offers digital services like those of big banks, Alliant stands out in providing this combination.

Alliant Credit Union – Best Credit Union for Digital Users

- High savings and interest bearing checking accounts.

- Zelle integrated mobile app.

- Free access to over 80,000ATMs.

- Stable non profit makers for easy eligibility.

- Overdraft protection at no additional charges.

9. Monzo

Monzo is a digital bank in the UK famous for updating transactions in real-time, offering budgeting insights, and having an easy to use app. It enables users to receive instant notifications after purchases and helps track subscriptions.

Monzo’s “Pots” feature allows customers to set aside money for specific goals, and its “Get Paid Early” option enables faster access to wages. Travel-friendly, the bank also supports easy international card usage with no transaction fees.

The app features a customer support chat, and even supports joint accounts, as well as bill-splitting. With vibrant community engagement and transparent communication, Monzo stands out as a customer-first neobank.

The service has transformed personal banking for the mobile generation with its fast and flexible offering.

Monzo – Best for Budgeting Features

- Real-time block spending notifications.

- Joint accounts allows for bill splitting.

- Categorizing savings in ‘pots’.

- Overbound transaction fees.

- Support through the mobile app is very useful.

10. Chime

Chime is a neobank based in the United States, offering a mobile banking experience with no fees, an overdraft limit of $200, and early access to direct deposits.

The Chime app offers additional features such as automatic savings, real-time transaction alerts, and savings from rounded-off amounts for each transaction.

It provides a secured credit card that helps users improve their credit scores without having to pay interest, and also helps them build credit.

Chime enables instant zero-fee payments, even to users without Chime accounts, through its Pay Anyone feature. With FDIC insurance offered via its banking partners, and a keen emphasis on transparency, Chime suits digital consumers looking for inexpensive, all-encompassing financial services.

Chime is well-regarded within the mobile banking community for its low-cost, hassle-free, and speedy banking services.

Best for Fee-Free Digital Banking – Chime

- No hidden fees, monthly fees, or overdraft charges.

- Advance payday up to two days early.

- Credit can be improved using the Credit Builder card.

- Alerts and savings can be done automatically in real timely fashion.

- No charge for transfers with “Pay Anyone.”

Conclusion

For effortless digital banking requiring minimal effort, Ally Bank emerges as the best in class. It combines user experience, no concealed costs, competitive interest rates, and around the clock service seamlessly.

Ally Bank is perfect for individuals looking for dependability and convenience. Yet, if your priorities are international transfers, claimable crypto rewards, or business banking, then banks like Quontic, Bluevine, and even Revolut can become more appropriate.

Whichever bank you prefer for digital transactions, it should match your preferences regarding your finances, lifestyle, and technological inclinations.