In this article, I will talk about Best Crypto Exchange for Trading Illiquid Altcoins. Not all exchanges provide adequate support for obscure or emerging coins, therefore finding the right platform is crucial when working with low liquidity tokens.

I’ll showcase the best of them that ensure quick listings, reasonable liquidity, and a seamless trading experience for altcoin users.

Key Point & Best Crypto Exchange for Trading Illiquid Altcoins List

| Exchange | Key Point |

|---|---|

| TradeOgre | Best for micro-cap and highly illiquid altcoins with minimal KYC requirements. |

| MEXC | Rapid listings of new, low-liquidity altcoins with good trading volume. |

| KuCoin | Wide selection of small-cap coins with strong community trading activity. |

| Gate.io | Huge range of rare and experimental altcoins with active spot markets. |

| AscendEX | Specializes in early-stage altcoins and strategic project partnerships. |

| BitMart | Early access to newly launched, low-liquidity crypto assets. |

| LBank | Global exchange with frequent listings of illiquid and niche tokens. |

| ProBit Global | Focus on emerging altcoins through IEOs and direct listings. |

| XT.COM | Fast-growing platform for Asian altcoin projects and low-volume tokens. |

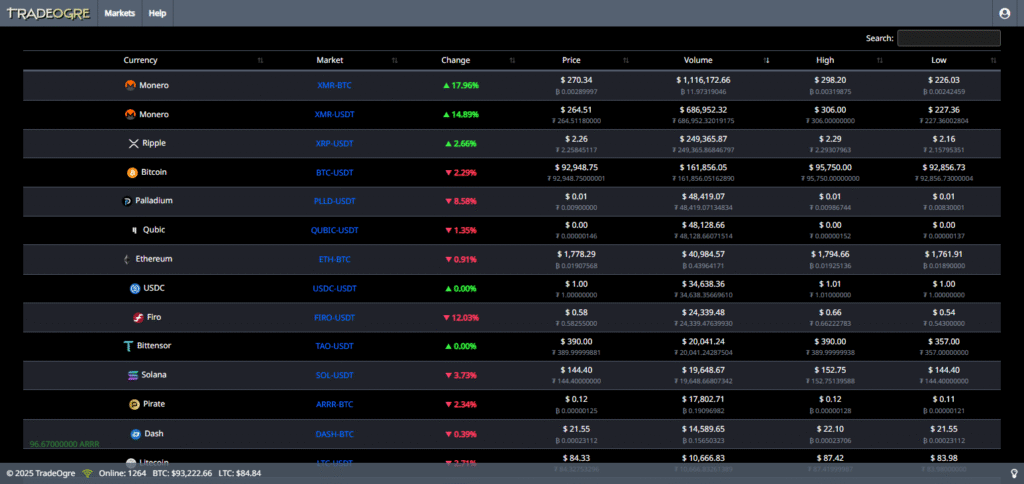

1. TradeOgre

TradeOgre is one of the best exchanges you could use to trade in lower-market cap illiquid altcoins. Like any other exchange, it supports trading pairs and operates without mandatory KYC requirements.

This widens its appeal to traders concerned about privacy. Due to the minimal listing barriers set by this exchange, small projects are free to list their tokens through TradeOgre, even if they do not undergo rigorous vetting.

As a result, an eclectic mix of lesser known coins is available on this trading platform. Nevertheless, as with most proprietary exchanges, TradeOgre has very low liquidity which leads to whipsaw price movements and high slippage when entering and exiting positions.

This is further compounded by the sizeable spread which is quite common for two-sided markets with limited depth. Down to the simplicity of the interface and the low fees of 0.2% per trade, TradeOgre is superb for speculative traders, but they should be cautious of scams or projects that haven’t been properly vetted.

This is because speculative traders operating in other markets are eager to trade in illiquid altcoins. From these points, we can see that TradeOgre is specially designed for traders seeking early-stage tokens and obscure altcoins.

TradeOgre Features

- Focuses on lesser-known, low market cap, and illiquid coins.

- Very limited KYC requirements. Values privacy.

- Lightweight trading platform. Simple to use.

- Best for early retrieval of micro cap assets.

2. MEXC

MEXC is famous for quickly listing new and relatively unknown altcoins, giving their traders deep access to emerging altcoin markets. Supporting over 2,900 tokens and 3,000 trading pairs, MEXC frequently captures low market altcoins (before they are added to larger exchanges) making the platform ideal for early adopters.

The competitive trading fees offered (0% maker fees and 0.05% taker fees for spot trading) along with no KYC requirements for withdrawals up to 10 BTC per day, makes it accessible for a wide range of global users. MEXC also provides futures trading with up to 200x leverage, appealing to risk-tolerant traders.

Liquidity is generally good for popular tokens, but most illiquid altcoins suffer from limited liquidity, leading to slippage. Security is strong, with no major hacks reported, but traders need to be cautious and verify project legitimacy because of the rapid listing pace.

Overall, MEXC is an attractive option for trading illiquid tokens due to its extensive altcoin selection, low trading costs, and welcoming user policies.

MEXC Features

- New and uncommon altcoins are listed there.

- Liquidity available even for low cap tokens.

- Low transaction fees in spot and futures markets.

- Simple to operate interface coupled with complex trading options.

3. KuCoin

KuCoin ranks as one of the primary contender’s for trading lower market capitalization altcoins. Its trading offering consists of upper 750 cryptocurrencies and lesser nicher competitors like TradeOgre.

Moreover, these includes many low cap tokens that are supported by the understaned interface and trades done by the users world apart. Spot trading on KuCoin is comparatively cheap charging only 0.10% with discounts available for holders of the native KCS token.

Also, the platform has margin trading, futures, and staking which serves out multiple trading strategies. Experts believe KuCoin has greater liquidity to illiquid altcoins as compared to other smaller exchanges but are not able to compete with Binace for the most obscure tokens.

Some trading pairs have lower order books which affect overall trading. The funds were alledgedly recovered but worries were raised over security during the hack of 2020 and since then there have been no major incidents. The combination of low fees and higher liquidity makes it a benchmark for altcoin traders busting the easiest obstacles.

KuCoin Features

- Extensive collections of altcoins including lesser-known, and low liquid ones.

- Active community involvement and continuous token issuances.

- Margin and futures trading available.

- Trading contests and promotional activities.

4. Gate.io

Gate.io is particularly known for having over 1,400 listed cryptocurrencies, which includes a number of low-liquidity and experimental altcoins. This makes the platform a go-to destination for traders who want to work with speculative projects.

The platform supports over fifty fiat currencies for onboarding, which increases accessibility and allows customers from various regions of the world to purchase crypto easily. Gate.io is one of the first platforms to support new tokens, so traders can use them at their early stages.

They also offer competitive trading fees of 0.20%, which can be reduced for those holding GT tokens. Customers on Gate.io also have access to advanced trading features such as futures, margin trading, and IEOs (Initial Exchange Offerings).

Gate.io is known for its strong security and has never been hacked, but customers should still beware of some of the more experimental listings. The liquidity of some cryptocurrencies can also be inconsistent, leading to low trading volumes and price volatility. Gate.io is one of most popular exchanges for trading illiquid tokens because of its wide reach and extensive catalog.

Gate.io Features

- Extremely experimental and rare token products.

- Trading line is secured; has very strict listing standards.

- Frequent new coin listings every day.

- Assists launching startups projects at the early stages.

5. AscendEX

AscendEX defines a reliable exchange for niche altcoin trading as it lists 186 tokens and…

…of smaller, lesser-known projects. It assists risk-tolerant traders by early access to emerging tokens due to low trading fees ($0.1 for large cap tokens and $0.2 for altcoins).

Additionally, AscendEX easy interface and staking options enhances its value for altcoins investors and its global coverage guarantee reasonable altituse. The liquidity of illiquid altcoins altcoins is limited which aligns with the focus on smaller projects, leading to wider spreads or slippage.

The exchange has clean security records with no hacks reported, altthough smaller selection of tokens than Gate.io or MEXC does reduce options. AscendeX focus on illiquid niche altcoins and supporting speculative trading is great for those targeting illiquid markets.

AscendEX Features

- Known to focus on listing new alts at an early stage.

- Staking, yield farming, and DeFi services offered.

- Small market cap tokens can be traded with leverage.

- Forming strategic partnerships with new projects in the crypto world.

6. BitMart

For traders in search of an illiquid altcoin, BitMart is the go to platform as it provides early access to lesser known tokens and supports over 600 cryptocurrencies and 700 trading pairs, providing a broad selection of low cap tokens.

The platform also offers spot, futures, and staking services alongside low trading fees of 0.25%, which are further reduced through the possession of the BMX token. Supporting lower cap tokens comes with risks, as illiquid altcoins will often have low liquidity, but deposit and withdraw issues are also common, making the platform lose customer trust.

Furthermore, in 2021, BitMart suffered a significant hack resulting in the loss of $196 million, forcing the platform to strengthen their security measures. Despite the challenges, the risk navigating traders still choose to engage with BitMart due to their focus on early stage tokens.

BitMart Features

- First to access newly added small-cap tokens.

- Simple buying process for novice users.

- Regular promotional campaigns and token distribution.

- Strong foothold in developing crypto regions.

7. LBank

LBank is one of the cryptocurrency trading platforms which has listed many new or illiquid currencies. It focuses mostly on altcoin traders in Asia. It frequently adds speculative tokens and hostsToken sales allowing access to early-stage projects.

Trading fees on lBank are very low at 0.2%. However, some of the altcoins tend to have higher volatility due to the low liquidity. This exchanges also do not have the best reputation on the market as compared to its altenatives like KuCoin and Gate.io.

Due to high volume of new tokens and low demand makes it a breeding ground for low qulaity tokens and scams. Although lacking polish of the better exchanges, lBank at least provides something to the more targeted traders.

LBank Features

- Quickly adds obscure and illiquid altcoins.

- International focus on developing regions.

- Frequent participatory trading contests and marketing.

- Aggressive acceptance of low-cap projects.

8. ProBit Global

ProBit Global focuses on small or newly emerged market capitalization altcoins and it a major platform for IEOs and token sales which perfectly suits traders looking for early stage prospects.

The exchange offers a wide array of low market capitalization tokens and their respective trading pairs, usually before they receive significant market attention. Their trade commissions amount to approximately 0.20%, but can be lowered by holding PROB tokens.

ProBit’s global clientele, along with the variety of supported fiat payment methods, do increase accessibility, but their liquidity for lesser-known altcoins is low when compared to KuCoin or MEXC.

ProBit has had no major hacks and has maintained a clean security record, but users should exercise caution with the speculative listings. ProBit’s strong focus on new tokens and their IEOs makes it an ideal trading platform for illiquid altcoins.

ProBit Global Features

- Strongly prioritizes hosting Initial Exchange Offerings (IEOs).

- Hundreds of low and emerging market cap tokens.

- Regionally dominant in Asia and developing countries.

- Flexible and tailor-made trading systems.

9. XT.COM

XT.COM is a relatively new Exchange that specializes in low liquidity Altcoins such as newly listed tokens from Asian and global Blockchain startups. The exchange augments low cap and illiquid tokens for most available listings because these tokens are attractive to traders looking for speculative trading.

XT.COM enables spot and futures trading and charges transaction fees of approximately 0.20% which may be lowered through the holding of XT tokens. XT.COM’s customers are altcoin investors and traders, but with illiquid tokens, their liquidity can be low creating large price shifts resulting in bad reputation.

XT.COM is not as well known as other bigger exchanges, like Gate.io and Binance. Though XT.COM is known for new project listings, a less scrupulous vetting process creates the risk of poor quality projects surfacing on the exchange.

Exploiting the gaps of established Exchanges, XT.COM aims to be the go to platform for traders and investors looking to target early emerging markets.

XT.COM Features

- Another rapidly growing exchange focusing on the Asian altcoin market.

- An extensive list of under-limited altcoins is available.

- Rewarding trading and gaming interaction.

- Active marketing in Pre-token launch sponsorships.

Conclusion

Choosing the right exchange is critical for discovering illiquid altcoins early and capitalizing on rare trading opportunities.

MEXC is arguably the best option for all trading them due to its quick listings, relatively high liquidity even for small-cap tokens, low user trading fees, and trading interface.

TradeOgre, KuCoin, and Gate.io also provide superb options for those looking to trade emerging and micro-cap altcoins.