I will discuss the Best Crypto Under 2$ To Buy In 2025 in this article.

These low-priced cryptocurrencies show great potential for appreciation and thus are suitable for investors who wish to acquire high-value assets at a lower price.

By understanding their unique features, market opportunities and industry prospects, one can make wise decisions in choosing which assets to add to their portfolio for superior returns in the future.

Key Point & Best Crypto Under 2$ To Buy In 2025

| Item | Key Point |

|---|---|

| Tether (USDT) | A widely-used stablecoin pegged to the US dollar, ensuring minimal volatility. |

| XRP | A cryptocurrency designed for fast and cost-effective cross-border transactions. |

| Artificial Superintelligence | Theoretical AI surpassing human intelligence, impacting various industries. |

| Stacks (STX) | A layer-1 blockchain enabling smart contracts and apps for Bitcoin. |

| Optimism (OP) | A layer-2 scaling solution for Ethereum focused on reducing transaction costs. |

| Immutable (IMX) | A platform for creating and trading NFTs with zero gas fees. |

| Bitget Token (BGB) | Native utility token of the Bitget exchange, offering trading discounts. |

| Theta Network (THETA) | A decentralized network for video streaming and content delivery. |

| Lido DAO | Lido DAO is a decentralized autonomous organization (DAO) |

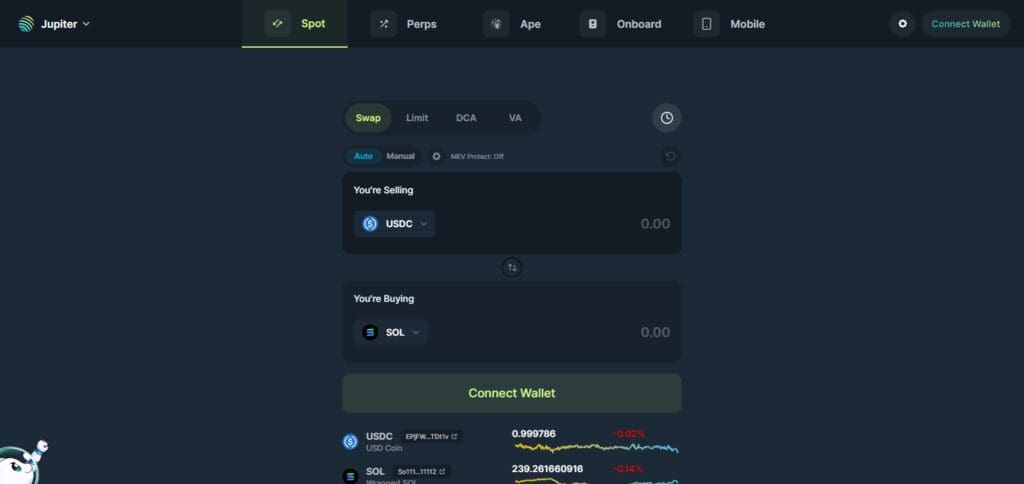

| Jupiter (JUP) | A blockchain project focused on secure data sharing and communication. |

10 Best Crypto Under 2$ To Buy In 2025

1. Tether (USDT)

Tether (USDT) combines the relatively stable value of the US dollar with cryptocurrency stablecoin utilities.

It is an excellent asset for fast and secure, low-risk crypto transactions.

Although it has no appreciation in value over time, it is essential in protecting against the issues of price volatility.

Its popularity across different exchanges offers effortless trading of the currency.

In 2025, the currency will still greatly serve crypto investors looking for a safe and reliable digital currency for value transfer and storage during harsh market conditions.

Pros & Cons

Pros

- It is very liquid and has a very strong support across exchanges.

- Makes transitioning from fiat to crypto much easier.

- Great for remittance with very low conversion costs.

- Serves as a safe asset during bear market.

Cons

- It’s centralized and lacks transparency.

- Can be underclose’ scrutiny concerning their reserves.

- There are no staking or earning opportunities.

- Very little use other than spot trading and hedging.

2. XRP

XRP, associated with Ripple Labs, is worth under $2 because of its effectiveness around cross-border payments.

It can attract banks and other financial spread across the globe due to its speed and low transaction costs.

Due to growing demand and a developing legal situation in the US, XRP has so much potential to grow.

In 2025 it is predicted that the coin would still be active in the global economy because of its affordable price and therefore a great investment opportunity.

Pros & Cons XRP

Pros:

- Transaction processing speed is blazing.

- Capable of processing high-volume transactions.

- Good penetration in remittance and banking industries.

- Good technology to manage its liquidity.

Cons:

- Somewhat higher than average volatility compared to cross-border alternatives.

- Do not see too much utility outside of the financial industry.

- For now, these tokens suffer an adverse effect from ongoing litigations.

- Criticism over the centralized nature of the token distribution model.

3. Artificial Superintelligence (ASI Tokens)

The tokens of Artificial Superintelligence (ASI) are relatively new commodities that are based on the field of AI and new technologies.

These are the tokens that would typically aid in the creation and running of AI enumerations across a decentralized system.

Investing in ASI tokens priced under $2 might be a good idea. They have the potential of disrupting several industry as healthcare, robotics, and finance.

These tokens could balloon in value by 2025 because the demand for AI technology keeps increasing.

Early adopters stand a chance of enjoying great returns as early as 2025.

Pros & Cons Artificial Superintelligence

Pros:

- Transforming various industries such as health care and robotics.

- Could help jump start decentralized platforms of AI.

- Excellent upside potential due to low adoption.

- Expanding public as well as investor awareness towards AI technologies.

Cons:

- There are no specific use cases in the existing markets.

- Great risk involved as it is speculative.

- Other AI as well as blockchain projects are serious competitors.

- Relies on the future development of technological innovations.

4. Stacks (STX)

Stacks (STX) is a layer 1 blockchain that seeks to introduce smart contracts and decentralized applications on the Bitcoin network.

Stacks’ strategy is different because it relies on the security of Bitcoin while providing developers with cutting-edge tools.

Due to Stacks’ vision of developing a programmable Bitcoin ecosystem, the project’s growth will likely be rapid by 2025.

This price range is perfect for investors who want to venture into the bond between smart contracts and the Bitcoin decentralized system.

Pros & Cons Stacks

Pros:

- Connects Bitcoin to the world of decentralized apps.

- Great number of developers and supporters in the community.

- Introduction to the revolutionary proof-of-transfer consensus mechanism.

- Bitcoin integration enhances security and decentralization.

Cons:

- Lower levels of adoption than Ethereum standard solutions.

- Limited outreach to marketing affecting exposure.

- Dependent from the ecosystem of Bitcoin for improvement.

- Has huge competition from another smart contract blockchain.

5. Optimism (OP)

Optimism is Ethereum’s layer 2 scaling, improving high transaction costs and network congestion issues.

Together with Ethereum, Optimism increases the efficiency of decentralized applications by making transactions faster and cheaper.

With the growth of the Ethereum ecosystem, Optimism’s importance steadily increases.

The price isn’t high ($2) thus it is perfect for new investors regarding Ethereum’s expansion. It’s predicted that its scalability solutions will be increasingly in use by 2025.

Pros & Cons Optimism

Pros:

- Works well with other Ethereum dApps without disrupting the usability.

- Makes use of rollup technology which allows for faster transactions.

- Uses scalable solutions and therefore reduces environmental footprint.

- Strong developer incentives are offered to establish the ecosystem.

Cons:

- Difficult and complicated technology that requires booking a user training session.

- Ethereum updates will be a long-term solution.

- If the adoption is too early, the user experience will be unable to accommodate growth in the foreseeable future.

- There is limited utility for the token beyond scaling the network.

6. Immutable (IMX)

Immutable (IMX) belongs to the category of NFT and gaming applications as the pioneer blockchain platform.

The NFT creator and gamer can easily mint and trade because there is no gas fee, and trades are settled instantly.

With the growth of the NFT craze, Immutable is likely to benefit. IMX could barely be above $2, and investors looking to take advantage of the growing trend in digital collectibles and gaming by 2025 should go for this.

Pros & Cons Immutable

Pros:

- No gas fees cut down costs and promote more adoption.

- Aimed at improving NFT creators who are the end users.

- The company’s credibility is enhanced through an alliance with the gaming planets.

- Revolutionary environmentally sustainable blockchain technology.

Cons:

- Use of NFTs means heavy income reliance which limits growth.

- Very gradual evolution into a complete gaming and collectibles entity.

- Still a new project to the market and thus bears a great deal of competitive risk.

- The rate of growth is proportional to the success of the platforms they partnered with.

7. Bitget Token (BGB)

Bitget Token (BGB), on the other hand, is the utility token of the Bitget exchange, allowing its users to enjoy a reduced cost of trading, benefit from staking rewards, and have access to some exclusive perks.

For those who are already in the cryptocurrency market, then they know that Bitget’s platform and token are gaining traction.

The tokens are currently available for purchase at less than $2, thus making it reasonable for 2025 as they will enable passive earnings and bonuses from one of the active crypto traders’ havens.

Pros & Cons Bitget Token

Pros:

- Use of exclusive features available on Bitget exchange.

- Initiatives by communities improve the demand for the token.

- Can be used for staking and earning.

- Buybacks are in place to help support uphold the price of the token.

Cons:

- High dependency on the performance of the Bitget exchange.

- The first issue includes the fact that expansion of Bitget is limited as of now. It is limited in geography and partnerships.

- The second issue can be called lack of market activity during bearish conditions.

- Third issue lies within the realm of regulations for any centralized exchange.

8. Theta Network (THETA)

One would think that Theta Network (THETA) offers a much-appreciated service and makes video streaming very easy with its decentralized content delivery network.

Instead of users paying higher fees, he shares his resources, and in this way, any streaming service can reduce its operating expenses.

Given its objective of enhancing Web3 entertainment, this cryptocurrency assures growth as one of the potential candidates.

With a price under $2, it presents a profitable investment option for decentralized streaming and blockchain believers to make investments by 2025.

Pros & Cons Theta Network

Pros:

- Promotes the development of innovative video streaming services that are decentralised.

- Support from major actors in the media industry.

- Active users are rewarded as a directive.

- Has an environmentally friendly solution to deliver video content.

Cons:

- The success is reliant on the users’ active participation.

- Lack of interest in non-media markets.

- Difficult to merge decentralised streaming into the mainstream.

- Other streaming service providers.

9. Lido DAO

Lido DAO is a decentralized autonomous organization (DAO) which provides staking infrastructure for multiple blockchain networks.

Most notably, the platform provides a liquid staking solution for Ethereum, allowing users to stake their ETH and receive stETH (Lido staked ETH) tokens in exchange, representing the user’s staked ETH and staking rewards.

Lido DAO is secured by decentralized governance, audited code and smart contracts.

The Lido protocol runs on Ethereum with help from smart contracts that process user deposits and distribute staking rewards, among other functions.

Several third-party security firms have audited Lido’s smart contracts to identify and address potential vulnerabilities.

Pros & Cons Lido DAO

Pros of Lido DAO

- Liquid staking and derivatives such as stETH are carried out.

- Provides support for multiple chains, thus enhancing user mobility.

- The governance is distributed so as to ensure community decision processes.

- Many of the users who degen within DeFi also earn staking rewards.

Cons of Lido DAO

- Due to concentration in a certain amount of staked assets, there are centralization threats.

- There is a potential threat in the area of smart contract risk.

- In times of stress, even derivative tokens will deviate from their intended price.

- Costs lower staking returns than native staking options because they pay out little.

10. Jupiter (JUP)

Jupiter aims to provide trustable and decentralized data exchange and cross-discipline communications using the blockchain.

To address the needs of the privacy-minded customer. As more people become alarmed about cyber threats, Jupiter’s proposals become more significant.

Investing in JUP currently is somewhat reasonable as its price is less than $2.

In the next three years, JUP could evolve into whatever is more useful in the blockchain society due to the current privacy and secure communications focusing ladder.

Pros & Cons Jupiter

Pros:

- Strong privacy and secure communication.

- A portable blockchain allows instantaneous transactions.

- Developed for practical use – document transfer.

- Making the project ‘open source’ brings developers together.

Cons:

- Almost unknown in the wider markets beyond specific areas.

- Underperformed the early bloomers in the blockchain space.

- Other privacy-centric tokens have been vastly established and potent.

- More partnerships are necessary to expand the usage.

How To Choose the Best Crypto Under 2$ To Buy In 2025

1. Project Basics

Authenticate the mission of the particular projects, their usefulness and their roadmap. Choose coins with tangible use, active teams and communities.

2. Target the Growth Potential of the Market

Try to find some cryptos with potential growth potential in areas like AI, gaming, or DeFi. Stay away from coins that are already overhyped.

3. Verify Liquidity and Availability

Ensure the coin is listed on well-established and trusted exchanges with a significant volume of trade so that buying and selling them is not an issue.

4. Evaluate the Tokenomics

Check total supply and distribution, as well as mechanisms such as staking or burning, to get an insight of basic long-term value.

5. Trends of the Industry

Forecast your choice according to growing factors like layer2 scaling, NFTs or AI based cryptos.

6. Risk Factors For Investments

Avoid low market cap cryptos that are highly volatile and balance funds among sectors to lower exposure on investment.

Conclusion

Selecting the best cryptocurrencies under $2 with the prospect of long-term growth potential in 2025 requires background research and strategy.

Focus on projects with solid fundamentals, utility in the real world, and growth potential.

Analyze trends in the market, tokenomics of specific coins, and potential risks present in the investment strategy.

If such an approach is adopted, the low cost of these coins may offer excellent returns, which would suit a more diversified portfolio strategy.

However, always exercise due diligence and be conscious of the rapidly changing world of cryptocurrency.